Taxable Social Security Worksheet 2020 COLA for 2020 Other important 2020 Social Security information is as follows Tax Rate 2019 2020 Employee 7 65 7 65 Self Employed 15 30 15 30 NOTE

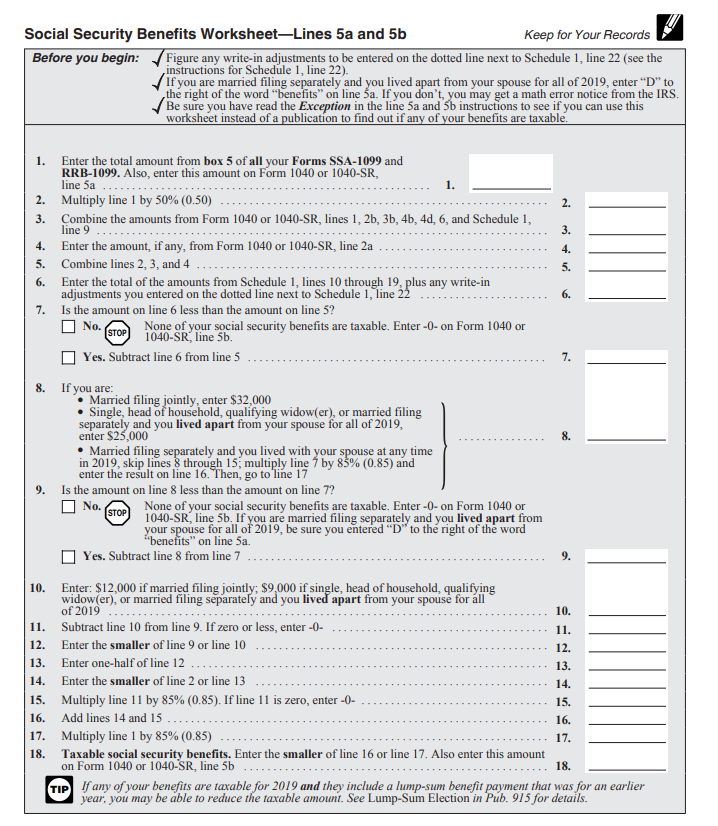

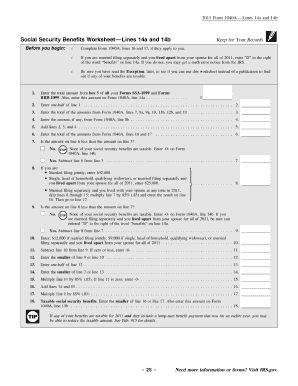

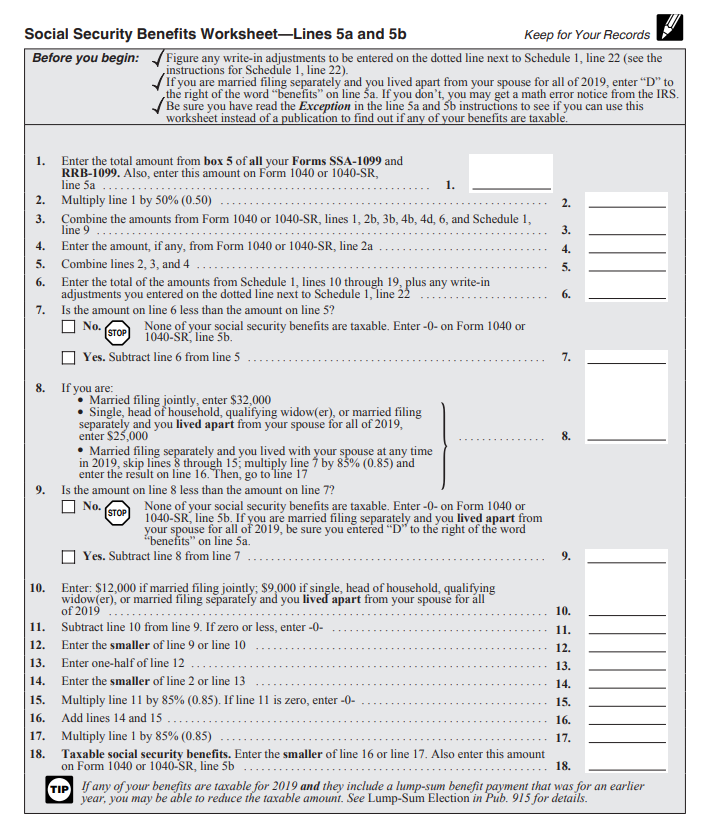

This Social Security planner page explains when you may have to pay income taxes on your Social Security benefits 3 Enter the taxable amount of Social Security benefits reported on your 2020 federal Social Security Benefits Worksheet Line 18 4 IF MARRIED FILING

Taxable Social Security Worksheet 2020

https://images.squarespace-cdn.com/content/v1/5b2c618596d455860e15ec8f/1609791972896-THBK30R3E77U3F9SENTO/Social+Security+Income+Calculations.PNG

The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen If the benefits are not taxed

Templates are pre-designed files or files that can be used for different functions. They can save effort and time by supplying a ready-made format and design for developing various type of material. Templates can be utilized for individual or expert jobs, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Taxable Social Security Worksheet 2020

Form 1040 Line 6: Social Security Benefits — The Law Offices of O'Connor & Lyon

IRS Publication 915 2020-2023 - Fill out Tax Template Online

Social Security Benefits Worksheet - Lines 20a and 20b

Social Security Benefits Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

1040 (2022) | Internal Revenue Service

IRS Publication 915 | pdfFiller

https://www.irs.gov/pub/irs-prior/n703--2020.pdf

Read This To See if Your Social Security Benefits May Be Taxable If your social security and or SSI supplemental security income

https://media.hrblock.com/media/knowledgedevelopment/itc/2021forms/2020_social_security_taxable_benefits_wksht.pdf

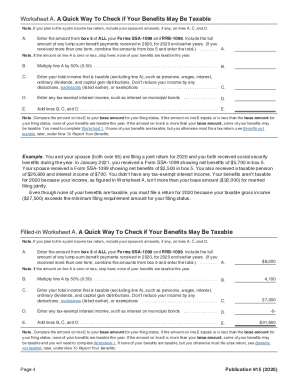

None of your benefits are taxable for 2020 For more information see Repayments More Than Gross Benefits in Pub 915

https://fill.io/Social-Security-Taxable-Benets-Worksheet-2020

Fill Online Printable Fillable Blank Social Security Taxable Benets Worksheet 2020 Form Use Fill to complete blank online OTHERS pdf forms

https://tax.ri.gov/sites/g/files/xkgbur541/files/2022-01/social-security-worksheet_b_3.pdf

State of Rhode Island Division of Taxation 2020 Modification Worksheet Taxable Social Security Income Worksheet Enter your spouse s date of birth if

https://www.taxact.com/support/1375/2020/social-security-benefits-worksheet-taxable-amount

If your income is modest it is likely that none of your Social Security benefits are taxable Follow these instructions to view Social Security Benefits

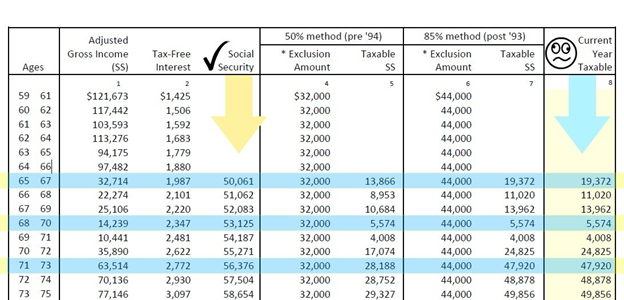

NOTE This also affects you if you are single and use the Tax Reduction Worksheet The reportable Social Security benefit is calculated using the worksheet Many of those who receive Social Security retirement benefits will have to pay income tax on some or all of those payments More specifically if your total

worksheet to calculate Social Security tax liability How to File Social Security Income on Your Federal Taxes Once you calculate the amount