Turbotax What If Worksheet what if worksheet what is the what if worksheet and how do i get around it when filing my taxes in online turbotax there is no forms function and the

You will need to have your federal tax return and if applicable a completed Virginia Schedule ADJ to prepare the worksheet Married couples who file a The personal income tax is filed using Form PIT 1 Personal Income Tax Return If you are a New Mexico resident you must file if you meet any of the following

Turbotax What If Worksheet

Turbotax What If Worksheet

Turbotax What If Worksheet

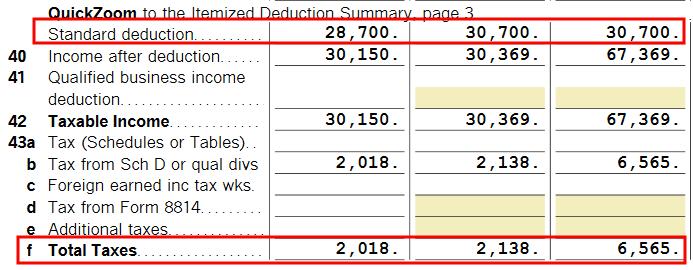

https://thefinancebuff.com/wordpress/wp-content/uploads/2023/05/tt-what-if-05-total-tax.jpg

How do I file a Maine income tax return 1 How can I tell if I am a resident of Maine For income tax purposes you are a resident of Maine if

Pre-crafted templates provide a time-saving option for producing a varied range of documents and files. These pre-designed formats and designs can be made use of for various personal and expert tasks, consisting of resumes, invites, flyers, newsletters, reports, presentations, and more, improving the material development process.

Turbotax What If Worksheet

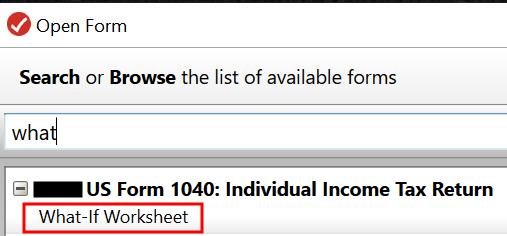

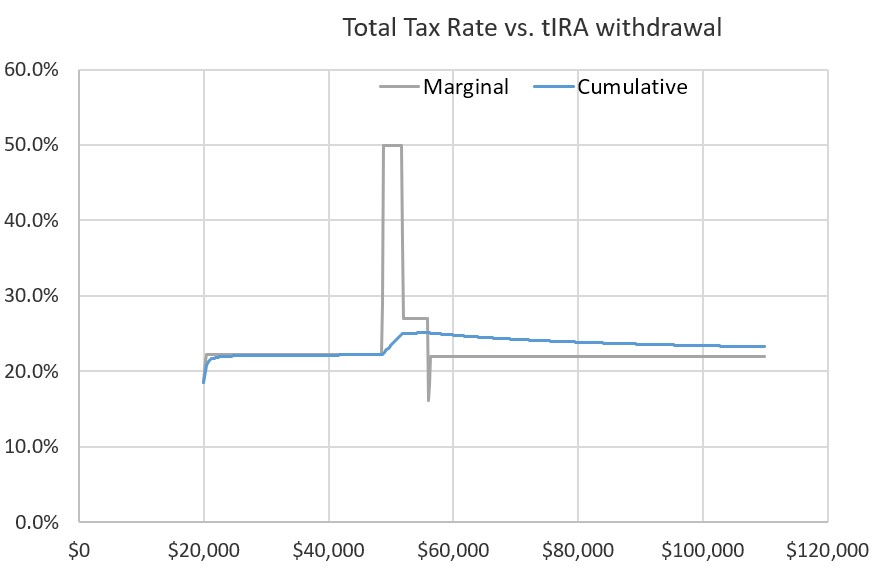

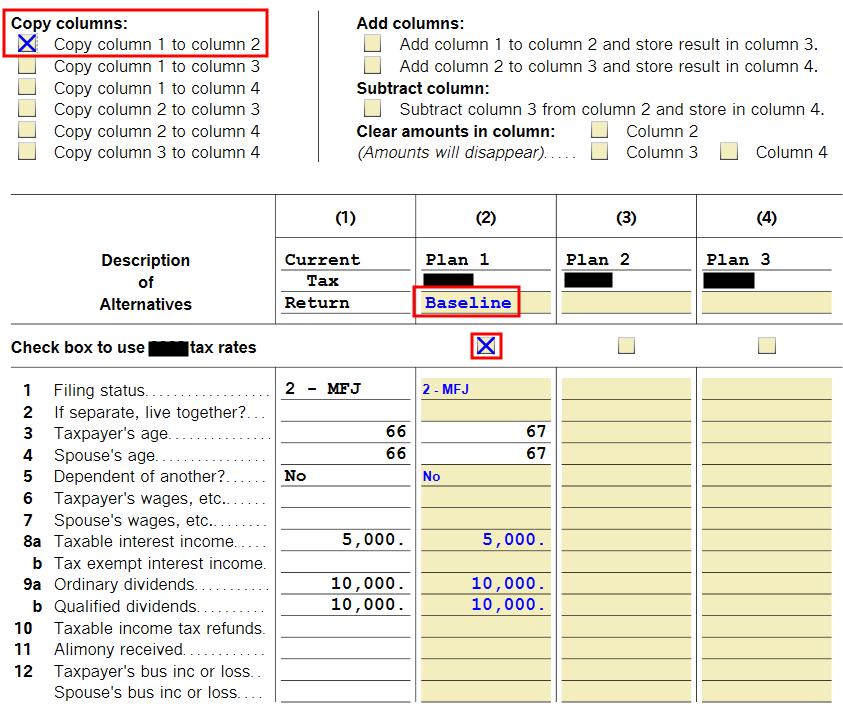

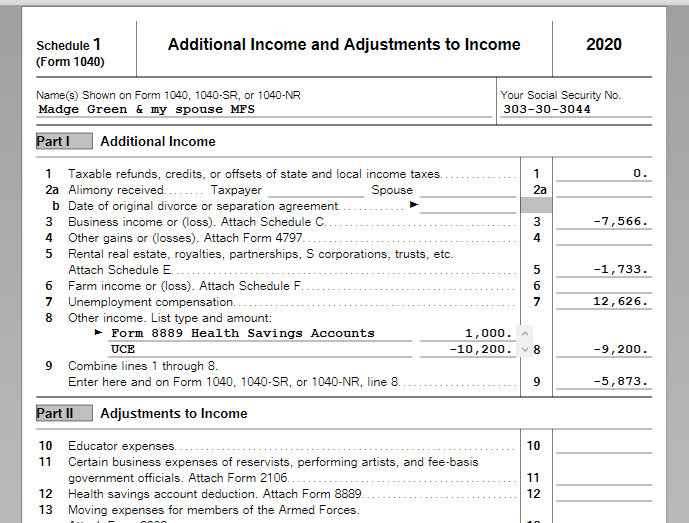

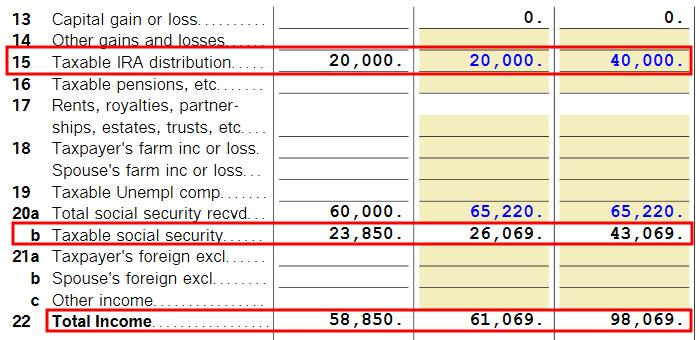

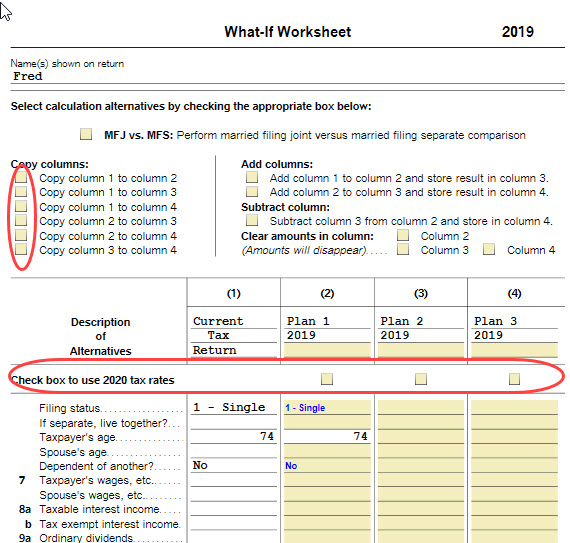

Tax Planning with TurboTax What-If Worksheet: Roth Conversion

Tax Planning with TurboTax What-If Worksheet: Roth Conversion

How do I display the Tax Computation Worksheet?

total of payments and withholdings

Tax Planning with TurboTax What-If Worksheet: Roth Conversion

How do I display the Tax Computation Worksheet?

https://groups.google.com/g/alt.comp.software.financial.quicken/c/jMFm9vzoD00

I have been using Turbotax for several years and have never been able to access the What if worksheet from the Tools menu It would be

https://www.bogleheads.org/forum/viewtopic.php?t=308170

I use the What If Worksheet mentioned above It consolidates everything into one form which makes it easy to see what s going on and have

https://thefinancebuff.com/turbotax-what-if-planning-roth-conversion.html

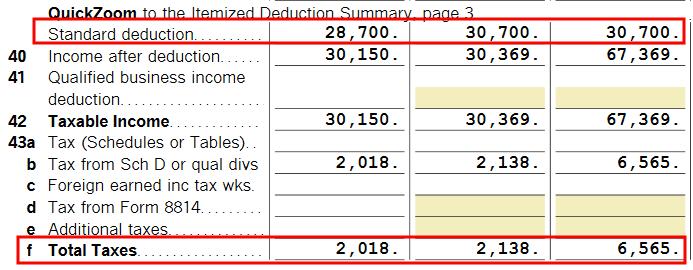

The What If Worksheet in TurboTax doesn t show the marginal tax rate directly You have to calculate it yourself by dividing the difference in

https://www.irs.gov/individuals/get-ready-to-file-your-taxes

If you re comfortable preparing your own taxes you can use Free File Fillable Forms regardless of your income to file your tax returns either by mail or

https://www.hrblock.com/tax-calculator/

Estimate your tax refund for 2022 by answering a few simple questions about your income with H R Block s easy to use free tax calculator

Kentucky is now offering a new way to file your return If you would like to fill out your Kentucky forms and schedules without software help or assistance you tax return are required to file a Georgia income tax return Normally Georgia will accept the automatic federal extension to file Form 4868 if it is

You must claim the credit on the 2022 FTB 3514 form California Earned Income Tax Credit or if you e file follow your software s instructions Generally