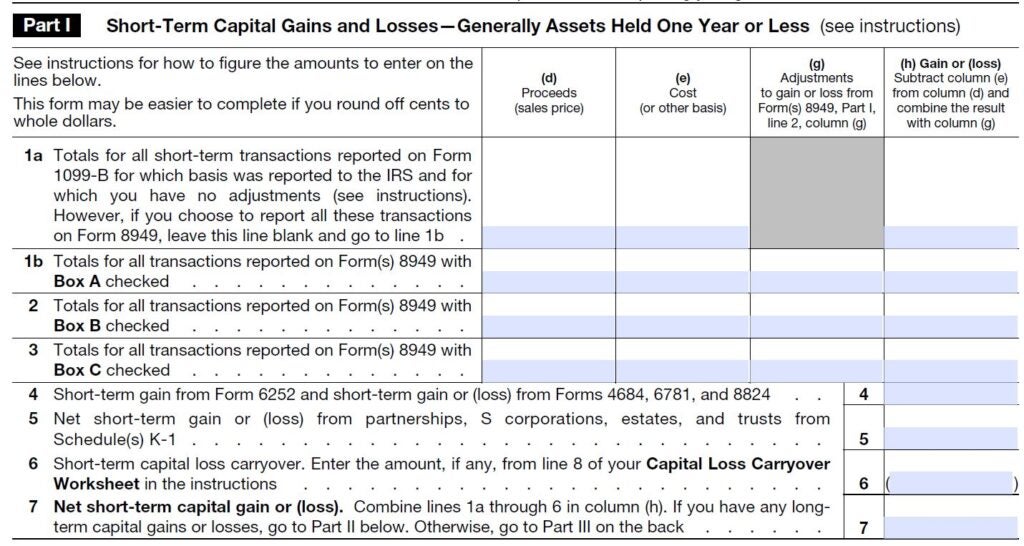

2022 Capital Loss Carryover Worksheet 5 6 Short term capital loss carryover Enter the amount if any from line 8 of your Capital Loss Carryover Worksheet in the instructions

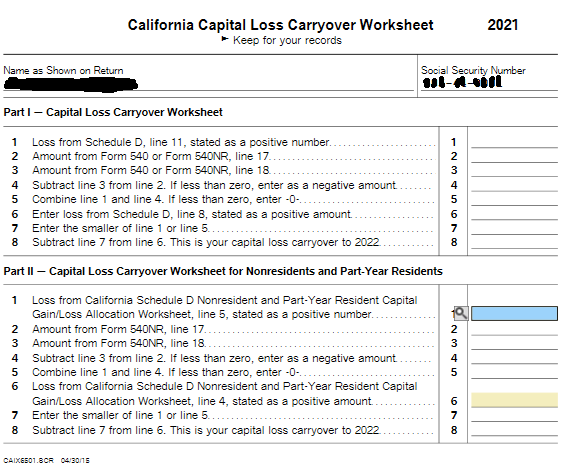

Capital loss carryover is the capital loss that can be carried forward to future years and used to offset capital gains or as a deduction California Capital Loss Carryover Worksheet Loss from Schedule D 540 line 11 stated as a positive number Amount from Form 540 line 17 Amount from

2022 Capital Loss Carryover Worksheet

2022 Capital Loss Carryover Worksheet

2022 Capital Loss Carryover Worksheet

https://www.signnow.com/preview/100/84/100084945.png

worksheet 2021 2021 irs qualified dividends and capital gain tax worksheet To report a capital loss carryover from 2021 to 2022 Additional information

Pre-crafted templates provide a time-saving solution for producing a varied range of files and files. These pre-designed formats and designs can be made use of for various personal and expert jobs, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, simplifying the material creation procedure.

2022 Capital Loss Carryover Worksheet

Capital Loss Carryover: Definition, Rules, and Example

Capital Loss Carryover - Trying to Understand it - Bogleheads.org

:max_bytes(150000):strip_icc()/IRSScheduleD-c7be5030d7394773ad2d905654e9e902.png)

When Would I Have to Fill Out a Schedule D IRS Form?

Carryover short term capital losses confusion from FreeTaxUSA. My losses in 2020 were $3339, but software says my carryover is only $935. : r/tax

Short term capital loss carryover is 0 despite $500 short term capital loss? : r/tax

Schedule D: How To Report Your Capital Gains (Or Losses) To The IRS | Bankrate

https://www.irs.gov/instructions/i1040sd

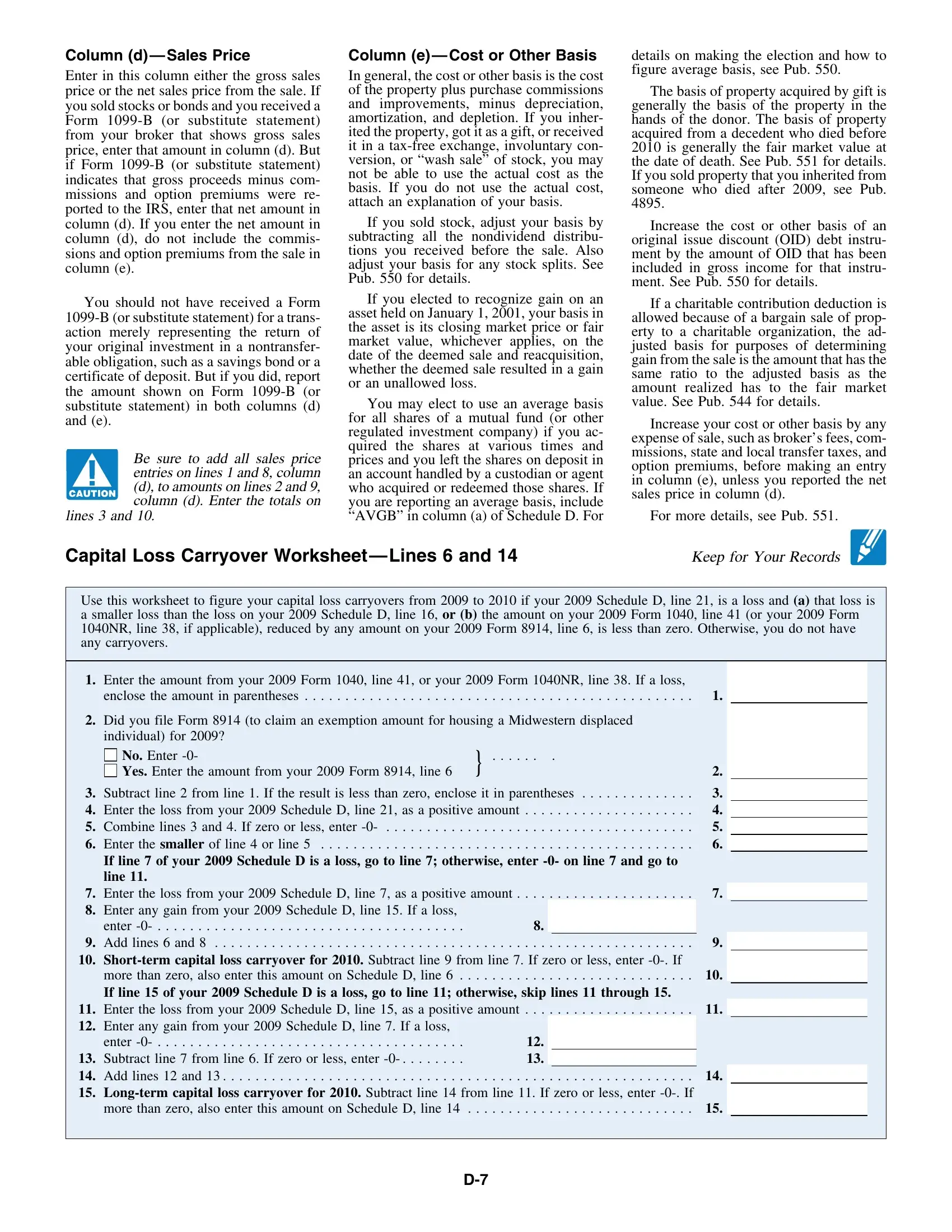

Capital Loss Carryover Worksheet Lines 6 and 14 Use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021

https://www.youtube.com/watch?v=oZi2INpLTyc

How to file your taxes with TurboTax In this video I cover the basics of Capital Loss carryovers

https://www.taxact.com/support/1024/2022/capital-gains-and-losses-capital-loss-carryover

You may deduct capital losses up to the amount of your capital gains plus 3 000 1 500 if married filing separately If part of the loss is still unused

https://www.cchwebsites.com/content/taxguide/tools/caploss_m.php

Capital Loss Carryover Worksheet If you have a net capital loss greater than 3 000 for the year that is if your capital losses exceed your gains by

https://capital-loss-carryover-worksheet.pdffiller.com/

The Capital Loss Carryover Worksheet is used to determine the amount of capital loss that can be carried over from one tax year to the next It helps taxpayers

In View mode the page labeled Wks Loss Capital Loss Carryover Worksheet shows the calculation for what portion of the loss is available to be carried forward D Capital Gains and Losses Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2022 June 2 2023 8 43 AM OVERVIEW

Any losses also carries into the Carryover report and is proforma d next year UltraTax CS automatically includes capital loss carryovers in the net income