Tax And Interest Deduction Worksheet Within the pages of Tax And Interest Deduction Worksheet an enthralling opus penned by a highly acclaimed wordsmith readers embark on an immersive

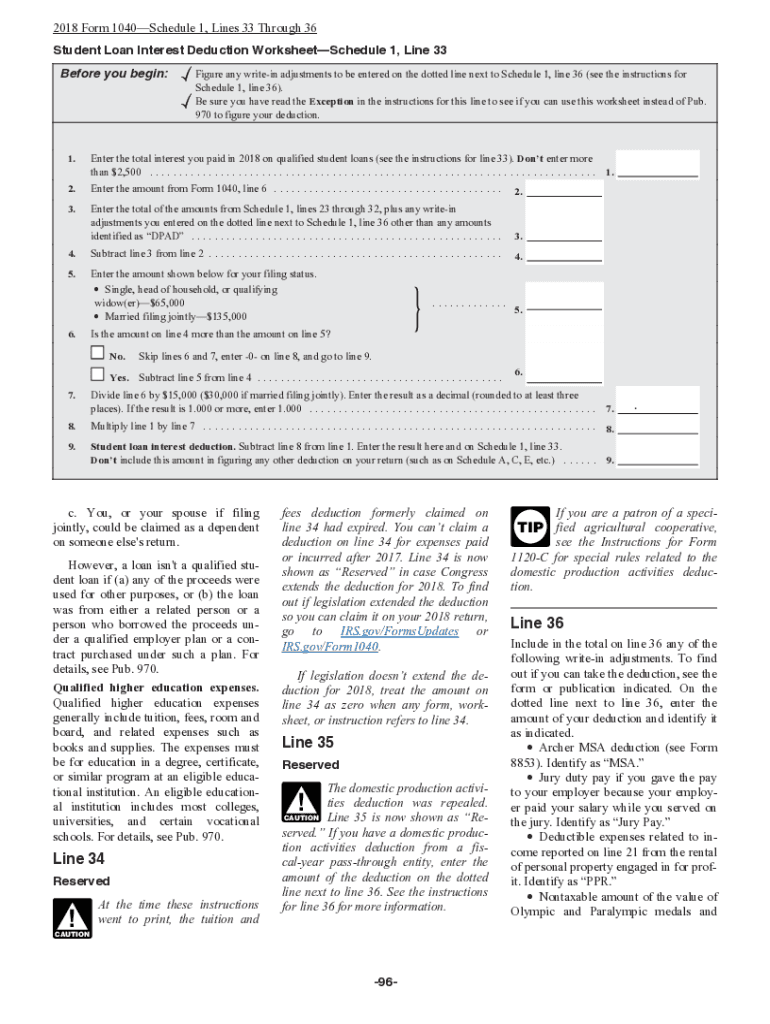

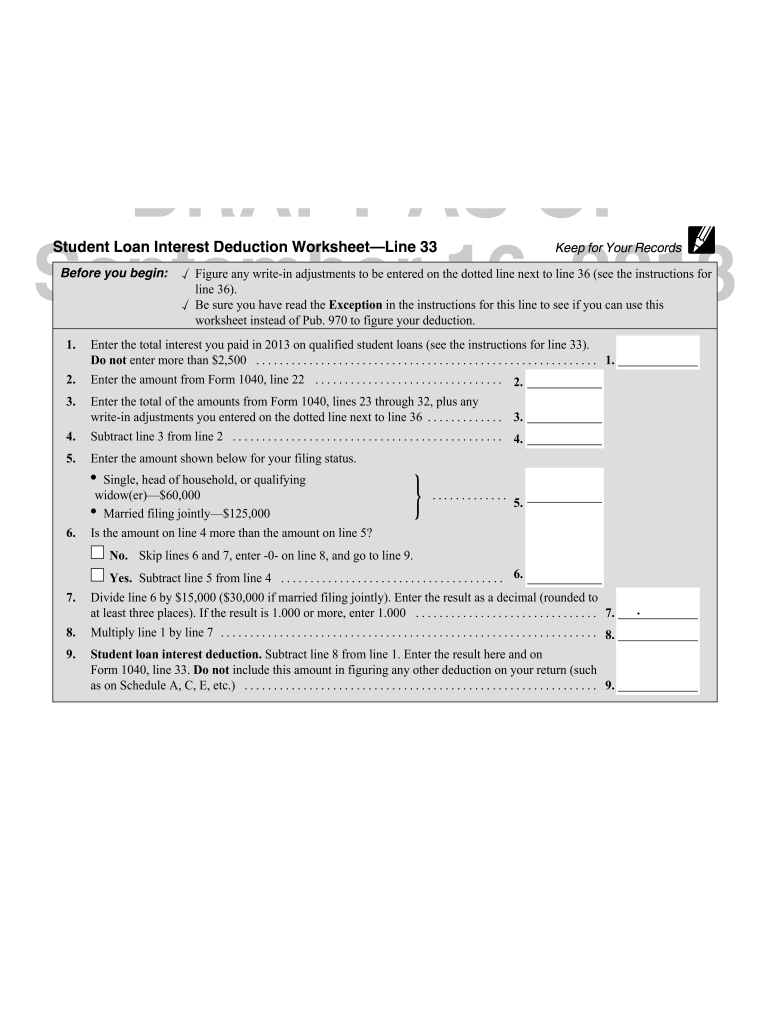

The deduction is calculated using a worksheet in the Instructions to Form 1040 or IRS Pub 970 An individual who pays more than 600 in student loan interest This tax worksheet computes the taxpayer s qualified mortgage loan limit and the deductible home mortgage interest Example

Tax And Interest Deduction Worksheet

Tax And Interest Deduction Worksheet

Tax And Interest Deduction Worksheet

https://www.pdffiller.com/preview/100/72/100072485/large.png

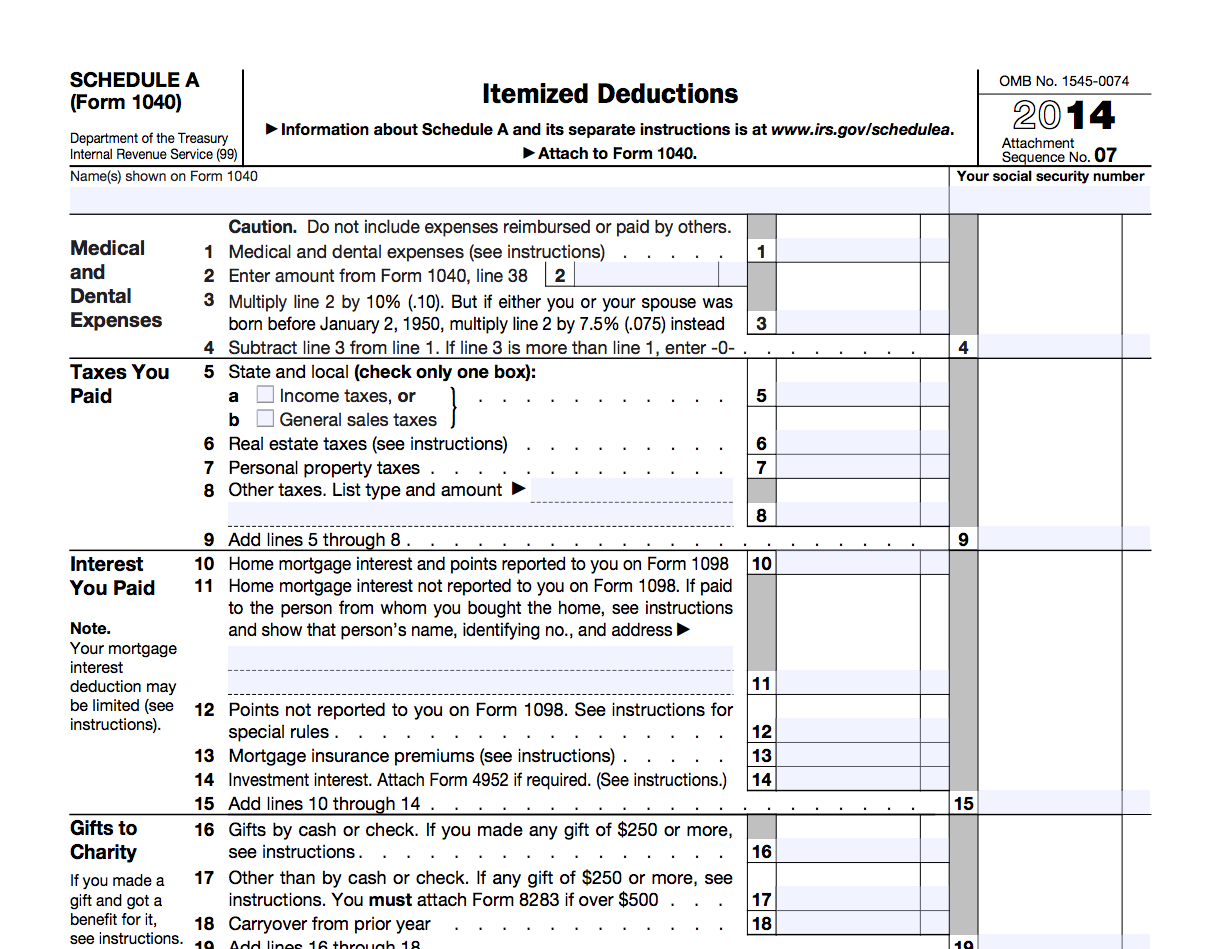

6 Other deductible taxes List type and amount Foreign income taxes 6 7 Add itemized deduction worksheet here Otherwise enter the state and local

Pre-crafted templates offer a time-saving option for creating a varied range of files and files. These pre-designed formats and designs can be utilized for different individual and professional projects, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, streamlining the content development procedure.

Tax And Interest Deduction Worksheet

Tax Deduction Worksheet for Police Officers - Fill and Sign Printable Template Online

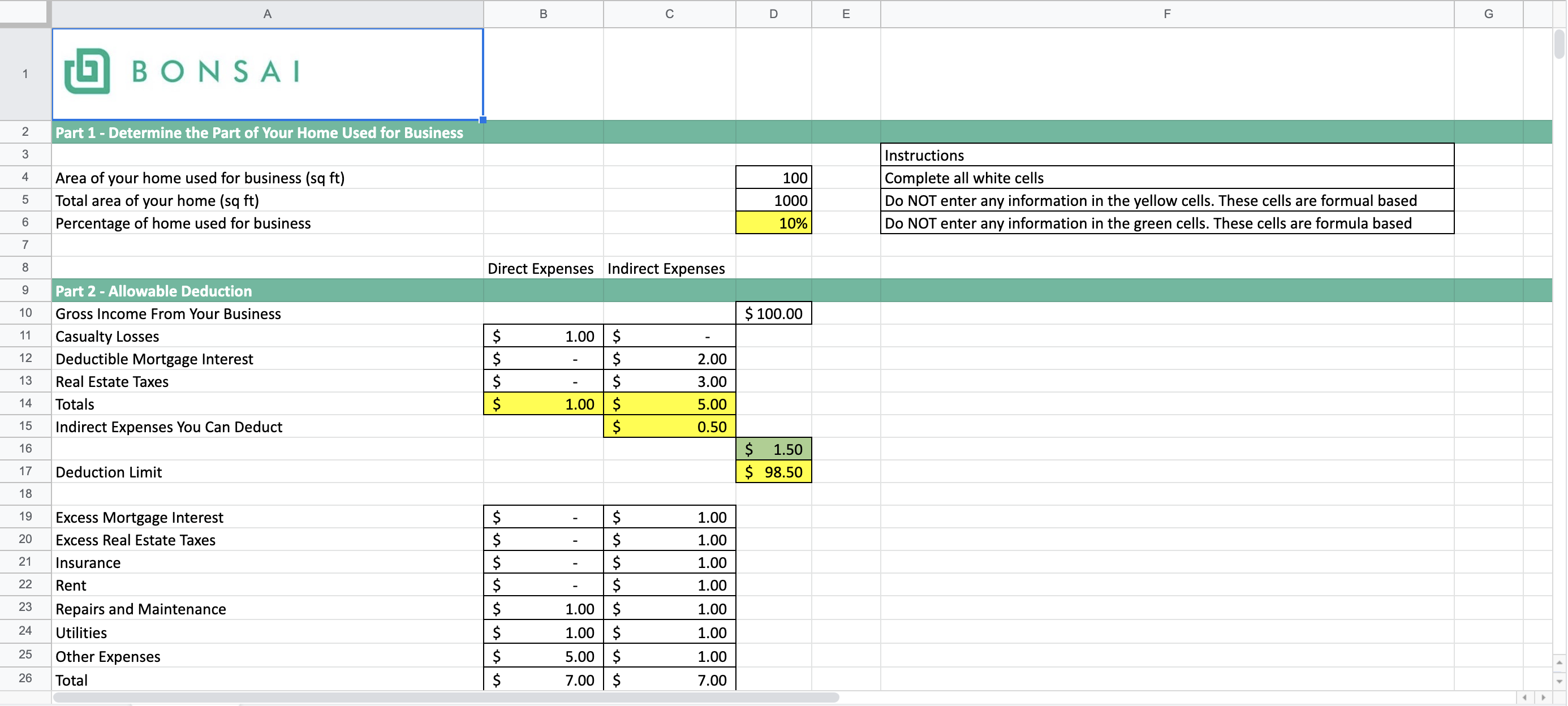

FREE Home Office Deduction Worksheet (Excel) For Taxes

Fillable depreciation workshhet: Fill out & sign online | DocHub

Deductible Home Mortgage Interest Worksheet - Page 9

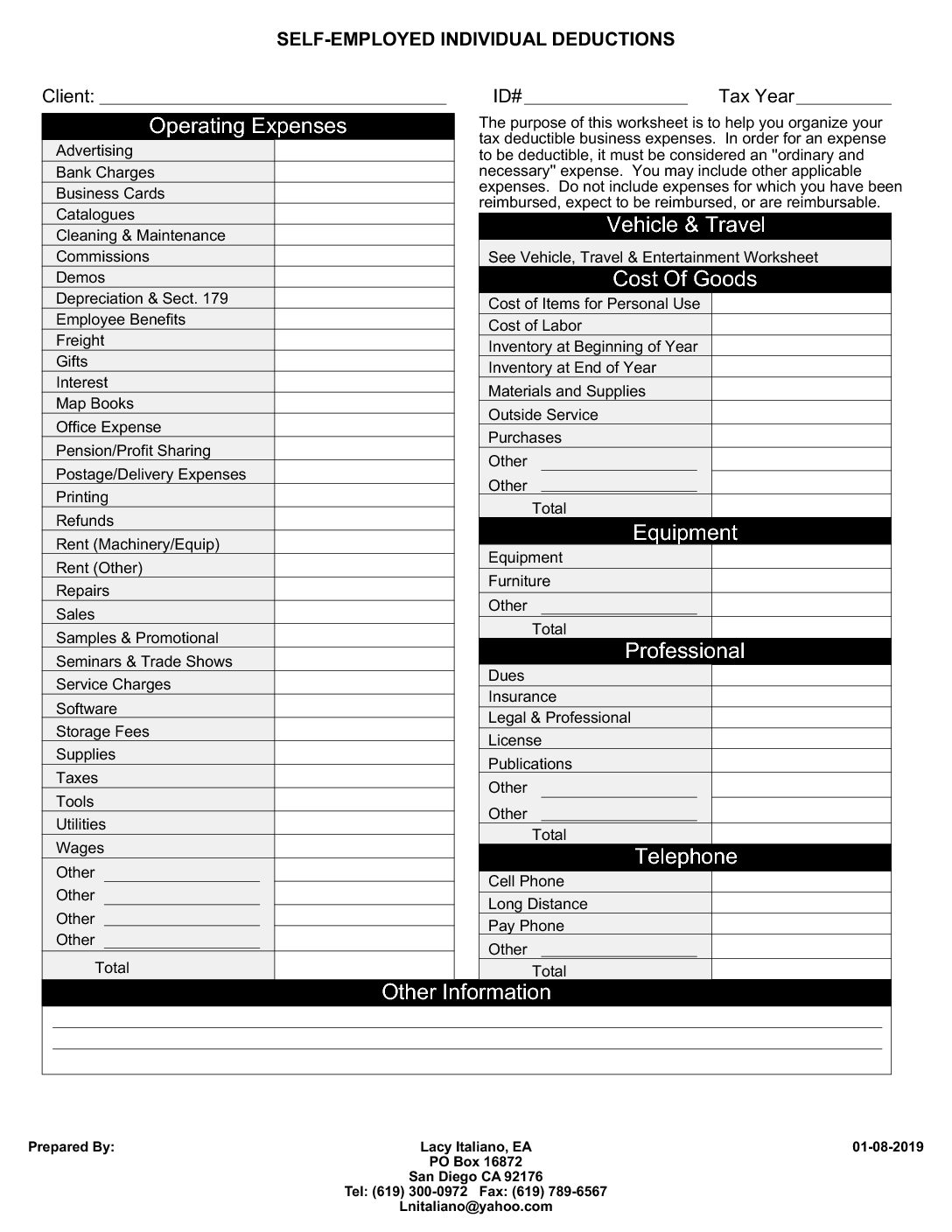

Self-Employed Business Deduction Worksheet -

Itemized Tax Deductions - McKinley & Hutchings CPA PLLC

https://ttlc.intuit.com/community/tax-credits-deductions/discussion/what-is-the-tax-and-interest-deduction-worksheet/00/796024

The tax and interest deduction worksheet is used if you are going to itemized deductions on a Form 1040 Schedule A

https://www.irs.gov/instructions/i1040sca

State and Local General Sales Tax Deduction Worksheet Line 5a This is an Image box gif Yes Enter your local general sales tax rate but omit the percentage

https://global.oup.com/us/companion.websites/fdscontent/uscompanion/us/static/companion.websites/9780190200824/Worksheets/07_Tax_Deduction_Worksheet.pdf

This worksheet allows you to itemize your tax deductions for a given year Tax deductions for calendar year 2 0 HIRED HELP SPACE Accountant

https://www.ftb.ca.gov/file/personal/deductions/index.html

1 Enter your income from line 2 of the Standard Deduction Worksheet for Dependents in the instructions for federal Form 1040 or 1040 SR

https://www.tax.ny.gov/pdf/current_forms/it/it196i.pdf

Home mortgage interest limited If your home mortgage interest deduction is limited only enter on line 10 the deductible mortgage interest and points that

Student Loan Interest Deduction Worksheet Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor You figure the business portion of your real estate taxes using Form 8829 if you file Schedule C Form 1040 or the Worksheet To Figure the Deduction for

Enter the total of federal itemized deductions less state and local income taxes penalty and interest on tax not paid by April 15 2023 Note In the case of