28 Percent Rate Gain Worksheet Most taxpayers who file Schedule D do not have amounts on line 18 which contains capital gain taxed at the 28 rate or line 19 where

4 28 percent rate gain For purposes of this subsection the term 28 percent rate gain means the excess if any of A the sum of i collectibles gain If you sold a stock regardless of whether you made or lost money on it you have to file Schedule D This form can be a hassle

28 Percent Rate Gain Worksheet

28 Percent Rate Gain Worksheet

28 Percent Rate Gain Worksheet

https://cdn.numerade.com/ask_images/1000e1ef35a3478ab78f0cf7e42d672f.jpg

Note Gains on the sale of collectibles rental real estate income collectibles antiques works of art and stamps are taxed at a maximum rate of 28 More

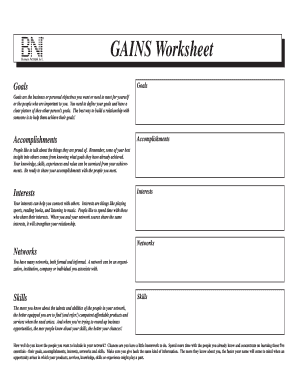

Pre-crafted templates offer a time-saving option for developing a varied series of documents and files. These pre-designed formats and designs can be made use of for various personal and professional tasks, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, improving the material creation procedure.

28 Percent Rate Gain Worksheet

The Ultimate Guide to NFT Taxes in 2023 | CoinLedger

2018-2023 Form IRS Capital Loss Carryover WorksheetFill Online, Printable, Fillable, Blank - pdfFiller

Capital loss carryover: Fill out & sign online | DocHub

How to Minimize Portfolio Taxes

✓ Solved: Lisa Kohl (age 44) is an unmarried high school principal. Lisa received the following tax documents:

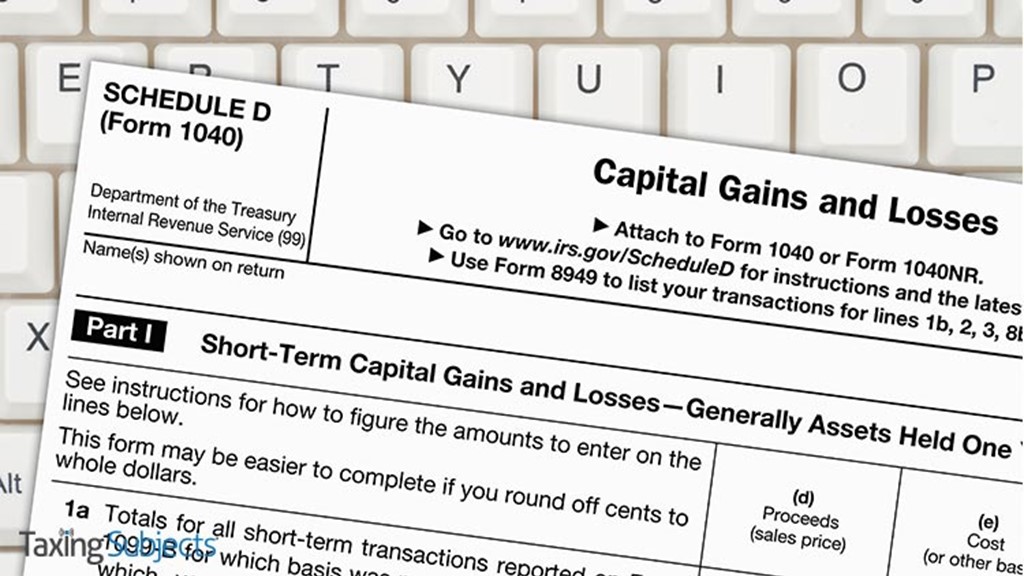

IRS Fixes Error in Schedule D Worksheet - Taxing Subjects

https://support.taxslayerpro.com/hc/en-us/articles/360009170694-Schedule-D-Adjust-28-Rate-1250-Worksheet-Menu

Adjust 28 Rate 1250 Worksheets 28 Rate Gain Worksheet If the sum of short term capital gains or losses plus long term capital gains or

https://www.irs.gov/instructions/i1040sd

28 Rate Gain Worksheet Line 18 1 Enter the total of all collectibles gain or loss from items you reported on Form 8949 Part II 1

https://omb.report/icr/201806-1545-014/doc/83919101

OMB 1545 0092 reference document for 28 Rate Gain Worksheet Sch D Inst

https://proconnect.intuit.com/support/en-us/help-article/federal-taxes/calculating-capital-gains-28-rate-lacerte/L4kr0EUxp_US_en_US

Lacerte calculates the 28 rate on capital gains according to the IRS form instructions Per the instructions the 28 rate will generate if

http://www.a-ccpa.com/content/taxguide/text/c60s10d507.php

You will need to complete the 28 Rate Gain Worksheet in the Schedule D Instructions Then you take your short term gain or loss and net it against your long

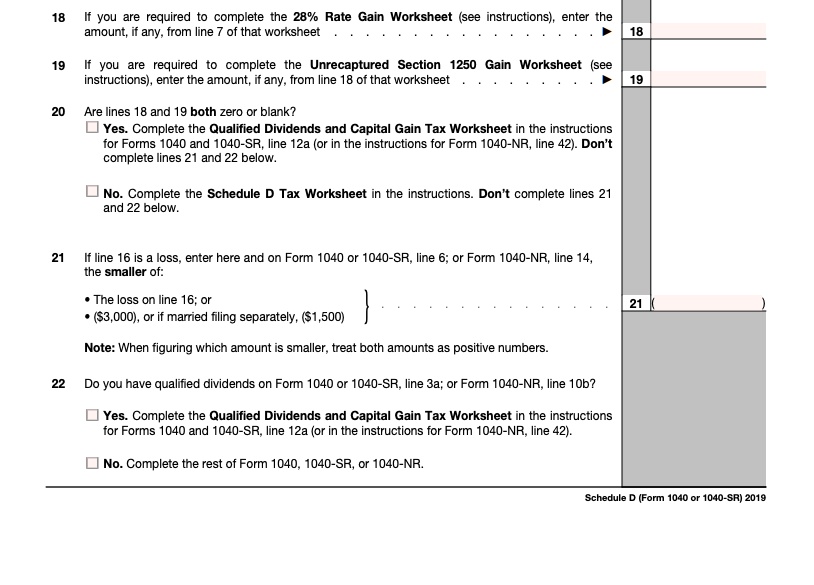

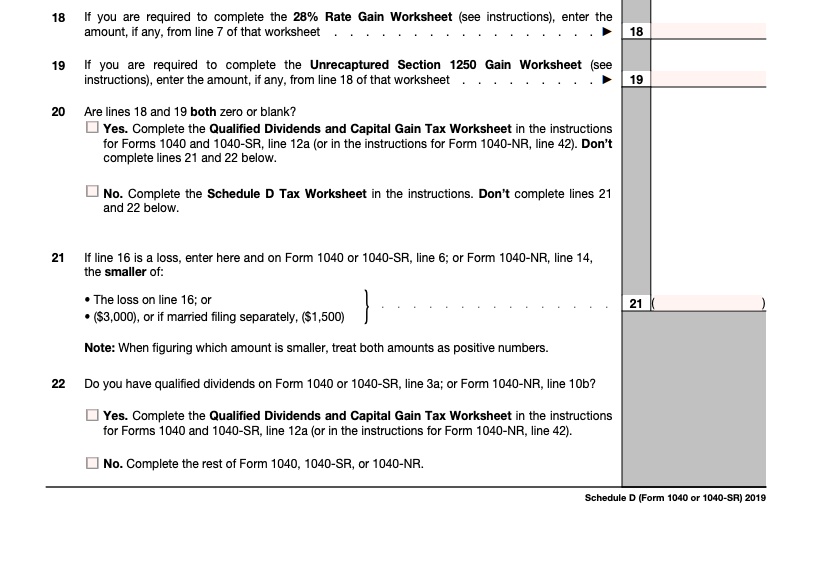

If there is an amount on Line 18 from the 28 Rate Gain Worksheet or Line 19 from the Unrecaptured Section 1250 Gain Worksheet of Schedule D Form 1040 A 28 rate gain worksheet is a document used to calculate the capital gains tax rate on the sale of a capital asset It is used to determine how much of any

If you are required to complete the 28 Rate Gain Worksheet see instructions enter the amount if any from line 7 of that worksheet If