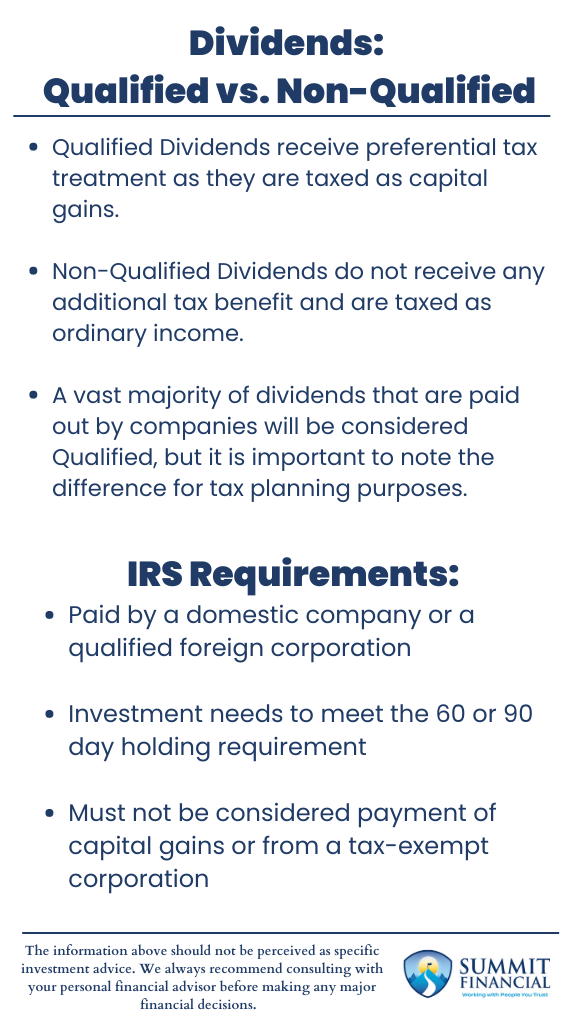

What Are Qualified Dividends Unqualified dividends are taxed at a taxpayer s income tax rate Qualified dividends are taxed at a preferred rate Here s a breakdown of the differences

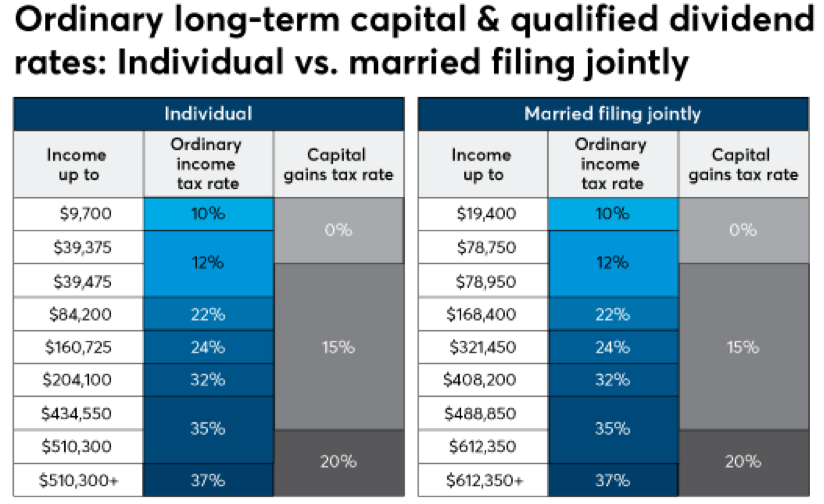

Jul 4 2024 0183 32 Qualified dividends are taxed at the same rates as the capital gains tax rate These rates are lower than ordinary income tax rates The tax rates for ordinary dividends typically those that May 24 2022 0183 32 Qualified dividends are dividends taxed at a lower tax rate than the income tax rate This is different from traditional dividends Learn more about how each works

What Are Qualified Dividends

What Are Qualified Dividends

What Are Qualified Dividends

https://1.simplysafedividends.com/wp-content/uploads/2018/09/A-table-of-non-qualified-dividend-taxes.jpg

Aug 18 2022 0183 32 What Are Qualified Dividends A qualified dividend is a dividend that may be eligible for a lower tax rate than other forms of income While qualified dividend stocks may offer a slight tax advantage you probably don t need to worry about the type of dividends your investments pay

Pre-crafted templates provide a time-saving option for producing a diverse series of documents and files. These pre-designed formats and designs can be used for numerous individual and professional tasks, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, improving the material development process.

What Are Qualified Dividends

Understanding Dividends Qualified Vs Non Qualified Summit Financial

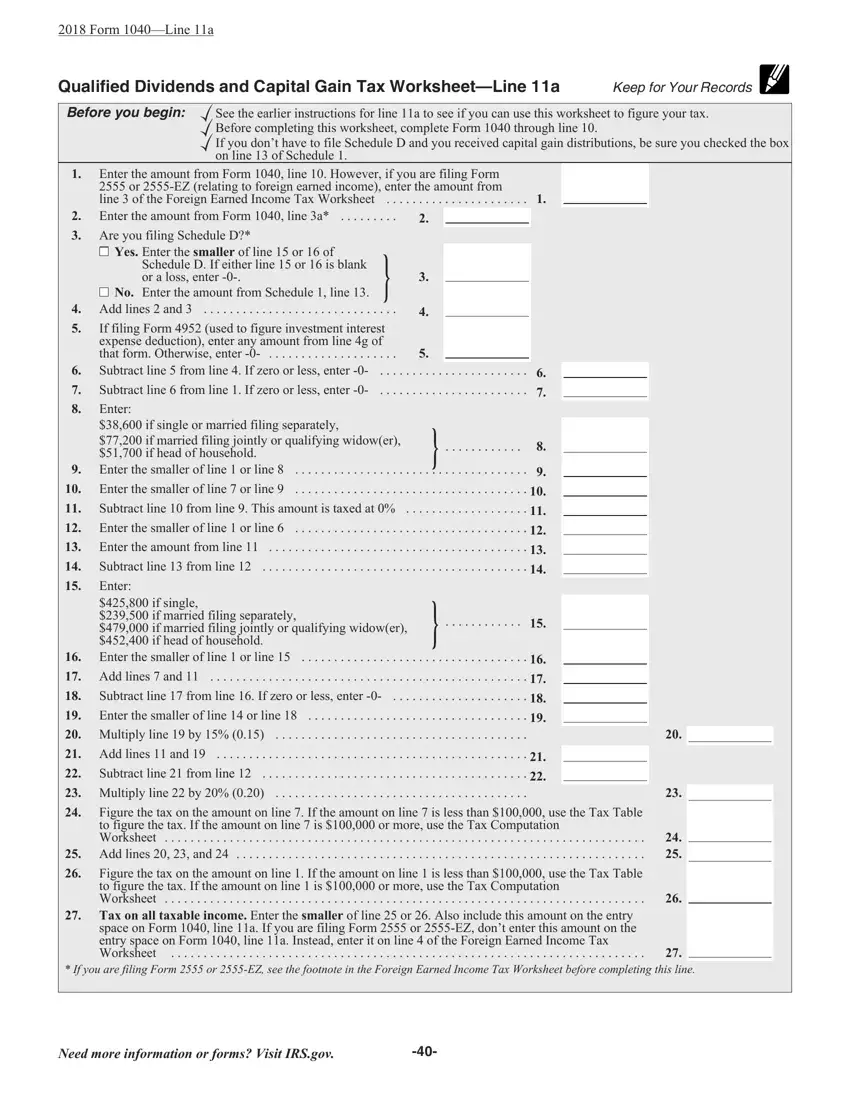

1040 Capital Gains Worksheets

Qualified Dividends And Capital Gain Worksheet 2021 At Vancoltenblog Blog

Qualified Dividends Tax Worksheet PDF Form FormsPal

Consider Taxes In Your Investment Strategy Rodgers Associates

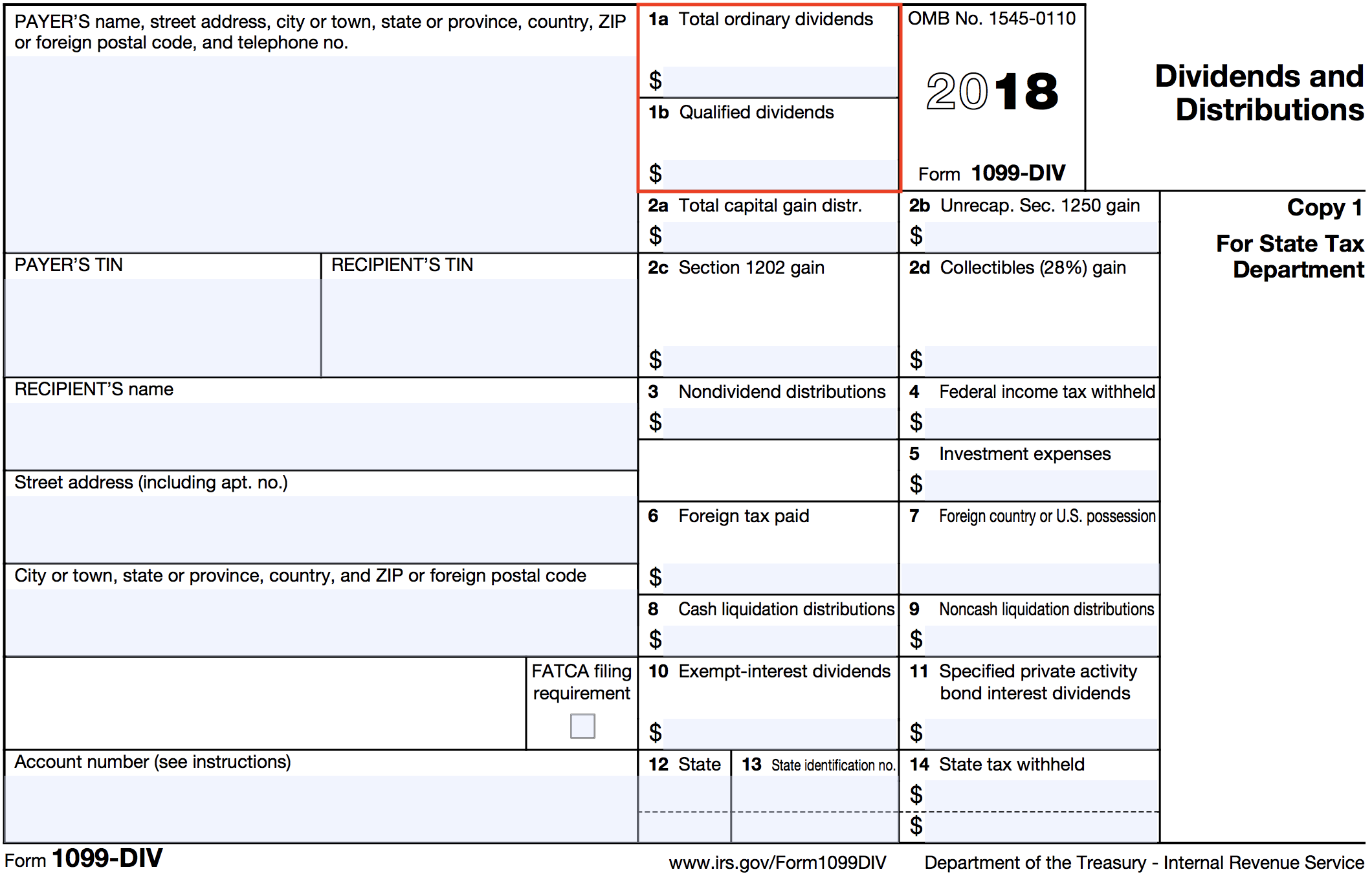

Are Qualified Dividends Included In Total Income 1040 Line 6 R tax

https://www.fool.com/terms/q/qualified-dividends

May 20 2024 0183 32 Learn what qualified dividends are how they differ from ordinary dividends and how you can legally pay less of your dividend income to the government

https://www.kiplinger.com/investing/stocks/

Oct 28 2024 0183 32 The concept of qualified dividends began with the 2003 tax cuts signed into law by George W Bush Previously all dividends were taxed at the taxpayer s normal marginal rate The lower

https://www.fidelity.com/tax-information/tax-topics/qualified-dividends

Qualified dividends are generally dividends from shares in domestic corporations and certain qualified foreign corporations which you have held for at least a specified minimum period of time known as a holding period

https://www.investing.com/academy/trading/what-is

Nov 29 2024 0183 32 Qualified dividends are ordinary dividends from domestic corporations and certain foreign corporations that qualify for the lower long term capital gains tax rates rather than ordinary income

https://www.bankrate.com/investing/qualified-dividends

Sep 1 2023 0183 32 Qualified dividends are a type of investment income that receive preferential tax treatment from the IRS Compared to ordinary dividends qualified dividends are taxed at a lower rate

[desc-11] [desc-12]

[desc-13]