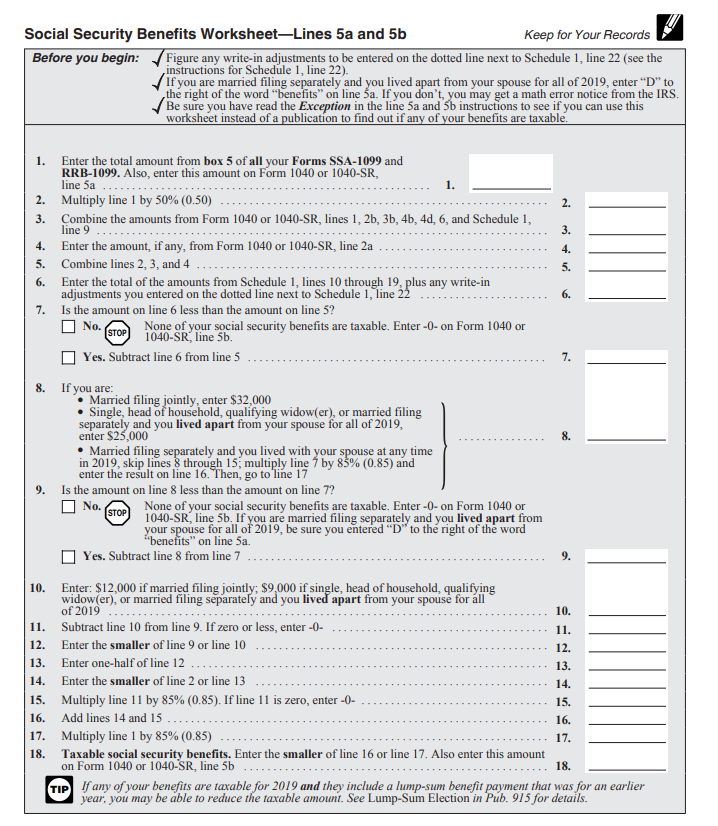

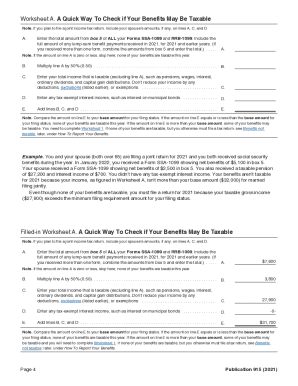

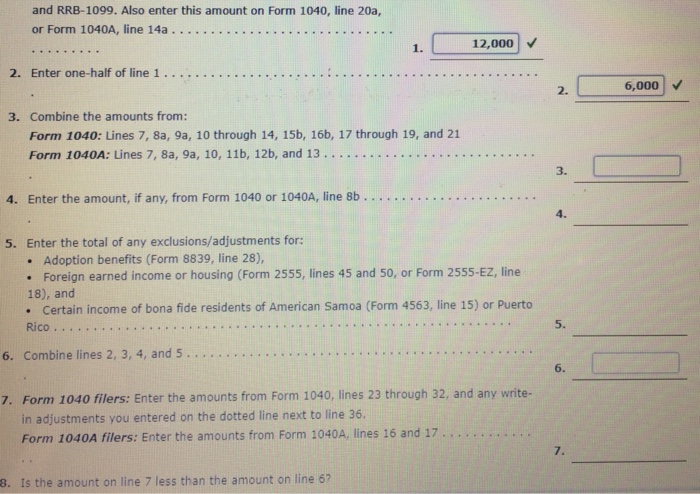

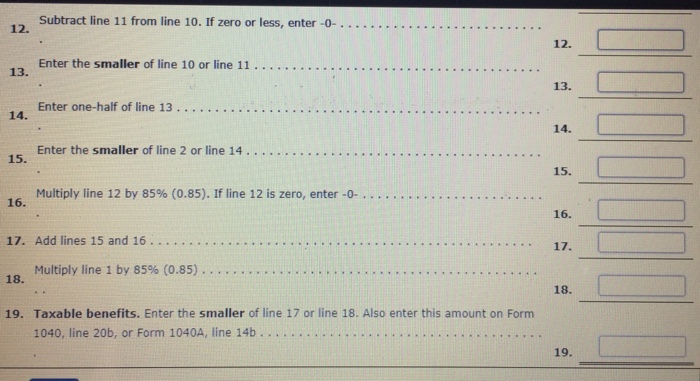

Worksheet 1 Figuring Your Taxable Benefits The IRS will not have Social Security worksheets available for tax year 2022 to calculate the amount of benefits that are taxable until late

Figuring total income To figure the total of one half of your benefits plus your other income use Worksheet A discussed later If the total is more than your They complete Worksheet 1 shown below entering 29 750 15 500 14 000 250 on line 3 They find none of Ray s social security benefits are taxable On

Worksheet 1 Figuring Your Taxable Benefits

https://imgv2-1-f.scribdassets.com/img/document/308426813/original/4fe57c34db/1695285946?v=1

NOTE Use this worksheet to determine the amount if any of your Social Security modification on Schedule M line 1s Yes Yes Married filing jointly or

Templates are pre-designed documents or files that can be utilized for numerous purposes. They can conserve time and effort by offering a ready-made format and design for developing different kinds of material. Templates can be used for individual or expert projects, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Worksheet 1 Figuring Your Taxable Benefits

2014-2023 Form IRS Instruction 1040 Line 20a & 20bFill Online, Printable, Fillable, Blank - pdfFiller

Form 1040 Line 6: Social Security Benefits — The Law Offices of O'Connor & Lyon

Fillable Social Security Benefits Worksheet - Fill and Sign Printable Template Online

2017 Irs Publication 915 Worksheet 1 - Fill Out and Sign Printable PDF Template | signNow

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

Medical Assistance Manual Appendix H-Determining Countable RSDI Payments for MAGI Budgeting

https://www.irs.gov/pub/irs-pdf/p915.pdf

You need to complete Worksheet 1 If none of your benefits are taxable but you must otherwise file a tax return see Benefits not taxable later under How

https://www.taxact.com/support/1375/2022/social-security-benefits-worksheet-taxable-amount

The TaxAct program will automatically calculate the taxable amount of your Social Security income if any To view the Social Security Benefits Worksheet

https://www.cchwebsites.com/content/taxguide/tools/ssbenefits_m.php

The taxable portion can range from 50 to 85 percent of your benefits The worksheet provided can be used to determine the exact amount Social Security

https://www.taxact.com/support/1373/2022/social-security-benefits-lump-sum-payments

The TaxAct program supports Worksheet 1 Figuring Your Taxable Benefits from IRS Publication 915 Social Security and Equivalent Railroad Retirement Benefits

https://pdfliner.com/social_security_benefits_worksheet_lines_20a_and_20b

The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen If the benefits are not taxed

Page 1 Social Security Benefits Worksheet Figuring Your Taxable Benefits 2016 TIP Worksheet 1 Forms 1040 1040A Before you begin 1 1 2 2 3 3 4 4 your benefits more than 34 000 up to 85 percent of your benefits may be taxable file a joint return and you and your spouse have a combined income that is

Although Railroad Retirement benefits are not taxable one half of the benefits received must be used to determine the amount of Social Security benefits that