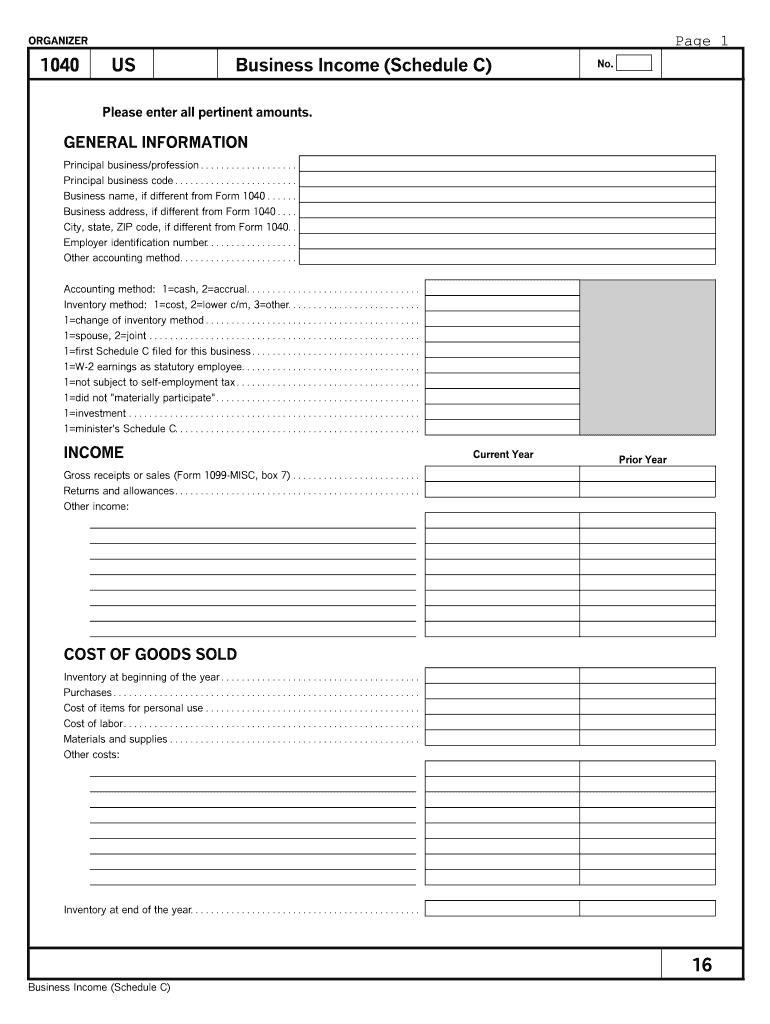

What Is Schedule C Worksheet Schedule C is used to report self employment income on a personal return Self employment income is how we describe all earned income derived

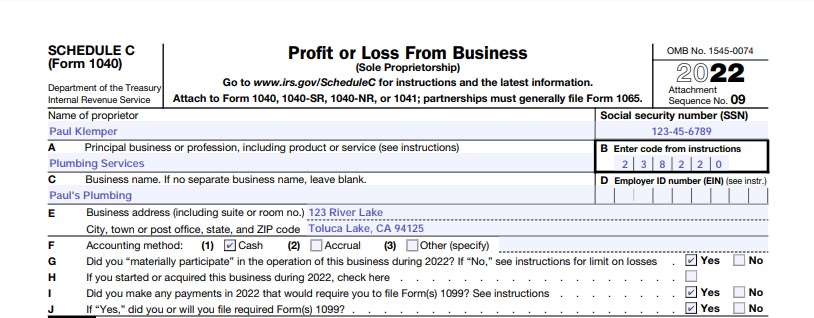

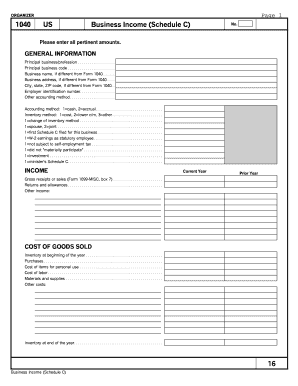

Step 2 Fill Out Schedule C Basic Business Information Name of proprietor Social Security number Line A Principal business or profession Use Schedule C Form 1040 or 1040 SR to report income or loss from a business you operated or a profession you practiced as a sole proprietor

What Is Schedule C Worksheet

What Is Schedule C Worksheet

What Is Schedule C Worksheet

https://www.pdffiller.com/preview/40/37/40037376/large.png

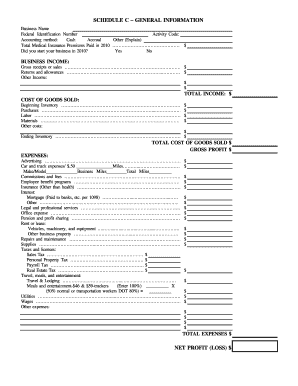

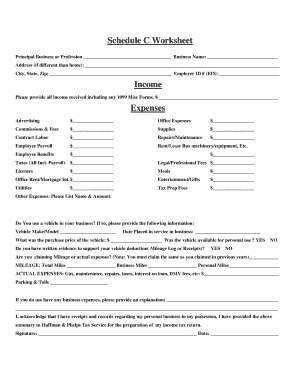

Schedule C Worksheet for Self Employed Businesses and or Independent Contractors IRS requires we have on file your own information to support all Schedule

Pre-crafted templates use a time-saving solution for creating a diverse variety of files and files. These pre-designed formats and designs can be used for different personal and expert projects, including resumes, invitations, flyers, newsletters, reports, presentations, and more, simplifying the content production procedure.

What Is Schedule C Worksheet

Writing off Business Expenses With Schedule C – Ride Free Fearless Money

Schedule C Expenses Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Schedule C Instructions: How to Fill Out Form 1040 - Excel Capital

What do the Expense entries on the Schedule C mean? – Support

What is a Schedule C? — Stride Blog

How To Fill Out Your 2022 Schedule C (With Example)

https://www.irs.gov/instructions/i1040sc

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png?w=186)

https://turbotax.intuit.com/tax-tips/self-employment-taxes/-what-is-a-schedule-c-irs-form/L7v0iDelI

Schedule C is used to report income and expenses from a business you own as a sole proprietor or single member LLC If you are self employed

https://www.investopedia.com/ask/answers/081314/whos-required-fill-out-schedule-c-irs-form.asp

Schedule C is a tax form used to report business related income and expenses This schedule is filled out by self employed individuals sole proprietors or

https://www.hrblock.com/tax-center/irs/forms/what-is-a-schedule-c-tax-form/

The Schedule C Profit or Loss From Business Sole Proprietorship is used to report how much money you made or lost in a business you operated by yourself

https://www.irsvideos.gov/Business/SBTW/Lesson2

In this segment we ll provide an overview of Form 1040 Schedule C Profit or Loss from Business and discuss how to calculate gross profit and gross income

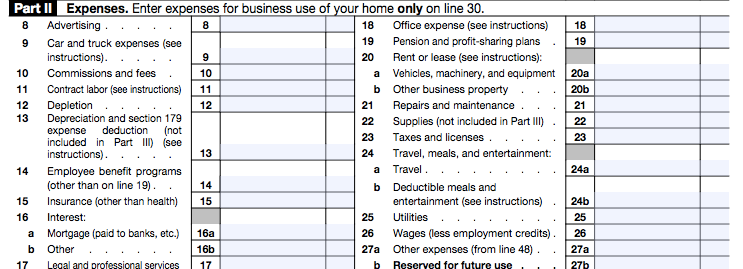

The resulting profit or loss is typically considered self employment income fill in schedule to print What Tax Forms Are Required Financial Aid W 2 Form Line 9 Car Truck Expenses This is where you can deduct your mileage there are special instructions for doing so and you ll calculate what you need on Page

Tip Phone utilities computer expenses and other office expenses Business insurance such as insurance on your business property and