The Qualified Dividends And Capital Gain Tax Worksheet A qualified dividend will be one that falls under capital gains tax rates and is then taxed at a lower rate than income taxes rates for those

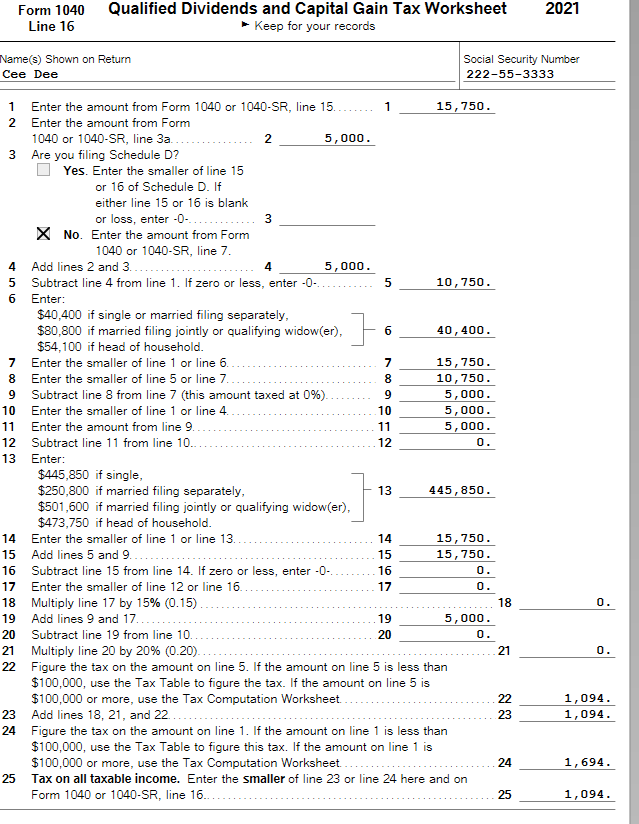

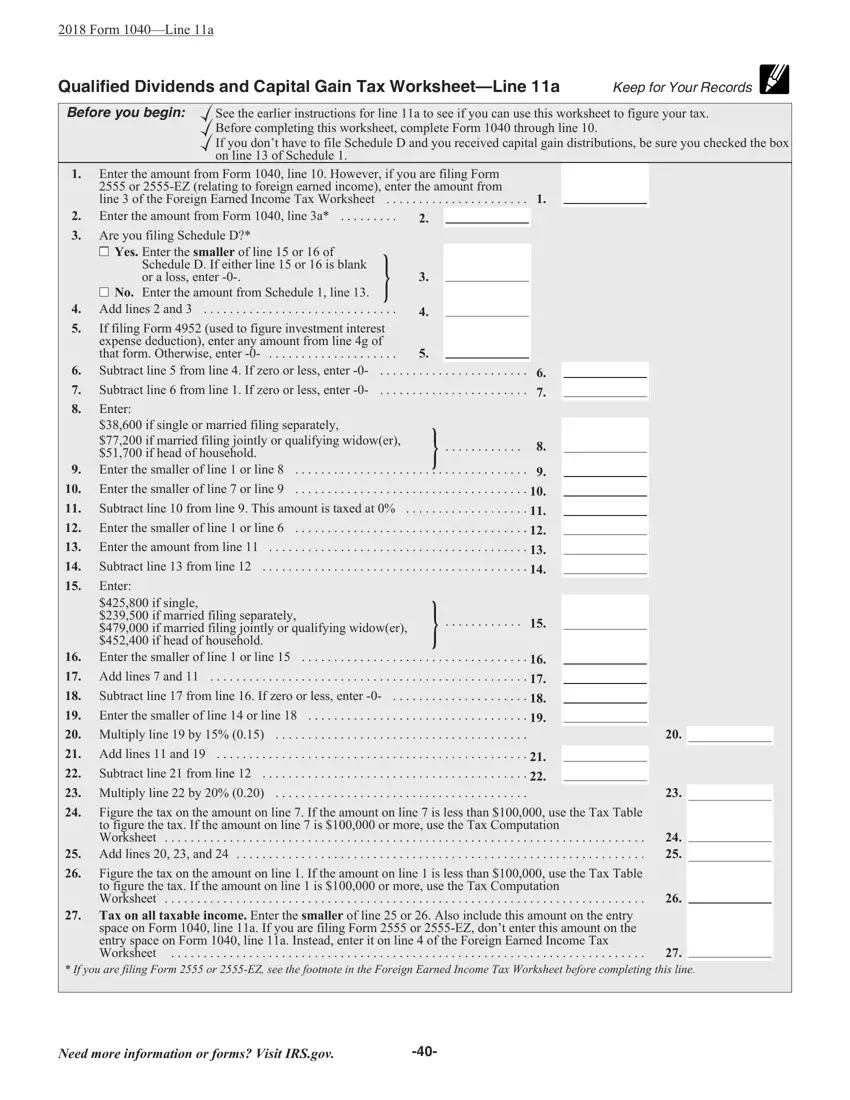

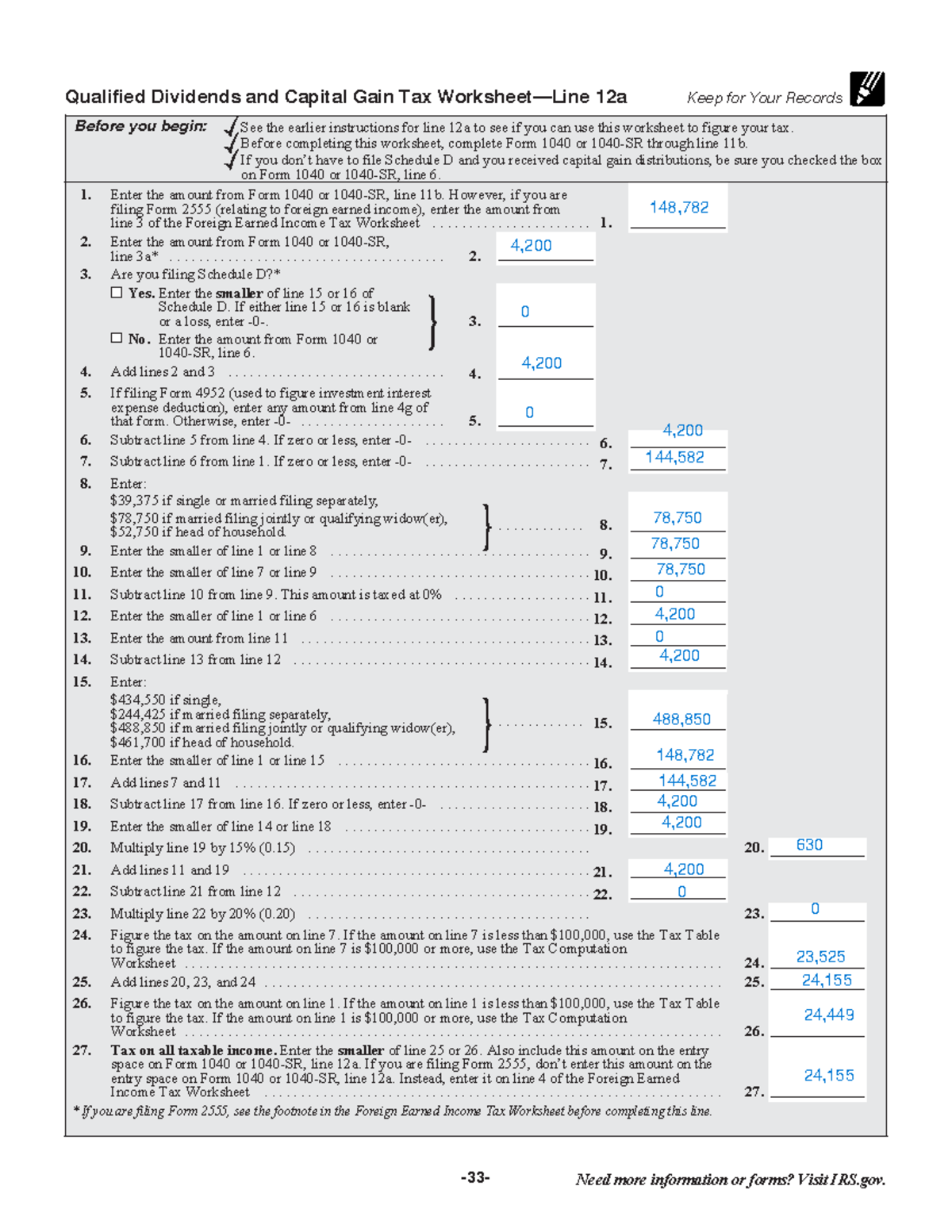

Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 16 No Complete the rest of Form 1040 1040 SR or 1040 For this reason the first step of the Qualified Dividends and Capital Gain Tax Worksheet is to split those two separate types back out Lines 1

The Qualified Dividends And Capital Gain Tax Worksheet

The Qualified Dividends And Capital Gain Tax Worksheet

The Qualified Dividends And Capital Gain Tax Worksheet

https://www.pdffiller.com/preview/391/725/391725062/large.png

The Qualified Dividends and Capital Gain Tax Worksheet also known as Form 1040 Line 44 is designed to calculate taxes on capital gains at a special rate

Pre-crafted templates provide a time-saving service for producing a varied series of documents and files. These pre-designed formats and designs can be used for numerous personal and expert jobs, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, improving the content production process.

The Qualified Dividends And Capital Gain Tax Worksheet

IN C++ Please Create a Function to Certify the | Chegg.com

SOLUTION: Acc 330 qualified dividends and capital gain tax worksheet alexa thomas - Studypool

Qualified Dividends Form - Fill Out and Sign Printable PDF Template | signNow

Qualified dividends and capital gain tax worksheet | Chegg.com

SOLUTION: Qualified Dividends and Capital Gain Tax Worksheet - Studypool

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet – Marotta On Money

https://www.irs.gov/pub/irs-news/fs-04-11.pdf

The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099

https://www.youtube.com/watch?v=gqRKwn4ef74

The tax rate computed on your Form 1040 must consider any tax favored items such as

https://pdfliner.com/qualified-dividends-and-capital-gain-tax-worksheet

This printable PDF blank is a part of the 1040 guide you on your way brochure s Tax and Credits section It is used only if you have dividend income or long

https://media.hrblock.com/media/KnowledgeDevelopment/ITC/2023Forms/2022_Qualified_Dividends_and_Capital_Gains_Tax_Worksheet_line_16_fillable.pdf

Enter the amount from Form 1040 or 1040 SR line 15 However if you are filing 1 Form 2555 relating to foreign earned income enter the amount from

https://www.taxact.com/support/1111/2022/qualified-dividends-and-capital-gain-tax

Qualified Dividends and Capital Gain Tax Information reported to you on Form 1099 DIV and Form 1099 B can be entered in the TaxAct program in the Investment

Qualified Dividends and Capital Gain Tax Worksheet Line 11aSee the earlier instructions for line 11a to see if you can use this worksheet to figure your tax Taxable Income Threshold 0 15 20 Married Filing Jointly and Surviving Spouse 0 to 89 250 89 251 to 553 850 553 851 and up

income rises It takes 27 lines in the IRS qualified dividends and capital gain tax worksheet to work through the computations Form 1040