Built In Gains Tax Calculation Worksheet A built in gain represents the excess of the fair market value over the tax basis of an asset as of the conversion date If an asset is sold

The built in gains tax is a corporate level tax on gain from certain property sales made in the recognition period following an S election by a Built in Gains Tax Worksheet keep for your records INFORMALTABLE summary Use this worksheet to compute built in gains tax a Excess

Built In Gains Tax Calculation Worksheet

Built In Gains Tax Calculation Worksheet

Built In Gains Tax Calculation Worksheet

http://www.marottaonmoney.com/wp-content/uploads/2017/05/line44.jpg

Calculating Built In Gains Tax Deduct NOL and capital loss carried over from C corporation Equals Taxable amount Multiply by Highest corporate tax rate

Pre-crafted templates offer a time-saving solution for developing a diverse variety of documents and files. These pre-designed formats and layouts can be utilized for various individual and professional tasks, including resumes, invites, flyers, newsletters, reports, discussions, and more, enhancing the content development process.

Built In Gains Tax Calculation Worksheet

Sale of a Partnership Interest

1120S - Entering Built-In Gains

The best 10 excel tax spreadsheet templates for 2022 | WPS Office Academy

1120 - Calculating Book Income, Schedule M-1 and M-3 (K1, M1, M3)

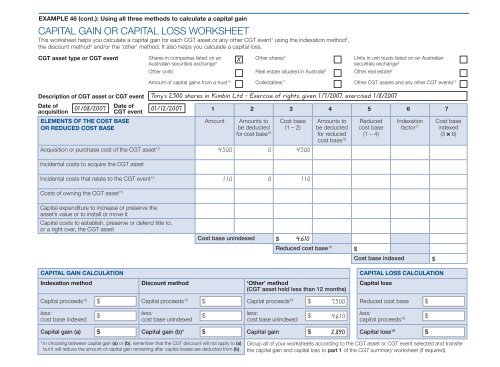

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet – Marotta On Money

Reporting publicly traded partnership Sec. 751 ordinary income and other challenges

https://www.irs.gov/instructions/i1120ssd

Instead figure the amount of net unrealized built in gain separately for each group of assets The built in gains tax is treated as a loss

https://www.esoppartners.com/blog/built-in-gains-tax

To calculate built in gains tax determine fair market value FMV of corporate assets such as real estate or equipment Next determine the

https://cs.thomsonreuters.com/ua/ut/cs_us_en/cus/faq/calculate-built-in-gain-tax.htm

The built in gain tax is calculated on the Built In Gains Tax Worksheet UltraTax CS prints this worksheet when there is data entered in any of the following

https://kb.drakesoftware.com/Site/Browse/13588/1120S-Entering-BuiltIn-Gains

To begin entering info for built In gains go to the Assets Sales Recapture tab select the D2 screen and locate the Part III Built In Gains Tax section

https://www.thetaxadviser.com/issues/2020/dec/built-in-gains-tax.html

The BIG tax is imposed at the highest corporate rate as specified in Sec 11 b Sec 1374 b 1 which is 21 and is triggered by the

In this session I discuss the built in gain gaims for S corporations Accounting students or CPA Capital gain calculation can be intimidating Luckily H R Block tax pros know how to calculate capital gains tax and get you the refund you deserve this

Internal Revenue Service 1980 Hazard Mitigation Grant Program Desk Reference FEMA 345 Federal Page 4 Built In Gains Tax Calculation Worksheet built in