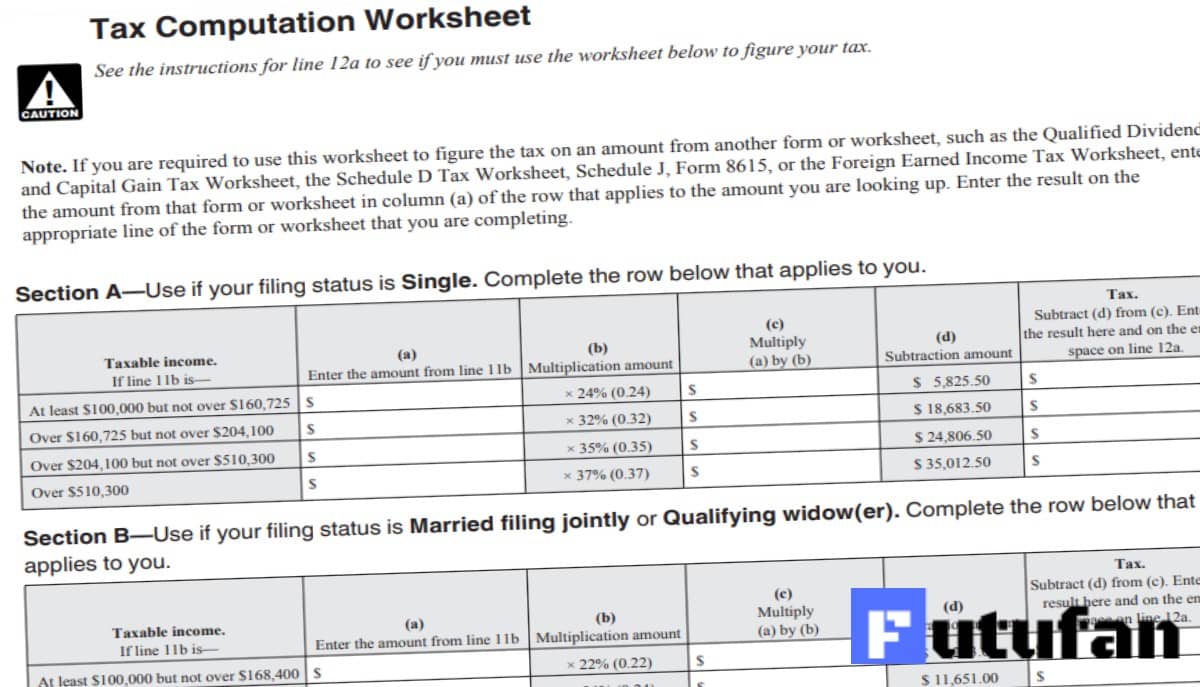

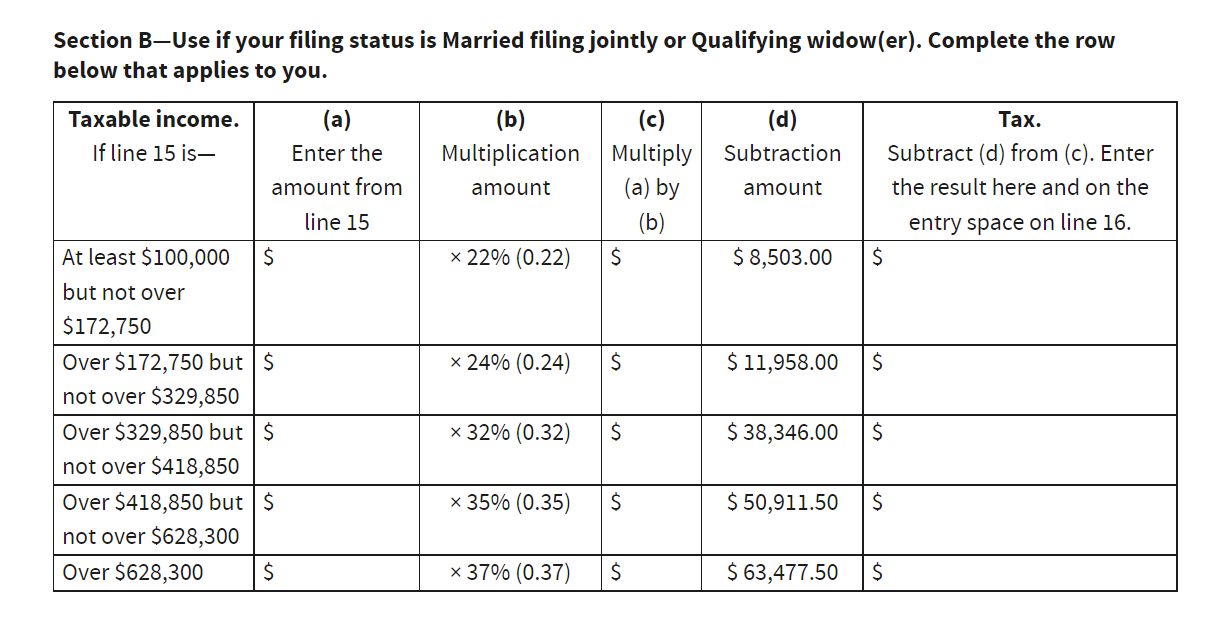

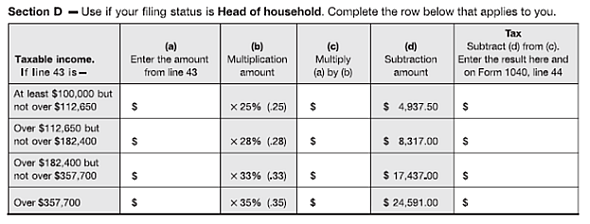

What Is The Tax Computation Worksheet If your taxable income is 100 000 or more you must use the alternate Tax Computation Worksheet 1040 Tax and Earned Income Credit Tables The program has

A tax table is a chart that displays the amount of tax due based on income received The IRS provides tax tables to help taxpayers determine how much tax they If you are required to use this worksheet to figure the tax on an amount from another form or worksheet such as the Qualified Dividends and Capital Gain Tax

What Is The Tax Computation Worksheet

What Is The Tax Computation Worksheet

What Is The Tax Computation Worksheet

https://d2vlcm61l7u1fs.cloudfront.net/media%2Fd01%2Fd012ca63-7dfb-4c75-8447-64d83327aed2%2Fphp88aQcU.png

Tax Table to figure the tax If the amount on line 1 is 100 000 or more use the Tax Computation Worksheet 25 Tax on all taxable income

Pre-crafted templates provide a time-saving option for developing a diverse series of files and files. These pre-designed formats and layouts can be made use of for different personal and professional tasks, including resumes, invites, flyers, newsletters, reports, presentations, and more, streamlining the material development process.

What Is The Tax Computation Worksheet

Tax Computation Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

1040 (2022) | Internal Revenue Service

Tax Computation Worksheet 2023 - 2024

How Your Tax Is Calculated: Understanding the Qualified Dividends and Capital Gains Worksheet – Marotta On Money

How to Calculate & Determine Your Estimated Taxes | Form 1040-ES

1040 (2022) | Internal Revenue Service

https://www.irs.gov/pub/irs-pdf/i1040tt.pdf

This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Form 1040 and 1040 SR FreeFile is the fast safe

https://answerconnect.cch.com/document/mtg01e13d4eba7b571000b66d001e0bcd1526014/mastertaxguide/2022-tax-computation-worksheet

TAX RATE SCHEDULES FOR 2022 AND 2023

https://www.marottaonmoney.com/how-your-tax-is-calculated-tax-table-and-tax-computation-worksheet/

The second worksheet is called the Tax Computation Worksheet It can be found in the instructions for 1040 Line 16 This second worksheet is

https://kb.drakesoftware.com/Site/Browse/10298/1040-No-Tax-or-Tax-Different-than-Tax-Table

Starting in Drake17 look for the Tax Computation Worksheet in the View mode of individual returns It shows how the tax on Form 1040 was calculated

https://cs.thomsonreuters.com/ua/ut/cs_us_en/utwapp/kb/1040-us-calculation-of-tax-on-form-1040.htm

The tax computation for Line 16 of Form 1040 can be calculated in one of four ways Qualified Dividend and Capital Gain Tax Worksheet To see this select

Tax Computation Worksheet Form 1040 easily fill out and sign forms download blank or editable online 2022 tax tables Select the return you file below IT 201 for New York State residents or IT 203 for New York State nonresidents or

In this video we will discuss how to use the IRS Income Tax Tables and Tax Computation