Dcaa Indirect Cost Rate Worksheet Even if DCAA has not reviewed your indirect rates Provide your company s financial statement showing the direct and indirect costs and indirect rate

Indirect Rates Overhead Rates Wrap Rate Multipliers whatever you call it this is the Overhead Rates Total Pool Expenses Base 87 21 92 16 80 78 80 56 82 85 Use the Cost Reimbursable Template Sheet 3 FY 1999 FY 2001 4 5 If you

Dcaa Indirect Cost Rate Worksheet

Dcaa Indirect Cost Rate Worksheet

x-raw-image:///3c1269b4d2f483e5a07d4f3b4986155064e6687d34c730844af1041aca3721ad

Federal Government Contractor Guidance Calculating an Indirect Cost Rate Direct costs are materials labor and other costs incurred for a contract

Templates are pre-designed documents or files that can be utilized for different functions. They can save effort and time by supplying a ready-made format and layout for creating various sort of content. Templates can be used for individual or expert jobs, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Dcaa Indirect Cost Rate Worksheet

INCURRED COST ELECTRONICALLY (ICE) MANUAL

What is an Incurred Cost Proposal

Incurred Cost Submissions

Incurred Cost Submissions

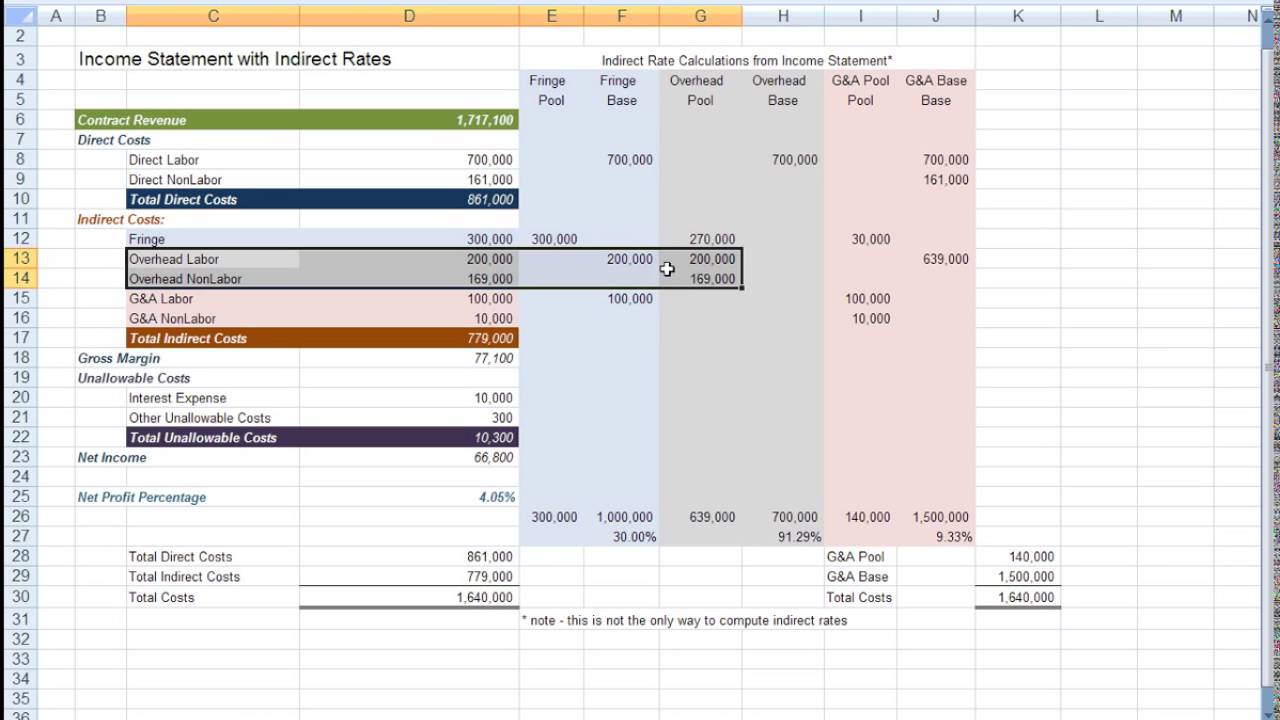

DCAA GovCon Indirect Rate Calculations DCAA compliant - YouTube

Welcome to Developing DCAA-Compliant Indirect Rates

https://www.dcaa.mil/Portals/88/Documents/Guidance/Audit%20Overview/g_Incurred_Cost_Submissions_2018-10-01%20(Releasable).pdf?ver=2019-10-10-153946-443

Cumulative Allowable Cost Worksheet Schedule J Subcontract Information Schedule indirect rate proposals incurred cost proposals Two levels of penalties

https://www.dcaaconsulting.com/indirect-cost-rates/

I am often asked about indirect costs and how to calculate indirect cost rates that are DCAA compliant or compliant with FAR 31 2 Indirect costs is a highly

https://www.govconaccountants.com/step-9-indirect-rate-calcultions

We provide a sample excel template that you can utilize to compute your indirect rates and allocate indirect costs to your contracts The Profit by Job No

https://www.dcma.mil/Portals/31/Documents/Policy/MAN_2201-03r_(Rewrite)_(20211220).pdf

Allowable cost worksheet the ACO must contact DCAA to request the missing documents If the ACO cannot retrieve the requested FICR

https://warrenaverett.com/insights/dcaa-compliant-indirect-rate-calculation/

As evident in the formula the indirect rate is the result of dividing the indirect cost pool by the allocation base As with any such equation

Fill Dcaa Indirect Cost Rate Worksheet Edit online Sign fax and printable from PC iPad tablet or mobile with pdfFiller Instantly Try Now If the rates are audit determined DHS relies on the indirect cost rates established by DCAA unless the DHS and DCAA mutually agree that another agency will be

The indirect rate is calculated by taking the cost pool balance and dividing it by the allocation base This calculation shows you how much of