Employee Retention Credit 2021 Worksheet Excel ERC Worksheet 2021 was created by the IRS to assist companies in calculating the tax credits for which they are qualified The worksheet is not

Cray Kaiser has created Employee Retention Credit ERC templates to assist businesses in applying for ERC credit 2021 and the American Rescue Plan Act of Take your time and see how the employee retention tax credit works because there are different guidelines for 2020 and 2021 to file for the credit It might be

Employee Retention Credit 2021 Worksheet Excel

Employee Retention Credit 2021 Worksheet Excel

Employee Retention Credit 2021 Worksheet Excel

https://msofficegeek.com/wp-content/uploads/2022/01/2021-Quarter-1-ERC-Calculator.png

Original Legislation from March 2020 The ERC is a refundable payroll tax credit of up to 5 000 per employee Qualification Factor The ERC is available to

Pre-crafted templates offer a time-saving solution for creating a diverse series of documents and files. These pre-designed formats and layouts can be made use of for different personal and expert tasks, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, streamlining the material creation process.

Employee Retention Credit 2021 Worksheet Excel

.jpg)

Form 941 Worksheet 2 for Q2 2021 | New Worksheet for 2nd quarter

Ready-To-Use Employee Retention Credit Calculator 2021 - MSOfficeGeek

ERTC and PPP Update 2021 | RestaurantOwner

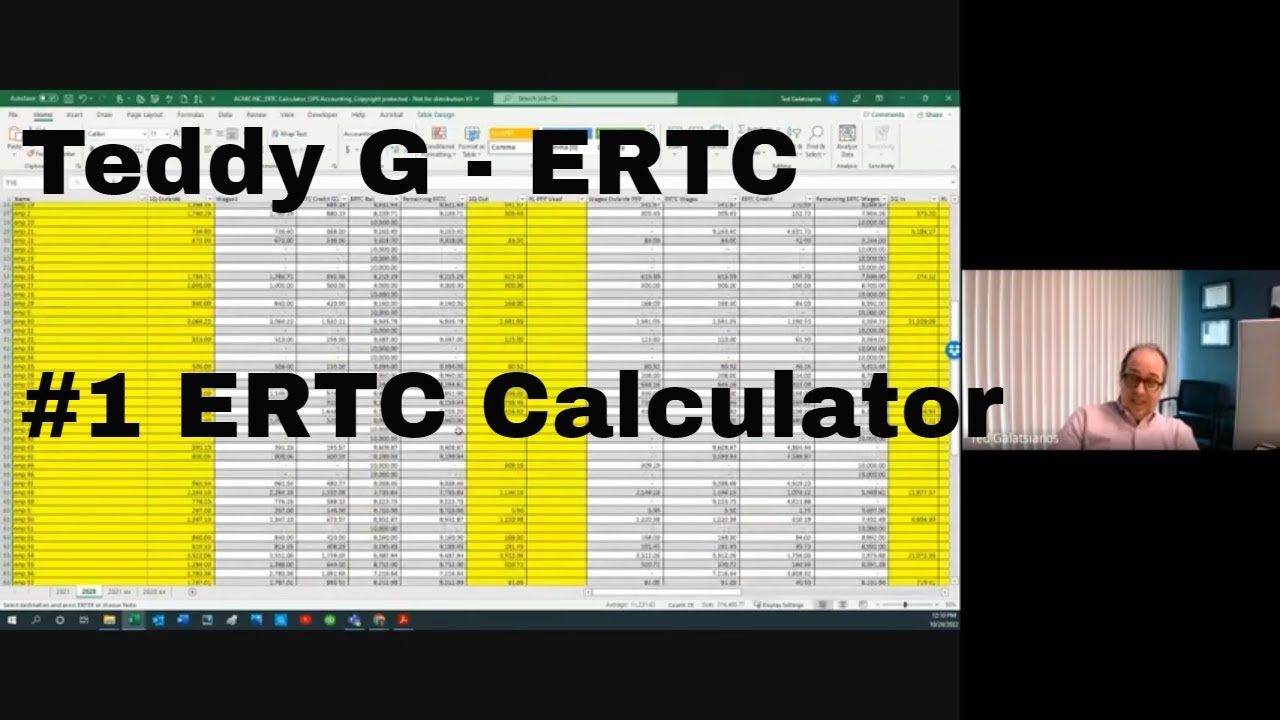

ERTC Calculator & Calculation Spreadsheet for the Employee Retention Credit with PPP Coordination - YouTube

IRS Form 941 worksheets | In-built worksheet at TaxBandits

A Guide to Understand Employee Retention Credit Calculation Spreadsheet 2021 | DisasterLoanAdvisors.com

https://www.youtube.com/watch?v=L_2Ik-YFiBc

The 1 ERTC Calculator and Calculation Spreadsheet on the market today Calculate the

https://www.youtube.com/watch?v=8KTECqudKkw

Guide to Understand Employee Retention Credit Calculation Spreadsheet for 2021 tax year

https://pstap.org/attachments/3304.pdf

IMPORTANT Please read the following notes on the ERC spreadsheet Spreadsheet assumes 1 No qualified health plan expenses 2 No qualified sick leave nor

https://www.cainwatters.com/wp-content/uploads/2021/04/ERC-Template-Worksheet-1F.3.xlsx

This is an example of the worksheet filled in properly using payroll information 4 Practice Name 5 Employee Retention Credit Mandated

https://www.disasterloanadvisors.com/a-guide-to-understand-employee-retention-credit-calculation-spreadsheet/

This video will show you a guide to understand employee retention credit calculation spreadsheet 2021 An Ultimate Guide to Employee

Enter the refundable portion of the employee retention credit from Worksheet 2 Step 2 line 2i The employee retention credit is 70 of the qualified wages An Excel worksheet may be helpful in this as each employee must be accounted for in terms of total wages and staying within quarterly and

The Employee Retention Credit ERC is a refundable tax credit for businesses that kept employees on payroll during the COVID 19 pandemic Eligible businesses