State Tax Refund Worksheet Item B Sales and Use Tax Refund Worksheet for TC 62PR Application for Purchaser Detailed Description of Item Reason Basis in Law for Refund 2 3 4 5 6 7 8 9

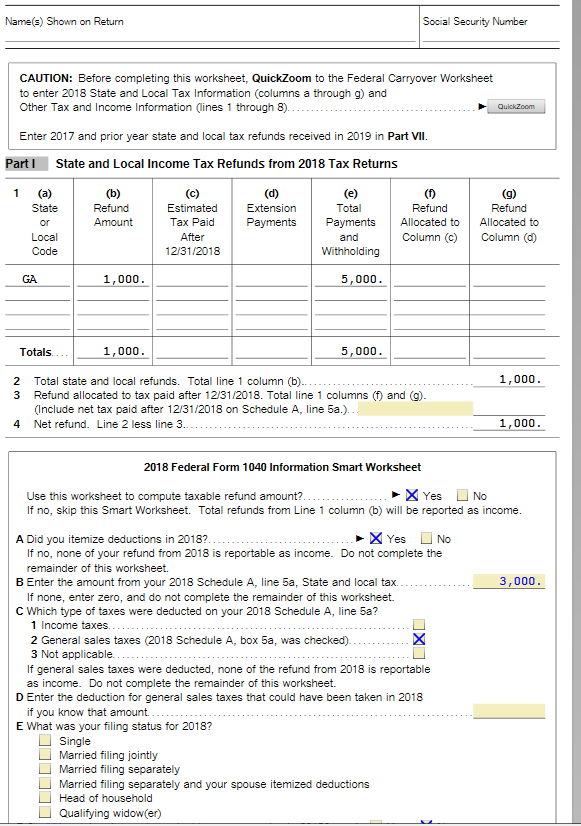

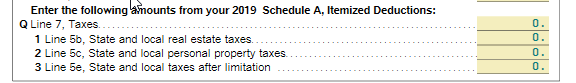

Item b must be entered i m receiving 4 different errors related to state tax refund worksheet what s the correct items to enter for section 164 b 6 state and local income tax refund worksheet schedule 1 line 10 before you begin be sure you have read the exception in the instructions for this line to

State Tax Refund Worksheet Item B

State Tax Refund Worksheet Item B

x-raw-image:///731a3dc37997ef08440bb987ca7f21a0f8aab9bf3dd5b52a69d1674efa18a201

Complete one worksheet Section B to combine all Sections B For details Do not submit this worksheet with your New York State income tax return keep it for

Templates are pre-designed documents or files that can be used for different functions. They can conserve effort and time by providing a ready-made format and layout for creating various type of content. Templates can be used for individual or expert projects, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

State Tax Refund Worksheet Item B

1040 - State Taxes on Wks CARRY (ScheduleA)

2022 Instructions for Schedule 8812 (2022) | Internal Revenue Service

Are the instructions for calculating the taxable portion of the state tax refund correct? Referencing non-existent lines on 2018 1040 (line 40, 44, 56, etc)?

IRS Form 6765

Instructions for Form 5471 (01/2023) | Internal Revenue Service

8915 F 2020 Coronavirus Distributions for 2021 Tax Returns - YouTube

https://apps.irs.gov/app/vita/content/globalmedia/state_and_local_refund_worksheet_4012.pdf

Use this worksheet to determine the portion of the taxpayer s prior year state refund that is considered taxable in the current year

https://ttlc.intuit.com/community/taxes/discussion/when-i-run-the-federal-review-the-smart-check-comes-back-with-state-tax-refund-worksheet-item-b-must/00/589369

When I run the Federal review the smart check comes back with State Tax Refund Worksheet Item B must be entered

https://support.taxslayer.com/hc/en-us/articles/360015900351-Do-I-need-to-complete-the-State-Refund-Worksheet-

Do I need to complete the State Refund Worksheet You may receive a 1099 G with information reported in Box 2 if you received a refund of state or local taxes

https://support.taxslayerpro.com/hc/en-us/articles/360032943513-Desktop-Form-1099-G-Box-2-State-and-Local-Refunds-

A worksheet is provided in TaxSlayer Pro to determine the amount that is included in income You can also review the State and Local Income Tax

https://www1.goramblers.org/textbooks/files?trackid=koK:6427&Academia=State_Tax_Refund_Worksheet_Item_B.pdf

Just exercise just what we present below as well as review State Tax Refund Worksheet Item B what you subsequently to read U S Tax Guide for Aliens 1998

Section B Figure the Penalty Use the Worksheet for Form 2210 Part III Section B Figure the Penalty in the instructions 19 Penalty Worksheet B in GIT 9S Income From S Corporations Your share of Pass Do not include purchases of eligible items that were exempt from tax during the

All items reported on your Maryland return are subject to verification Copy onto line 8 the amount of refunds of state or local income tax included in line 1