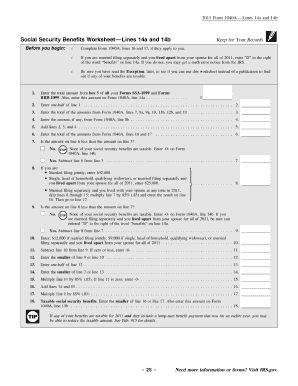

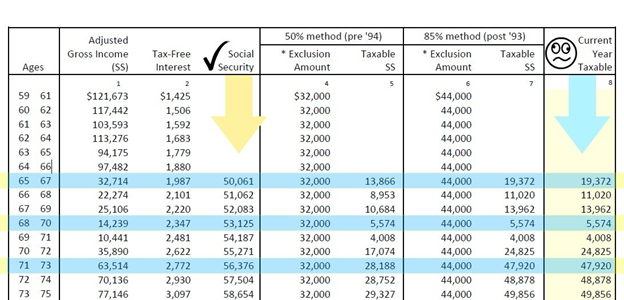

Taxable Social Security Worksheet To compute the amount of Social Security benefits that are taxable to Iowa complete the worksheet below The worksheet below calculates the 2013 89 phase

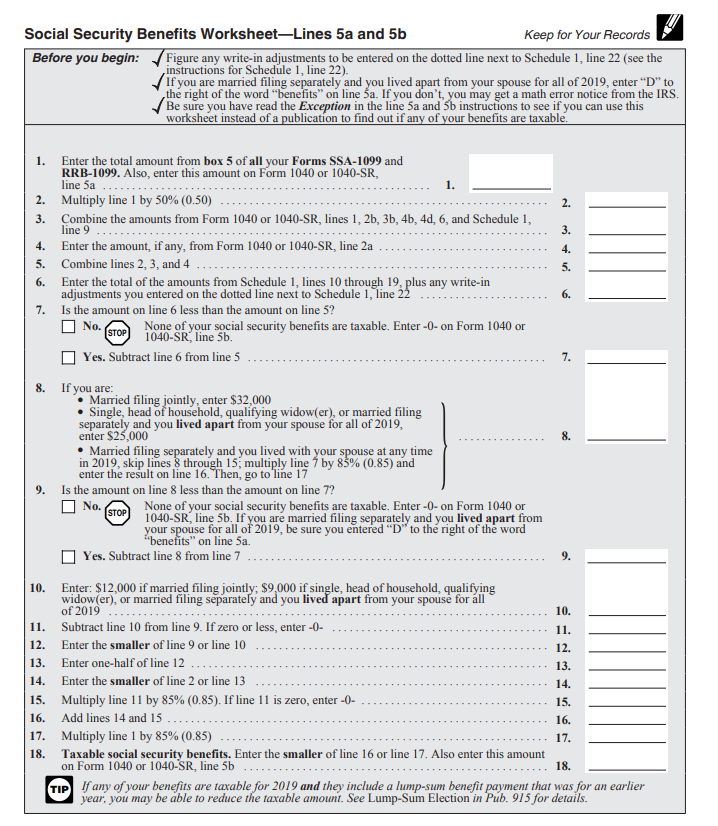

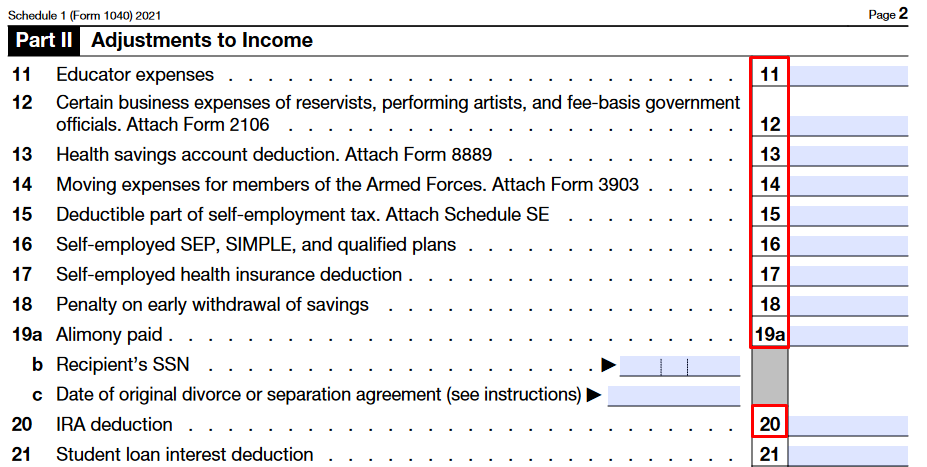

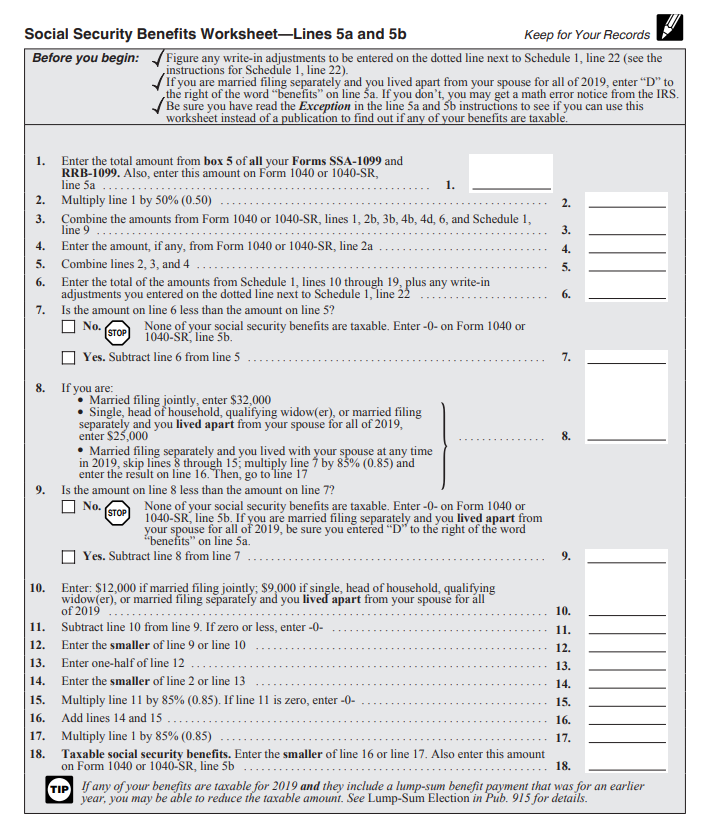

The reportable Social Security benefit is calculated using the worksheet below and entered on Step 4 of the IA 1040 SOCIAL SECURITY WORKSHEET 1 Enter the None of the benefits are taxable for 2019 3 Use the worksheet in IRS Pub 915 if any of the following apply Form 2555 Foreign Earned Income is

Taxable Social Security Worksheet

https://images.squarespace-cdn.com/content/v1/5b2c618596d455860e15ec8f/1609791972896-THBK30R3E77U3F9SENTO/Social+Security+Income+Calculations.PNG

The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen If the benefits are not taxed

Templates are pre-designed files or files that can be used for numerous functions. They can conserve time and effort by offering a ready-made format and design for producing different kinds of content. Templates can be utilized for individual or professional projects, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Taxable Social Security Worksheet

Form 1040 Line 6: Social Security Benefits — The Law Offices of O'Connor & Lyon

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

Social Security Benefits Worksheet - Lines 20a and 20b

Social Security Benefits Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

Guide to Taxation of Social Security and Equivalent Railroad Retirement Benefits (Publication 915) | DocHub

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

https://www.irs.gov/pub/irs-pdf/n703.pdf

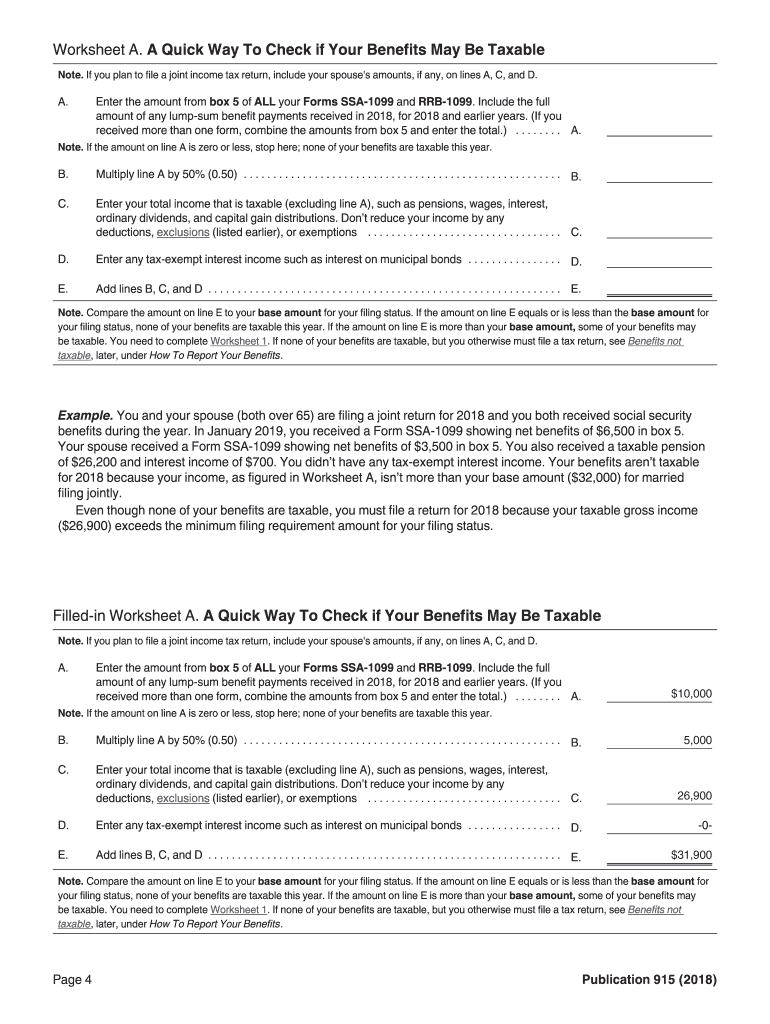

Read This To See if Your Social Security Benefits May Be Taxable If your Do not use the worksheet below if any of the following apply to you instead go

https://www.ssa.gov/benefits/retirement/planner/taxes.html

This Social Security planner page explains when you may have to pay income taxes on your Social Security benefits

https://www.cchwebsites.com/content/taxguide/tools/ssbenefits_m.php

The taxable portion can range from 50 to 85 percent of your benefits The worksheet provided can be used to determine the exact amount Social Security

https://tax.ri.gov/sites/g/files/xkgbur541/files/2022-12/Social%20Security%20Worksheet_w.pdf

Taxable Social Security Income Worksheet Enter your spouse s date of birth if MODIFICATION FOR TAXABLE SOCIAL SECURITY INCOME WORKSHEET STEP 1

https://www.taxact.com/support/1375/2022/social-security-benefits-worksheet-taxable-amount

The TaxAct program will automatically calculate the taxable amount of your Social Security income if any To view the Social Security Benefits Worksheet

Social Security benefits entered on screen SSA that are either partially or totally taxable If the benefits are not taxable then the worksheet is not produced worksheet is part of IRS Publication 915 is described below Calculate modified total income MTI Total Income without Social Security Benefits 50

The IRS will not have Social Security worksheets available for tax year 2022 to calculate the amount of benefits that are taxable until late