Home Cost Basis Worksheet In real estate the cost basis is the original value that a buyer pays for their property Read our article to learn about cost basis and how to calculate

All of these permanent improvements can be used to increase the tax basis of your home which means that your capital gains upon selling the home will be Free Download this Real Estate Cost Basis Worksheet Template Design in Word Google Docs Excel Google Sheets Apple Numbers Format Easily Editable Printable

Home Cost Basis Worksheet

Home Cost Basis Worksheet

Home Cost Basis Worksheet

https://149347908.v2.pressablecdn.com/wp-content/uploads/2013/02/calculating-cost-basis.png

Please use this worksheet to give us your rental income and expenses for preparation of your tax returns Please download open in Adobe complete and securely

Templates are pre-designed files or files that can be used for various functions. They can conserve time and effort by supplying a ready-made format and design for developing various sort of material. Templates can be utilized for personal or professional projects, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Home Cost Basis Worksheet

Why It's Important to Keep Track of Improvements to Your House - Merriman Wealth Management

Sale of Primary Residence – How to Enter into ProSeries

Desktop: Excluding the Sale of Main Home (Form 1099-S) – Support

Basics of Basis NATP Book Preview

Adjusted Basis Of Home Sold Worksheet - Fill and Sign Printable Template Online

1031 Exchange - Overview and Analysis Tool (Updated Apr 2022) - Adventures in CRE

https://www.irs.gov/faqs/capital-gains-losses-and-sale-of-home/property-basis-sale-of-home-etc/property-basis-sale-of-home-etc-3

The amount you realize on the sale of your home and the adjusted basis of your home are important in determining whether you re subject to

https://subset.so/blog/real-estate-cost-basis-spreadsheet

You can use this free Real Estate Cost Basis Spreadsheet template to help you calculate and track your cost basis over time How to Calculate

https://img1.wsimg.com/blobby/go/be7650a5-e955-4f55-af32-ada841445d8f/downloads/1d2da4e0p_688062.pdf?ver=1610657578222

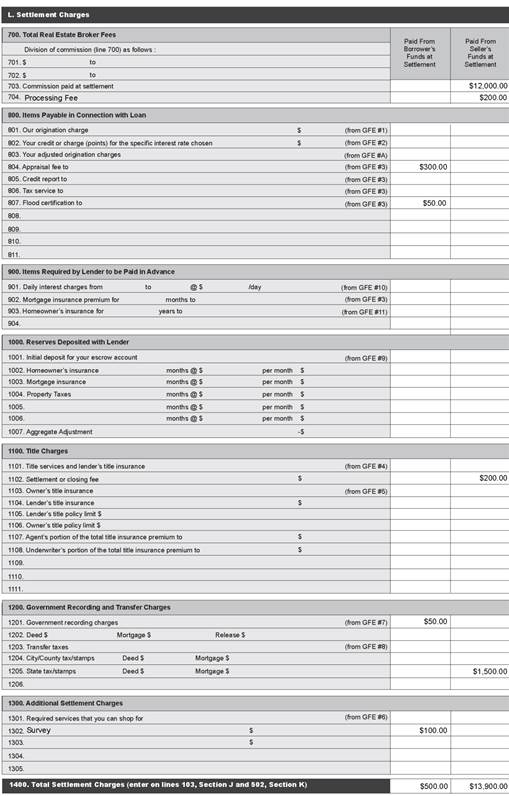

CALCUALTING THE COST BASIS OF PROPERTY Home Land or Other Property Amount Purchase Price Date of Purchase Additional Costs Paid Towards Purchase

https://cotaxaide.org/tools/Home%20Sale%20Worksheet.html

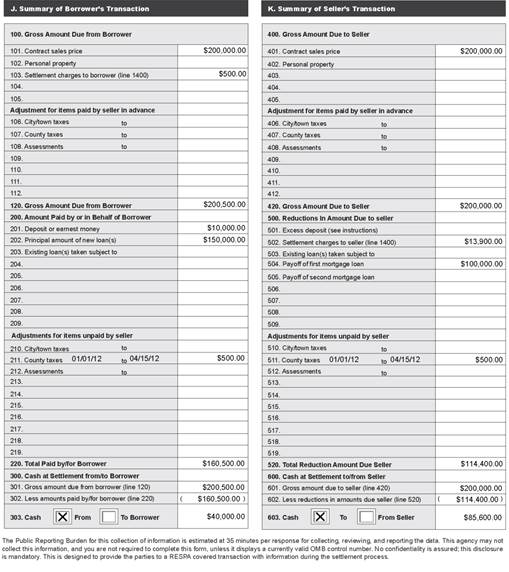

From home improvements tab Adjusted basis after spouse died Fair Market Value when spouse died HOME COST BASIS NOW Home

https://www.costbasis.com/personalresidence.html

Your cost basis is increased by the costs you incurred directly related to purchasing the home such as attorney fees title insurance stamp taxes transfer

Cost basis in real estate can have a big impact on your tax obligations If you re buying property understanding your cost basis ahead of Did you sell property over the past tax year Find out from the experts at H R Block how to calculate cost basis for your real estate

The seller s initial basis in the property is the property s cost plus taxes freight charges and installation fees In determining the capital gain the