What Is A Carryover Worksheet MI NOL Carryover Instructions A B 1 Michigan NOL Carryover Worksheet Instructions 2 3 4 General Information The purpose of this worksheet is to provide

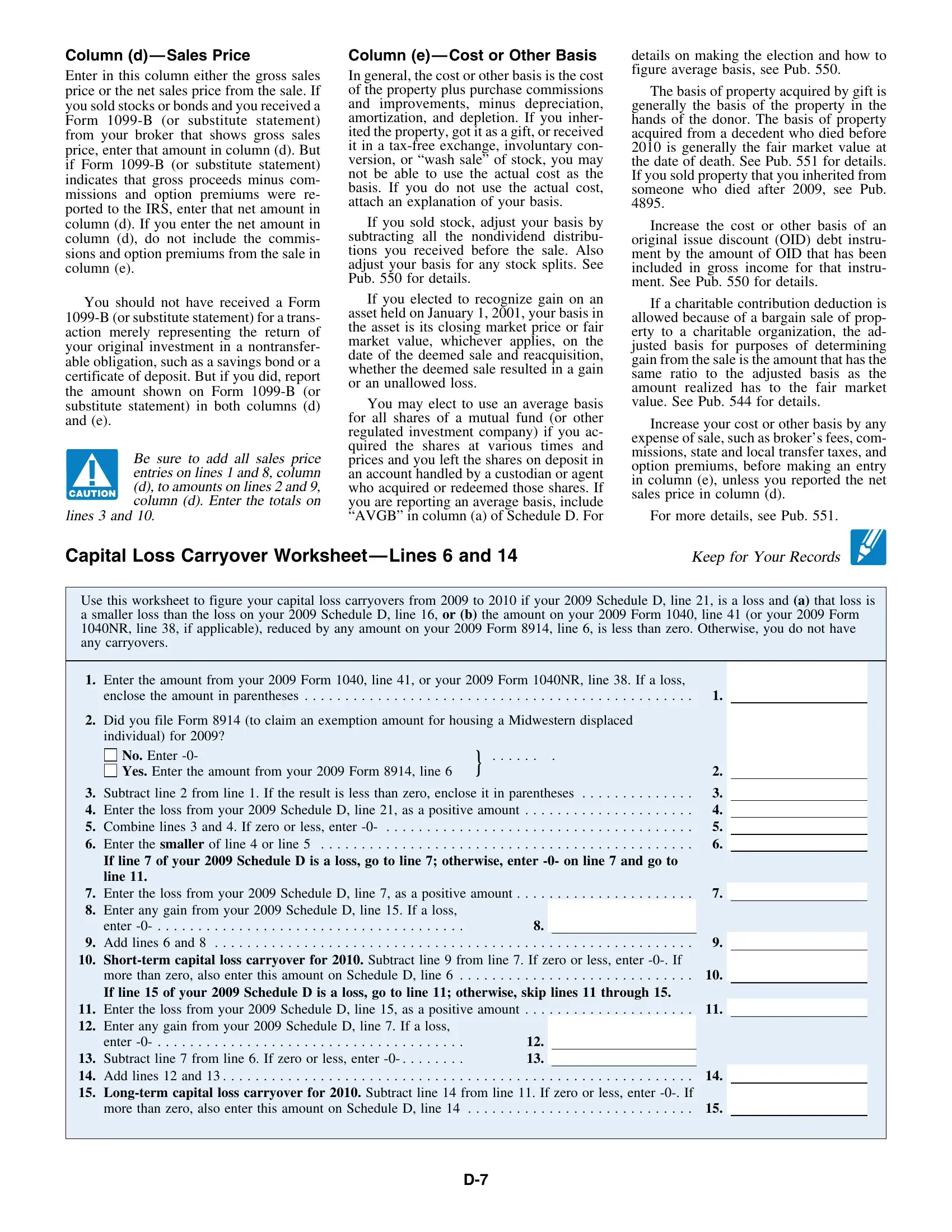

Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D line 21 is a loss and a that loss is a smaller loss Carryover typically occurs when you have an expense that exceeds the annual limits for a tax deduction or you are unable to use the full amount of tax credit

What Is A Carryover Worksheet

What Is A Carryover Worksheet

What Is A Carryover Worksheet

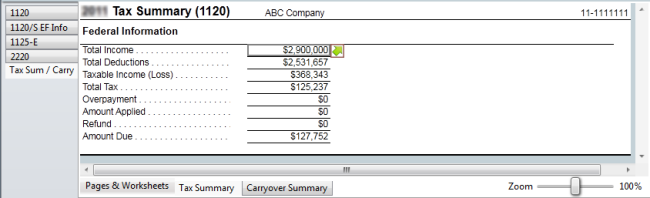

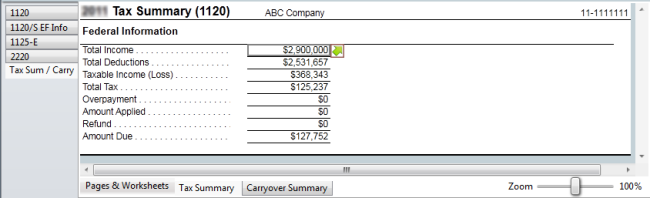

http://files.cchsfs.com/doc/atx/2016/Help/Content/Resources/Images/Forms_TaxSumCarry_650x198.png

what is the feds carryover worksheet real what exactly do they want me to do at it a tax loss carryforward is a special tax rule that allows capital

Pre-crafted templates provide a time-saving solution for creating a diverse range of files and files. These pre-designed formats and layouts can be utilized for various individual and professional jobs, including resumes, invites, leaflets, newsletters, reports, discussions, and more, streamlining the material development process.

What Is A Carryover Worksheet

1040 - Net Operating Loss FAQs

Capital Loss Carryover Worksheet PDF Form - FormsPal

Solved: What is passive loss carryover

:max_bytes(150000):strip_icc()/ScheduleD2022IRS-11353a1e824e41a9a83f83e39fd0f879.jpg)

What Is Schedule D: Capital Gains and Losses? Example With Taxes

Carryover short term capital losses confusion from FreeTaxUSA. My losses in 2020 were $3339, but software says my carryover is only $935. : r/tax

Solved: Passive loss carryover form boxes

https://www.investopedia.com/terms/c/capital-loss-carryover.asp

Capital loss carryover is the capital loss that can be carried forward to future years and used to offset capital gains or as a deduction

https://www.youtube.com/watch?v=wzBiMiKrQQs

carryover is a situation where you might have an expense that isn Qualified Dividend and

:max_bytes(150000):strip_icc()/IRSScheduleD-c7be5030d7394773ad2d905654e9e902.png?w=186)

https://www.youtube.com/watch?v=oZi2INpLTyc

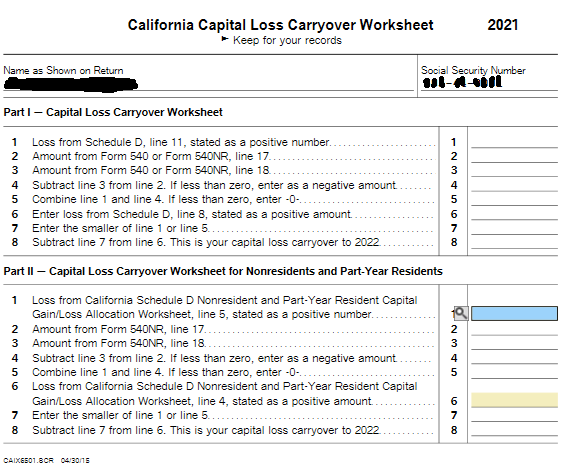

carryover worksheets and use that information to update our 2022 tax return One of the most

https://www.irs.gov/taxtopics/tc409

You may use the Capital Loss Carryover Worksheet found in Publication 550 Investment Income and Expenses or in the Instructions for Schedule D

https://groups.google.com/g/misc.taxes.moderated/c/IaCmKp_fCnI

After importing 2010 return into 2011 on the Federal Carryover Worksheet 2011 on top is a table of 2010 State and Local Income Tax Information containing

3c Unused carryover of IRC 179 expense deduction worksheet instructions Part 1 Employee business expenses and reimbursements Complete Part 1 if you The carry forward is just following the instructions to copy that number over via the Capital Loss Carryover Worksheet All you need is last year s tax

If you contributed more than 4 000 per account during the taxable year you may carry forward any undeducted amounts until the contribution has been fully