Tax Deduction Worksheet For Self Employed Self Employment Tax Deductions Worksheets PDF Tax worksheet for self employed independent contractors sole proprietors single LLC LLC s

Tax Worksheet for self employed independent contractors sole proprietors single member LLCs people who received a 1099 NEC or 1099 K 16 Tax Deductions and Benefits for the Self Employed 1 Self Employment Tax Deduction 2 Home Office Deduction 3 Internet and Phone Bills Deduction 4

Tax Deduction Worksheet For Self Employed

Tax Deduction Worksheet For Self Employed

Tax Deduction Worksheet For Self Employed

https://lacyitaliano.com/wp-content/uploads/2019/01/Self-Employed-Business-Deduction-Worksheet-pdf-232x300.jpg

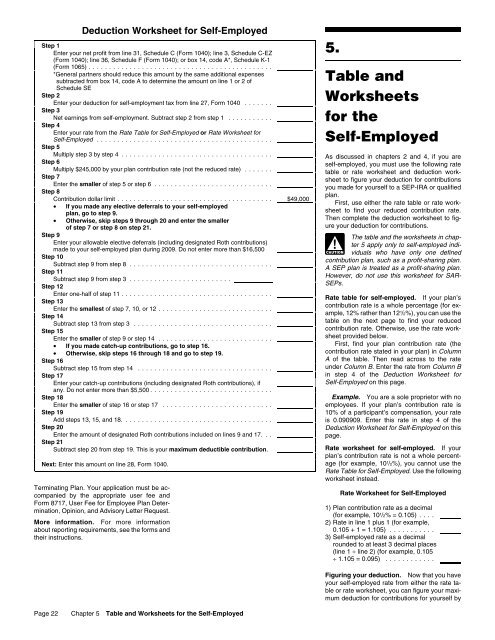

Deduction for Self Employment Tax 2 3 532 From IRS Form 1040 Step 3 This worksheet will assist you with calculating your contri bution and can help

Templates are pre-designed documents or files that can be used for different functions. They can conserve time and effort by offering a ready-made format and layout for developing different sort of content. Templates can be utilized for individual or professional tasks, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Tax Deduction Worksheet For Self Employed

Nurse Tax Deduction Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Tax Deduction Worksheet | Small business tax deductions, Small business tax, Business tax deductions

Anchor Tax Service - Home use worksheet

Self Employed Tax Deductions Worksheet Form - Fill Out and Sign Printable PDF Template | signNow

Hairstylist Tax Write Offs Checklist for 2023 | zolmi.com

Real Estate Agent Tax Deductions Worksheet Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

https://www.hellobonsai.com/blog/self-employed-tax-deductions-worksheet

If you are concerned with how much you ll owe don t worry The team at Bonsai organized this self employed tax deductions worksheet copy and

https://www.demoretaxservice.com/files/109128408.pdf

Tax Worksheet for Self employed Independent contractors Sole proprietors Single LLC LLCs 1099 MISC with box 7 income listed

https://www.irs.gov/businesses/small-businesses-self-employed/self-employed-individuals-tax-center

If you estimated your earnings too high simply complete another Form 1040 ES worksheet to refigure your estimated tax for the next quarter

https://www.azdhs.gov/documents/preparedness/epidemiology-disease-control/disease-integrated-services/adap/enroll/self-employment-worksheet-english.pdf

SELF EMPLOYMENT WORKSHEET Please provide 3 months of all self employment Deductible Expense Advertising Car Truck Expenses Commissions Fees Contract

https://sharetheharvest.com/wp-content/uploads/2018/03/9-Schedule-C-Self-Employed-Single-LLC.pdf

Use a separate worksheet for each business owned operated Do not duplicate expenses Name type of business Owned Operated by Client Spouse Income

As discussed in chapters 2 and 4 if you are self employed you must use the following rate table or rate worksheet and deduction worksheet to figure your You can deduct part of the self employment tax you paid as an adjustment to income So you can claim the deduction even if you don t itemize deductions Claim

The TaxAct program offers the Publication 560 Worksheet in order for qualified self employed individuals to calculate their maximum deductible contribution