2021 Earned Income Credit Worksheet For tax returns prior to 2021 Publication 596 is the IRS publication issued to help taxpayers understand Earned Income Credit EIC It includes eligibility

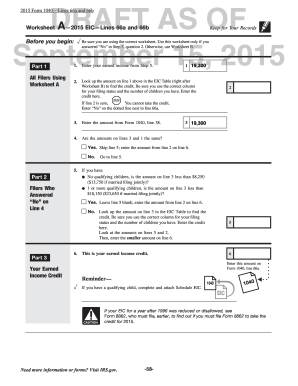

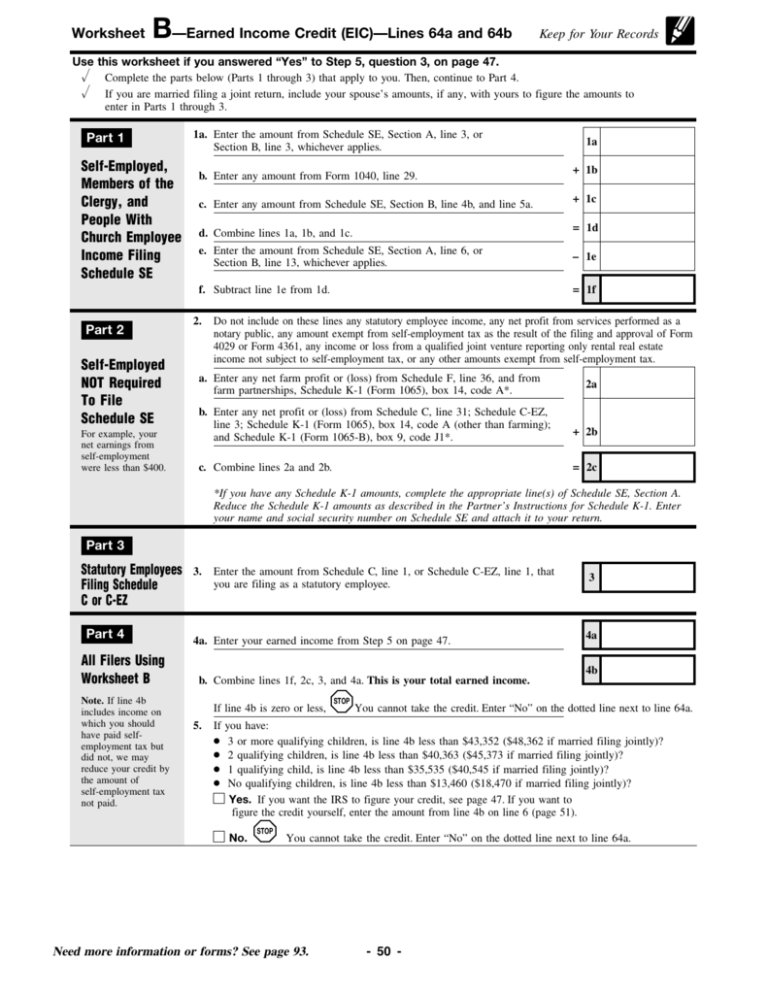

The IRS provides a worksheet and tables in the Instructions for Form 1040 to calculate the credit Earned Income Credit for Childless Taxpayers in 2021 Complete Worksheet B on the back page before continuing 5 Is the IRS figuring your federal earned income credit EIC for you If Yes complete lines 6 through

2021 Earned Income Credit Worksheet

2021 Earned Income Credit Worksheet

2021 Earned Income Credit Worksheet

https://www.pdffiller.com/preview/100/104/100104679.png

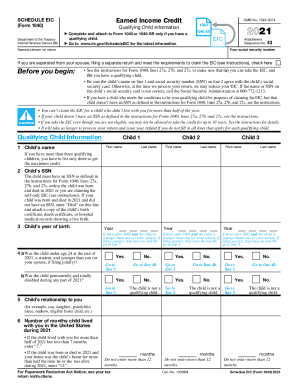

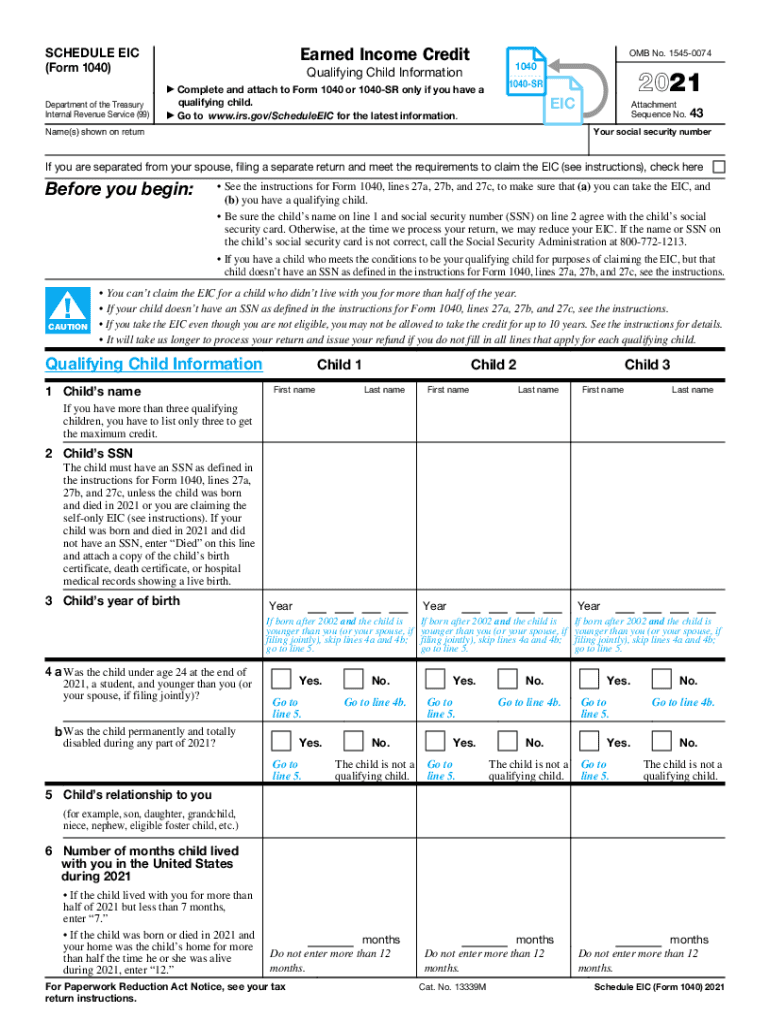

Earned Income Credit Worksheet in your IRS Form 1040 instruction booklet If you have a qualifying child be sure to attach a Schedule EIC You can ask the

Pre-crafted templates provide a time-saving option for developing a diverse series of documents and files. These pre-designed formats and layouts can be utilized for different individual and expert projects, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, streamlining the material creation process.

2021 Earned Income Credit Worksheet

Earned Income Credit (EIC)

2022 Schedule EIC Form and Instructions (Form 1040)

Indiana eic: Fill out & sign online | DocHub

Publication 972 (2020), Child Tax Credit and Credit for Other Dependents | Internal Revenue Service

DelBene Tax Prep Dispatch - The EITC Lookback is back (it never left!) | Prosperity Now

Publication 596 (2022), Earned Income Credit (EIC) | Internal Revenue Service

https://www.irs.gov/publications/p596

The special rules that changed the age requirements for certain filers claiming the EIC without a qualifying child were limited to 2021 For

https://www.maine.gov/revenue/sites/maine.gov.revenue/files/inline-files/21_earned_income_cred_ff.pdf

Earned Income Tax Credit Worksheet for Tax Year 2021 36 M R S 5219 S Enclose with your Form 1040ME Revised December 2021 The Maine EIC is equal to 20

https://media.hrblock.com/media/KnowledgeDevelopment/ITC/2021Forms/Earned_Income_Credit_Worksheets_for_Step_5.pdf

2020 WORKSHEET A EARNED INCOME CREDIT EiC LINE 27 Keep for Your Records Before you begin Be sure you are using the correct worksheet Use this

https://turbotax.intuit.com/tax-tips/tax-deductions-and-credits/when-to-use-schedule-eic-earned-income-credit/L41wy2200

However for 2021 you can claim the credit as a single person as young as age 19 and there is not any upper age limit Also for 2021 a

https://www2.laworks.net/Downloads/Posters/2021_Earned_Income_Credit.pdf

Earned Income Credit EIC2021 Notice to Employees of Federal Earned Income Tax Credit EIC If you make 51 000 or less your employer should notify you at

Enter the credit from that column on your EIC Worksheet Example If your filing status is single you have one qualifying child who has a valid SSN and eic worksheet a 2021 eic table 2021 eic table 2021 pdf 2020 eic worksheet earned income credit 2022 eitc calculator 2021 worksheet a 2020 eic line 27 People

The Earned Income Tax Credit EITC provides relief for some workers at tax time If you qualify the tax credit lowers the amount of taxes you are required to