What Tax Deductions Can I Claim As An Employee Nov 22 2023 0183 32 The interest you pay for your mortgage can be deducted from your taxes The write off is limited to interest on up to 750 000 375 000 for married filing separately taxpayers of mortgage debt

There are some albeit few expenses that can still be deducted as the result Tax Reform that happened in 2018 A detailed list of employee expenses that have been discontinued as employee tax deductions some until 2026 and others beyond that The Tax Cuts and Jobs Act removed many miscellaneous deductions including employee expense Feb 11 2022 0183 32 1 Home office deduction The home office deduction may be the largest deduction available if you re self employed If you work 100 remotely as a W 2 employee you do not qualify for this

What Tax Deductions Can I Claim As An Employee

What Tax Deductions Can I Claim As An Employee

What Tax Deductions Can I Claim As An Employee

https://southernpb.com/wp-content/uploads/2021/06/How-To-Obtain-Small-Business-Tax-Deductions-1.png

Dec 1 2022 0183 32 The importance of the 2 floor To deduct workplace expenses your total itemized deductions must exceed the standard deduction You must also meet what s called quot the 2 floor quot That is the total of the expenses you deduct must be greater than 2 of your adjusted gross income and you can deduct only the expenses over that amount

Pre-crafted templates offer a time-saving solution for developing a diverse series of files and files. These pre-designed formats and layouts can be made use of for various individual and professional tasks, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, enhancing the material creation process.

What Tax Deductions Can I Claim As An Employee

List Of Tax Deductions Here s What You Can Deduct

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Tax Deductions You Can Deduct What Napkin Finance

Small Business Expenses Tax Deductions 2023 QuickBooks

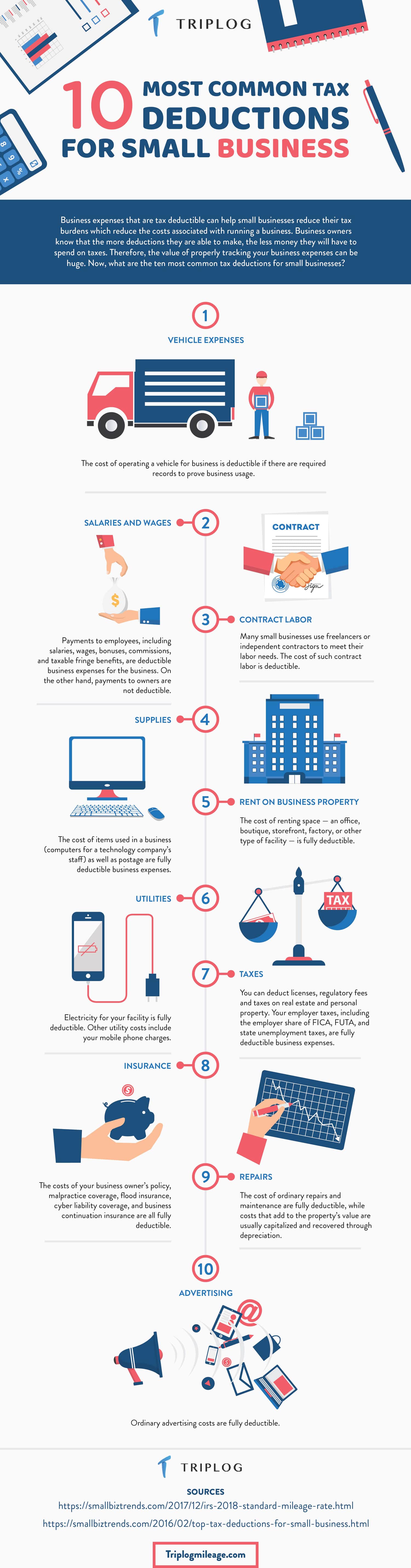

10 Most Common Small Business Tax Deductions Infographic

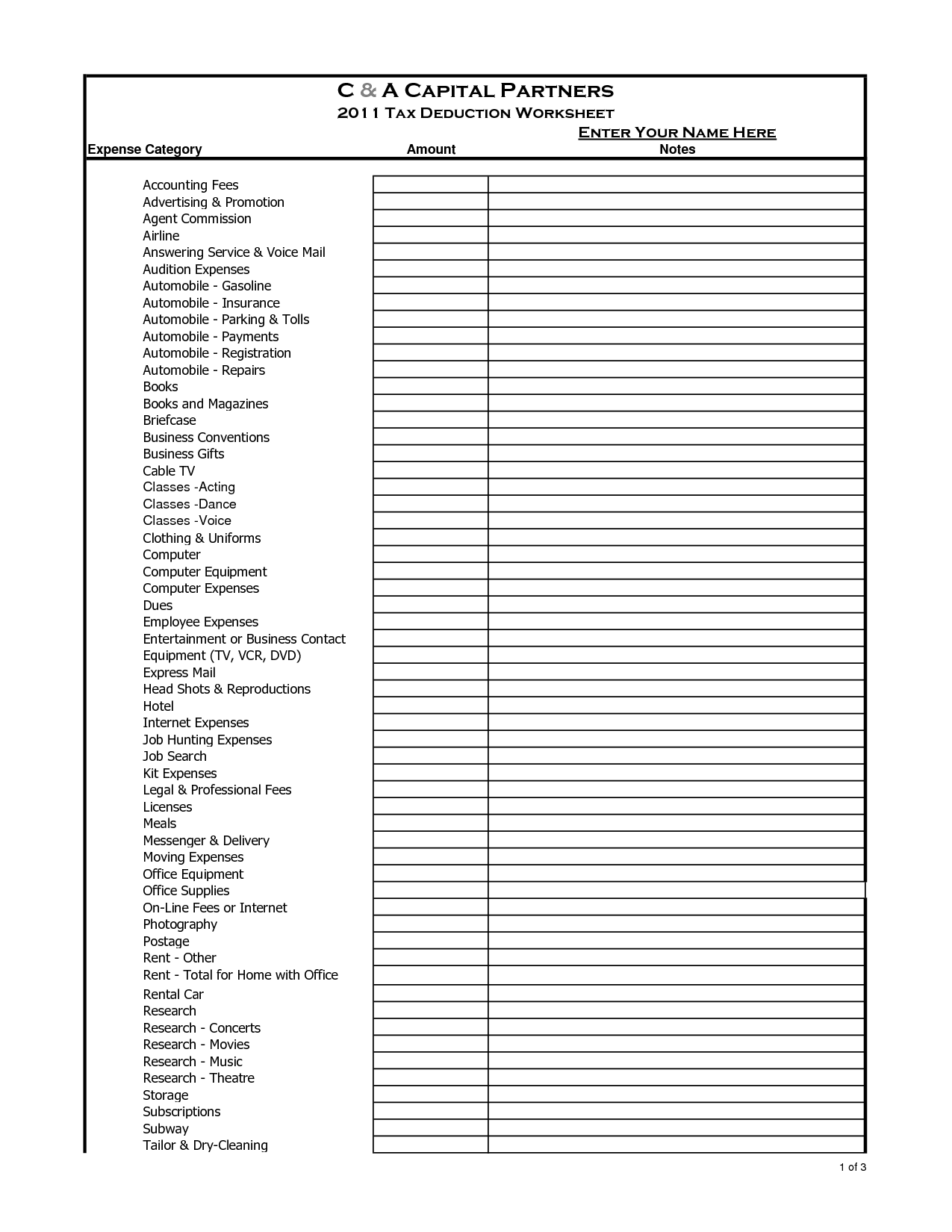

10 2014 Itemized Deductions Worksheet Worksheeto

https://www.gov.uk/tax-relief-for-employees

You must have paid tax in the year you re claiming for You ll get tax relief based on what you ve spent and the rate at which you pay tax Example If you claim 163 60 and pay tax at a

https://www.policygenius.com/taxes/tax-deductions

Jan 24 2023 0183 32 Normally employees pay a tax of 7 65 on their income FICA taxes and their employers also pay that amount for a combined tax of 15 3 Self employed workers need to pay the whole tax but can then deduct the employer portion on their federal tax return Use Schedule SE to calculate your self employment tax and Schedule 1 to claim

https://www.nerdwallet.com/article/taxes/tax-deductions-tax-breaks

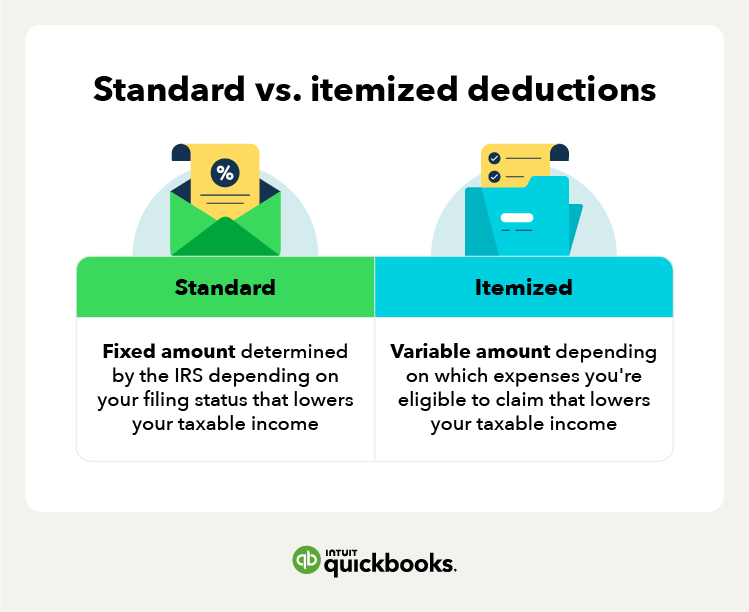

Jan 2 2024 0183 32 Generally there are two ways to claim tax deductions Take the standard deduction or itemize deductions You can t do both The standard deduction is a flat dollar

https://www.which.co.uk/money/tax/income-tax/tax

On certain job related expenses known as a tax deductible expense you can claim tax relief for the amounts you ve paid out This applies both where you have paid the expenses yourself without any reimbursement your employer reimbursed the expense but you were taxed on the reimbursement

https://www.cnet.com/personal-finance/here-are-the

Apr 17 2023 0183 32 Eligible W 2 employees need to itemize to deduct work expenses If you are an eligible W 2 employee you can only deduct work expenses on your taxes if you decide to itemize your deductions Your

Jan 28 2024 0183 32 If your home office is used exclusively and regularly for your self employment you may be able to deduct a portion of your home related expenses such as mortgage interest property taxes homeowners insurance and utilities You do not have to meet the exclusive use test if you claim the deduction for using your home as a daycare Dec 11 2023 0183 32 Eligible taxpayers can deduct up to 20 of their QBI A pass through s QBI is the net amount of qualified items of income gain deduction and loss from a qualified trade or business Key

Feb 8 2024 0183 32 You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for Claim credits A credit is an amount you subtract from the tax you owe This can lower your tax payment or increase your refund