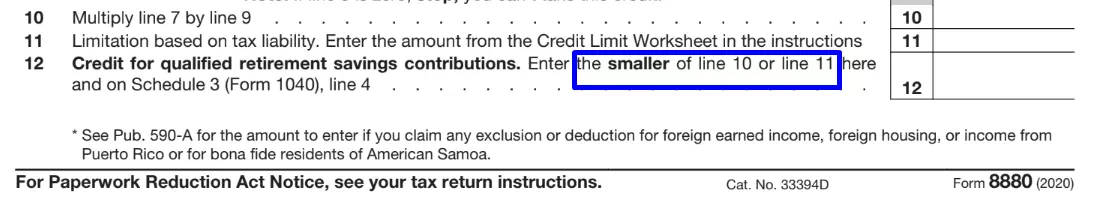

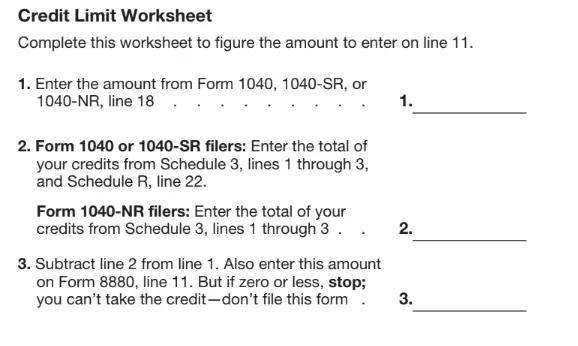

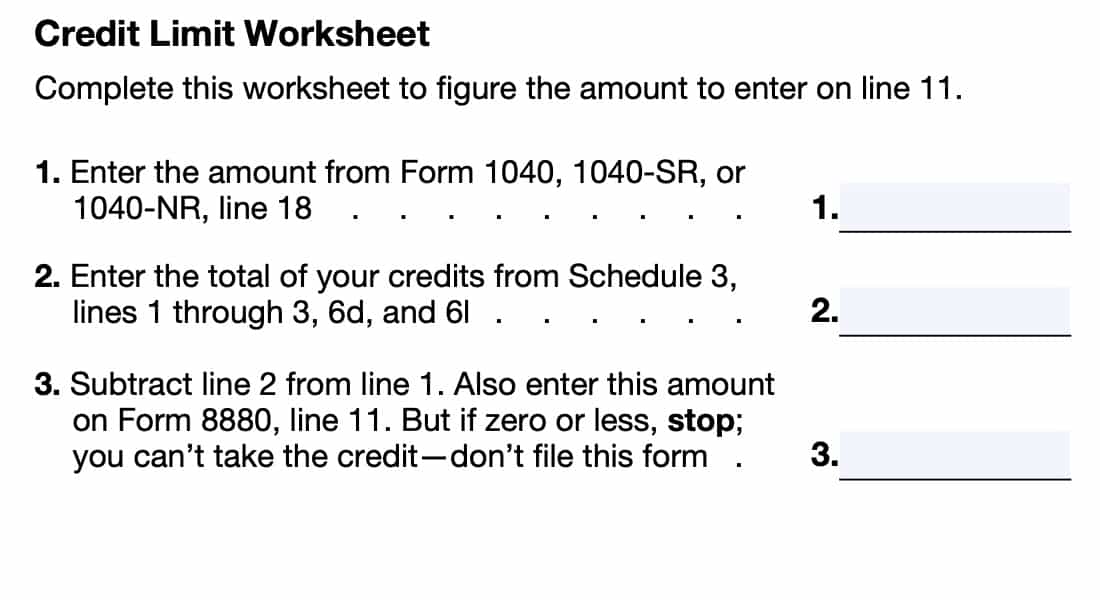

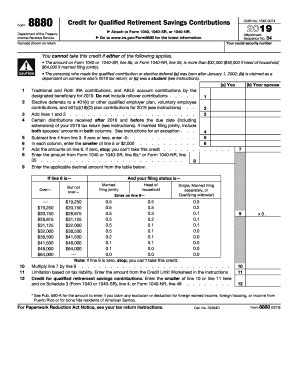

Credit Limit Worksheet Form 8880 There is a separate Credit Limit Worksheet in the form instructions that you use for line 11 6 Include Form 8880 With Your Tax Return Make sure to include

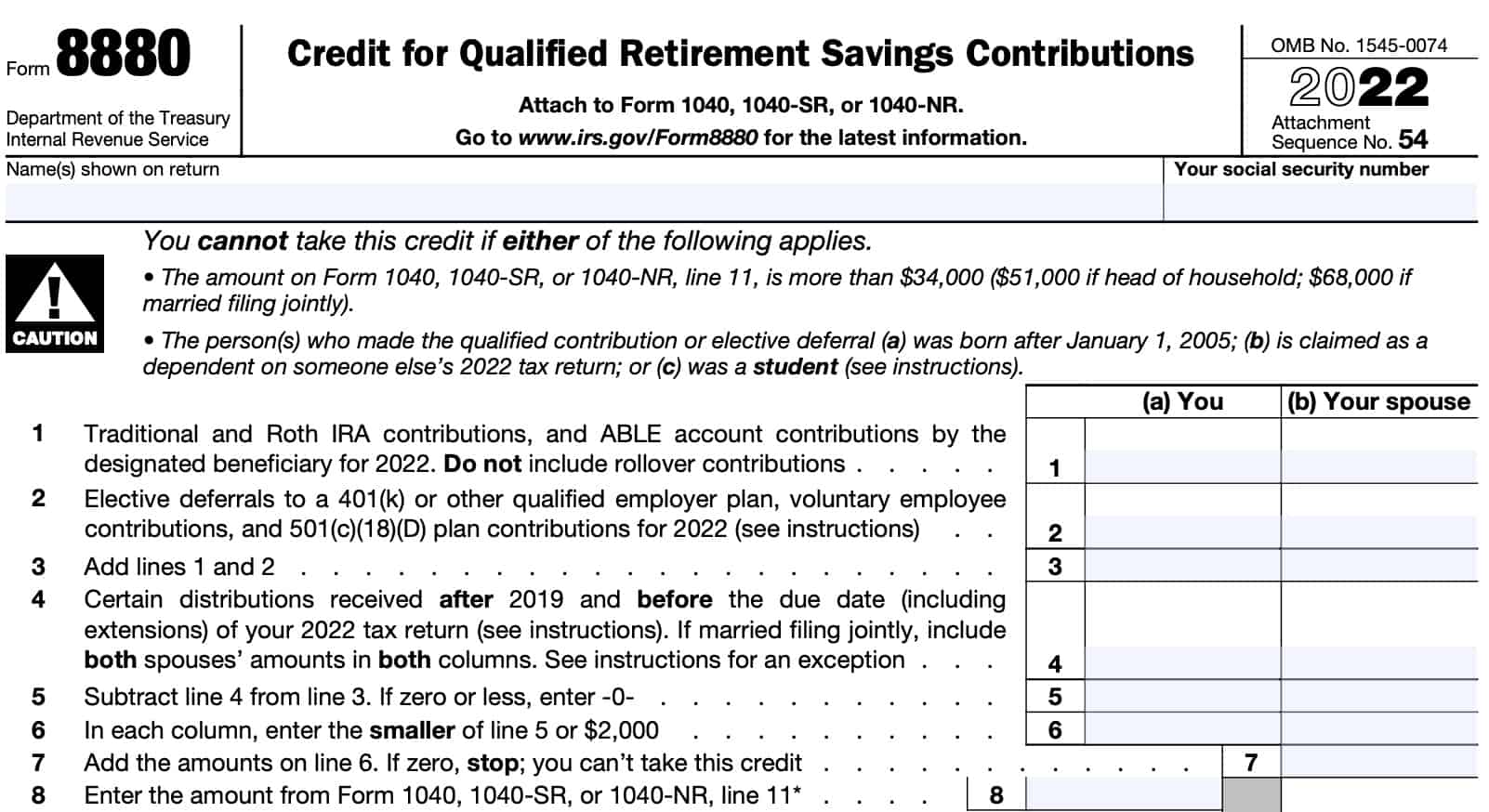

What are the income limits for the Saver s Credit Single married filing separately and qualifying surviving spouse up to 32 500 Head of The credit is equal to 50 20 or 10 of your retirement plan contributions The amount is dependent on your Adjusted Gross Income The maximum credit amount

Credit Limit Worksheet Form 8880

Credit Limit Worksheet Form 8880

Credit Limit Worksheet Form 8880

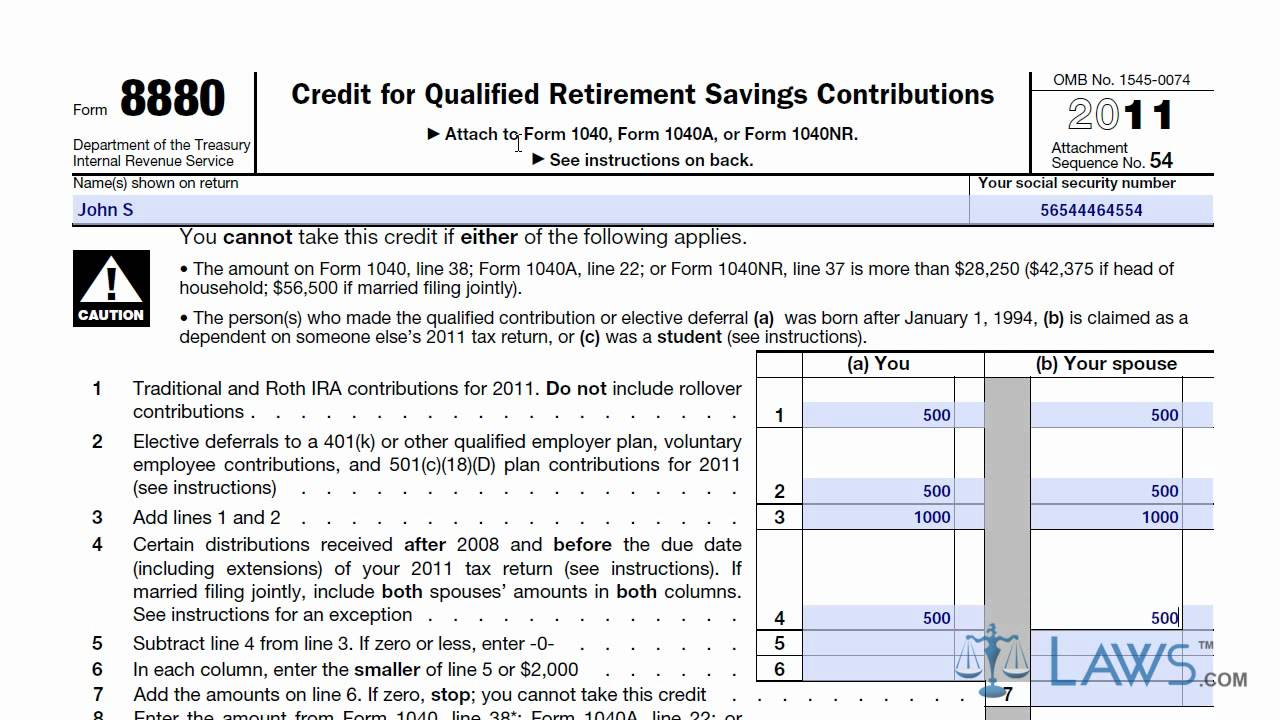

https://i.ytimg.com/vi/0F57RclHTYE/maxresdefault.jpg

Visit http legal forms laws tax form 8880 To download the Form 8880 in printable

Templates are pre-designed files or files that can be utilized for various functions. They can conserve effort and time by offering a ready-made format and layout for developing different sort of content. Templates can be used for individual or expert tasks, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Credit Limit Worksheet Form 8880

IRS Form 8880 ≡ Fill Out Printable PDF Forms Online

IRS Form 8880 Instructions - Retirement Savings Tax Credit

IRS Form 8880 - Credit for Qualified Retirement Savings Contributions - Form 8880 Department of the Treasury Internal Revenue Service Credit for | Course Hero

8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms Online

8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms Online

Don't Miss These Tax Credits if You Want the Biggest Possible Tax Refund - CNET

https://www.irs.gov/forms-pubs/about-form-8880

Use Form 8880 to figure the amount if any of your retirement savings contributions credit also known as the saver s credit Current

https://www.esmarttax.com/tax-forms/federal-form-8880-instructions/

Use Form 8880 to figure the amount if any of your retirement savings contributions credit also known as the saver s credit TIP This credit can be claimed

https://www.investopedia.com/irs-form-8880-credit-for-qualified-retirement-savings-contributions-5114767

IRS Form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan Eligible plans to which you can

https://turbotax.intuit.com/tax-tips/investments-and-taxes/what-is-the-irs-form-8880/L0mePsZju

Your Form 8880 will guide you through a calculation to determine the maximum credit amount you are eligible to claim The size of your tax

https://www.reginfo.gov/public/do/DownloadDocument?objectID=85804501

Enter the amount from the Credit Limit Worksheet in the instructions Also enter this amount on Form 8880 line 11 But if zero or less stop you

The Credit Limit Worksheet of Form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to Information about Form 8880 and its instructions is at www irs gov form8880 OMB Enter the amount from the Credit Limit Worksheet in the instructions

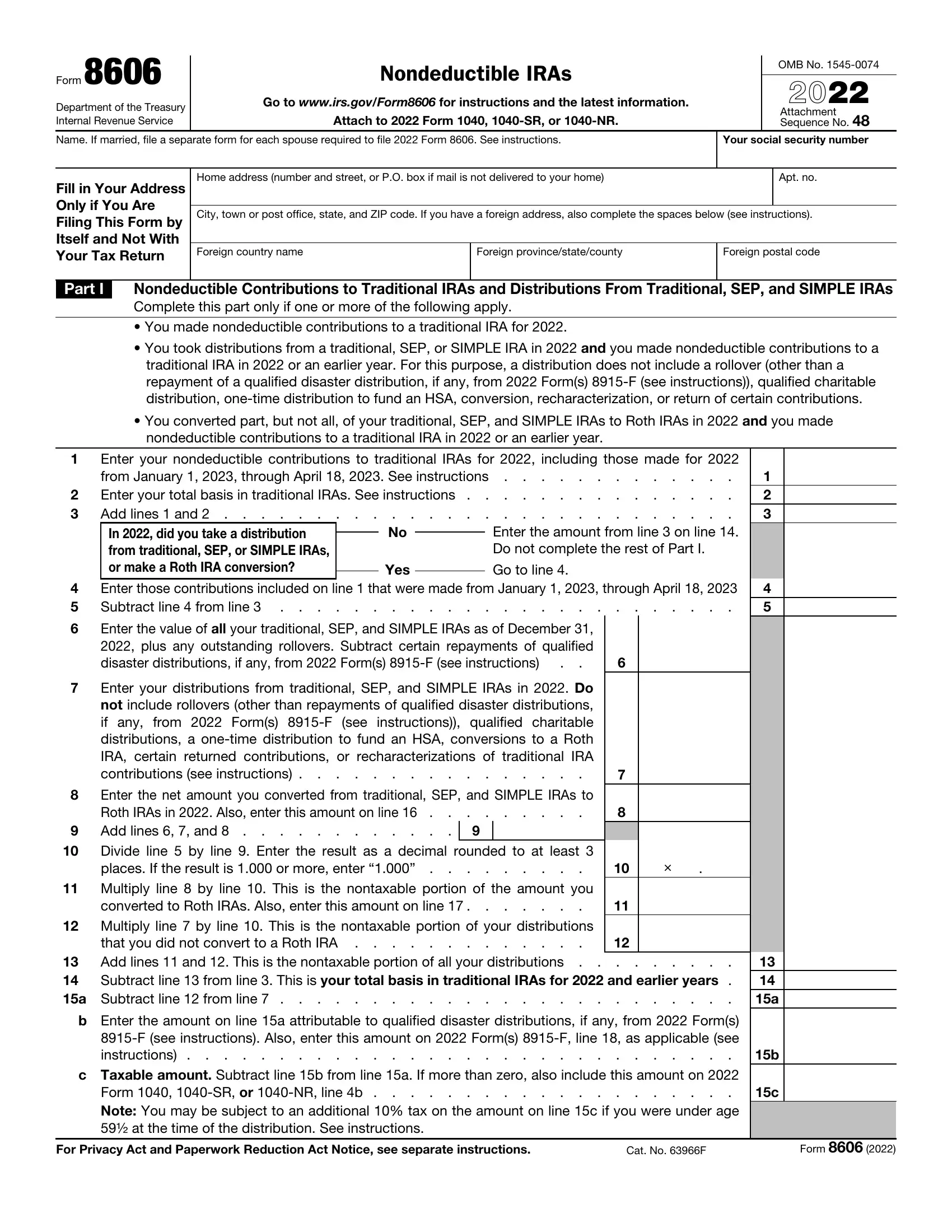

The Internal Revenue Service allows certain taxpayers who contribute to qualified retirement accounts to claim a tax credit on their income