Capital Gains Worksheet 2022 Capital Gain Tax Work sheet or the Schedule D Tax Worksheet whichever applies to figure your tax See the instructions for line 16 for

These worksheets take you through calculations of your various types of income and figure the appropriate taxation level for each Before you Follow this simple instruction to redact 2022 Instructions for Schedule D 2022 Instructions for Schedule D Capital Gains and Losses in PDF format online free

Capital Gains Worksheet 2022

Capital Gains Worksheet 2022

Capital Gains Worksheet 2022

http://www.marottaonmoney.com/wp-content/uploads/2017/05/line44.jpg

WebIf you are required to use this worksheet to figure the tax on an amount from another form or worksheet such as the Qualified Dividends and

Pre-crafted templates use a time-saving service for creating a varied series of files and files. These pre-designed formats and layouts can be used for different individual and professional projects, including resumes, invitations, flyers, newsletters, reports, discussions, and more, simplifying the content production procedure.

Capital Gains Worksheet 2022

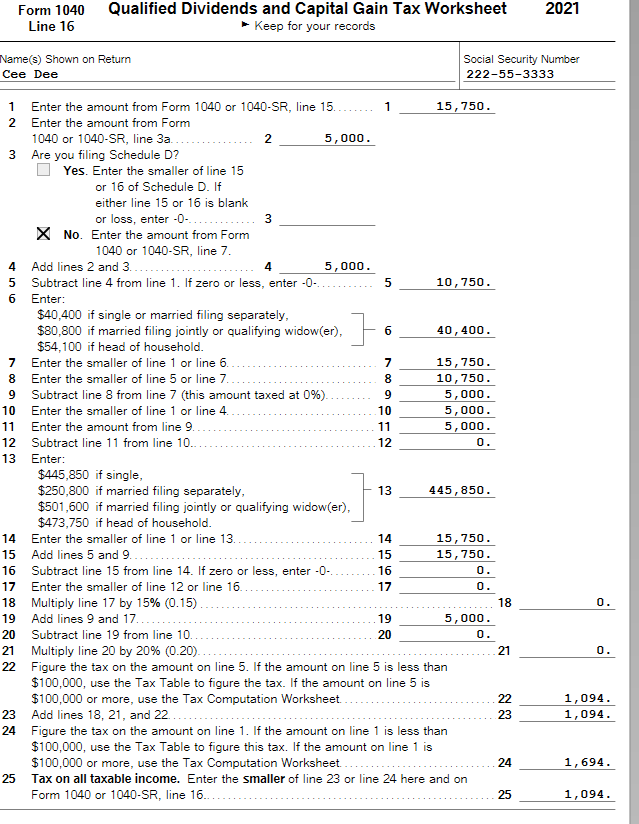

Qualified Dividends And Capital Gain Tax Worksheet 2022 Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

SOLUTION: Acc 330 qualified dividends and capital gain tax worksheet alexa thomas - Studypool

15 Printable irs tax calculator Forms and Templates - Fillable Samples in PDF, Word to Download | pdfFiller

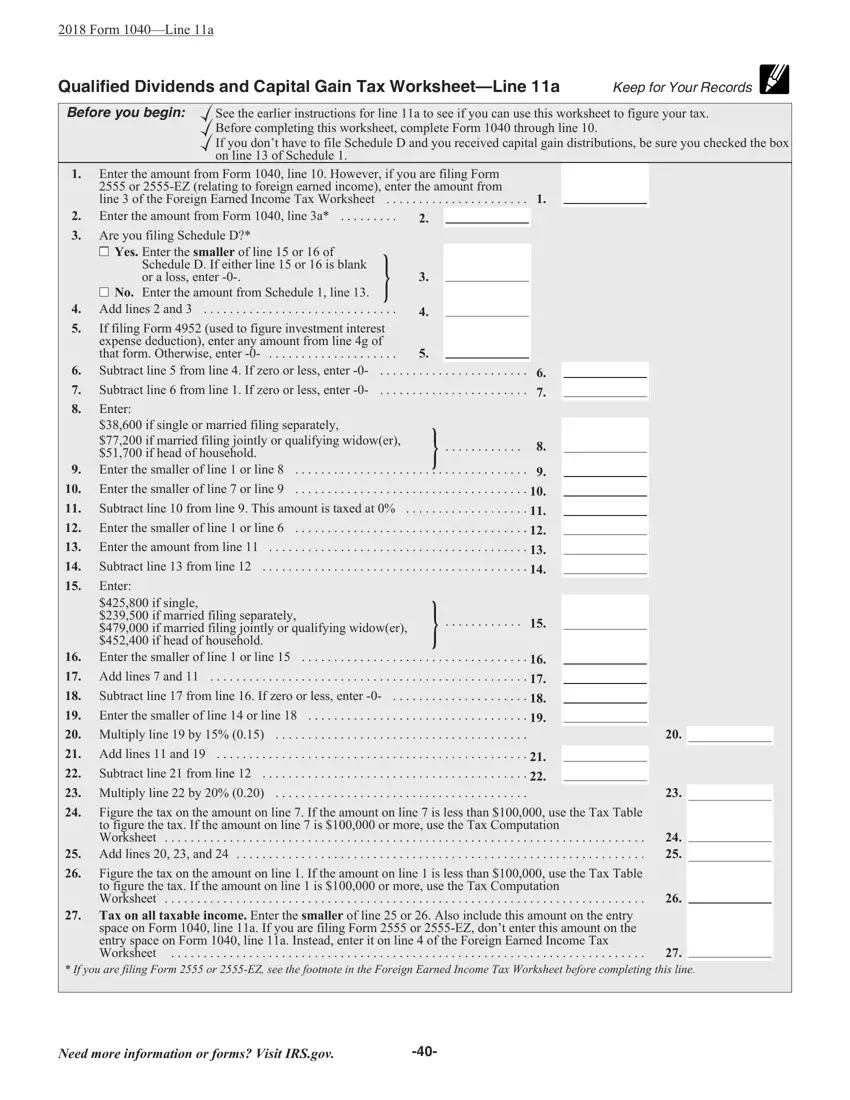

ACC 330 Qualified Dividends and Capital Gain Tax Worksheet.pdf - 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line | Course Hero

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet – Marotta On Money

Qualified Dividends And Capital Gain Tax Worksheet' - A Basic, Simple Excel Spreadsheet For The Math. - Anura Guruge

https://www.irs.gov/pub/irs-pdf/f1040sd.pdf

Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line 16 Don t complete lines 21 and 22 below No Complete

https://www.nar.realtor/magazine/tools/client-education/handouts-for-sellers/worksheet-calculate-capital-gains

Download DOC When you sell a stock you owe taxes on the difference between what you paid for the stock and how much you got for the sale

https://pdfliner.com/qualified-dividends-and-capital-gain-tax-worksheet

This printable PDF blank is a part of the 1040 guide you on your way brochure s Tax and Credits section It is used only if you have dividend income or long

https://www.taxact.com/support/1112/2022/schedule-d-viewing-tax-worksheet

Gains and Losses according to the IRS the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet

https://turbotax.intuit.com/tax-tips/investments-and-taxes/guide-to-schedule-d-capital-gains-and-losses/L1bKWgPea

Guide to Schedule D Capital Gains and Losses Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2022 June 2

Capital gains tax rate 2022 thresholds Note Gains on the sale of collectibles rental real estate income collectibles antiques works of art and stamps Tax Credits Worksheet Foreign tax credit Credit for child and dependent care capital gains and qualified dividends For this purpose taxable income is

Louisiana Revised Statute 47 293 9 a xvii provides a deduction for net capital gains resulting from the sale or exchange of an equity