Capital Gains Tax Worksheet The first step in how to calculate long term capital gains tax is generally to find the difference between what you paid for your asset or property and how

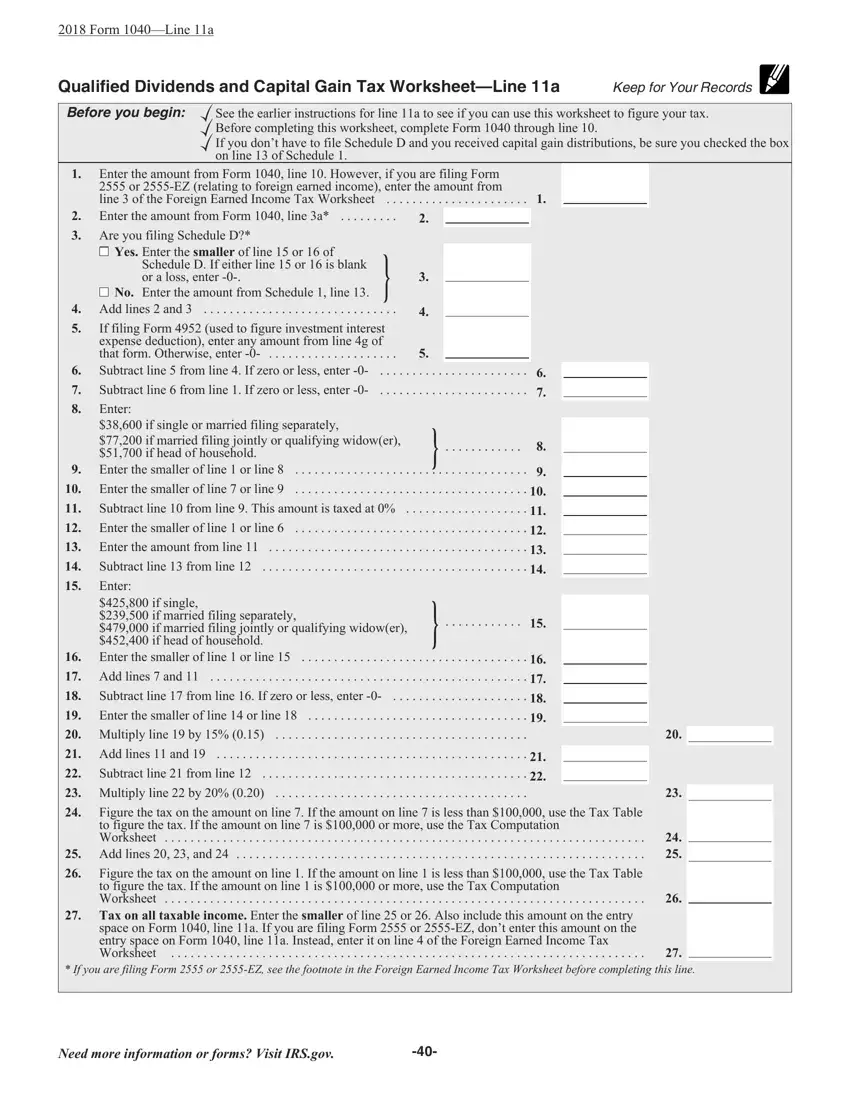

IRS Form 8949 is used to report capital gains and losses from investments for tax filing The form includes Part I and Part II to separate short term capital Gains and Losses according to the IRS the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet

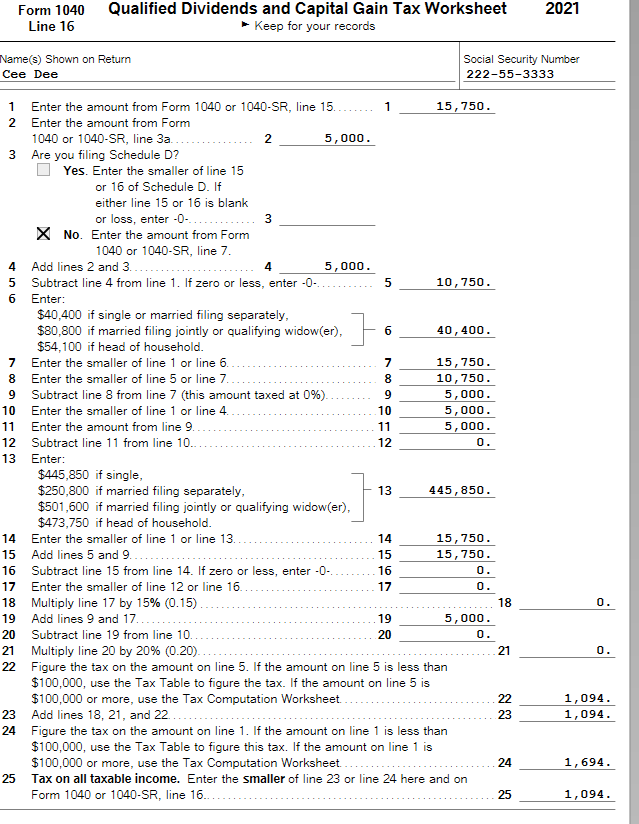

Capital Gains Tax Worksheet

Capital Gains Tax Worksheet

Capital Gains Tax Worksheet

http://www.marottaonmoney.com/wp-content/uploads/2017/05/line44.jpg

Capital Gain Worksheet Sale of Depreciable Real Estate Calculation of Adjusted Basis Purchase price Total Capital Gains Tax lines 12 13 14

Templates are pre-designed files or files that can be used for various purposes. They can save effort and time by offering a ready-made format and design for developing various sort of content. Templates can be used for personal or expert jobs, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Capital Gains Tax Worksheet

Qualified Dividends Tax Worksheet PDF Form - FormsPal

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet – Marotta On Money

Qualified Dividends Form - Fill Out and Sign Printable PDF Template | signNow

SOLUTION: Qualified Dividends and Capital Gain Tax Worksheet - Studypool

Irs capital gains worksheet 2011 form: Fill out & sign online | DocHub

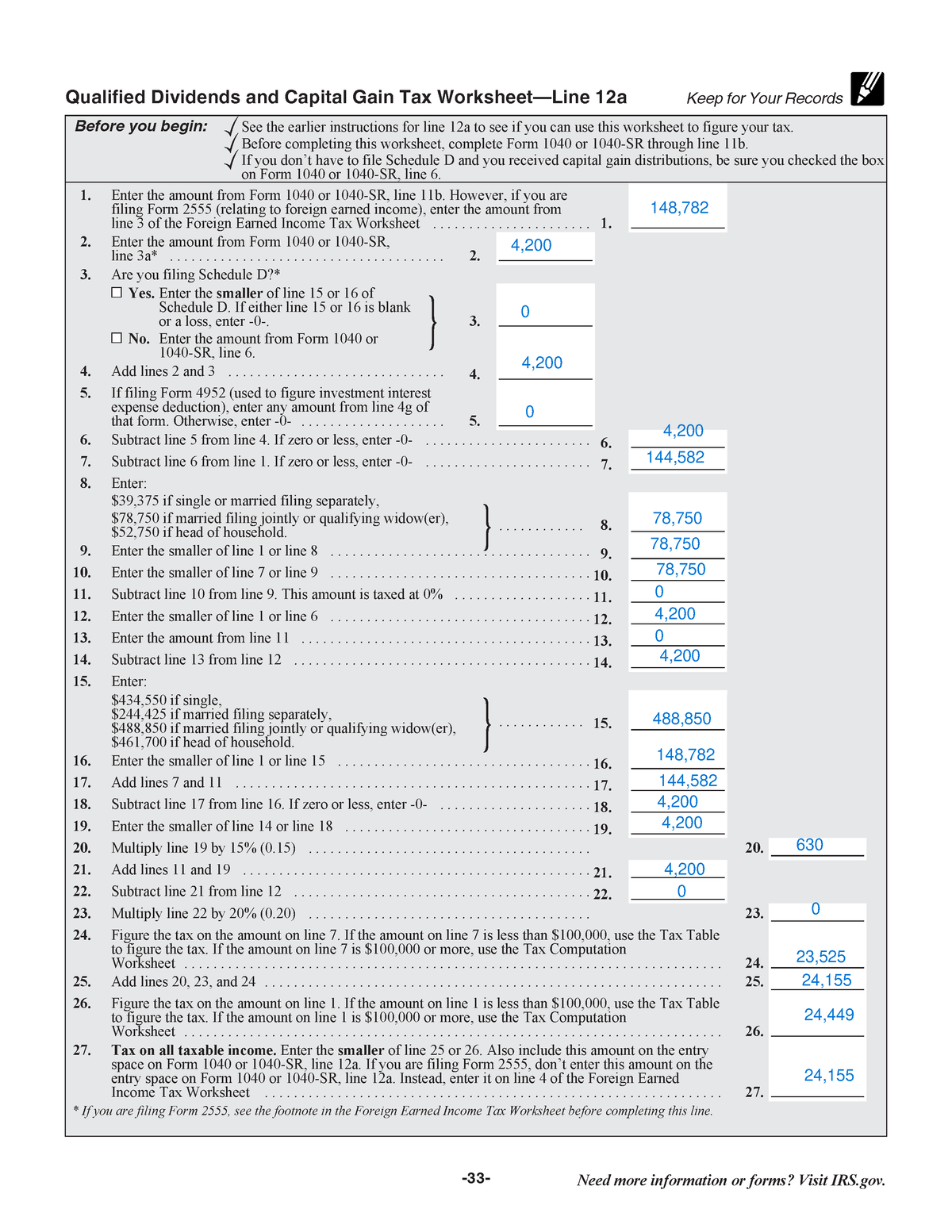

Qualified Dividends and Capital Gains Worksheet - Page 33 of 108 Fileid: - Studocu

https://www.irs.gov/pub/irs-pdf/f1040sd.pdf

Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 16 Don t complete lines 21 and 22 below No Complete

https://www.nar.realtor/magazine/tools/client-education/handouts-for-sellers/worksheet-calculate-capital-gains

Download DOC When you sell a stock you owe taxes on the difference between what you paid for the stock and how much you got for the sale

https://pdfliner.com/qualified-dividends-and-capital-gain-tax-worksheet

This printable PDF blank is a part of the 1040 guide you on your way brochure s Tax and Credits section It is used only if you have dividend income or long

https://turbotax.intuit.com/tax-tips/investments-and-taxes/guide-to-schedule-d-capital-gains-and-losses/L1bKWgPea

The Schedule D form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the

https://www.bankrate.com/investing/schedule-d-reporting-your-capital-gains-or-losses/

Schedule D is an IRS tax form that reports your realized gains and losses from capital assets that is investments and other business interests

Why is form 1040 line 16 calculating tax using the Qualified Dividends Capital Gain worksheet instead of the tax tables in ATX According to the IRS Form Before completing this worksheet complete Form 1040 or 1040 SR through line 15 If you don t have to file Schedule D and you received capital gain

Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 16 Don t complete lines 21 and 22 below No Complete