Employee Retention Tax Credit Worksheet IMPORTANT Please read the following notes on the ERC spreadsheet Spreadsheet assumes 1 No qualified health plan expenses 2 No qualified sick leave nor

Practitioner COVID 19 Payroll Tax Credit Worksheet 2021 2 Spidell Publishing Inc Step 2 Review payroll tax returns for Employee Retention Credit ERC American businesses continue to feel the impacts of the COVID 19 pandemic as the job market

Employee Retention Tax Credit Worksheet

Employee Retention Tax Credit Worksheet

Employee Retention Tax Credit Worksheet

https://gusto.com/wp-content/uploads/2021/07/ERC-Calculation-1-1024x547.png

An Ultimate Guide to Employee Retention Credit Worksheet 2023 https www

Pre-crafted templates offer a time-saving option for developing a varied range of files and files. These pre-designed formats and designs can be utilized for numerous individual and professional projects, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, streamlining the content development procedure.

Employee Retention Tax Credit Worksheet

7-Step ERC Calculation Worksheet (Employee Retention Credit)

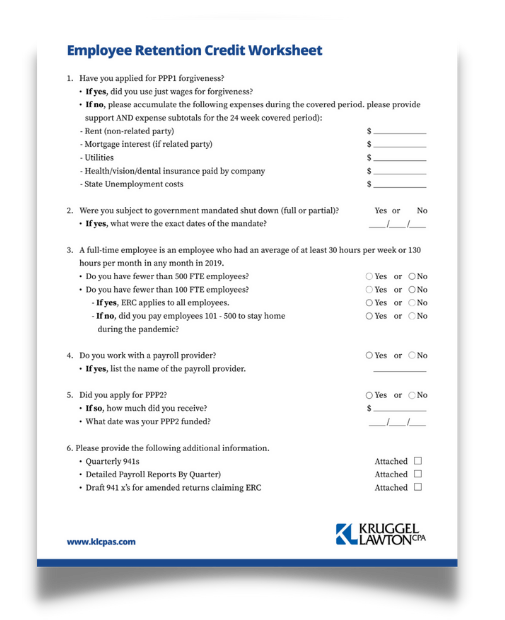

How to Unlock the Employer Retention Credit (ERC) for Your Business or Nonprofit | Kruggel Lawton CPAs

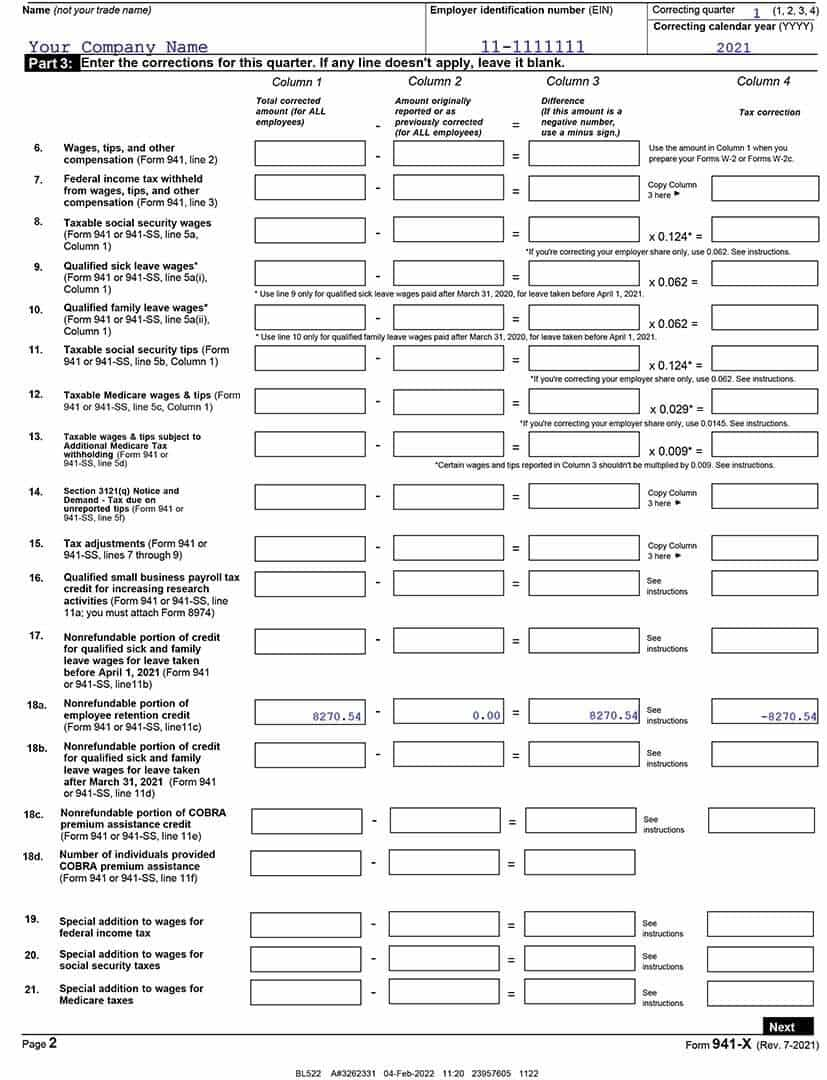

Step-by-Step How to Guide to Filing Your 941-X ERTC | Baron Payroll

12 Commonly Asked Questions on the Employee Retention Credit - Sikich LLP

Don't Forget Worksheet 1 When You File Your Form 941 this Quarter! | Blog - TaxBandits

An Ultimate Guide to Employee Retention Credit Worksheet 2021 by Employee Retention Credit (ERC) - Employee Retention Tax Credit (ERTC) - Issuu

https://www.irs.gov/instructions/i941x

tax year before the calendar quarter in which the employee retention credit is claimed You must use this worksheet if you claimed the employee retention

https://www.klcpas.com/wp-content/uploads/2021/03/Employee-Retention-Credit-Worksheet-FORM.pdf

Employee Retention Credit Worksheet 1 Have you applied for PPP1 forgiveness If yes did you use just wages for forgiveness If no please accumulate

https://erctoday.com/employee-retention-credit-worksheet/

The 7 Step Employee Retention Tax Credit Calculation Worksheet Step 1 Understand Which Quarters Qualify Step 2 Evaluate Your Eligibility

https://www.disasterloanadvisors.com/an-ultimate-guide-to-employee-retention-credit-worksheet-2021/

ERC Worksheet 2021 was created by the IRS to assist companies in calculating the tax credits for which they are qualified The worksheet is not

https://www.hostmerchantservices.com/articles/worksheet-with-essential-steps-for-employee-retention-tax-credit-calculations/

Remember the IRS created the Employee Retention Credit Worksheets to make it easier for businesses to calculate their qualifying tax credits However the IRS

Worksheet 1 was created by the IRS to assist employers in calculating the tax credits to which they are entitled Worksheet 1 is not required by For amounts paid to your employees enter the employer share of social security tax Refundable portion of employee retention credit Subtract line 3h from

You may claim the employee retention credit using Form 941 X within 3 years of the date the original Form 941 was filed or 2 years from the date