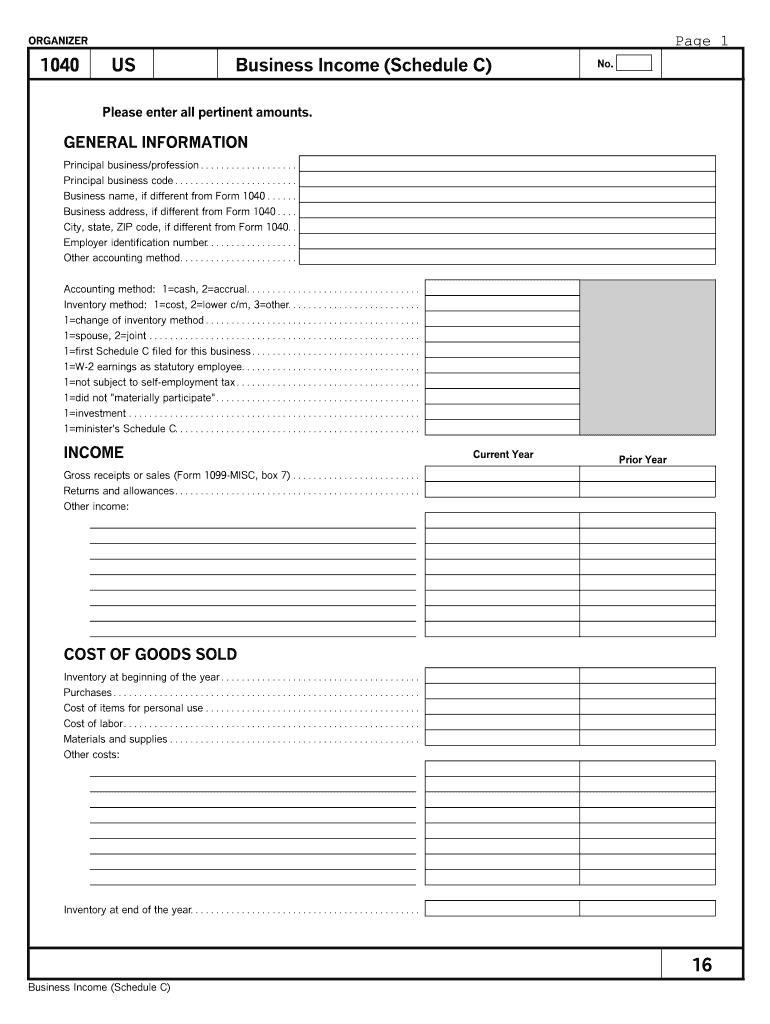

What Is A Schedule C Worksheet Report your net income from Schedule C on Form 1040 Schedule 1 Line 3 Calculate the Qualified Business Income Deduction Section 199A

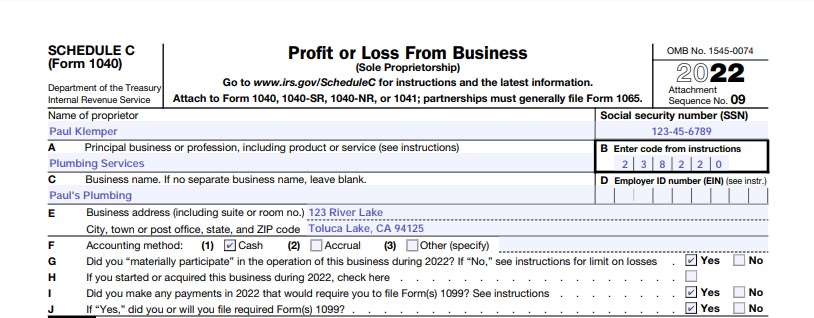

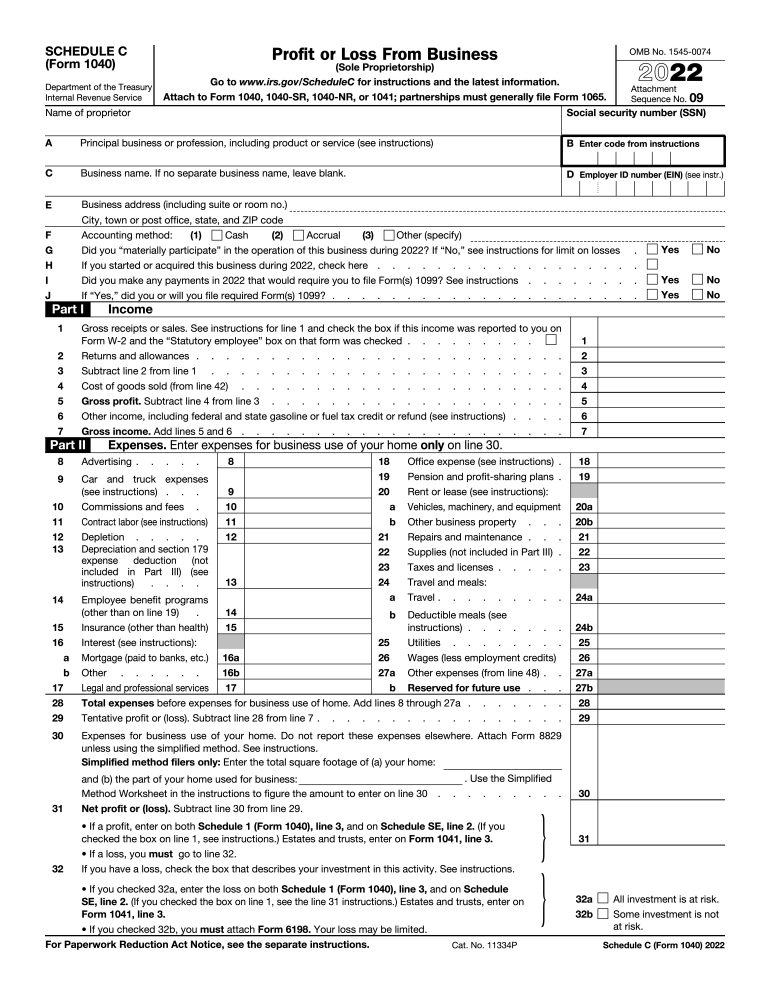

In this segment we ll provide an overview of Form 1040 Schedule C Profit or Loss from Business and discuss how to calculate gross profit and gross income Use Schedule C Form 1040 or 1040 SR to report income or loss from a business you operated or a profession you practiced as a sole proprietor

What Is A Schedule C Worksheet

What Is A Schedule C Worksheet

What Is A Schedule C Worksheet

https://www.pdffiller.com/preview/40/37/40037376/large.png

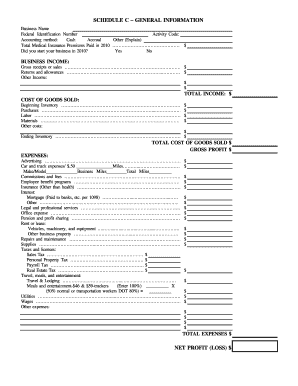

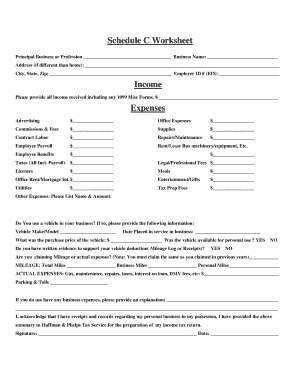

Schedule C Worksheet for Self Employed Businesses and or Independent Contractors IRS requires we have on file your own information to support all Schedule

Pre-crafted templates offer a time-saving solution for creating a varied variety of documents and files. These pre-designed formats and layouts can be used for numerous personal and professional jobs, including resumes, invites, leaflets, newsletters, reports, presentations, and more, improving the material creation procedure.

What Is A Schedule C Worksheet

Schedule C Instructions: How to Fill Out Form 1040 - Excel Capital

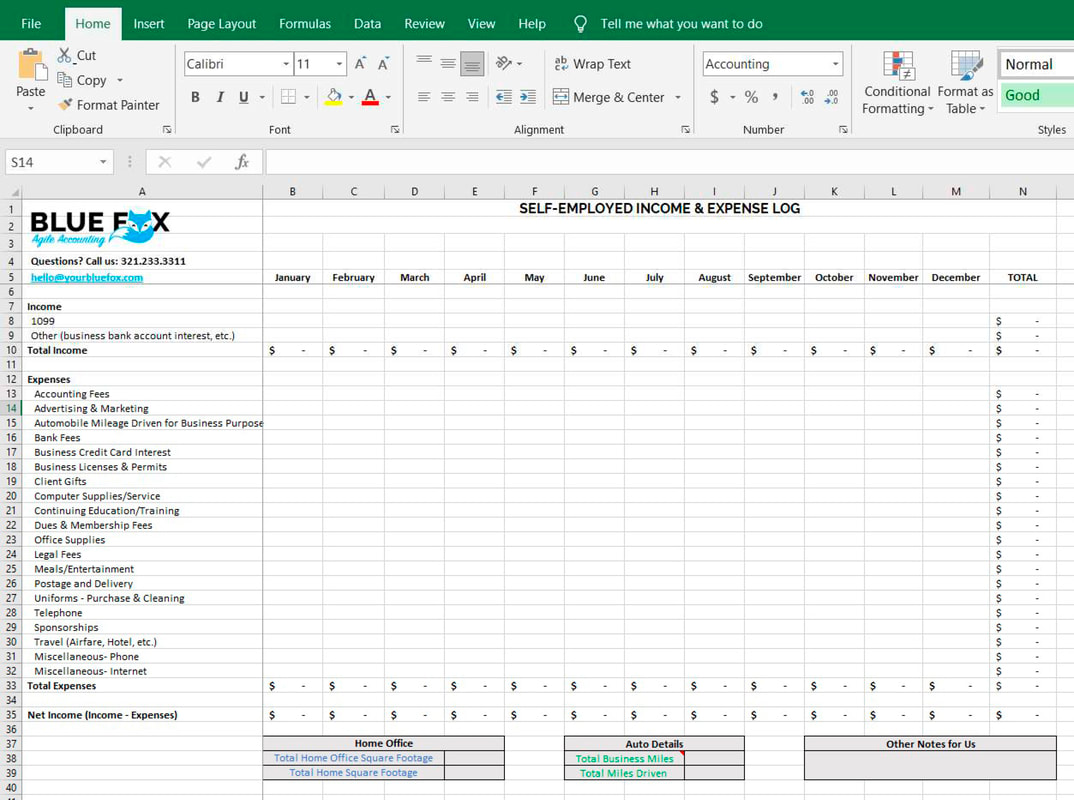

Free Download: Schedule C Excel Worksheet for Sole-Proprietors - BLUE FOX | Accounting for Nonprofits and Social Enterprises

Writing off Business Expenses With Schedule C – Ride Free Fearless Money

Schedule C Expenses Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

How To Fill Out Your 2022 Schedule C (With Example)

How to Fill Out Your Schedule C Perfectly (With Examples!)

https://turbotax.intuit.com/tax-tips/self-employment-taxes/-what-is-a-schedule-c-irs-form/L7v0iDelI

Schedule C is used to report income and expenses from a business you own as a sole proprietor or single member LLC If you are self employed

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png?w=186)

https://www.nerdwallet.com/article/taxes/schedule-c-definition

IRS Schedule C is a tax form for reporting profit or loss from a business You fill out Schedule C at tax time and attach it to or file it

https://www.investopedia.com/ask/answers/081314/whos-required-fill-out-schedule-c-irs-form.asp

Schedule C accompanies IRS Form 1040 and is used to report income or loss from a business or profession practiced as a sole proprietor

https://www.hrblock.com/tax-center/irs/forms/what-is-a-schedule-c-tax-form/

The Schedule C Profit or Loss From Business Sole Proprietorship is used to report how much money you made or lost in a business you operated by yourself

:max_bytes(150000):strip_icc()/ScheduleC1-7818321402c0410ba4c212ca697c6227.jpg?w=186)

https://www.thebalancemoney.com/business-income-3193083

Schedule C of Form 1040 is a tax calculation worksheet known as the Profit or Loss From Business statement

The resulting profit or loss is typically considered self employment income fill in schedule to print What Tax Forms Are Required Financial Aid W 2 Form What is a Schedule C Schedule C is used to report self employment income on a personal return Self employment income is how we describe

Schedule C instructions Other helpful IRS publications including Pub 334 Tax Guide for Small Businesses and Pub 535 Business Expenses These will help