Deduction For Rent Paid For Self Employed This is the maximum insurable earnings on which the employer and employee are required to pay EI premiums for in a year for their employment with that employer Rate This is a fixed

You can start change or stop a federal or provincial voluntary tax deduction at any time in MSCA Select quot Profile quot on your OAS dashboard then select Manage voluntary income tax Information on when and how to remit report a nil remittance confirm your remittance was received and correct remitting errors or misallocated payments

Deduction For Rent Paid For Self Employed

Deduction For Rent Paid For Self Employed

Deduction For Rent Paid For Self Employed

https://i.ytimg.com/vi/w_4TmMykeNA/maxresdefault.jpg

Scroll down to read the publication T4130 Employers Guide Taxable Benefits and Allowances Unless otherwise stated all legislative references are to the Income Tax Act or where

Templates are pre-designed files or files that can be utilized for various functions. They can save effort and time by supplying a ready-made format and layout for creating various kinds of content. Templates can be used for personal or expert jobs, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Deduction For Rent Paid For Self Employed

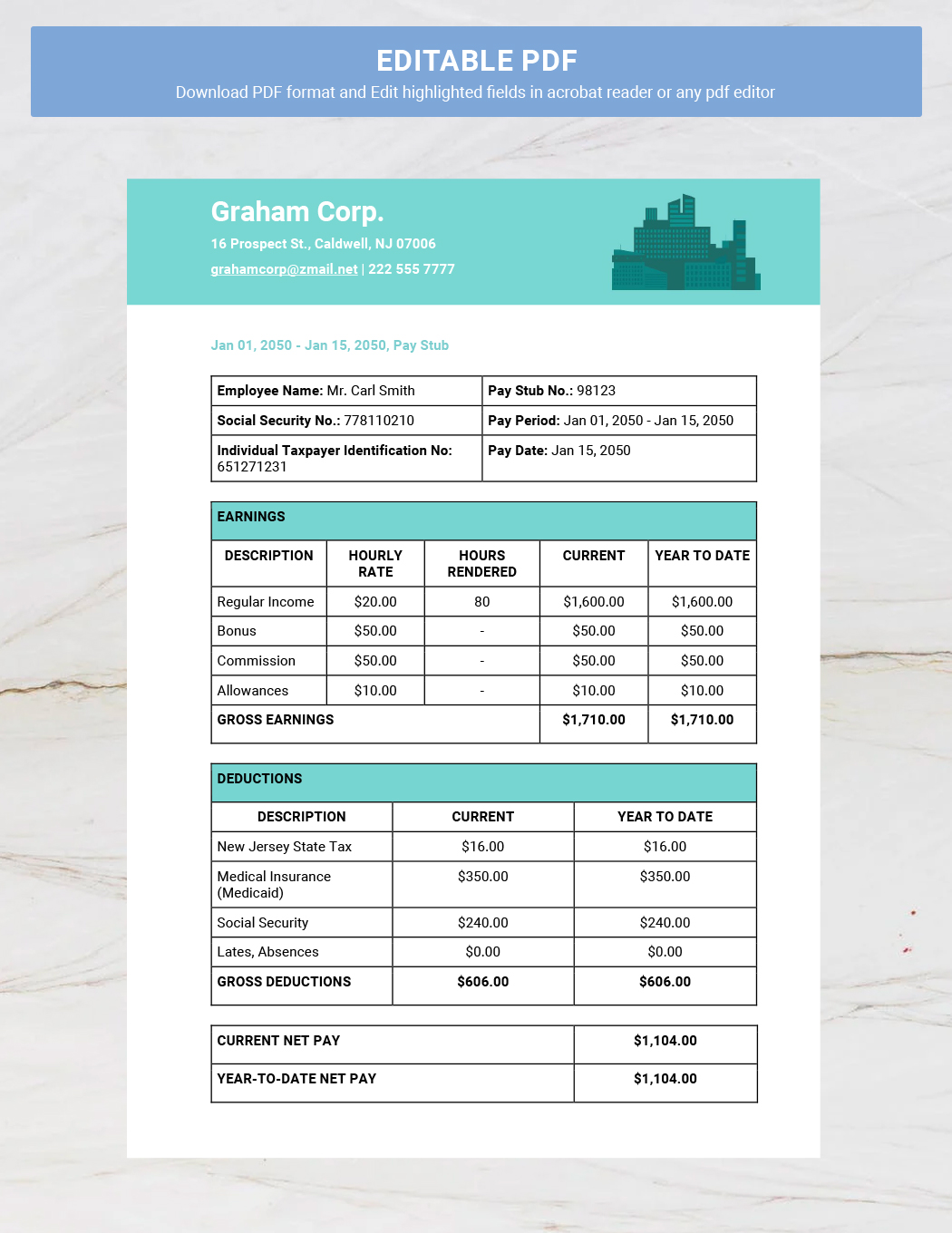

Self Employed Payslip Template Google Docs Word Template

A Bank Statement Program Loan Is An Ideal Way For Self employed

Tax Return Self Employed Grant Employment Form

New Zealand Self Employed Income Tax Calculator

Section 80GG Tax Claim Deduction For Rent Paid 2024

Self employed Tax Made Easy TaxScouts

https://www.canada.ca › en › revenue-agency › services › tax › individual…

Medical expense deductible expense deductions credits expenses child care child care expenses education education tax credits disability disability tax

https://www.canada.ca › fr › agence-revenu › services › impot › particulie…

Le formulaire T2200S D 233 claration des conditions de travail pour les d 233 penses li 233 es 224 un espace de travail 224 domicile en raison de la pand 233 mie de COVID 19 est une version simplifi 233 e du

https://www.canada.ca › en › revenue-agency › services › tax › business…

Apr 1 2023 0183 32 The weekly deductions are equal to his RPP contributions of 25 00 plus union dues deductions of 5 50 plus his deduction for living in a prescribed zone of 77 00 11 00 per day

https://www.canada.ca › fr › agence-revenu › services › impot › particulie…

D 233 couvrez quelles sont les d 233 ductions cr 233 dits et d 233 penses que vous pouvez demander pour r 233 duire le montant d imp 244 t que vous devez payer

https://www.canada.ca › en › employment-social-development › service…

Estimated net monthly payment after deduction If you receive OAS benefits you can view or update your voluntary tax deduction On your MSCA dashboard go to the Old Age Security

[desc-11] [desc-12]

[desc-13]