What Is A Federal Carryover Worksheet Complete this worksheet to compute the amount of your casualty and theft losses to enter on Form IT 196 line 20 Casualty and theft losses other than a

All online tax preparation software It means you have a loss carryover which means you couldn t use it what is a federal carryover worksheet the irs What is the carryover worksheet on turbotax What is the Federal Carryover Worksheet and what exactly do Intuit What do I enter in the carryover worksheet

What Is A Federal Carryover Worksheet

What Is A Federal Carryover Worksheet

What Is A Federal Carryover Worksheet

https://kb.drakesoftware.com/Site/Uploads/Images/11406%20image%201.0.jpg

Complete the worksheet below to determine the amount of your adjustment Computation of Virginia Bank Franchise Tax Deduction A shareholder of a bank may be

Pre-crafted templates offer a time-saving option for developing a varied series of files and files. These pre-designed formats and designs can be used for numerous personal and professional tasks, including resumes, invitations, flyers, newsletters, reports, discussions, and more, simplifying the content creation procedure.

What Is A Federal Carryover Worksheet

Federal information worksheet 2019: Fill out & sign online | DocHub

14073 image 3.jpg

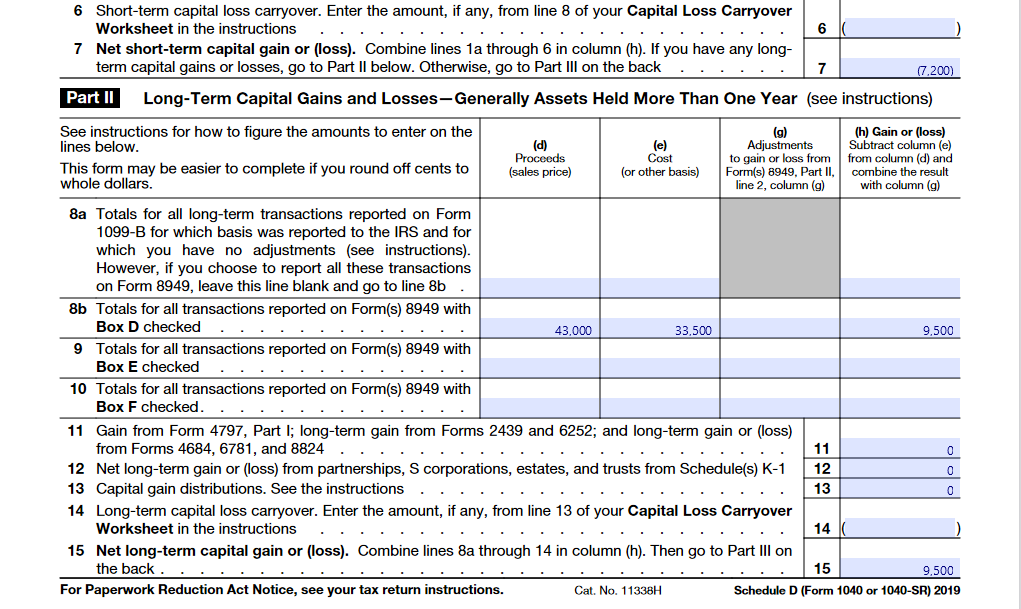

6 6 Short-term capital loss carryover. Enter the | Chegg.com

14073 image 2.jpg

Basic Schedule D Instructions | H&R Block

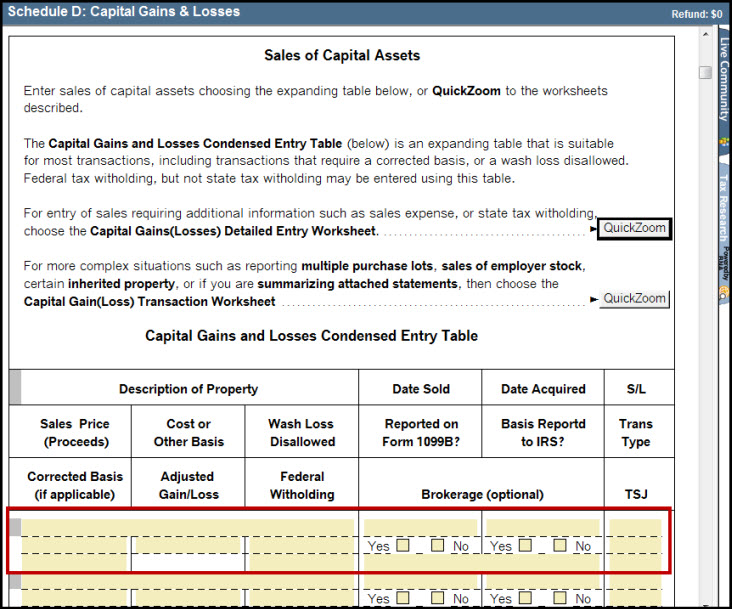

Entering Sale of Capital Assets in tax year 2019 and prior

http://files.cchsfs.com/doc/atx/2016/Help/Content/Both-SSource/Tax%20Summary%20Carryover%20Worksheet.htm

The Tax Summary Carryover worksheet is a two part worksheet that can be added to a return via the Forms menu The Tax Summary gives you an at a glance view of

https://groups.google.com/g/misc.taxes.moderated/c/IaCmKp_fCnI

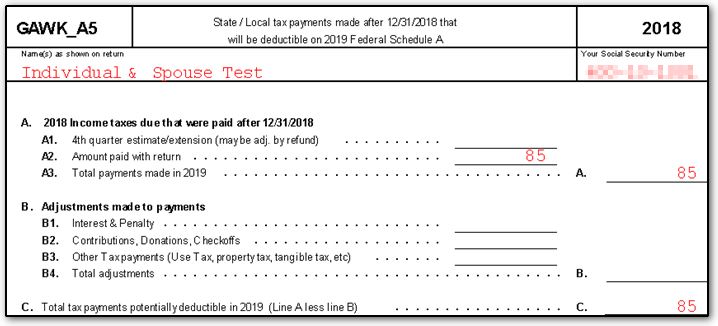

After importing 2010 return into 2011 on the Federal Carryover Worksheet 2011 on top is a table of 2010 State and Local Income Tax Information containing

https://www.irs.gov/pub/irs-prior/i1040sd--2022.pdf

Use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 Schedule D line 21 is a loss and a that loss is a smaller loss than

https://apps.irs.gov/app/vita/content/globalmedia/capital_loss_carryover_worksheet.pdf

Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D line 21 is a loss and a that loss is a smaller loss

:max_bytes(150000):strip_icc()/IRSScheduleD-c7be5030d7394773ad2d905654e9e902.png?w=186)

https://www.whitehouse.gov/wp-content/uploads/2022/04/2022-04-15-VPOTUS-Redacted-2021-Federal-and-State-Returns.pdf

Short term capital loss carryover Enter the amount if any from line 8 of your Capital Loss Carryover Worksheet in the instructions 6 7

Carryover typically occurs when you have an expense that exceeds the annual limits for a tax deduction or you are unable to use the full amount of tax credit More than the amount taxable under federal law enter the difference in column C Get FTB Pub 1005 for more information and worksheets for figuring the

If an NOL occurs for Iowa purposes but not for federal purposes the loss must first be carried back and then carried forward for the carryback and carryforward