Turbotax Car And Truck Expenses Worksheet Turbotax Car And Truck Expenses Worksheet The Enigmatic Realm of Turbotax Car And Truck Expenses Worksheet Unleashing the Language is Inner Magic In a fast

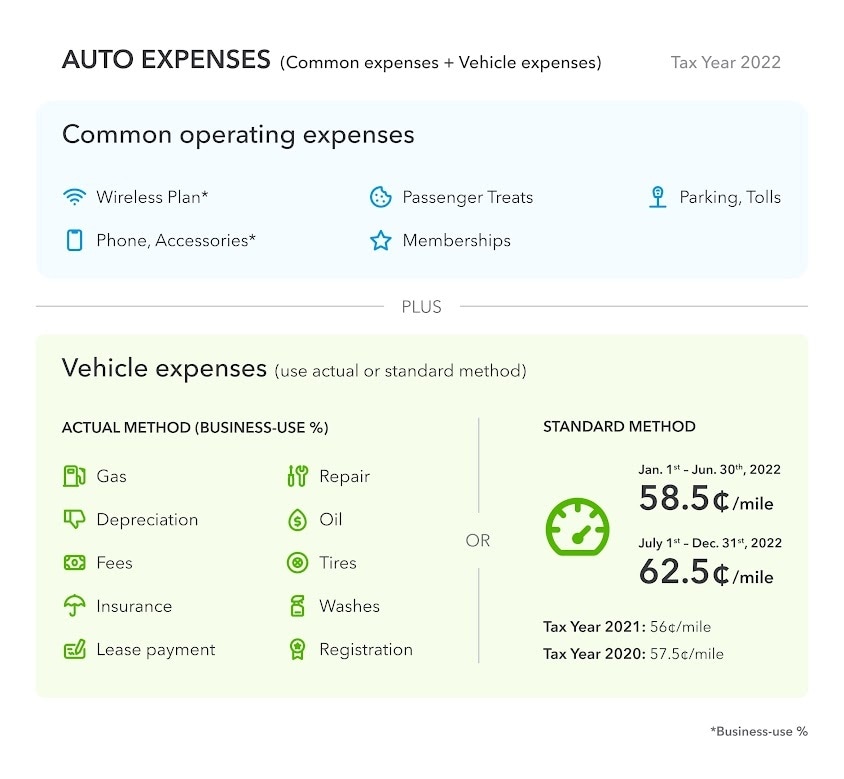

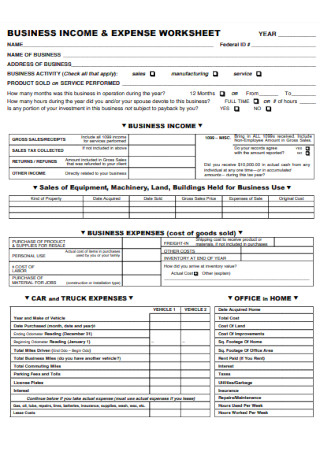

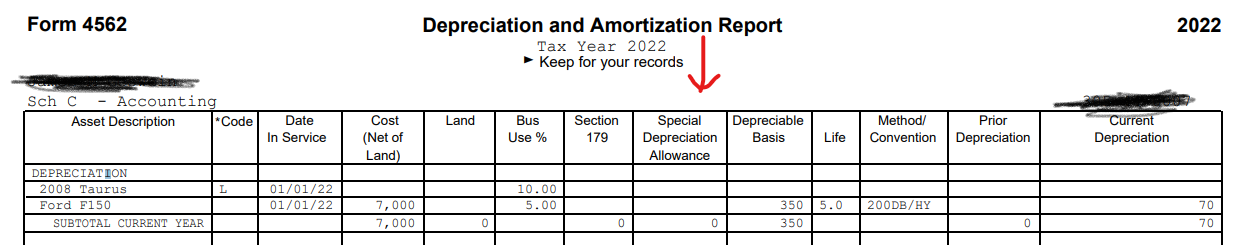

Within the depths with this touching examination we shall investigate the book is main harmonies analyze its enthralling writing style and submit ourselves Ordinarily expenses related to use of a car van pickup or panel truck for business can be deducted as transportation expenses Use of larger vehicles such

Turbotax Car And Truck Expenses Worksheet

Turbotax Car And Truck Expenses Worksheet

Turbotax Car And Truck Expenses Worksheet

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/fa52084f-8114-4287-9bd1-ba9e171d21d4.default.png

TurboTax Car and Truck Expense Bug How To Fix Editing Problem Issue in Schedule C

Templates are pre-designed files or files that can be used for various functions. They can conserve effort and time by supplying a ready-made format and layout for developing different kinds of content. Templates can be utilized for personal or expert projects, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Turbotax Car And Truck Expenses Worksheet

Maximizing Tax Deductions for the Business Use of Your Car - TurboTax Tax Tips & Videos

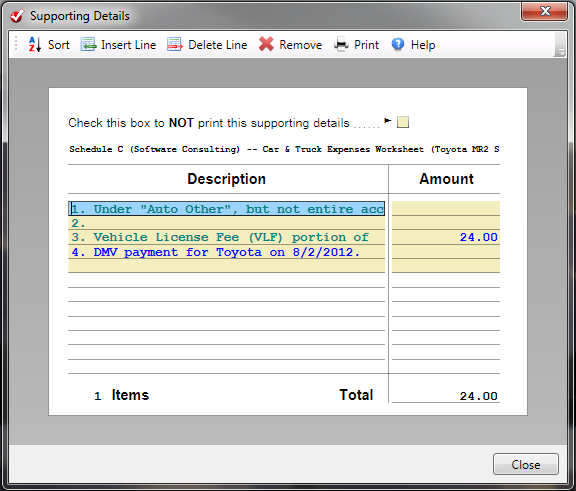

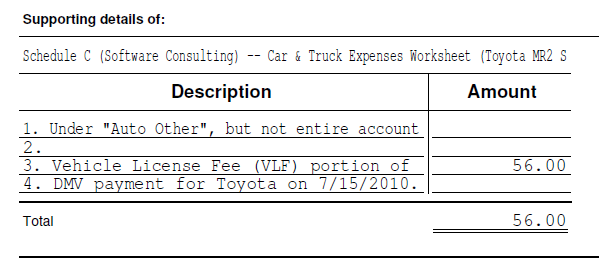

TurboTax Fails to Print Supporting Details | MCB Systems

How do I claim vehicle expenses if I'm self-employed?

Line 10 - Car and Truck Expenses | Center for Agricultural Law and Taxation

50+ SAMPLE Expense Worksheets in PDF | MS Word

![Independent Contractor Expenses Spreadsheet [Free Template] independent-contractor-expenses-spreadsheet-free-template](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b028566948eb14d155c7_all-business-expenses-tab.png)

Independent Contractor Expenses Spreadsheet [Free Template]

https://proconnect.intuit.com/support/en-us/help-article/federal-taxes/completing-car-truck-expenses-worksheet-proseries/L2gD181Q4_US_en_US

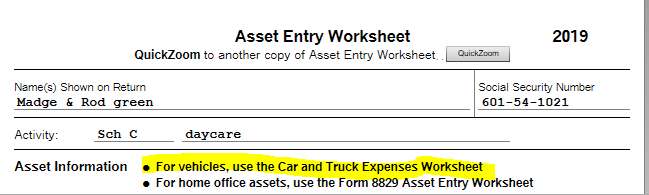

For entering vehicle expenses in an individual return Intuit ProSeries has a Car and Truck Expense Worksheet You should use this worksheet if you re

https://ttlc.intuit.com/community/business-taxes/discussion/car-and-truck-expenses-worksheet-says-line-51-depreciation-allowed-or-allowable-and-line-52-amt/00/2504504

Solved I m getting an error in TurboTax on car and truck expenses worksheet that says Line 51 depreciation allowed or allowable and Line

https://turbotax.intuit.com/tax-tips/self-employment-taxes/maximizing-tax-deductions-for-the-business-use-of-your-car/L1rikLUJ7

You ll want to calculate your vehicle expenses each way and then choose the method that yields the largest deduction for you If you are using

https://ttlc.intuit.com/community/taxes/discussion/how-do-i-delete-the-schedule-c-car-amp-truck-expenses-worksheet-from-the-software-not-online-version/00/326199

I need to know how to remove this worksheet while using the desktop Mac version of TurboTax Car Truck Expenses Worksheet Open Go to

https://www.reddit.com/r/TurboTax/comments/ljv5xr/schedule_c_endless_loop_turbotax_rep_suggested/

I was filing my taxes yesterday and on the last step I was prompted to review an item on my Schedule C Car Truck Expenses Worksheet

Car and Truck Expenses Drake Software Advance Child Tax Credit How to Write Off Car and Truck Expenses Worksheet Vehicle Expenses Worksheet for Form 2106 WORKSHEET pdf TurboTax Car and Truck Expense Bug How To Fix 1040 Auto

vehicle expenses for a business activity in Intuit TurboTax is flagging Schedule C Car Truck expense worksheet WebOriginal Issue Date 01 21