Tax Computation Worksheet 2019 Use the Use Tax Worksheet to compute use tax due on all purchases or Use the Use Tax Worksheet to compute use tax due on all individual items purchased for

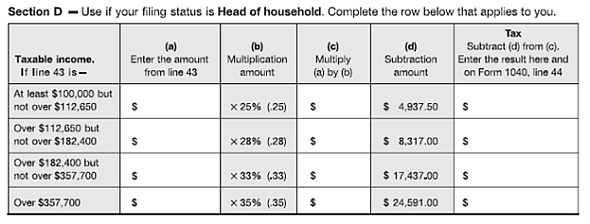

Tax Tables 2019 Edition 1 TAXABLE INCOME BASE AMOUNT OF TAX PLUS MARGINAL TAX RATE OF THE AMOUNT OVER OVER NOT OVER Find the 2019 federal tax forms you need Official IRS income tax forms are printable and can be downloaded for FREE Get the current year income tax forms

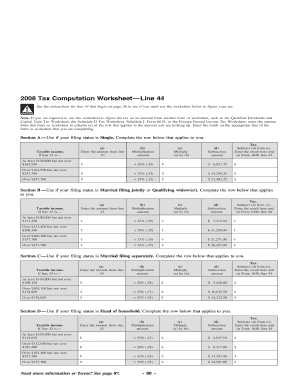

Tax Computation Worksheet 2019

Tax Computation Worksheet 2019

Tax Computation Worksheet 2019

https://www.pdffiller.com/preview/430/912/430912746.png

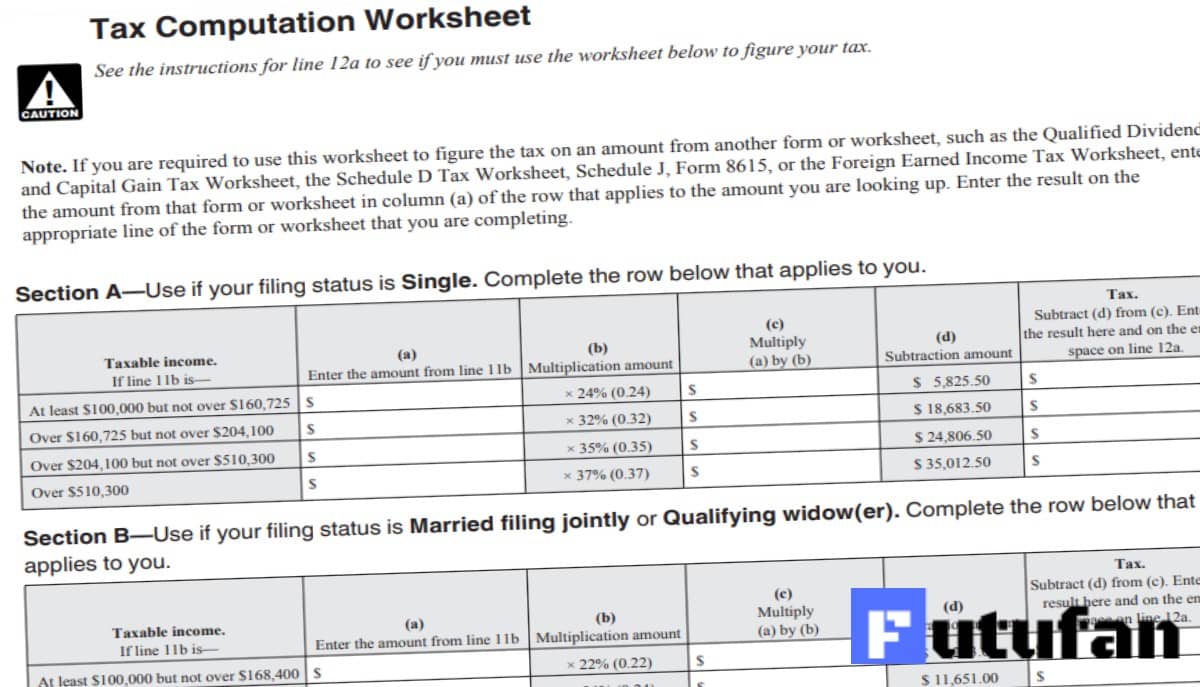

2019 tax computation worksheet line 12a WebComplete the rest of that worksheet through line 6 line 10 if you use the Schedule D Tax Worksheet

Templates are pre-designed files or files that can be used for different functions. They can save effort and time by supplying a ready-made format and design for producing different kinds of content. Templates can be used for personal or professional jobs, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Tax Computation Worksheet 2019

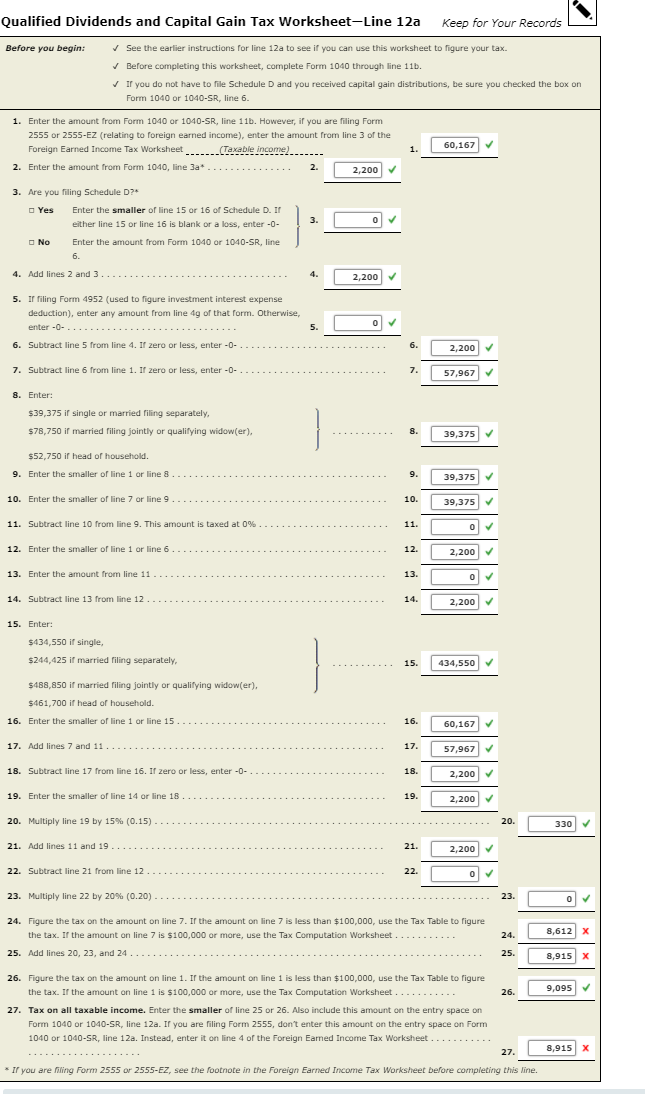

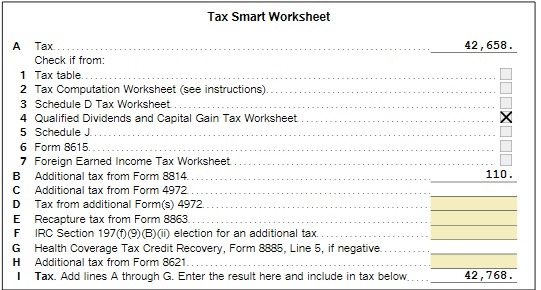

Qualified Dividends And Capital Gain Tax Worksheet 2019 - Fill and Sign Printable Template Online

Tax Computation Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Tax Computation Worksheet 2023 - 2024

Fill - Free fillable 2019 Tax Computation Worksheet—Line 12a PDF form

IRS 2019 Tax Tables, Deductions, & Exemptions — purposeful.finance

Note: This problem is for the 2019 tax year. Beth R. | Chegg.com

https://www.cchcpelink.com/w/wp-content/uploads/2020/03/2019-Tax-Computation-Worksheet.pdf

If you are required to use this worksheet to figure the tax on an amount from another form or worksheet such as the Qualified Dividends and Capital Gain Tax

https://www.irs.gov/pub/irs-prior/i1040tt--2019.pdf

This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Forms 1040 and 1040 SR FreeFile is the fast safe

https://www.cchcpelink.com/w/wp-content/uploads/2020/03/2019-Tax-Tables.pdf

The amount shown where the taxable income line and filing status column meet is 2 651 This is the tax amount they should enter in the entry space on Form

https://taxfoundation.org/data/all/federal/2019-tax-brackets/

Income Tax Brackets and Rates 12 9 701 to 39 475 19 401 to 78 950 13 851 to 52 850 22 39 476 to 84 200 78 951 to 168 400

https://portal.ct.gov/-/media/DOC/Pdf/Coronavirus-3-20/IRS-Form-1040-2019.pdf

Form 1040 Department of the Treasury Internal Revenue Service 99 U S Individual Income Tax Return 2019 OMB No 1545 0074 IRS Use Only Do not write or

2019 MAINE INCOME TAX TABLE If Line 19 Form 1040ME is And Your Filing Status is At Least But Less Than Single or Married Filing Separately You can not use this table if you take the standard deduction or if you itemize your deductions in calculating your net taxable income Regular Tax Table This

If your total number of exemptions exceeds eight reduce your tax table income by 1 000 for each exemption over eight Locate this reduced amount in the first