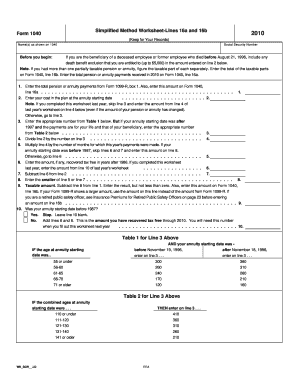

1099 R Simplified Method Worksheet The Simplified Method Worksheet in the TaxAct program shows the calculation of the taxable amount from entries made in the retirement income section You need

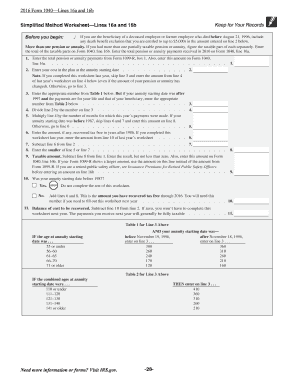

Simplified Method Worksheet for Pension Payments The pension or annuity sponsor may compute the amount for you and report it on the 1099 R information Within the captivating pages of Rrb 1099 R Simplified Method Worksheet a literary masterpiece penned by a renowned author readers set about a transformative

1099 R Simplified Method Worksheet

1099 R Simplified Method Worksheet

x-raw-image:///e60601e91eb1758ae5e5687c75370eae143965fd663b81d6bf646547fd4e8ca3

Look for Form 1099 R and accompanying worksheets If you are using TurboTax Online there is no forms function and the only way to see the

Pre-crafted templates use a time-saving option for creating a varied range of files and files. These pre-designed formats and layouts can be used for different individual and professional tasks, including resumes, invitations, leaflets, newsletters, reports, discussions, and more, improving the content development procedure.

1099 R Simplified Method Worksheet

Simplified Method Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

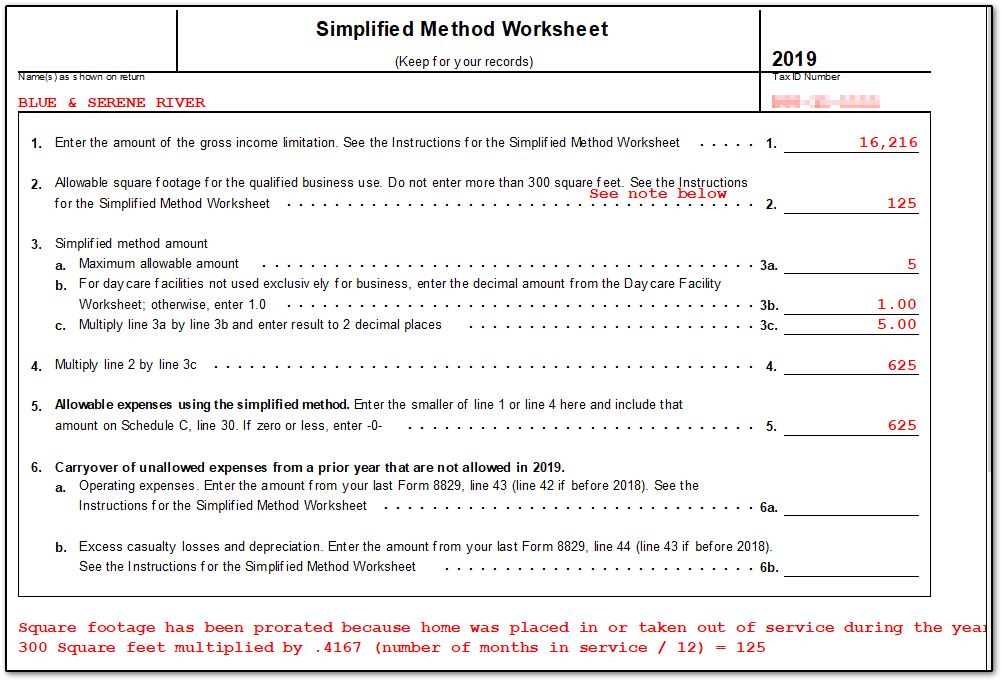

8829 - Simplified Method (ScheduleC, ScheduleF)

Simplified Method Worksheet

ACC180 - Simplified Method Worksheet- Winston.pdf - Simplified Method Worksheet 1 Before you begin: If you are the beneficiary of a deceased employee or former | Course Hero

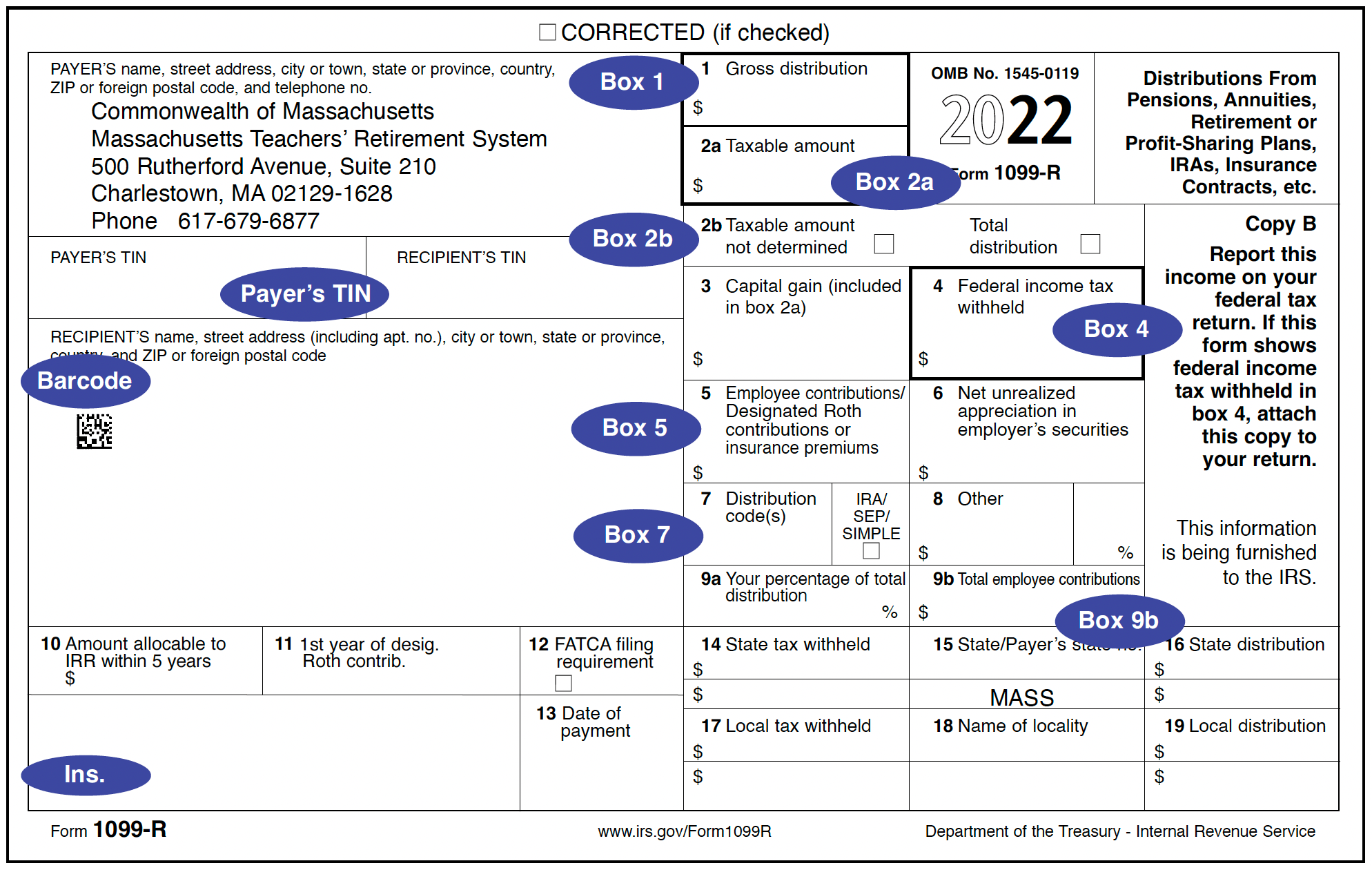

1099-R Information - MTRS

1040 Simplified Method Worksheet PDF Form - FormsPal

https://apps.irs.gov/app/vita/content/globalmedia/simplified_method_worksheet_1040i.pdf

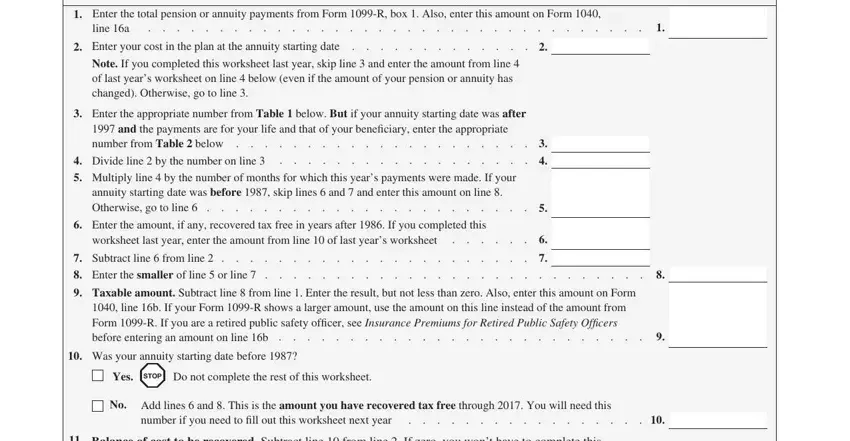

Worksheet next year The payments you receive next year will generally be fully taxable Enter the total pension or annuity payments from Form 1099 R box 1

https://support.taxslayer.com/hc/en-us/articles/360016472752-Should-I-use-the-Simplified-Method-Worksheet-to-figure-my-1099-R-s-taxable-amount-

The Simplified Method Worksheet can be found in Form 1040 1040 SR Instructions if you prefer to do it by hand Are there restrictions on when the Simplified

https://support.taxslayer.com/hc/en-us/articles/360015701872-How-do-I-complete-the-Simplified-Method-Worksheet-1099-R-

Within the 1099 R entry screen Federal Section Income 1099 R RRB SSA Add or Edit a 1099 R enter your payer information and Box 1 distribution Under

https://support.taxslayerpro.com/hc/en-us/articles/360009302073-The-Simplified-General-Rule-Worksheet

Note If Form 1099 R does show a taxable amount the taxpayer may be able to report a lower taxable amount by using the Simplified Method For

https://www.ctcresources.com/uploads/3/1/6/2/31622795/using_the_simplified_method_to_determine_taxable_amount-82021.pdf

In the Calculate Taxable Amount screen click to open Simplified Method Worksheet 5 Click Con nue to access the Worksheet 6 Complete the worksheet onscreen

It s used to determine the after tax contribution amount shown in Box 5 If you want to know what each field on Form 1099 R means then check 2021 uploaded Adv 7 1099 R Simplified Method 2021 uploaded Adv 7 1099 R Simplified Method 12 02 2021 03 50 2021 uploaded Adv 7 1099 R Simplified Method

575 Pensions and Annuity Income If you are using the Simplified General Rule refer to the Simplified General Rule worksheet in the