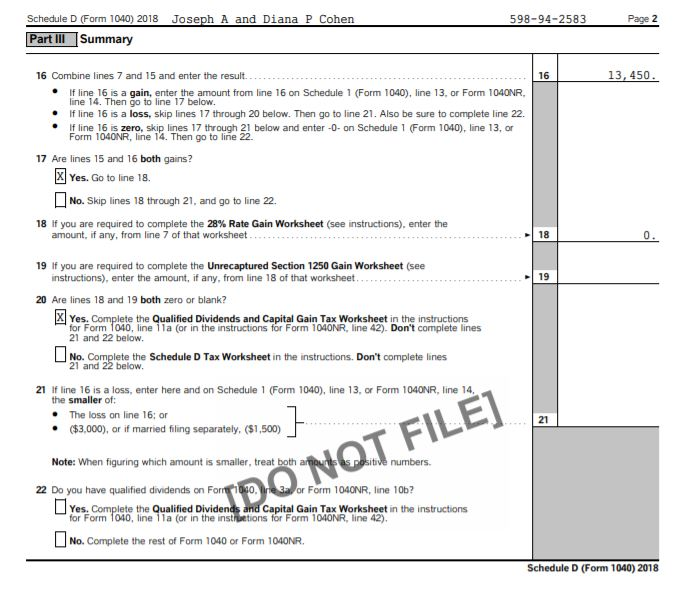

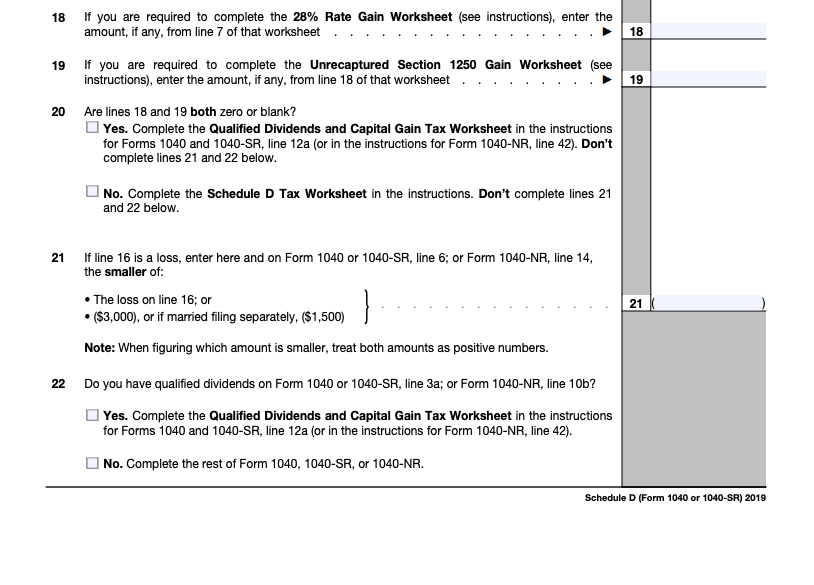

What Is The 28 Rate Gain Worksheet If you are required to complete the 28 Rate Gain Worksheet see instructions enter the amount if any from line 7 of that worksheet If

Note Gains on the sale of collectibles rental real estate income collectibles antiques works of art and stamps are taxed at a maximum rate of 28 More If there is an amount on Line 18 from the 28 Rate Gain Worksheet or Line 19 from the Unrecaptured Section 1250 Gain Worksheet of Schedule D Form 1040

What Is The 28 Rate Gain Worksheet

What Is The 28 Rate Gain Worksheet

What Is The 28 Rate Gain Worksheet

https://www.irs.com/wp-content/uploads/2023/05/28__rate_gain_worksheet-1200x900.webp

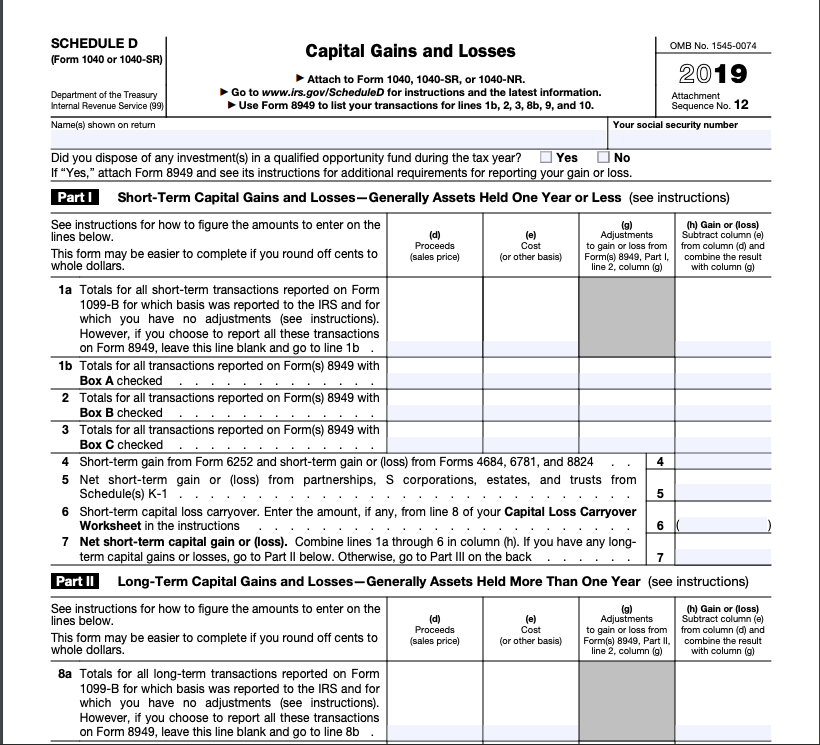

The gains you report are subject to income tax but the rate of tax you ll pay depends on how long you hold the asset before selling If you

Templates are pre-designed files or files that can be used for different functions. They can save time and effort by providing a ready-made format and layout for creating different type of content. Templates can be utilized for personal or professional tasks, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

What Is The 28 Rate Gain Worksheet

The images attached are what I need to put these | Chegg.com

Publication 564, Mutual Fund Distributions; Comprehensive Example

Tax project. Can you help me fill out Schedule D for | Chegg.com

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet – Marotta On Money

Capital Gains Tax Explained: What It Is and How Much You Pay | Kiplinger

1040 (2022) | Internal Revenue Service

https://www.irs.gov/instructions/i1040sd

A sale or other disposition of an interest in a partnership may result in ordinary income collectibles gain 28 rate gain or unrecaptured

http://www.a-ccpa.com/content/taxguide/text/c60s10d507.php

Remember any long term gains or losses from art jewelry antiques precious metals etc which are termed collectibles are taxed at a 28 percent rate You

https://omb.report/icr/201806-1545-014/doc/83919101

The estate or trust reported a long term capital gain from the sale or exchange of an interest in a partnership that owned section 1250 property

https://www.journalofaccountancy.com/news/2019/may/irs-corrects-error-schedule-d-tax-calculation-worksheet-201921235.html

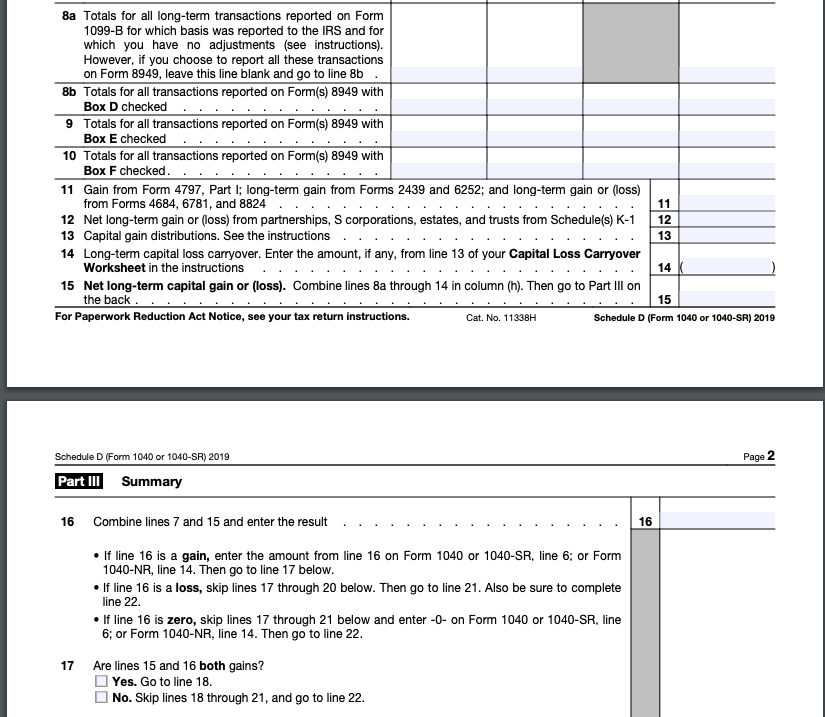

Most taxpayers who file Schedule D do not have amounts on line 18 which contains capital gain taxed at the 28 rate or line 19 where

https://www.bankrate.com/investing/long-term-capital-gains-tax/

Small business stock and collectibles 28 percent capital gains tax rate Two categories of capital gains are subject to a maximum 28 percent

Stock was acquired on 1 1 22 for 3 and sold on 4 28 22 for 7 resulting in a Long term gains are taxed according to the IRS capital gains rate For the How does the federal government tax capital gains income Four maximum federal income tax rates apply to most types of net long term capital gains income in tax

rate of 28 Remember short term capital gains from collectible assets are still taxed as ordinary income The IRS classifies collectible