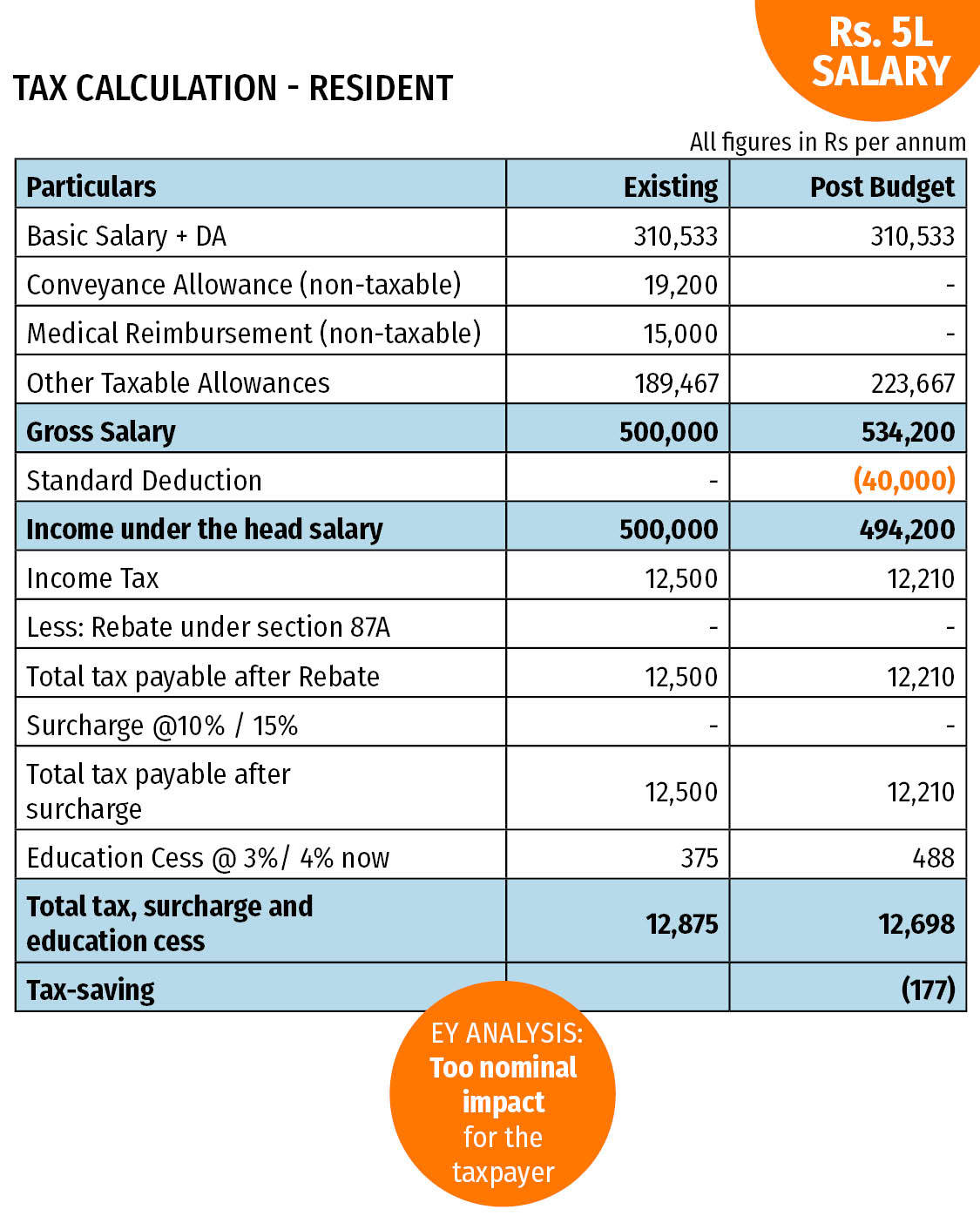

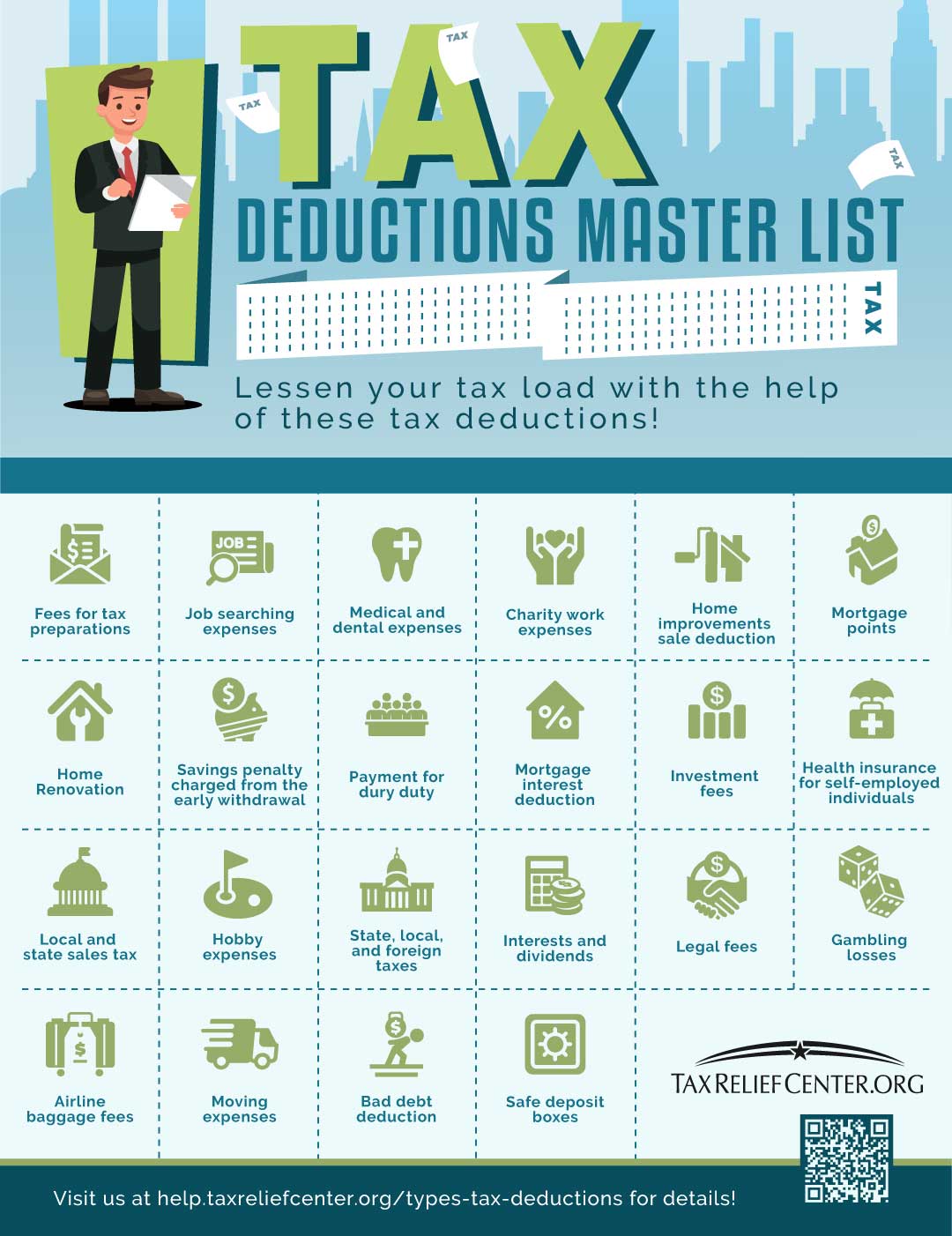

What Items Can You Deduct On Taxes For Investment Property May 31 2018 0183 32 To achieve optimal return on your investment property you should factor in the effects of the following investment property tax deductions in your investment property analysis Depreciation is one of the most obvious

Mar 9 2022 0183 32 Question when selling land vacant lot bought as an investment can I deduct property taxes payed while holding the lot April 28 2023 6 50 AM Yes you can It will go on Feb 19 2025 0183 32 A 1031 exchange allows investors to defer capital gains taxes when selling one investment property and reinvesting the proceeds in a similar property Final Thoughts While mortgage interest depreciation property

What Items Can You Deduct On Taxes For Investment Property

What Items Can You Deduct On Taxes For Investment Property

What Items Can You Deduct On Taxes For Investment Property

https://i.ytimg.com/vi/sMoHw0WafZ8/maxresdefault.jpg

As a property investor you can make significant tax savings on your investment properties by claiming them as allowable expenses on your tax return

Pre-crafted templates use a time-saving solution for creating a varied series of documents and files. These pre-designed formats and layouts can be utilized for numerous individual and professional projects, including resumes, invites, flyers, newsletters, reports, discussions, and more, enhancing the content production procedure.

What Items Can You Deduct On Taxes For Investment Property

Tax Preparation Guide Sheet

Tax Forms And Worksheets

Realtor Tax Deduction List

Maryland Income Tax Standard Deduction

Real Estate Tax Deduction Sheet

Tax And Interest Deduction Worksheet 2023

https://www.zillow.com › learn › tax-on-inv…

Jul 11 2019 0183 32 Investment Property How Much Can You Write Off on Your Taxes Learn how to navigate the tricky tax laws around investment properties including ways to save There are certain things you can do as a real estate investor to

https://www.resolutionsxv.com › post › wha…

Oct 2 2023 0183 32 One of the key aspects to consider when selling an investment property is understanding the expenses you can claim to reduce your tax liability These deductions can help you maximize your profits and minimize the impact

https://enrichest.com › en › blog › investment-property

Sep 21 2023 0183 32 In this complete guide we ll walk you through the ins and outs of investment property tax deductions unveiling strategies to legally reduce your tax burdens and potentially

https://sachetta.com › blog › deductions-and-tax

Jul 15 2022 0183 32 Some of the costs owners of investment properties may be able to deduct include Necessary expenses These include many of the basic costs associated with owning a

https://www.stessa.com › blog › rental-property-deductions-checklist

There are 25 main rental property deductions that most real estate investors can take to reduce taxable net income Expenses may be deducted for items such as normal operating expenses

Jan 22 2025 0183 32 If you itemize your taxes you can usually deduct your closing costs in the year in which you closed on your home If you close on your home in 2021 you can deduct these costs on your 2021 taxes Jul 25 2018 0183 32 Real estate investors pay taxes on their rental properties in a different way One thing to keep in mind is that it might seem like too many taxes but it is worthwhile with the

Aug 27 2024 0183 32 Below is a list of investment property tax deductions that property investors can claim as a deduction against rental income for this year We ve also included a list of investment property expenses that are not deductible and