Unrecaptured Section 1250 Gain Tax Rate 2022 Dec 21 2023 0183 32 So part of the gain beyond the original cost basis would be taxed as a capital gain but the part that relates to depreciation is taxed at the 1250 rule rate The unrecaptured section 1250 rate is capped at 25 for 2023

Jun 1 2023 0183 32 2022 short term capital gains tax rates Tax Rate Single Married Filing Jointly Married Filing Separately Head of Household 10 0 to 10 275 0 to 20 550 0 to 10 275 0 to 14 650 12 10 276 to 41 775 20 551 to 83 550 10 276 to 41 775 14 651 to 55 900 22 41 776 to 89 075 83 551 to 178 150 41 776 to 89 075 Jan 30 2024 0183 32 The portion of any unrecaptured section 1250 gain from selling section 1250 real property is taxed at a maximum 25 rate Note Net short term capital gains are subject to taxation as ordinary income at graduated tax rates Limit on the deduction and carryover of losses

Unrecaptured Section 1250 Gain Tax Rate 2022

Unrecaptured Section 1250 Gain Tax Rate 2022

Unrecaptured Section 1250 Gain Tax Rate 2022

https://images.squarespace-cdn.com/content/v1/5e1a32c24316850ed6cef645/1629909158341-C7C186X0Z49GE7D9LZAA/1245-1250-property-cost-segregation.jpg

Jul 18 2023 0183 32 When depreciation is recaptured a portion of the gain on the sale is taxed at ordinary income tax rates instead of the more favorable capital gain rates For depreciable real estate this recapture is called section 1250 recapture

Templates are pre-designed documents or files that can be used for different purposes. They can save time and effort by providing a ready-made format and layout for producing different type of content. Templates can be utilized for individual or professional tasks, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Unrecaptured Section 1250 Gain Tax Rate 2022

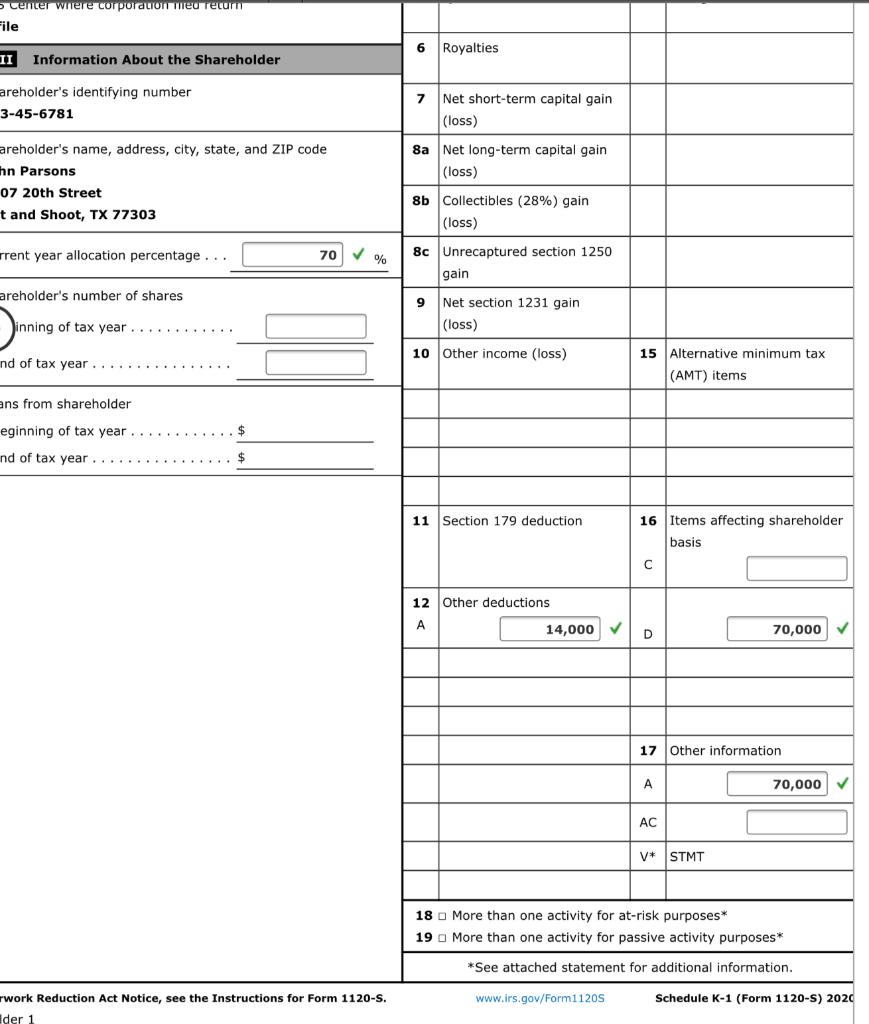

Solved Note This Problem Is For The 2020 Tax Year John Chegg

What Is Unrecaptured Section 1250 Gain The Expert Opinion By

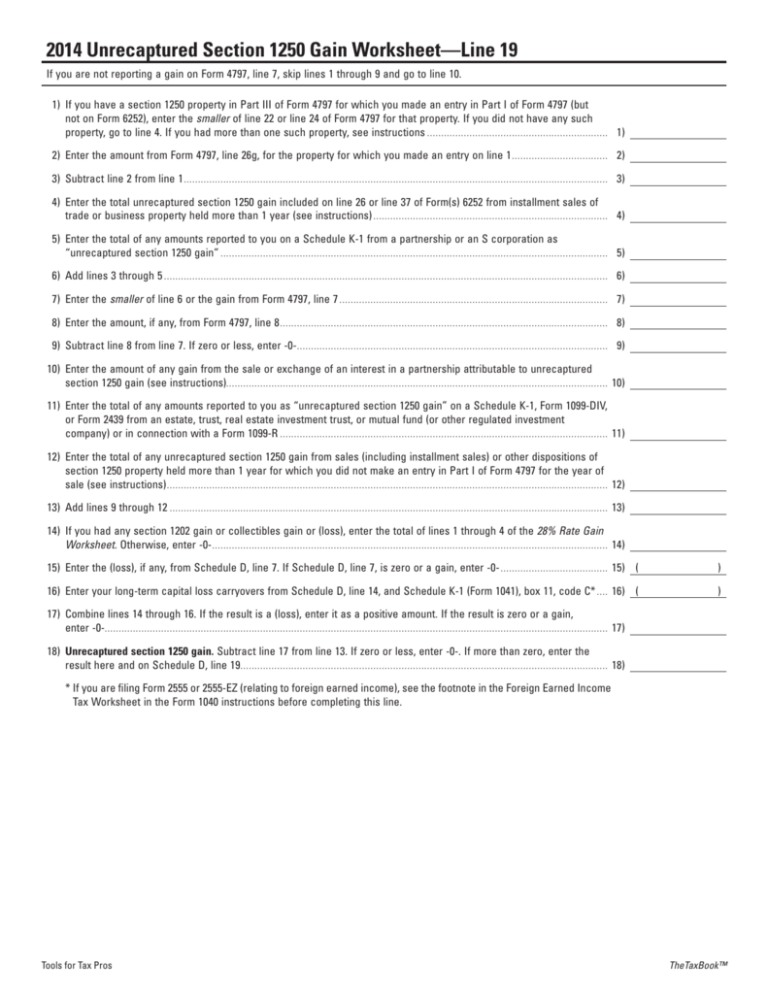

2014 Unrecaptured Section 1250 Gain Worksheet Line 19

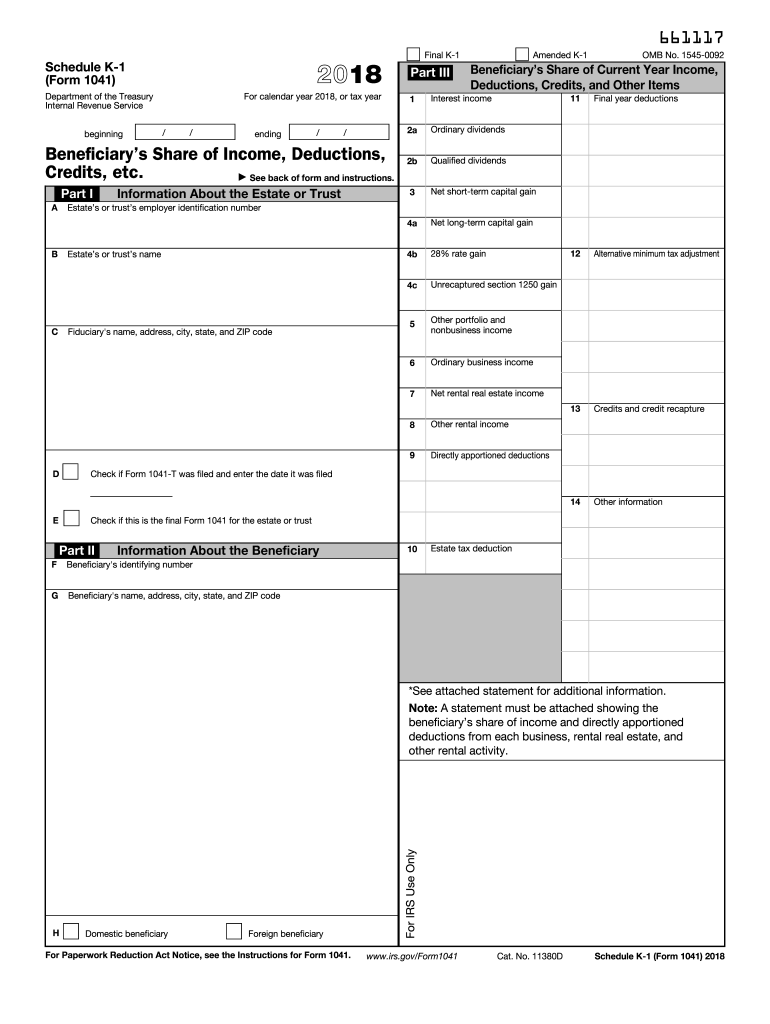

Schedule K 1 1041 2018 2024 Form Fill Out And Sign Printable PDF

:max_bytes(150000):strip_icc()/GettyImages-1279111702-e9d0d62e1ab3458299f00ffc773d52f4.jpg)

What Is An Unrecaptured Section 1250 Gain

Capital Gains Tax In The United States

https://www.irs.gov/publications/p544

Capital Gains Tax Rates Unrecaptured section 1250 gain Form 4797 Section 1231 gains and losses Ordinary gains and losses Mark to market election Ordinary income from depreciation Disposition of depreciable property not used in trade or business How To Get Tax Help Preparing and filing your tax return Free options for tax preparation

https://www.freshbooks.com/glossary/tax/unrecaptured-section-1250-gain

Aug 31 2023 0183 32 As of 2022 unrecaptured section 1250 gains are subject to the ordinary tax rate which is maxed out at 25 percent The recaptured amount is taxed at the capital gain tax rate of 0 15 or 20

https://www.thebalancemoney.com/what-is-an

Jul 31 2022 0183 32 How Much Are Taxes on Unrecaptured Section 1250 Gains The tax on unrecaptured Section 1250 gains tops out at 25 which is considerably higher than two of the three tax rates for long term capital gains which ranges from 0 to 20 depending on your income Most taxpayers pay a 0 or 15 rate on long term capital gains which is

https://www.irs.gov/pub/irs-pdf/i1040sd.pdf

recaptured Section 1250 Gain Work sheet in these instructions if you com plete line 19 of Schedule D If there is an amount in box 2c see Exclusion of Gain on Qualified Small Business QSB Stock later If there is an amount in box 2d in clude that amount on line 4 of the 28 Rate Gain Worksheet in these instruc

https://www.thetaxadviser.com/issues/2022/aug/

Aug 1 2022 0183 32 While Sec 1250 only requires additional depreciation to be recaptured as ordinary income Sec 1 h 1 E subjects unrecaptured Sec 1250 gain to a maximum tax rate of 25

For noncorporate taxpayers any unrecaptured depreciation gain on IRC Section 1250 property is currently taxed using a maximum tax rate of 25 According to the Greenbook the proposal would apply to noncorporate taxpayers with 400 000 or more in adjusted taxable income 200 000 for married individuals filing separate returns Jun 1 2022 0183 32 Unrecaptured Section 1250 Gain Worksheet Sch D Inst U S Income Tax Return for Estates and Trusts OMB 1545 0092 IC ID 191281 OMB report TREAS IRS OMB 1545 0092 ICR 202111 1545 019 More recent filings for OMB 1545 0092 can be found here 2023 08 30 Revision of a currently approved collection 2022 06 01

Your projected tax gain will be 65 000 140 000 less 75 000 100 000 cost less 25 000 depreciation Since your gain is greater than your accumulated tax depreciation the recapture rule will apply As a result your tax on sale is not 9 750 65 000 x 15 but rather 12 250 25 6 more in taxes than what you planned