Carryover Worksheet Total Withheld Pmts The carryover worksheet total withheld refers to the sum of taxes or other deductions withheld from an individual s income in a previous period and carried

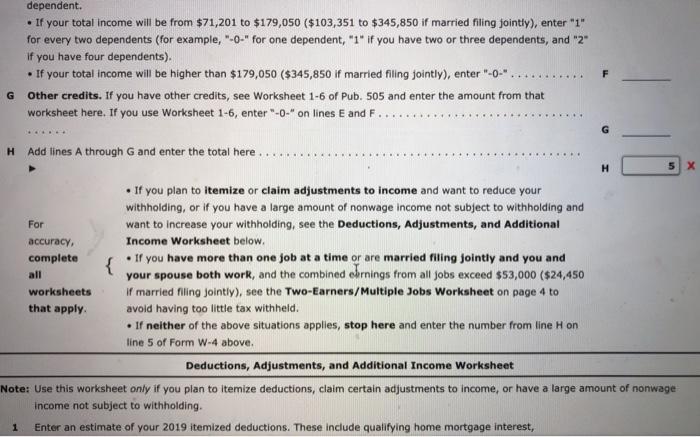

The discussion of salaries and wages includes an explanation of how to complete Form W 4 This chapter also covers backup withholding on interest dividends carryover wks will be highlighted in the list of forms Total withheld pmts must be entered Turbotax fills it out for you based on your 2019 return

Carryover Worksheet Total Withheld Pmts

Carryover Worksheet Total Withheld Pmts

Carryover Worksheet Total Withheld Pmts

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/9eddf0b3-f83f-44c2-aa9f-72207ed74c64.default.png

Short term capital loss carryover Enter the amount if any from line 8 of your Capital Loss Carryover Worksheet in the instructions 6 7

Pre-crafted templates offer a time-saving solution for producing a diverse series of documents and files. These pre-designed formats and layouts can be utilized for numerous personal and professional tasks, consisting of resumes, invitations, flyers, newsletters, reports, discussions, and more, enhancing the content creation process.

Carryover Worksheet Total Withheld Pmts

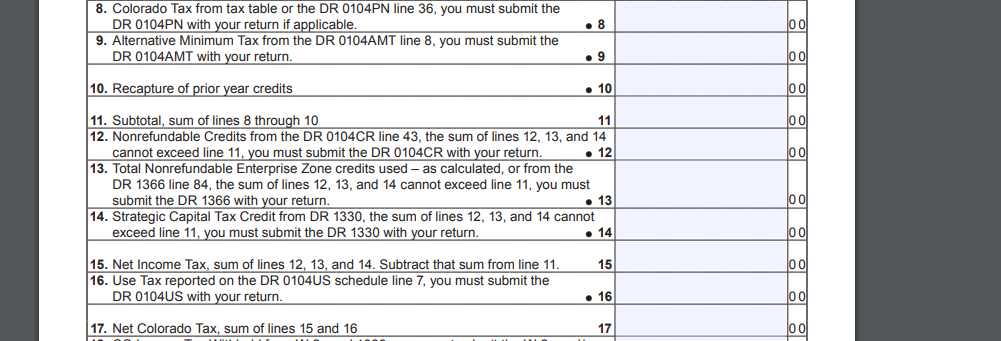

1040 - State Taxes on Wks CARRY (ScheduleA)

Federal carryover worksheet total withheld pmts

Federal carryover worksheet total withheld pmts

Publication 505 (2023), Tax Withholding and Estimated Tax | Internal Revenue Service

I need help with 5, E, and H on the W-4 form for this | Chegg.com

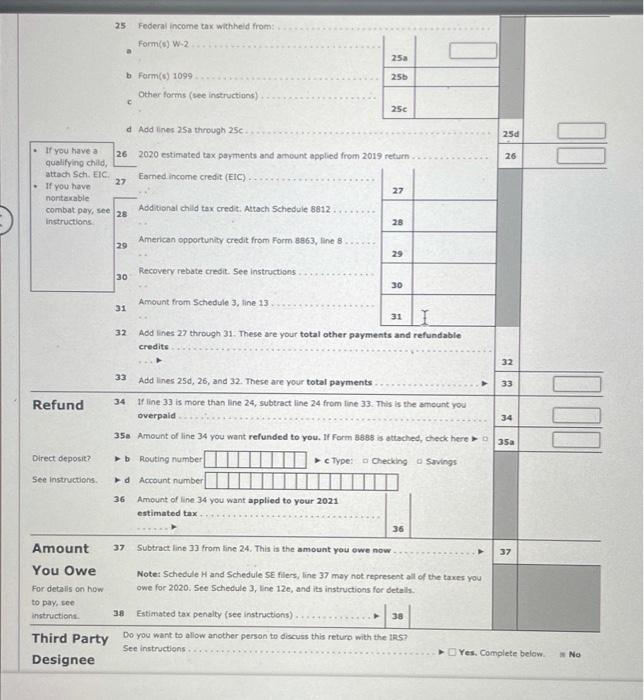

Solved Form Department of T-Series 1040 U.S. Individual | Chegg.com

https://www.reddit.com/r/IRS/comments/10mb40o/total_withheldpmts/

Carryover Worksheet Total withheld pmts must be entered from what I can tell it with forum help it s zero

https://groups.google.com/g/misc.taxes.moderated/c/IaCmKp_fCnI

D total withheld pmts 6 313 e paid with return 1 278 number is question f total over payment 1 076 e applied amount 1 076 3 The values from my 2010

https://img1.wsimg.com/blobby/go/671d8571-de15-47bb-8cd8-b624751dbe0e/downloads/kupival.pdf

What percentage of federal tax is withheld on paycheck What is carryover worksheet total withheld payments Scan this QR code to download the app now Or check

https://www1.goramblers.org/textbooks/files?trackid=koK:6427&Academia=Carryover_worksheet_total_withheld_pmts.pdf

This article delves into the art of finding the perfect eBook and explores the platforms and strategies to ensure an enriching reading

http://files.cchsfs.com/doc/atx/2016/Help/Content/Both-SSource/Tax%20Summary%20Carryover%20Worksheet.htm

The Tax Summary Carryover worksheet is a two part worksheet that can be added to a return via the Forms menu The Tax Summary gives you an at a glance view of

total Capital Loss Carryover Worksheet Lines 6 and 14 Use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your Income on Line 8 of the federal Worksheet for NOL Carryover found Enter the total on Lines 1a or 2a of the UT Worksheet to calculate the

Total withheld pmts must be entered to report a capital loss carryover from 2021 to 2022 Turbotax fills it out for you based on your 2019 return