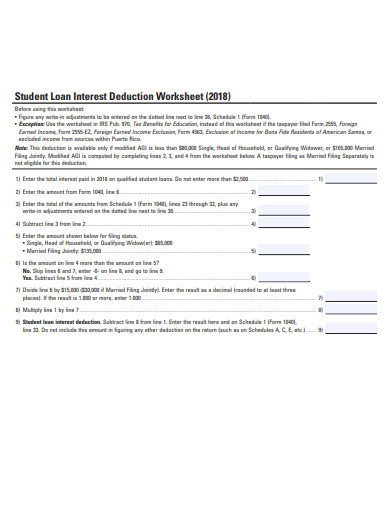

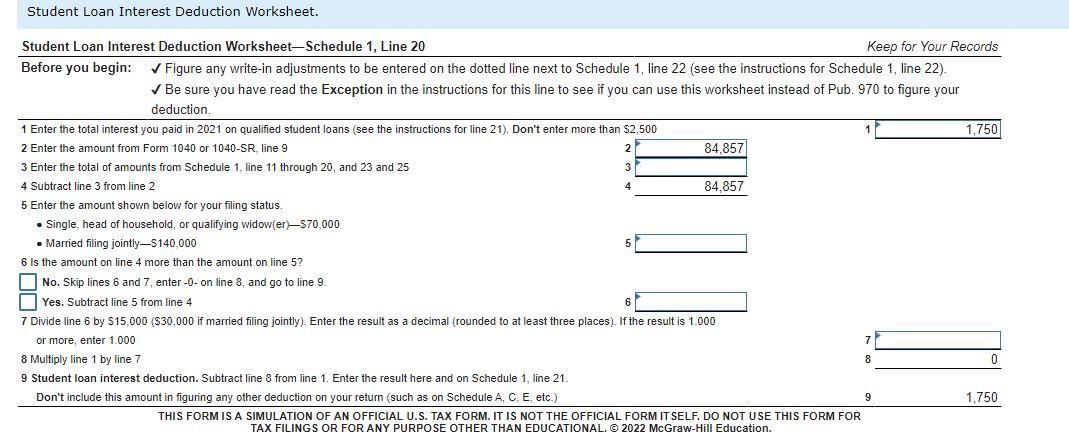

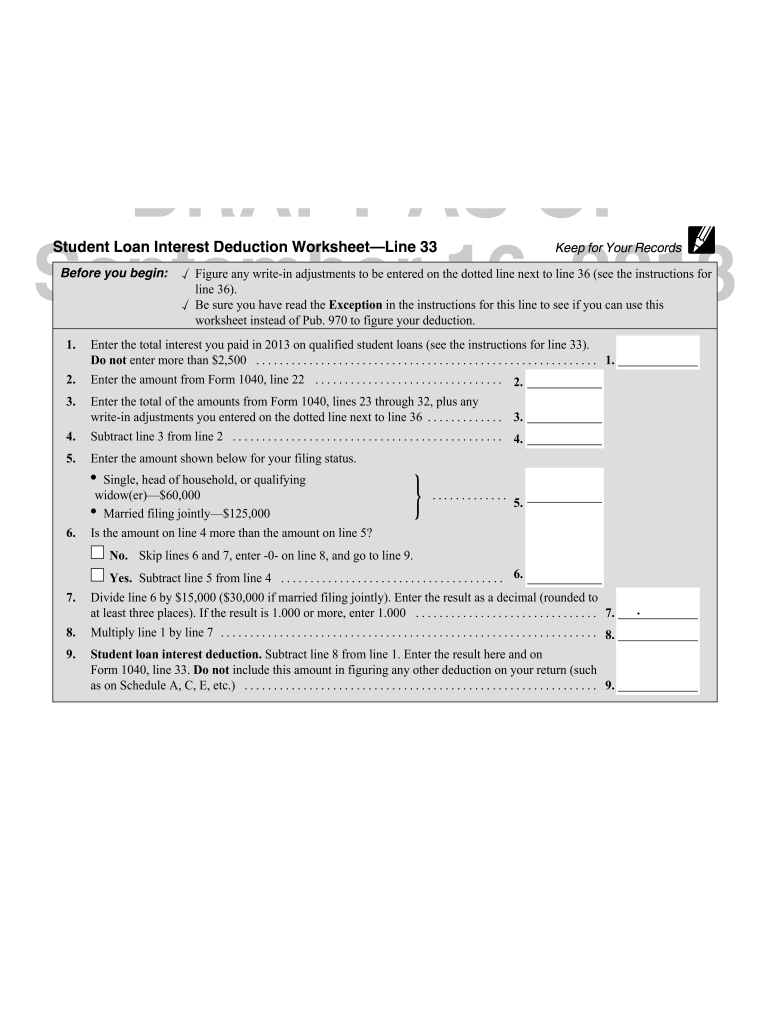

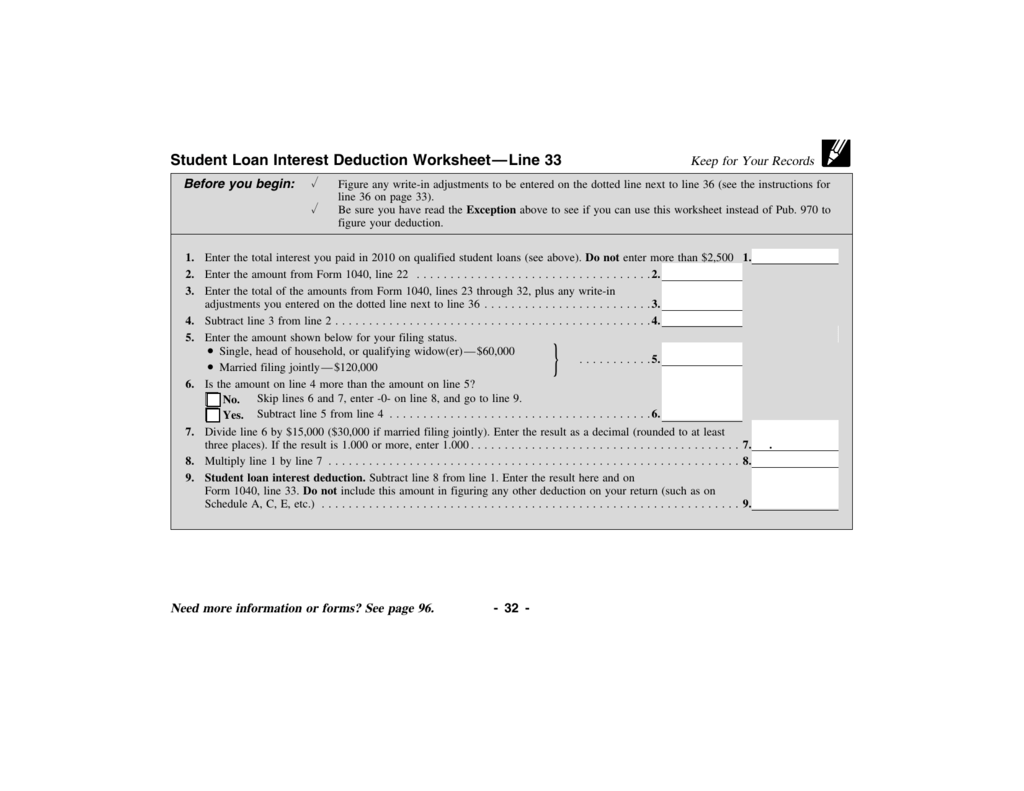

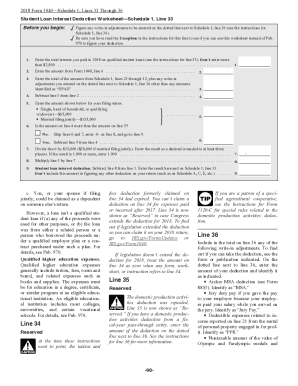

Student Loan Interest Deduction Worksheet To claim the student loan deduction enter the allowable amount on line 20 of the Schedule 1 for your 2019 Form 1040 The student loan interest

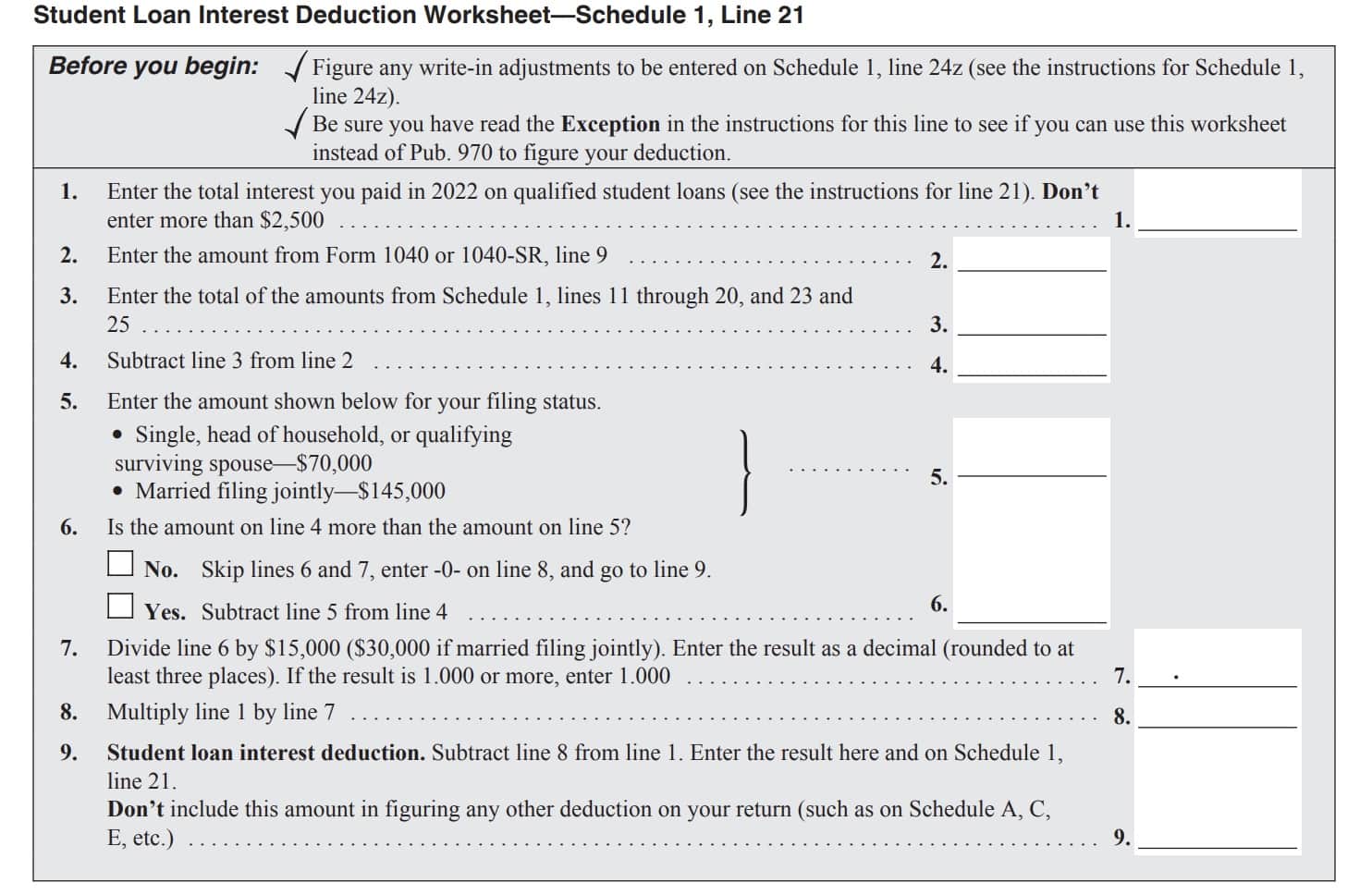

Enter the result on line 21 Schedule 1 student loan interest deduction worksheet Source Internal Revenue Service Get Help With Your Taxes The IRS has a simple worksheet to help you determine if you re eligible for the student loan interest deduction You ll need your adjustable

Student Loan Interest Deduction Worksheet

Student Loan Interest Deduction Worksheet

Student Loan Interest Deduction Worksheet

https://www.pdffiller.com/preview/100/72/100072485/large.png

The student loan interest deduction allows borrowers to deduct up to 2 500 of the interest paid on a loan for higher education directly on Form 1040

Templates are pre-designed documents or files that can be utilized for various purposes. They can save effort and time by offering a ready-made format and layout for developing different type of material. Templates can be utilized for personal or professional projects, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Student Loan Interest Deduction Worksheet

Student Loans & Taxes: Deductions, Filing, Returns, and Retirement | White Coat Investor

9+ Loan Worksheet Templates in PDF | DOC

IRS Schedule 1 Instructions - Additional Income & AGI Adjustments

Student Loan Interest Deduction and Tuition, Fees Deduction Offer Tax Incentives for Higher Education

Is Student Loan Interest Tax Deductible? | RapidTax

Solved Assume the taxpayer does NOT wish to contribute to | Chegg.com

https://www.irs.gov/taxtopics/tc456

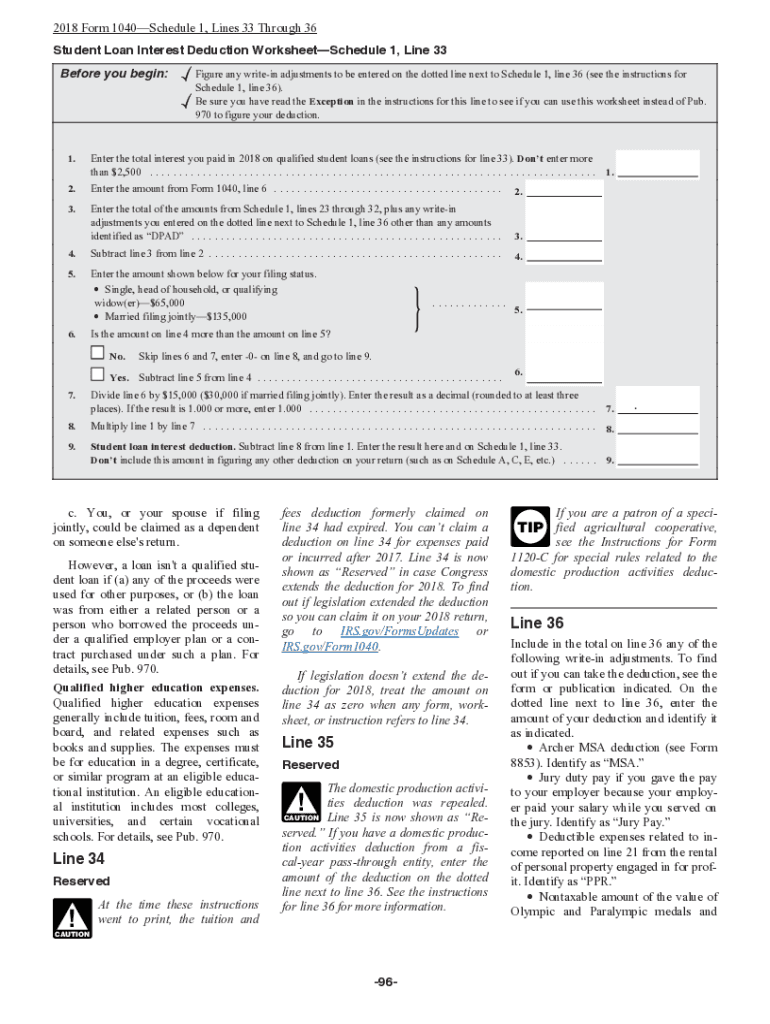

Student Loan Interest Deduction Worksheet in Publication 970 instead of the worksheet in the Instructions for Form 1040 and Form 1040 SR

https://www.taxact.com/support/24421/2021/student-loan-interest-deduction-worksheet

The TaxAct program automatically calculates the eligible amount of student loan interest deduction for the return based on the student loan interest expense

https://answerconnect.cch.com/document/mtg01a2f56dfc7c8510009a2890b11c2ac4f102/mastertaxguide/student-loan-interest-deduction

The deduction is calculated using a worksheet in the Instructions to Form 1040 or IRS Pub 970 An individual who pays more than 600 in student loan interest

https://answerconnect.cch.com/topic/52cd5eda7c6b1000a14990b11c18c902027/student-loan-interest-deduction

A worksheet in the Instructions to Form 1040 or IRS Pub 970 is used to calculate the deduction The taxpayer should receive Form 1098 E from

https://studentaid.gov/articles/1098e-deduct-interest/

This is known as a student loan interest deduction Below are some questions and answers to help you learn more about reporting student loan interest

The College Tuition Deduction Worksheet Form 1 Schedule Y instructions Federal student loan interest deduction total student loan Paying back your student loan won t generate any tax breaks but paying the interest on that student loan can by reducing your income tax The max deduction is

Edit sign and share tax and interest deduction worksheet online No need to install software just go to DocHub and sign up instantly and for free