What Can A Pastor Claim As Housing Allowance A housing allowance offers ministers the ability to deduct a portion of their gross income that they spend on housing costs from their federal income taxes Housing allowances can include all

Dec 4 2024 0183 32 According to the Internal Revenue Code IRC Section 107 a minister may be provided a parsonage or paid housing allowance as part of their salary compensation and To be eligible the pastor clergy must be a quot minister of the gospel quot and be ordained licensed or commissioned by a church convention or association of churches Q What is the advantage of

What Can A Pastor Claim As Housing Allowance

What Can A Pastor Claim As Housing Allowance

What Can A Pastor Claim As Housing Allowance

https://i.ytimg.com/vi/7jn_LS-AYI8/maxresdefault.jpg

Oct 18 2023 0183 32 To qualify for the housing allowance a person must meet the following criteria If you are a pastor or minister who meets the criteria above you are eligible to claim the housing

Templates are pre-designed files or files that can be utilized for numerous functions. They can save effort and time by providing a ready-made format and layout for developing different sort of content. Templates can be utilized for personal or expert projects, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

What Can A Pastor Claim As Housing Allowance

Housing Allowance Form FBMI

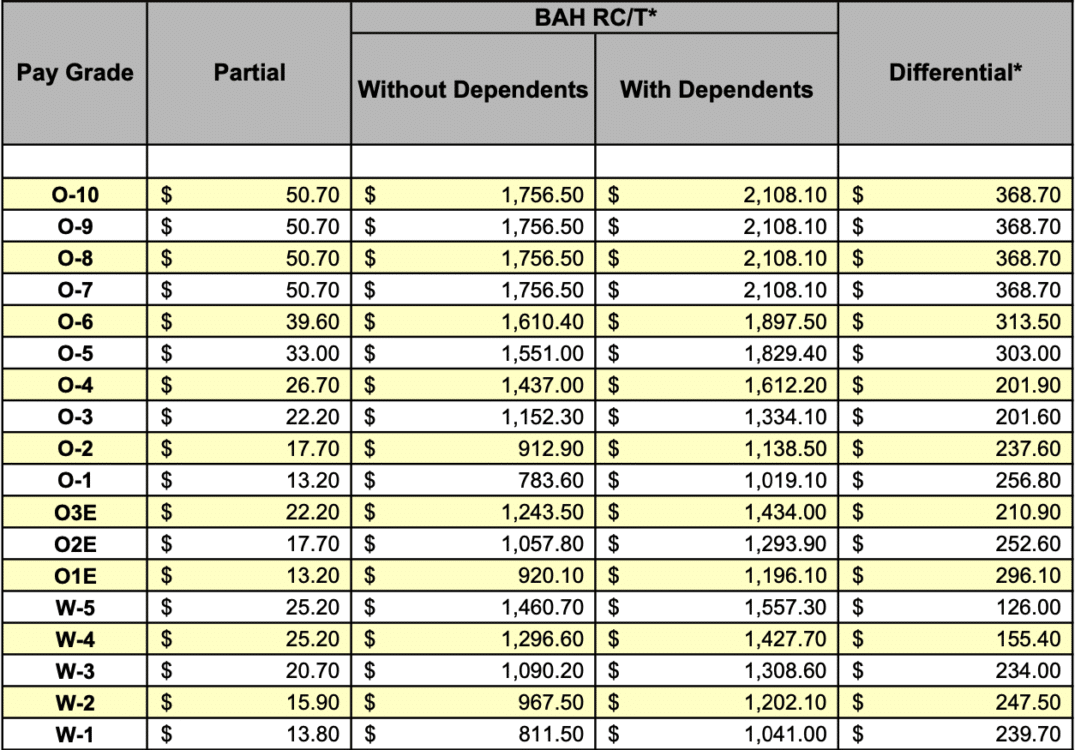

Bah 2025 Rates Chart Faris Jade

Pastor Housing Allowance Form

Pastor Housing Allowance Calculator

Church Housing Allowance For Pastors

Sample Pastor Housing Allowance Letter

https://pastorswallet.com › housing-allowance-questions-answered

Mar 6 2023 0183 32 How does a housing allowance work You the pastor calculate what your housing costs will be for the year and submit it to your church Your church approves the housing

https://www.irs.gov › › ministers-compensation-housing-allowance

Feb 7 2025 0183 32 A minister s housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self

https://pastorswallet.com › how-much-housing

If you are a bi vocational minister you can only claim a housing allowance from your ministerial income If your expenses can justify it though you could claim your entire ministerial income

https://www.ascensioncpa.com › clergy › everything

Perhaps one of the least understood tax benefits a housing allowance also called a parsonage allowance or rental allowance is defined as a designated portion of a minister s salary that is

https://churchleaders.com › administration

Feb 16 2021 0183 32 10 Housing Allowance For Pastors Tips 1 Ministers housing expenses are not subject to federal income tax or state tax The IRS allows a minister s housing expenses to be

Jun 19 2019 0183 32 Pastor James Housing Expenses Pastor James has the following annual housing expenses Rent 18 000 Taxes and Interest 0 Utilities 3 000 Furniture 1 000 Sep 16 2021 0183 32 Pastors who live in a church parsonage can still declare a housing allowance if they pay for utilities repairs furnishing or other eligible expenses

Feb 19 2024 0183 32 One of the greatest financial benefits available to pastors is the housing allowance exemption This comes in two forms the minister s cash housing allowance and parsonage