What Is Form 8812 Used For Sep 9 2019 0183 32 What is Schedule 8812 Schedule 8812 is the form used to claim the additional child tax credit Understanding the additional child tax credit begins with the child tax credit Starting with the 2018 tax year the

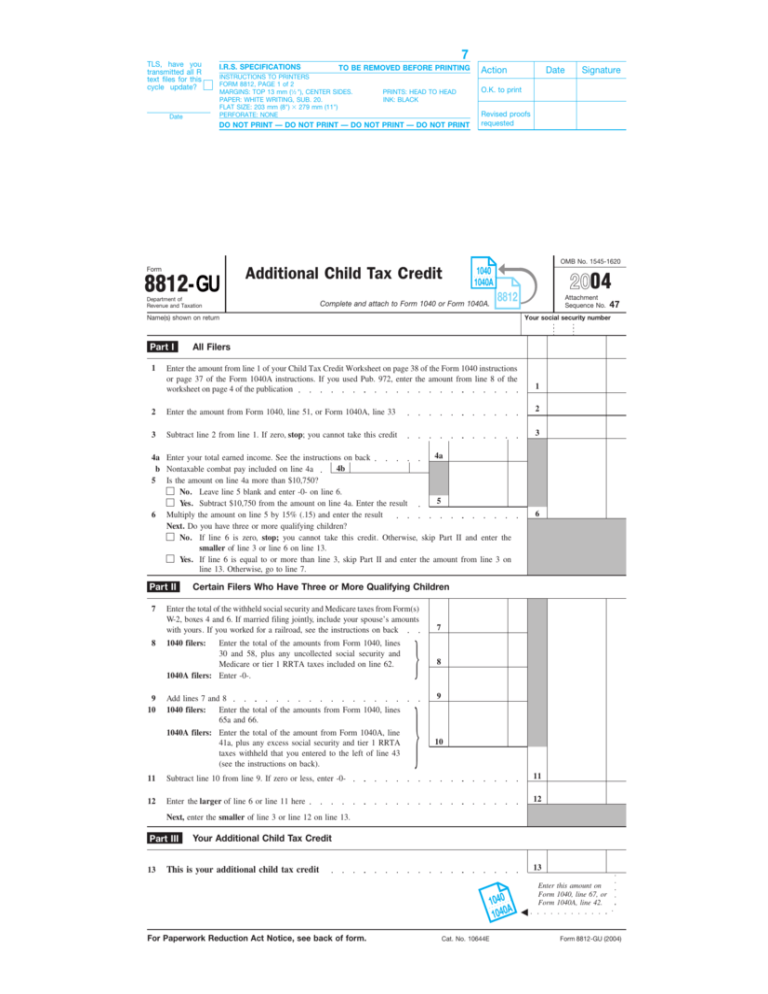

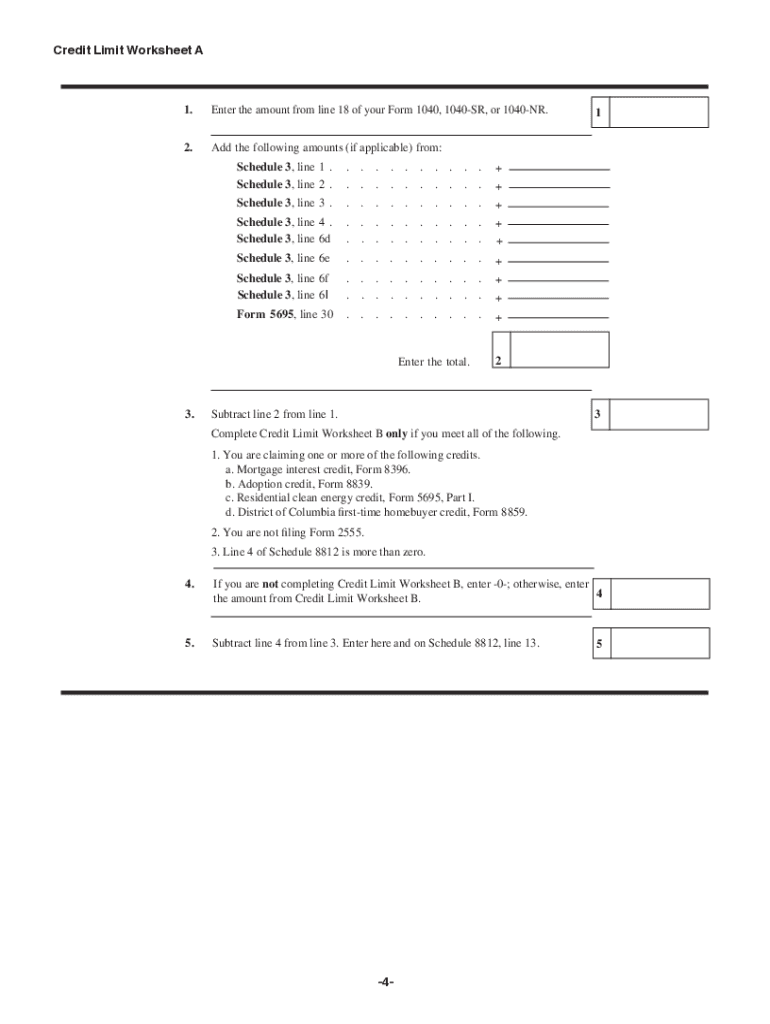

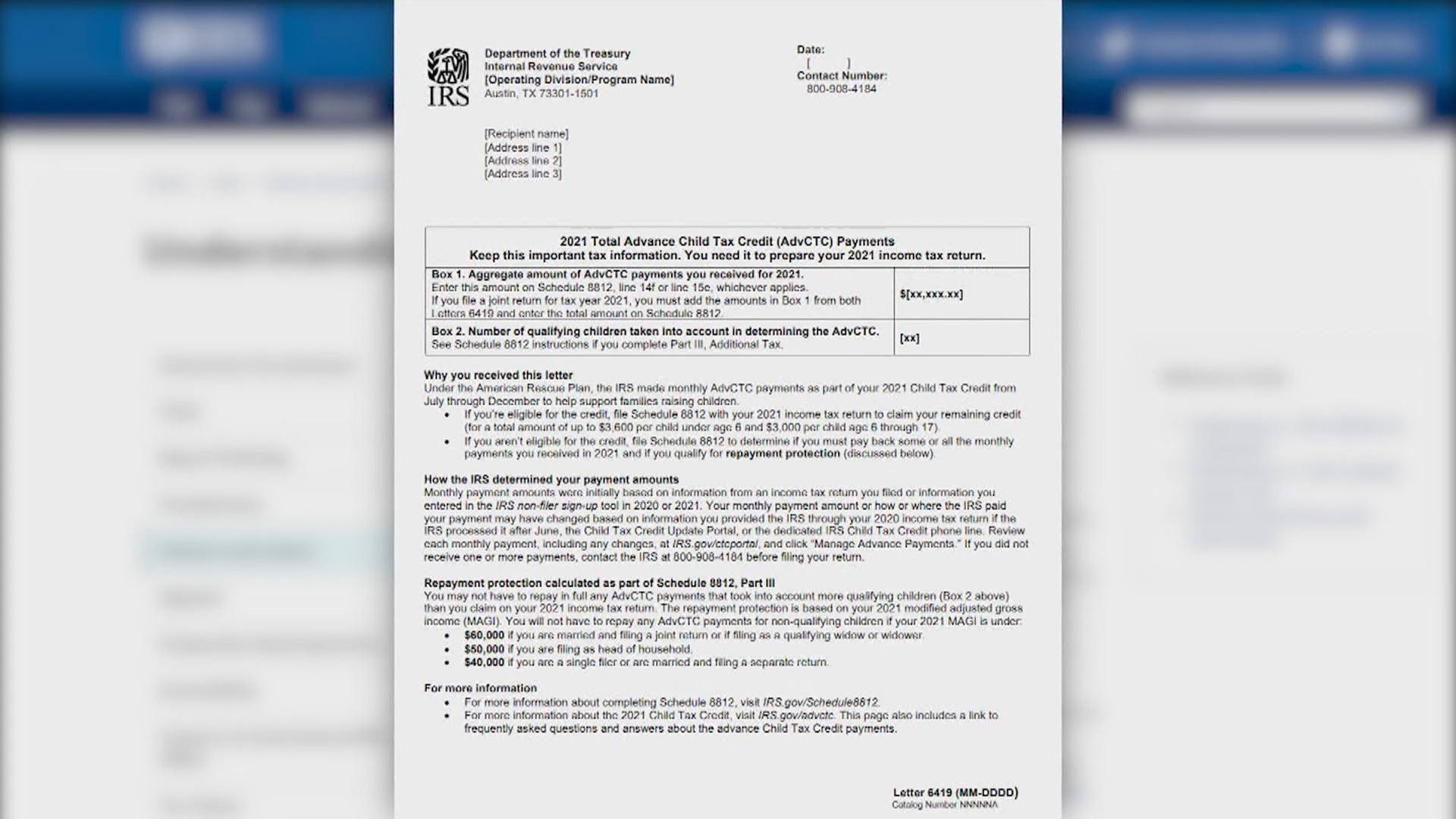

Schedule 8812 Child Tax Credit is used to claim the Child Tax Credit CTC Credit for Other Dependents ODC and Additional Child Tax Credit ACTC The CTC and ODC Form 1040 Instructions Schedule 8812 Instructions The American Rescue Plan Act increased the amount per qualifying child and is fully refundable for tax year 2021 only for qualifying taxpayers See the Temporary Provisions lesson earlier for the updates What is the additional child tax credit

What Is Form 8812 Used For

What Is Form 8812 Used For

What Is Form 8812 Used For

https://www.pdffiller.com/preview/624/405/624405770/large.png

Jan 27 2024 0183 32 To claim the Additional Child Tax Credit you need to complete Schedule 8812 and attach it to your Form 1040 or Form 1040 SR But don t worry about

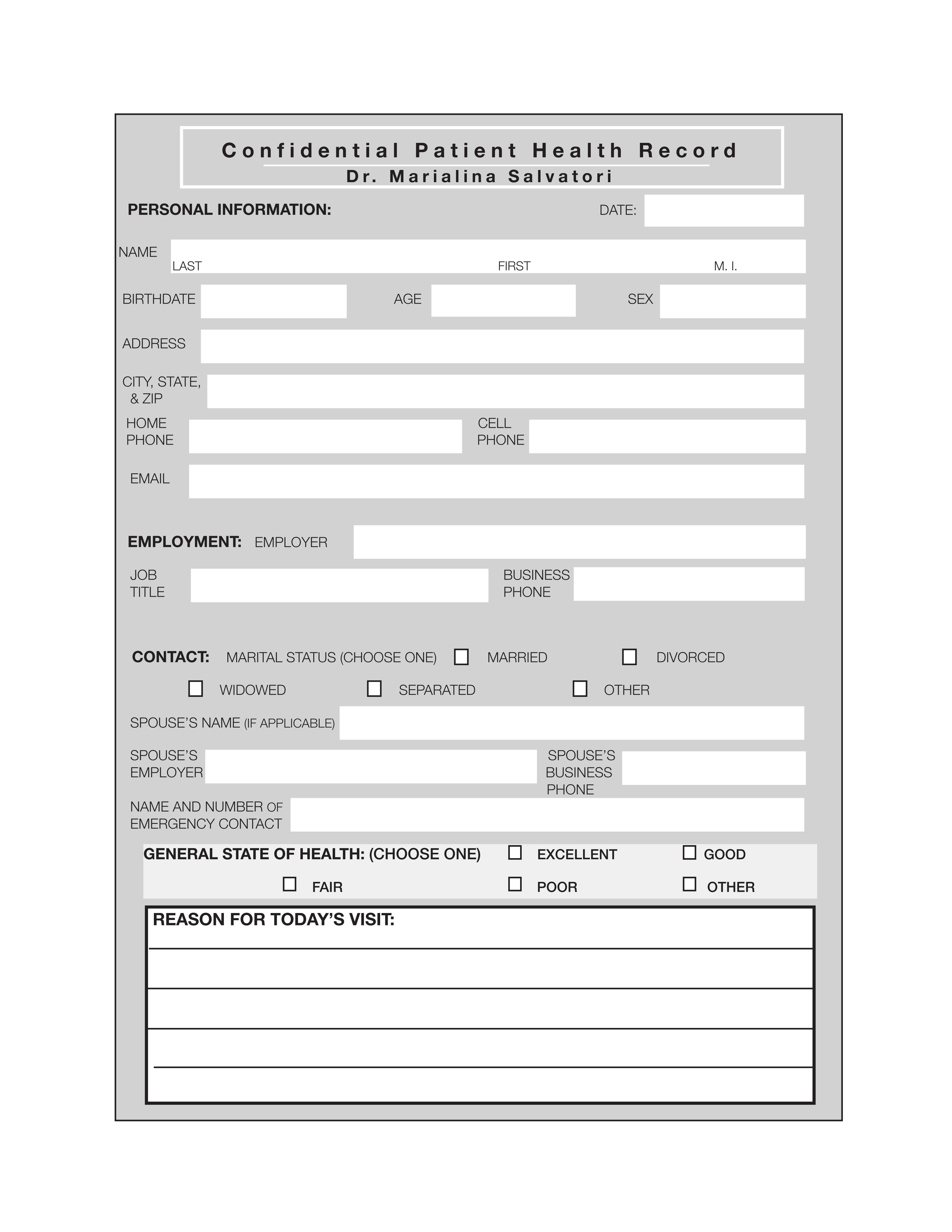

Pre-crafted templates use a time-saving solution for developing a diverse series of files and files. These pre-designed formats and layouts can be used for different individual and expert projects, including resumes, invitations, leaflets, newsletters, reports, discussions, and more, streamlining the material production process.

What Is Form 8812 Used For

Calam o IRS FORM 8811 REMIC TRUSTS

Form 8814 Instructions 2010

Form 8812 GU Additional Child Tax Credit 2004

30 Child Tax Credit Worksheet 2019

What Is The IRS Form 8812 TurboTax Tax Tips Videos

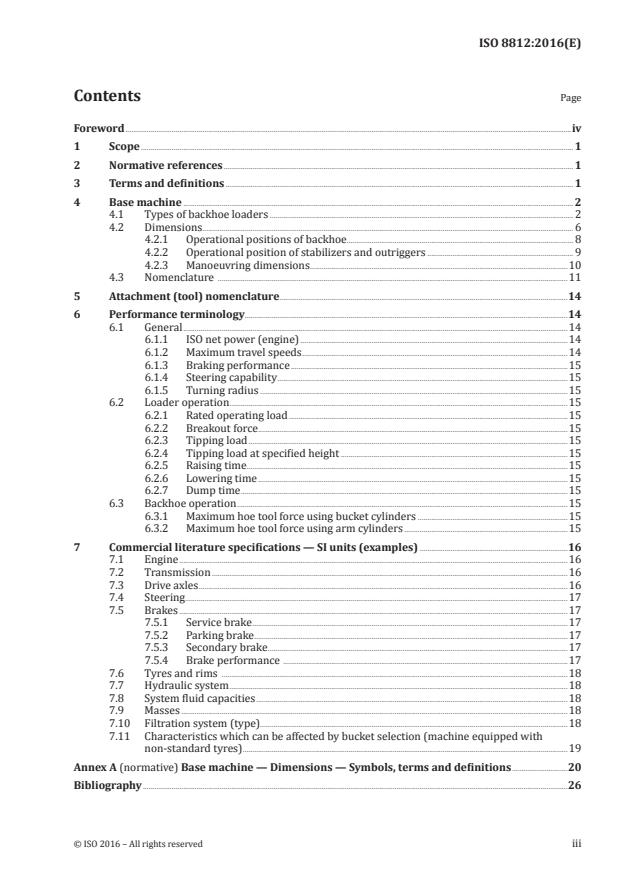

ISO 8812 2016 Earth moving Machinery Backhoe Loaders Terminology

https://www.irs.gov/instructions/i1040s8

Introduction Use Schedule 8812 Form 1040 to figure your child tax credit CTC credit for other dependents ODC and additional child tax credit ACTC The CTC and

https://tax.thomsonreuters.com/blog/what-is-schedule-8812

Sep 7 2023 0183 32 Schedule 8812 is the IRS tax form designed to help eligible taxpayers claim the additional child tax credit Schedule 8812 instructions Schedule 8812 requires

https://www.taxfyle.com/blog/schedule-8812

Sep 14 2023 0183 32 Schedule 8812 is a tax form used by taxpayers to claim the Additional Child Tax Credit ACTC This credit is available to individuals who receive less than the full

https://www.communitytax.com/tax-form/sche…

The Schedule 8812 Form is found on Form 1040 and it s used to calculate the alternative refundable credit known as the additional child tax credit For example if the amount you owe in taxes is either zero or less than

https://www.irs.gov/pub/irs-prior/i1040s8--2021.pdf

Use Schedule 8812 Form 1040 to figure your child tax credits to report advance child tax credit payments you received in 2021 and to figure any additional tax owed if you

Aug 8 2023 0183 32 One of the important tax credits is the child tax credit which taxpayers calculate on Schedule 8812 of their Form 1040 1040 SR or 1040 NR In this article we ll The calculations for the amount reported on line 28 are on Form 8812 Line 14i US Residents or 15h Non US residents Other Dependents Dependents who do not qualify for the Child Tax Credit are reported on Form 8812 Line 14h US residents or Line 15g non US residents This amount is pulled to line 19 of the 1040 Form

Feb 5 2024 0183 32 Use the 15 method described earlier How to claim the Child Tax Credit You can claim the Child Tax Credit as part of filing your annual tax return with Form 1040 You ll also need to complete and include Schedule 8812 Credits for Qualifying Children and Other Dependents