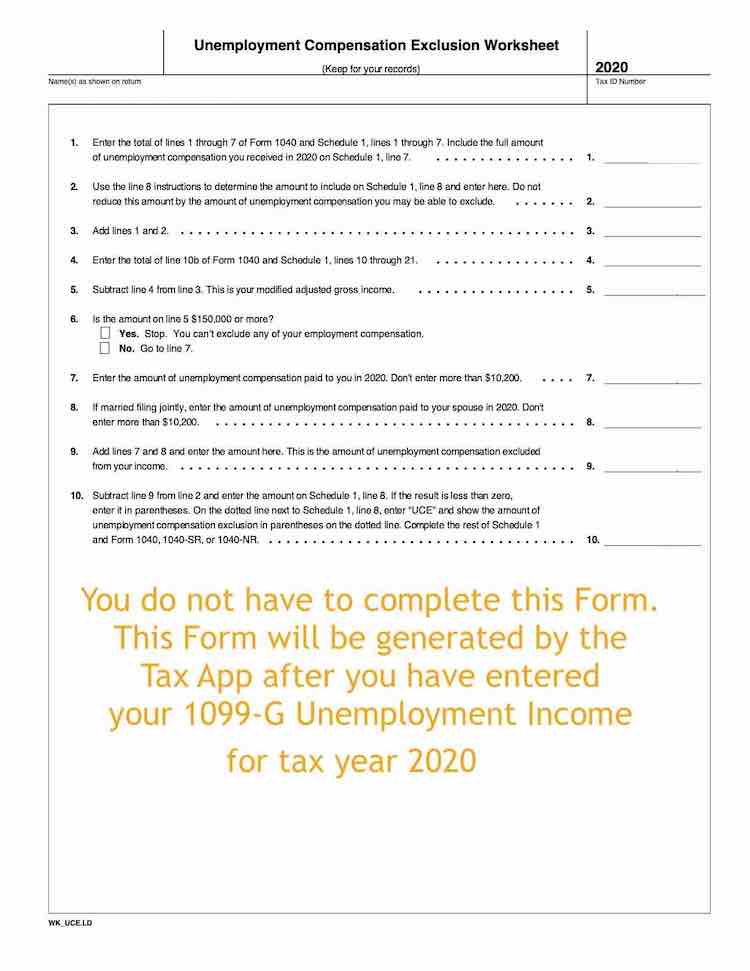

Unemployment Compensation Exclusion Worksheet This worksheet replaces the Unemployment Compensation Worksheet printed in the 2020 IT 40 and IT 40PNR instruction booklets For additional

2020 NMI Unemployment Compensation Exclusion Worksheet Schedule 1CM line 8b New Exclusion of up to 10 200 of Unemployment Compensation 1 Worksheet Schedule 1 Line 8 you should report half of your unemployment compensation and half of your spouse s unemployment compensation on line 8 of the

Unemployment Compensation Exclusion Worksheet

Unemployment Compensation Exclusion Worksheet

Unemployment Compensation Exclusion Worksheet

https://www.efile.com/image/unemployment-worksheet.jpg

When figuring these amounts the program will use the amount from line 3 of the Unemployment Compensation Exclusion Worksheet when asked to

Templates are pre-designed files or files that can be used for numerous purposes. They can conserve effort and time by providing a ready-made format and layout for producing various sort of content. Templates can be utilized for individual or professional jobs, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Unemployment Compensation Exclusion Worksheet

Stimulus and taxes: How to shield up to $10,200 in unemployment benefits from income taxes - syracuse.com

IRS Unemployment Exclusion Worksheet Now Live - YouTube

Unemployment Compensation Exclusion Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Unemployment Compensation Exclusion Worksheet – Schedule 1, Line 8 - Page 2

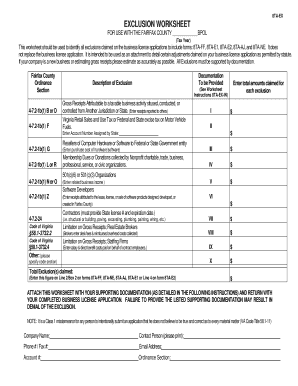

Fillable Online EXCLUSION WORKSHEET Fax Email Print - pdfFiller

Updated Unemployment Compensation Exclusion – Taxware Systems

https://www.irs.gov/newsroom/2020-unemployment-compensation-exclusion-faqs-topic-b-calculating-the-exclusion

You can also use the Unemployment Compensation Exclusion Worksheet in the Form 1040 1040 SR instructions for Schedule 1 to figure your MAGI Q3

https://media.hrblock.com/media/knowledgedevelopment/itc/2021forms/2020_unemployment_exclusion_worksheet_r1.pdf

WORKSHEET SCHEDULE 1 LINE 8 the full amount of unemployment commpensation On the dotted line next to Schedule 1 line 8 enter UCE and show the amount

https://www.taxnotes.com/research/federal/irs-guidance/fact-sheets/irs-amends-guidance-on-unemployment-compensation-exclusion/7clsd

If you re eligible you should exclude up to 10 200 of your unemployment compensation from income on your 2020 Form 1040 1040 SR or 1040 NR This means up to

https://answerconnect.cch.com/document/tax2022fbe939b0458745e6b2dd61e0916a1068/news/irs-allows-exclusion-of-unemployment-compensation-for-tax-year-2020-only

They can see the updated instructions and the Unemployment Compensation Exclusion Worksheet to figure their exclusion and the amount to enter on

https://support.taxslayerpro.com/hc/en-us/articles/1500004190581-2020-Unemployment-Compensation-Exclusion

The IRS has recently released a new unemployment compensation exclusion worksheet Unemployment Compensation Exclusion Worksheet The exclusion

However the Unemployment Compensation Exclusion Worksheet provides the following instructions for computing 2020 AGI for this purpose If you Use the Unemployment Compensation Exclusion Worksheet to figure your modified AGI and the amount you can exclude If you made contributions to a

The full amount of your unemployment income is required to be included in the calculation of household income Although the exclusion is no