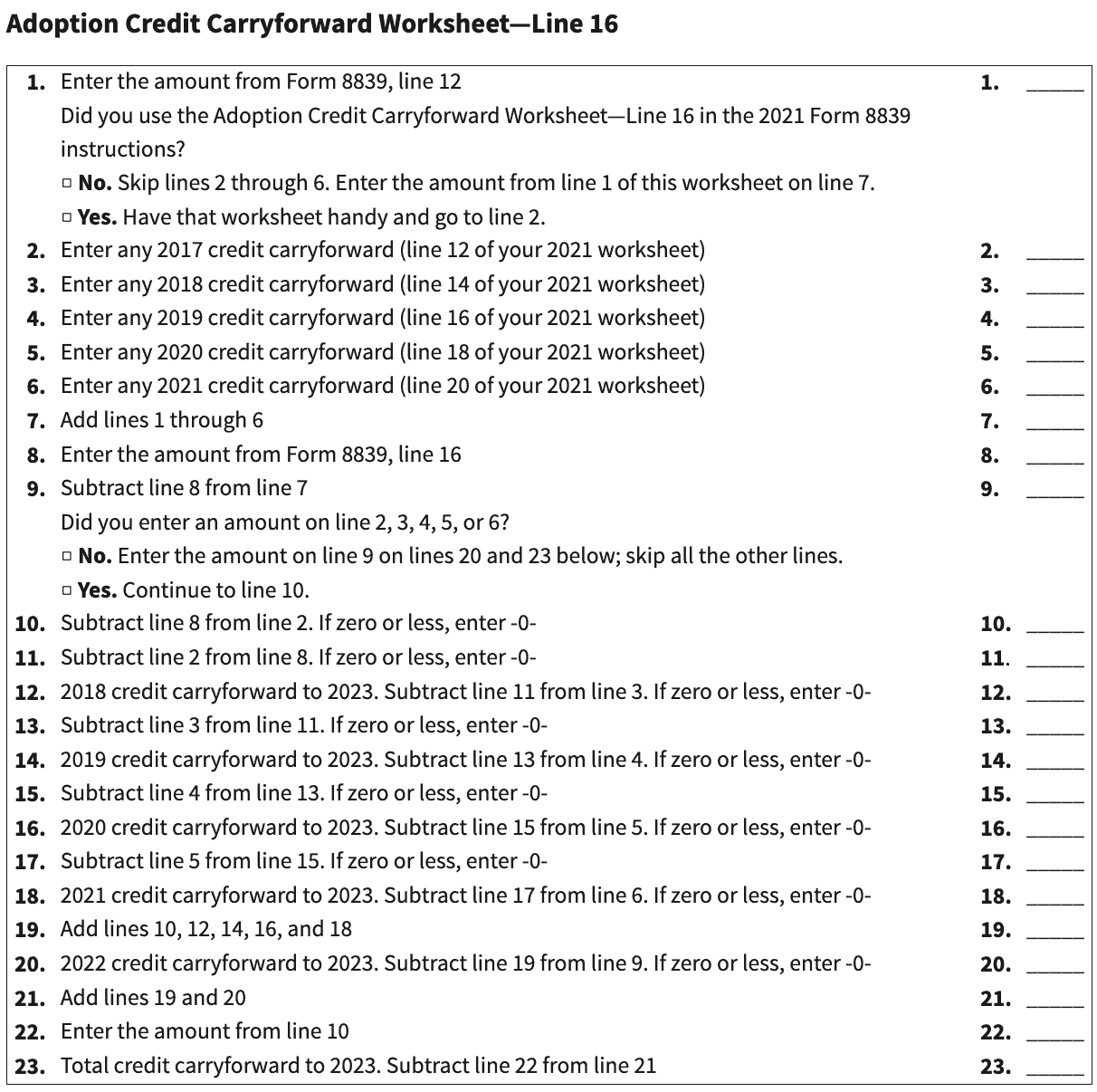

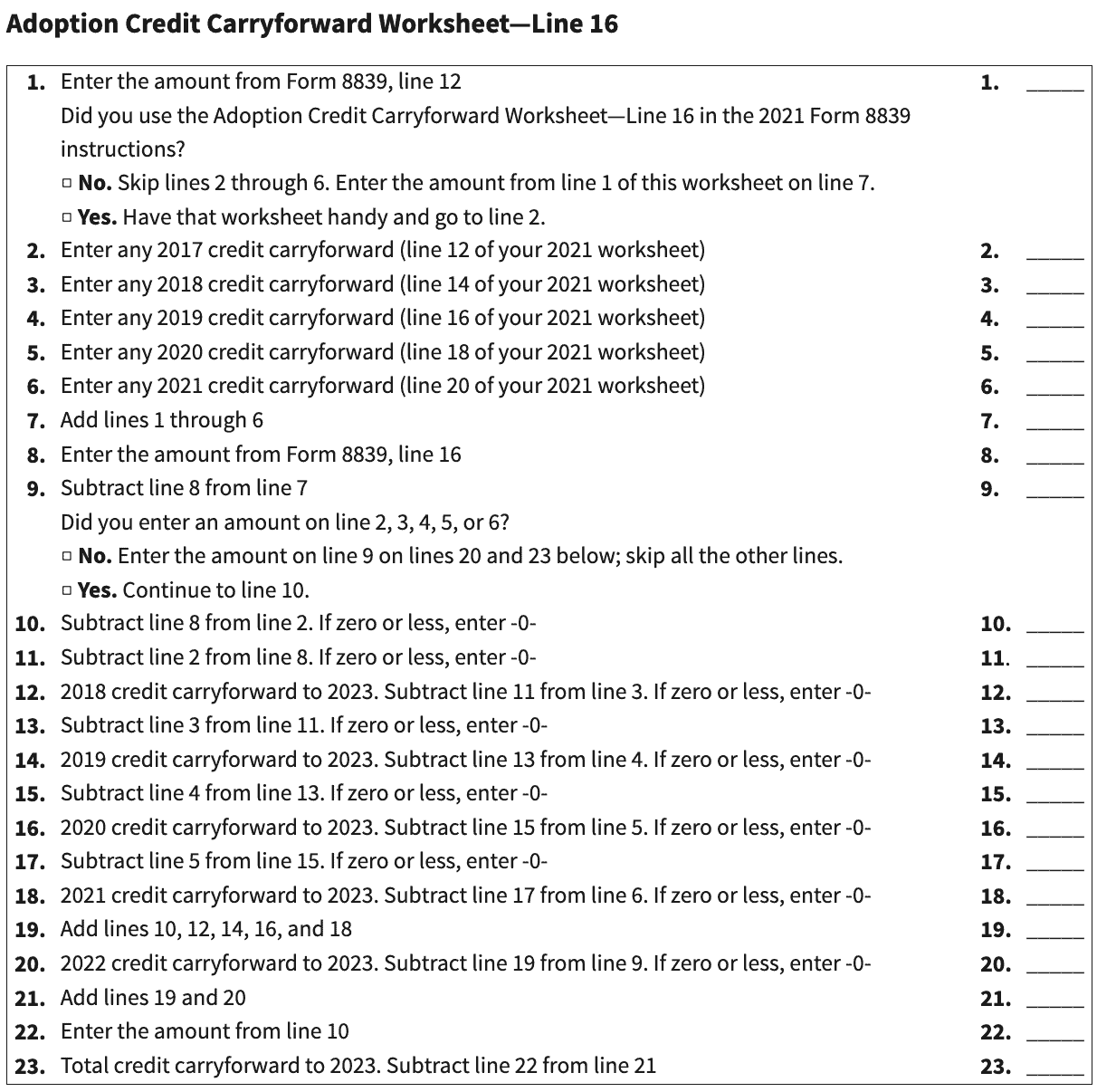

Adoption Credit Carryforward Worksheet The adoption tax credit is a nonrefundable tax credit meant to carry forward any remaining amount for up to five years For example

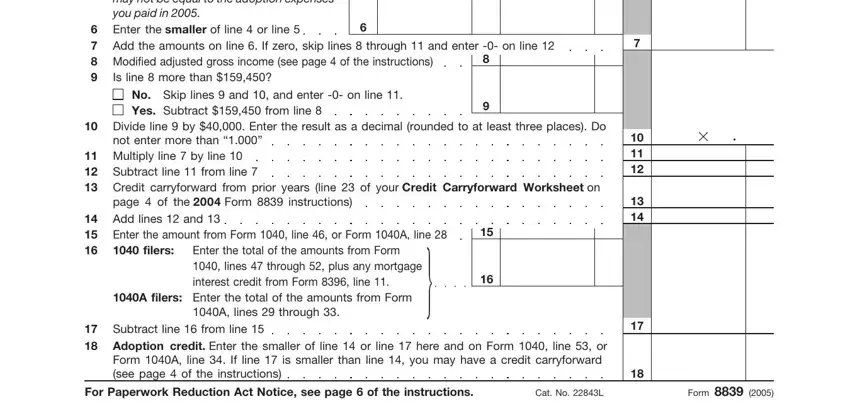

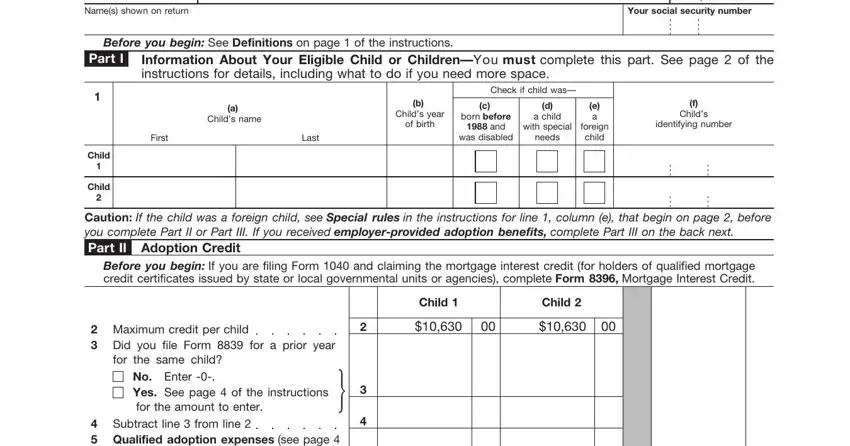

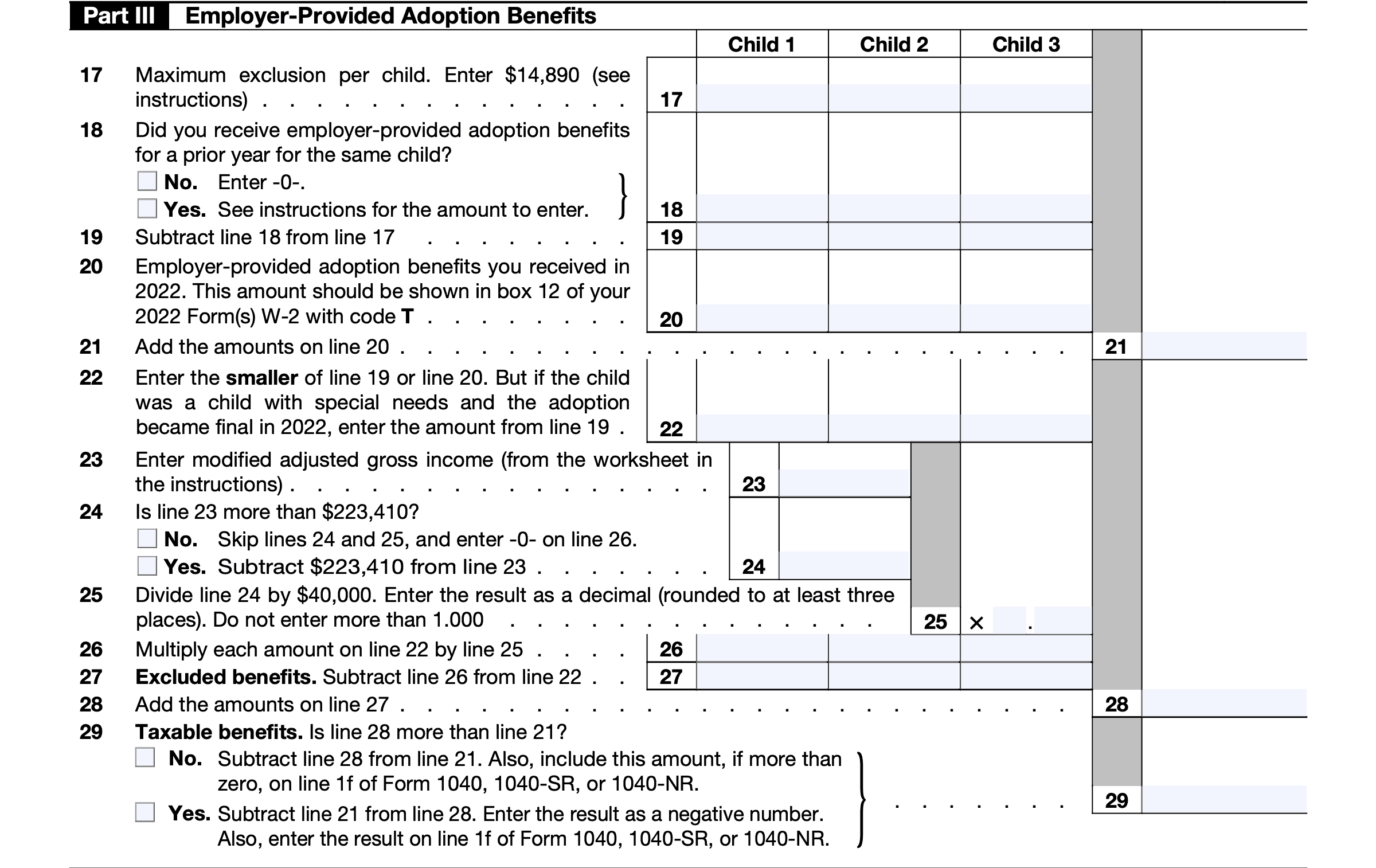

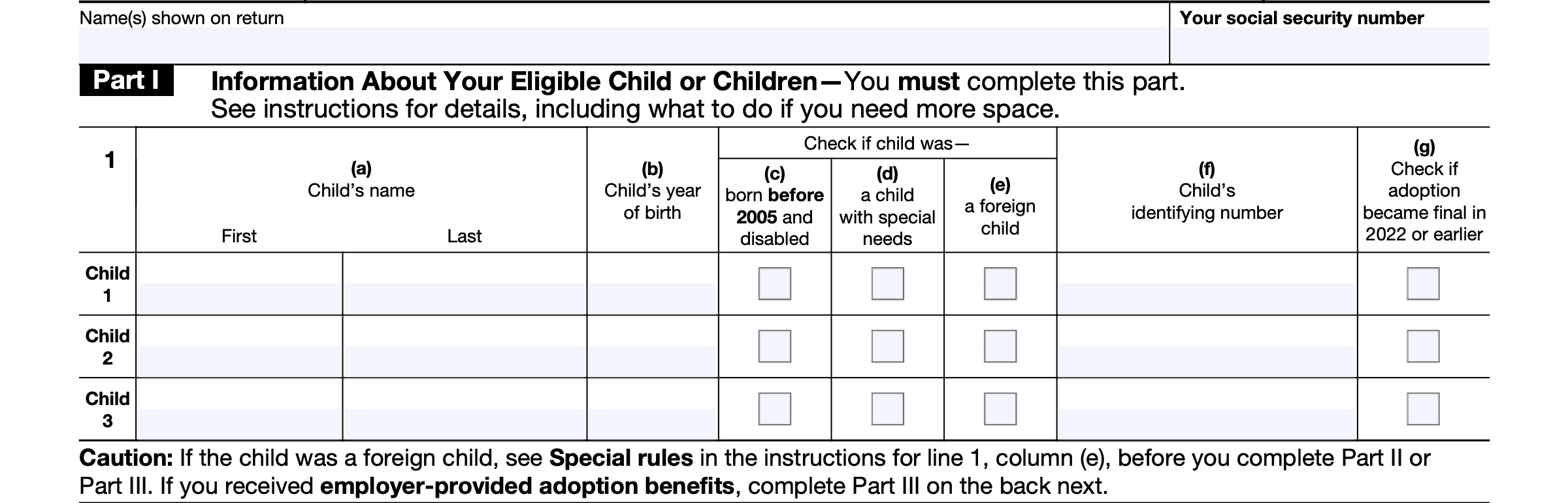

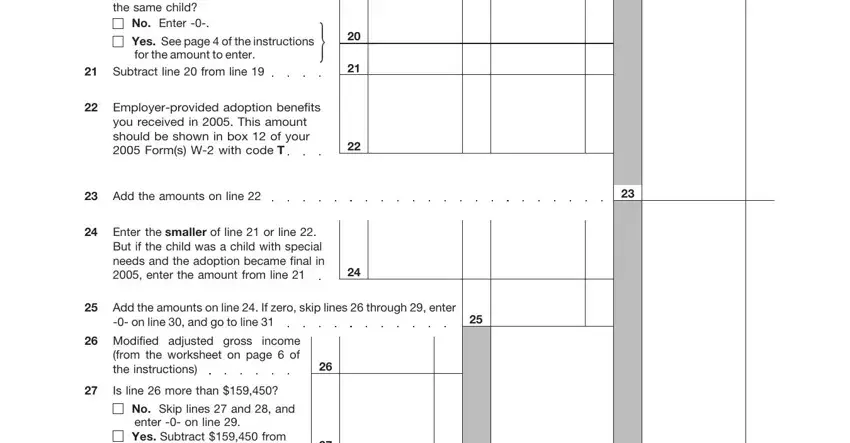

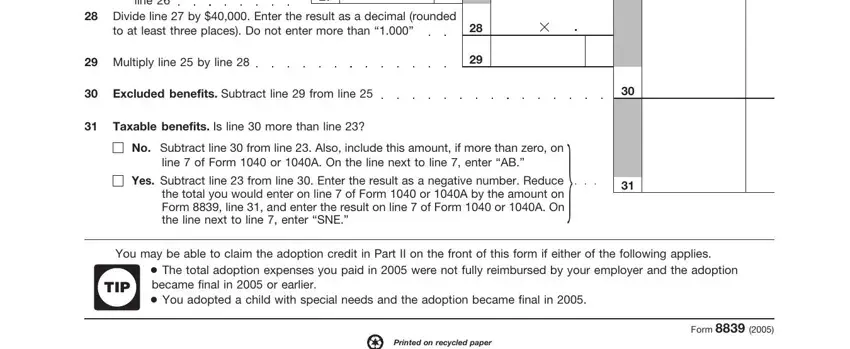

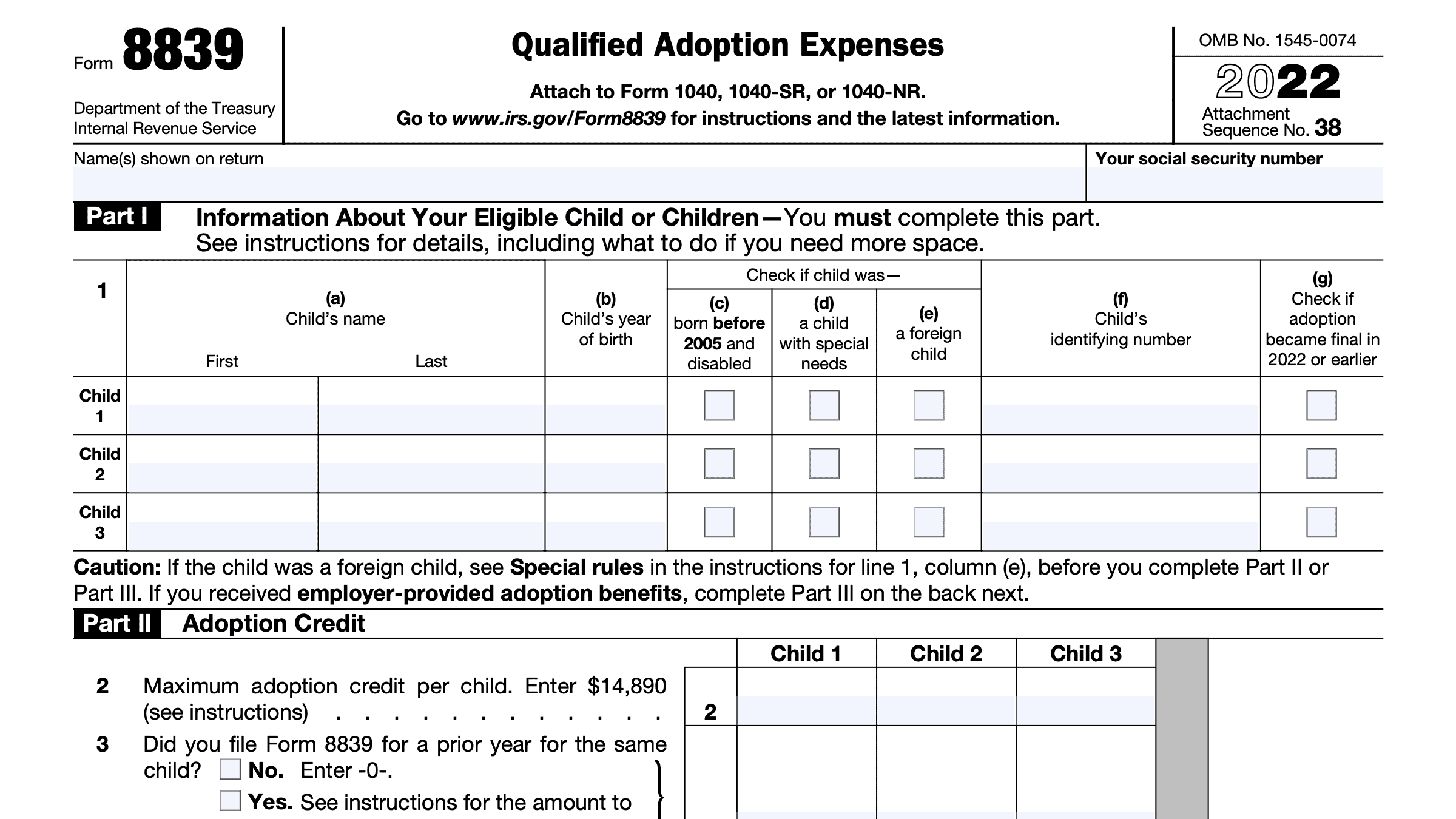

Use Form 8839 to figure your adoption credit and any employer provided adoption benefits Adoption credit carry forward worksheet in the instructions for line 16 which identifies unused credits that taxpayers may carry forward for 2015 has been

Adoption Credit Carryforward Worksheet

Adoption Credit Carryforward Worksheet

Adoption Credit Carryforward Worksheet

https://www.teachmepersonalfinance.com/wp-content/uploads/2023/03/irs_form_8839_line_16_adoption_credit_carryforward_worksheet.png

Use the Line 16 worksheet to determine your adoption credit carryforward for future tax years Be sure to keep a copy of this worksheet for next

Pre-crafted templates offer a time-saving solution for developing a varied range of files and files. These pre-designed formats and designs can be used for different personal and expert projects, including resumes, invites, flyers, newsletters, reports, discussions, and more, enhancing the material production procedure.

Adoption Credit Carryforward Worksheet

Form 8839 ≡ Fill Out Printable PDF Forms Online

Form 8839 ≡ Fill Out Printable PDF Forms Online

IRS Form 8839 Instructions - Guide to Qualified Adoption Expenses

IRS Form 8839 Instructions - Guide to Qualified Adoption Expenses

Form 8839 ≡ Fill Out Printable PDF Forms Online

Form 8839 ≡ Fill Out Printable PDF Forms Online

https://www.irs.gov/pub/irs-pdf/f8839.pdf

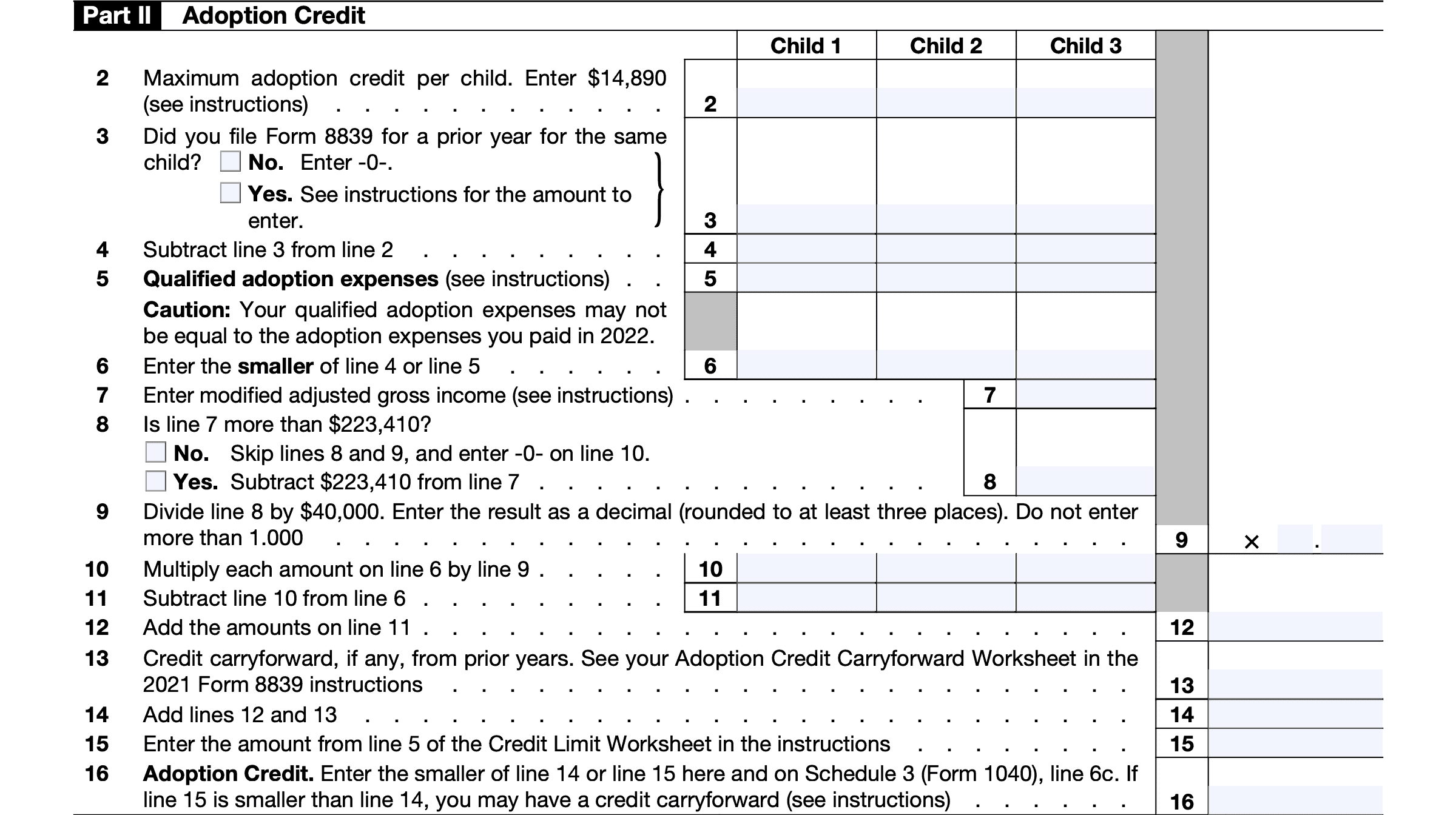

Credit carryforward if any from prior years See your Adoption Credit Carryforward Worksheet in the 2021 Form 8839 instructions

https://support.taxslayer.com/hc/en-us/articles/360018998631-Where-can-I-find-my-Adoption-carryforward-amount-

The carryforward amount is calculated on the Adoption Credit Carryforward Worksheet located in the PDF of your prior year return You will need to manually

https://kb.drakesoftware.com/Site/Browse/11814/8839-Adoption-Credit

This worksheet is found in Publication 972 Child Tax Credit and Credit for Other Dependents and may determine if the Child Tax Credit will be used before the

https://www.dcfs.louisiana.gov/assets/docs/searchable/OCS/adoption/AdoptionTaxCredit_SpecialNeeds.pdf

Credit Carryforward Worksheet in the Instructions for Form 8839 This documents the amount of the credit you can carry forward for up to five additional years

https://support.taxslayerpro.com/hc/en-us/articles/360025390914-Adoption-Credit-Form-8839

Form 8839 is used to calculate the allowable credit of an eligible child based on the taxpayer s qualified expenses Qualified Adoption Expenses

If you adopted a child in California you can claim a credit for 50 of the cost The child must have been both of the following 13 Credit carryforward if any from prior years See your Adoption Credit Carryforward Worksheet in the 2017 Form 8839 instructions

In the case of a child for whom a federal adoption credit is available for multiple years e g a federal credit carryforward or expenses incurred such that