What Expenses Qualify For Minister Housing Allowance Accrual expenses in the Fall Economic Statement are on a gross basis meaning the revenues are included in the accrual based revenue forecast while they are netted against expenditures

Calculating motor vehicle expenses If you use a motor vehicle or a passenger vehicle for both business and personal use you can deduct only the portion of the expenses that relates to Jan 1 2024 0183 32 The allowance is used to pay GST HST taxable other than zero rated expenses and at least 90 of the expenses are incurred in Canada or the allowance is for the use of a

What Expenses Qualify For Minister Housing Allowance

What Expenses Qualify For Minister Housing Allowance

What Expenses Qualify For Minister Housing Allowance

https://i.ytimg.com/vi/CYnDZ3srT8k/maxresdefault.jpg

The expenses are related to the performance of their employment duties step 2 If the allowance or reimbursement you provide to your employee for travel expenses does not meet all of the

Pre-crafted templates provide a time-saving service for producing a varied range of documents and files. These pre-designed formats and layouts can be utilized for numerous individual and professional projects, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, streamlining the content production process.

What Expenses Qualify For Minister Housing Allowance

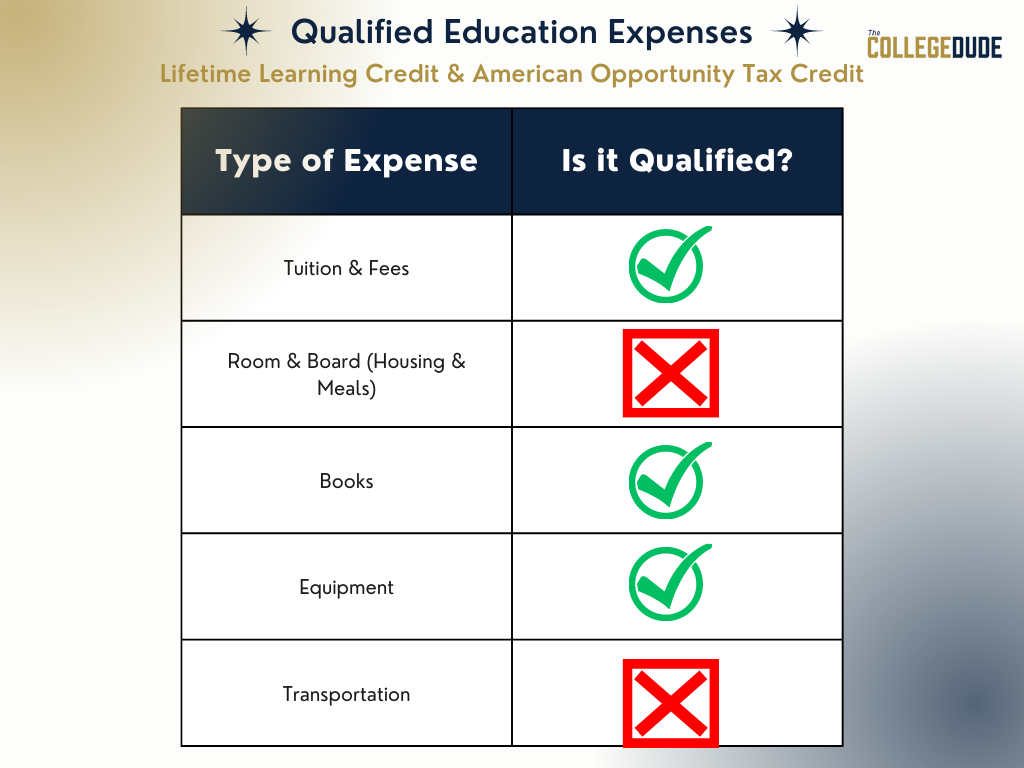

Qualified Education Expenses Explained The College Dude

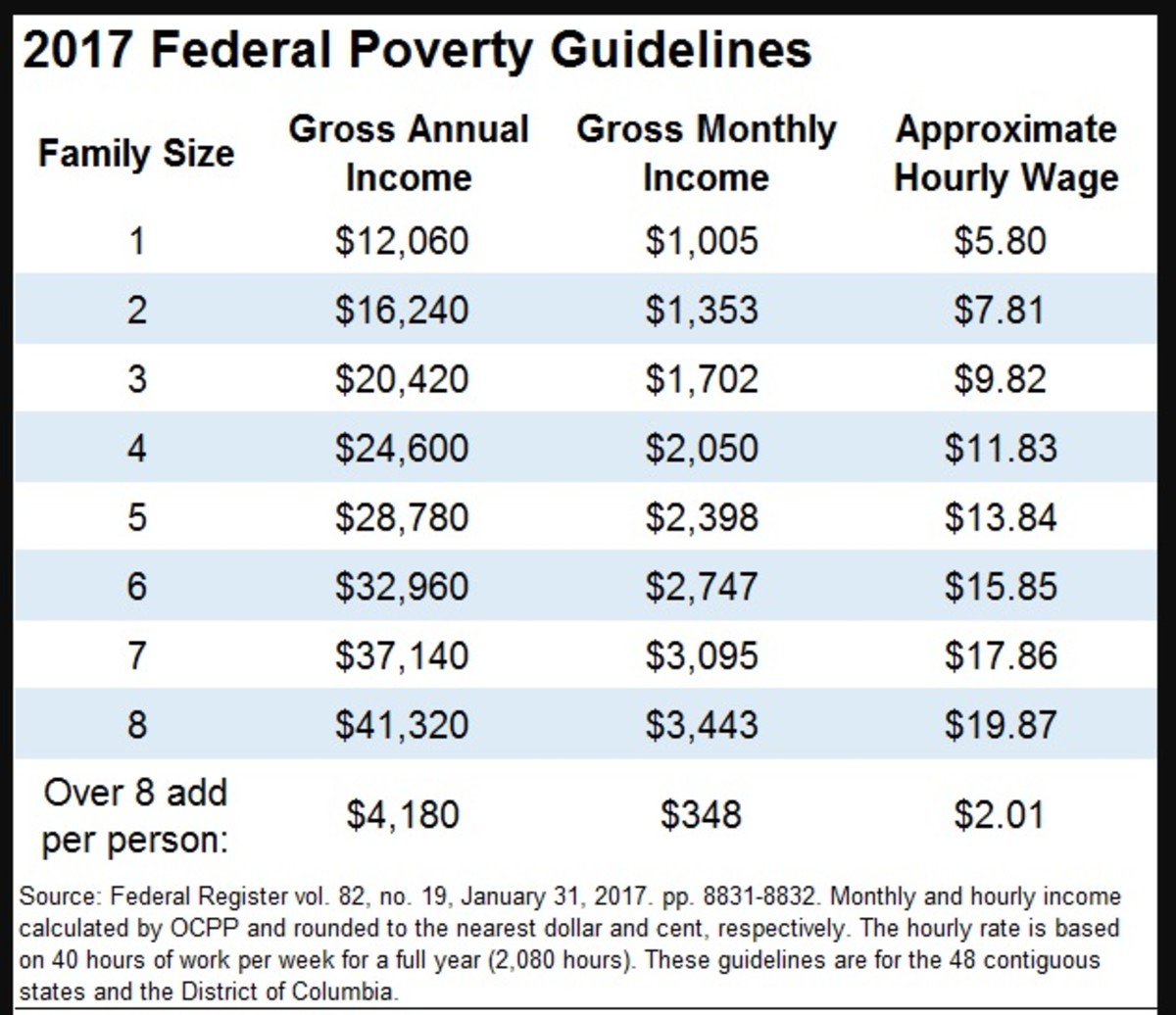

Michigan Food Stamp Eligibility 2025 Jonathan G Flinchum

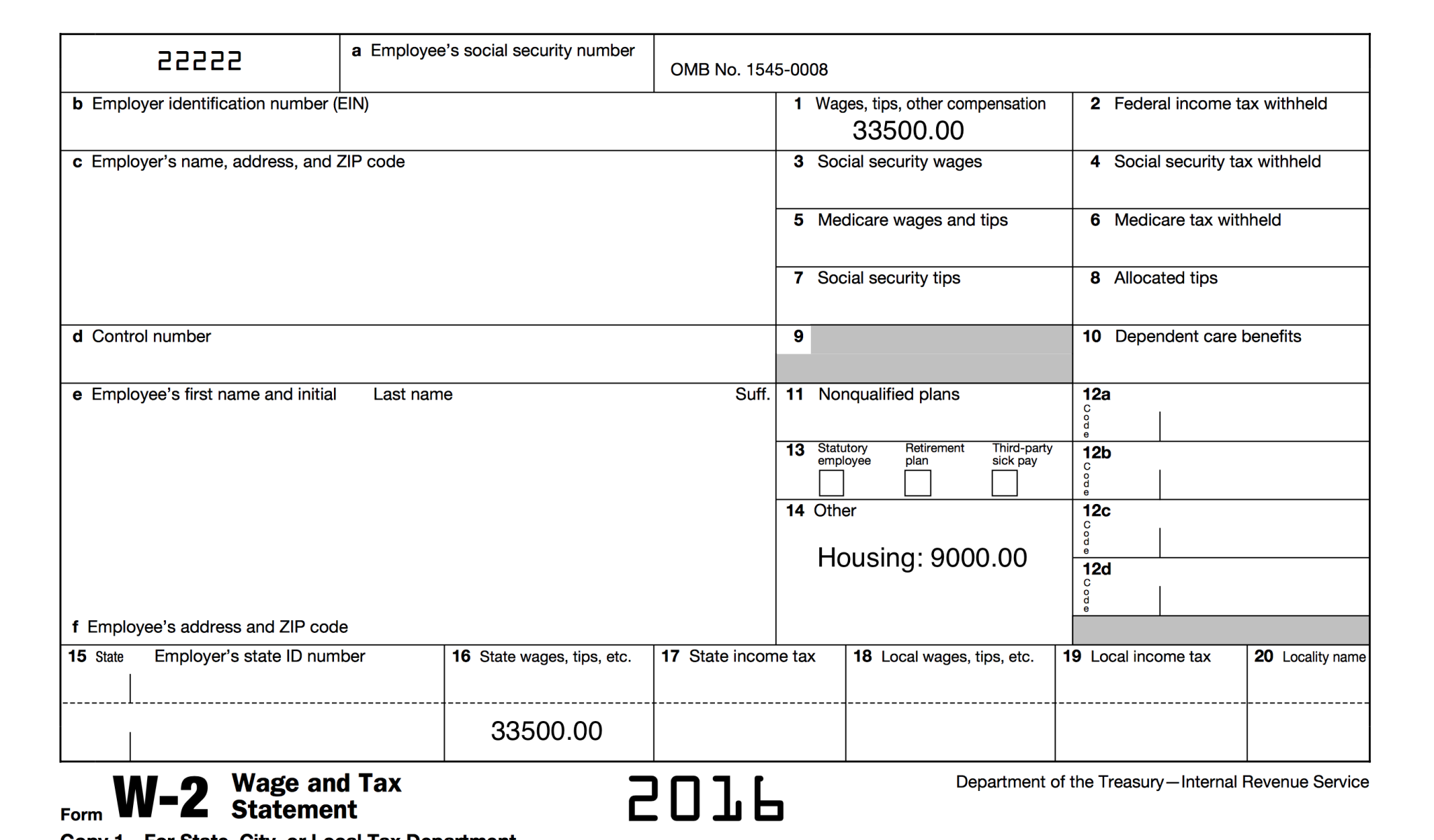

Fillable 1040 W 2 Form For A Minister Fillable Form 2023

Housing Allowance Form FBMI

What Expenses Qualify For Housing Allowance Financial Planning For

Food Stamps Cut Off 2025 Florida Sher Pierette

https://www.canada.ca › en › revenue-agency › services › tax › business…

Jun 30 2025 0183 32 When you claim the GST HST you paid or owe on your business expenses as an input tax credit reduce the amounts of the business expenses by the amount of the input tax

https://www.canada.ca › en › revenue-agency › services › forms-publicat…

Feb 3 2025 0183 32 Download and save the PDF to your computer Open the downloaded PDF in Acrobat Reader 10 or later

https://www.canada.ca › › excessive-interest-financing-expenses-limit…

Oct 1 2023 0183 32 The excessive interest and financing expenses limitation EIFEL rules limit the deductibility of interest and financing expenses by affected corporations and trusts The rules

https://www.canada.ca › en › revenue-agency › services › forms-publicat…

Use this form if you are an employee and your employer requires you to pay expenses to earn your employment income

https://www.canada.ca › en › revenue-agency › services › tax › individual…

Attendant care and care in a facilityAll regular fees paid for full time care in a nursing home or for specialized care or training in an institution are eligible as medical expenses including fees for

[desc-11] [desc-12]

[desc-13]