What Can You Claim On Tax For Investment Property Oct 21 2022 0183 32 As long as you have a rented dwelling on your investment property you can use land tax as a deduction However the levy differs significantly between states as does the timing of when you can claim the cost

As a property investor you can make significant tax savings on your investment properties by claiming them as allowable expenses on your tax return Apr 8 2021 0183 32 Own an investment property You can claim a tax deduction for the cost of gardening pest control and hiring a debt collector but what can t you claim

What Can You Claim On Tax For Investment Property

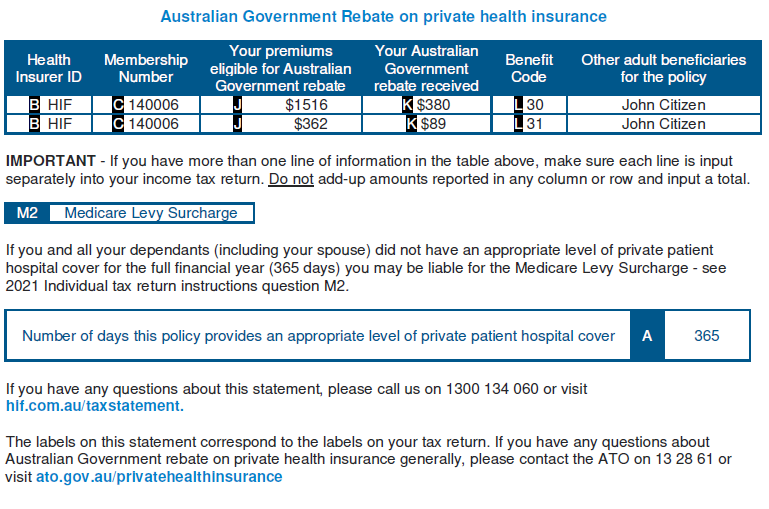

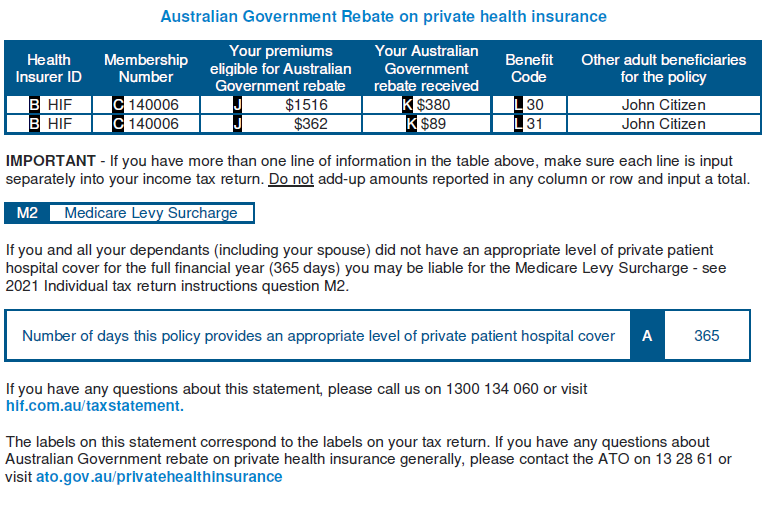

https://www.hif.com.au/theme/hif/assets/public/Image/Tax/Tax2021.PNG

Sep 23 2024 0183 32 Knowing about your investment property tax deductions will undoubtedly boost your tax return and overall rental income However many investors miss out on expense claims because they aren t equipped with the knowledge presented by the Australian Tax Office ATO

Templates are pre-designed files or files that can be utilized for different functions. They can save effort and time by offering a ready-made format and design for producing various sort of material. Templates can be used for individual or professional jobs, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

What Can You Claim On Tax For Investment Property

Printable Tax Deduction Cheat Sheet Printable Calendars AT A GLANCE

What Shoes Can You Claim On Tax YouTube

Tax Calculation And Analysis Desklib

Va Compensation For 2025

Images Blank Data Table

How To Claim Self Employed Expenses Small Business Tax Deductions

https://www.ato.gov.au › › tax-smart-tips-for-your-investment-property

Jun 16 2024 0183 32 Being tax smart when investing in property means more than making the right property choices If you use your property to earn income at any time you need to keep records right from the start work out what expenses you can claim as deductions work out if you need to pay tax instalments throughout the year

https://www.zillow.com › learn › tax-on-investment-properties

Jul 11 2019 0183 32 Investment Property How Much Can You Write Off on Your Taxes Learn how to navigate the tricky tax laws around investment properties including ways to save There are certain things you can do as a real estate investor to help manage your tax bill and maximize your after tax return on investment

https://www.realized1031.com › blog › what-investment

Apr 20 2021 0183 32 To maximize investment property tax deductions it s important to work with an accountant who is knowledgeable and experienced in real estate tax law In this article we ll do a rundown of the various expenses allowed to investment property owners

https://enrichest.com › en › blog › investment-property

Sep 21 2023 0183 32 In this complete guide we ll walk you through the ins and outs of investment property tax deductions unveiling strategies to legally reduce your tax burdens and potentially increase your investment gains

https://nchinc.com › blog › tax-accounting › tax

Feb 19 2025 0183 32 A 1031 exchange allows investors to defer capital gains taxes when selling one investment property and reinvesting the proceeds in a similar property Final Thoughts While mortgage interest depreciation property management fees and repairs offer valuable deductions certain costs such as capital improvements and personal use expenses are

Jan 22 2025 0183 32 If you are complete a paper tax return you may need to use supplementary page SA108 to record capital gains and losses on your SA100 tax return More information on Capital Gains Find out how to Jan 8 2025 0183 32 Are you claiming every deduction you re entitled to on your rental property Find out exactly what you can and can t write off when tax time rolls around

The IRS taxes you on any net profits you get out of a property when you sell it If you re flipping the property and you ve owned it for less than a year you pay short term capital gains tax which is the same rate as your marginal income tax rate If you re in the 28 tax bracket you ll pay a 28 tax on short term capital gains