Where Is Unrecaptured Section 1250 Gain Reported 6 days ago 0183 32 What Is an Unrecaptured Section 1250 Gain Unrecaptured section 1250 gain is an Internal Revenue Service IRS tax provision where previously recognized depreciation is

Apr 11 2025 0183 32 So it s called quot unrecaptured quot because it escaped full recapture as ordinary income but still gets taxed at a special 25 rate instead of the lower long term capital gains rates Apr 2 2025 0183 32 Unrecaptured Section 1250 gain is a specific type of capital gain that arises from the sale of depreciable real estate property It is called quot unrecaptured quot because it is the portion of

Where Is Unrecaptured Section 1250 Gain Reported

Where Is Unrecaptured Section 1250 Gain Reported

Where Is Unrecaptured Section 1250 Gain Reported

https://images.squarespace-cdn.com/content/v1/5e1a32c24316850ed6cef645/1629909158341-C7C186X0Z49GE7D9LZAA/1245-1250-property-cost-segregation.jpg

Jul 11 2022 0183 32 Section 1250 classifies a gain from selling property as unrecaptured if the sales price exceeds the initial cost basis This is the sum of what you paid for it and what you spent

Pre-crafted templates use a time-saving option for developing a diverse variety of documents and files. These pre-designed formats and layouts can be used for various personal and professional tasks, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, streamlining the content production process.

Where Is Unrecaptured Section 1250 Gain Reported

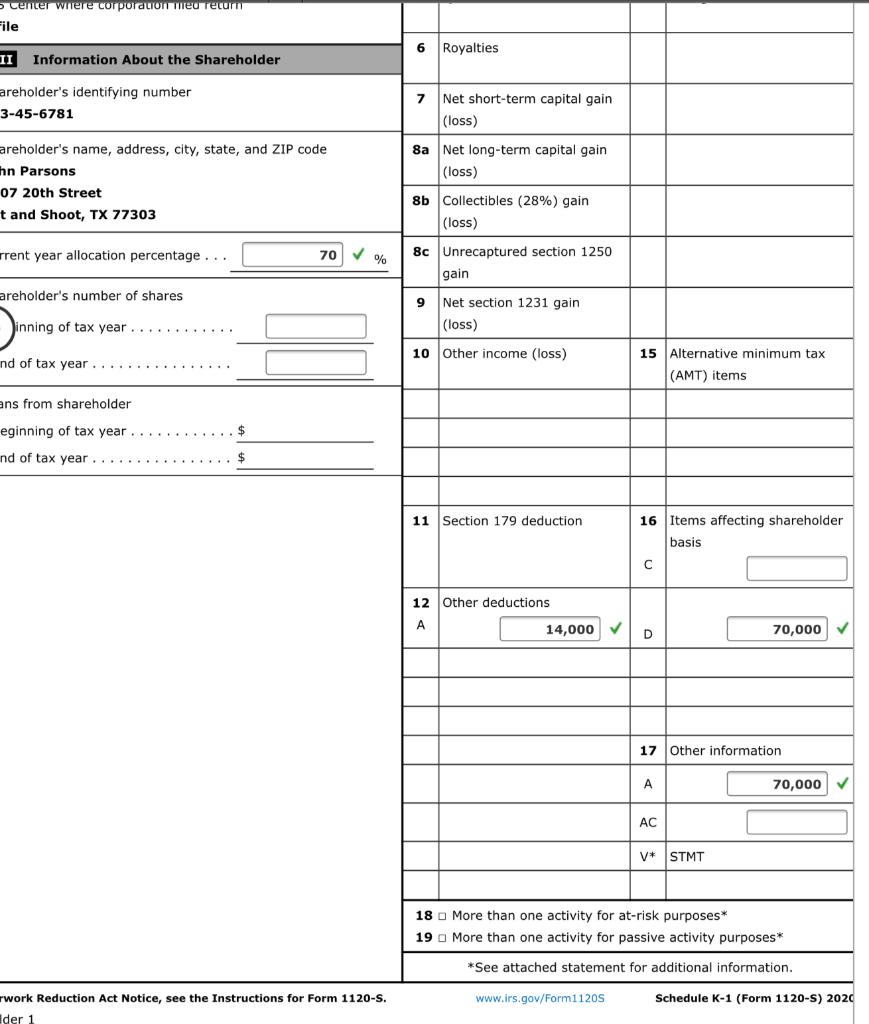

Taxpayer Information Name Bryan Jones Capital Gains Bryan Had The

Solved Note This Problem Is For The 2020 Tax Year John Chegg

Solved I Need Assistance With Answering Schedule K 1 Form 1120 S

Solved The Following Information Applies To The Questions Chegg

What Is Unrecaptured Section 1250 Gain The Expert Opinion By

:max_bytes(150000):strip_icc()/GettyImages-1279111702-e9d0d62e1ab3458299f00ffc773d52f4.jpg)

What Is An Unrecaptured Section 1250 Gain

https://fincent.com › glossary

Unrecaptured section 1250 gain is a tax provision under which previously recognised depreciation is recaptured into income when a gain on the sale of depreciable real estate property is realized

https://accountinginsights.org

Jun 16 2025 0183 32 The portion of the gain attributable to the straight line depreciation taken is categorized as unrecaptured Section 1250 gain This type of gain is subject to a maximum

https://ithy.com › article

Feb 18 2025 0183 32 Unrecaptured Section 1250 Income refers to the gain attributable to straight line depreciation on real property taxed at a preferential maximum rate of 25 rather than the

https://yourlegal.org › glossary

Learn about unrecaptured Section 1250 gains how they are calculated and the tax implications when selling depreciated real estate Understand the rules and how it affects your taxes

https://salestaxcel.com

Jul 1 2025 0183 32 Unrecaptured gain is another fascinating aspect of these tax rules Essentially it refers to the portion of your property s depreciation that hasn t been accounted for when you

[desc-11] [desc-12]

[desc-13]