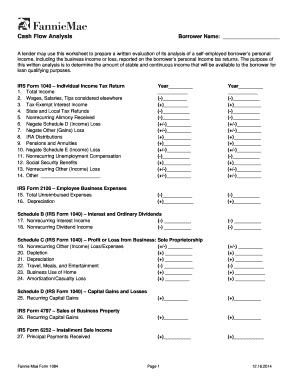

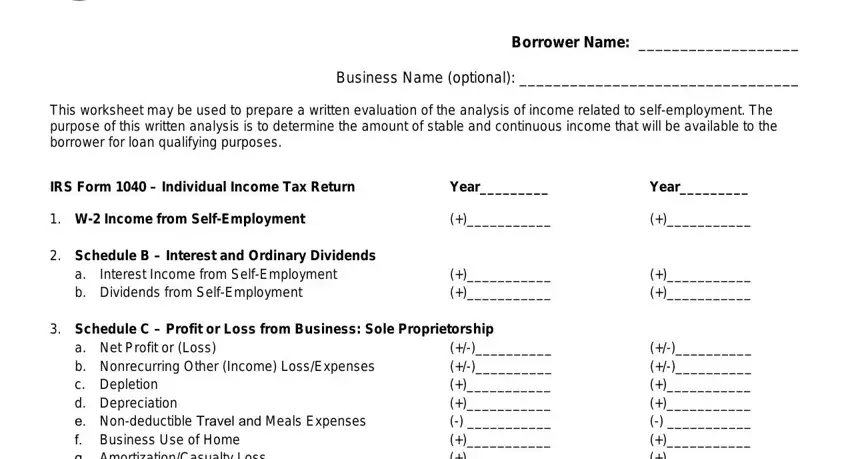

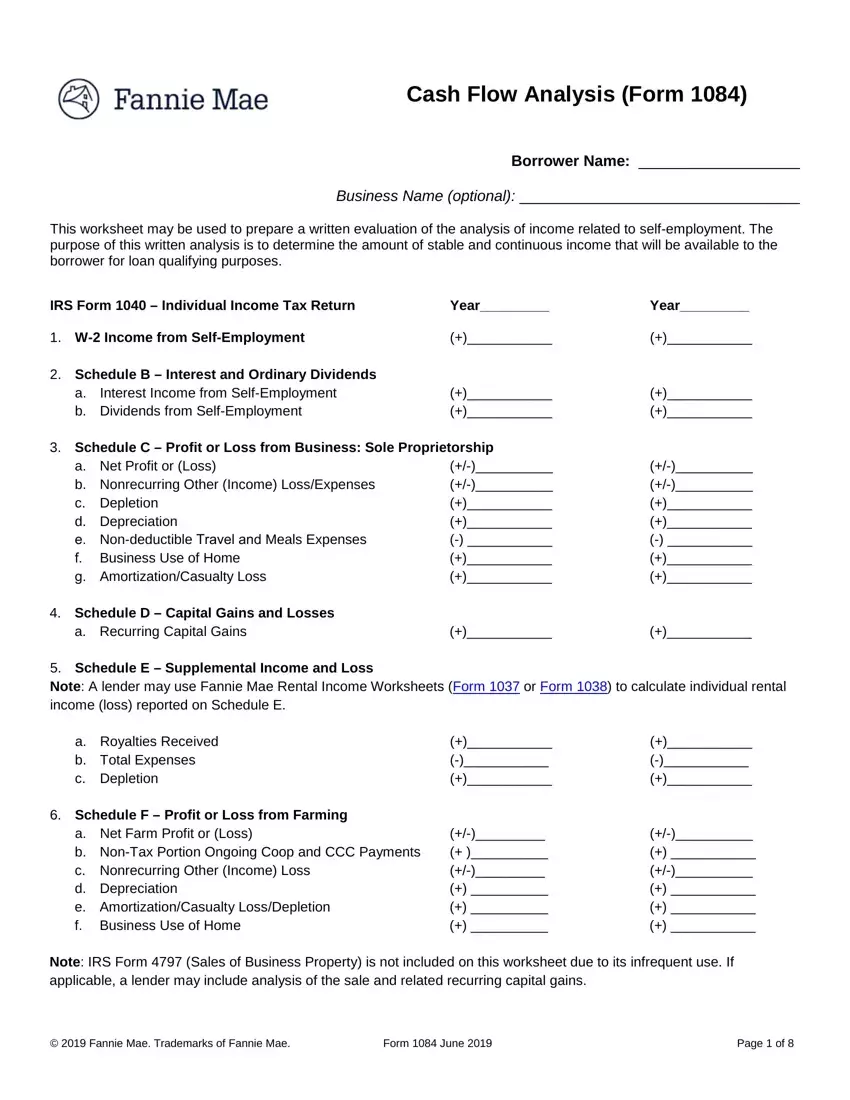

Fnma Self Employed Income Worksheet This worksheet may be used to prepare a written evaluation of the analysis of income related to self employment The purpose of this written analysis is to

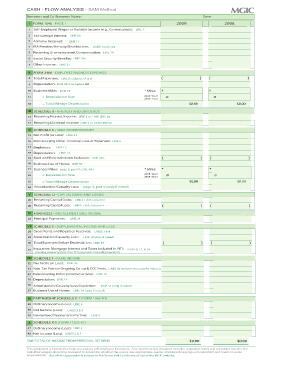

This is done by subtracting any allowable deductions from the total gross monthly income 6 Multiply the total net monthly income by 0 35 to get the Fannie MGIC s self employed borrower and income analysis calculators are editable and auto calculating worksheets for cash flow analysis and updated for the 2022

Fnma Self Employed Income Worksheet

Fnma Self Employed Income Worksheet

Fnma Self Employed Income Worksheet

https://www.pdffiller.com/preview/36/897/36897717.png

Follow this simple instruction to edit Self employed income calculation worksheet excel in PDF format online for free Register and sign in Register for a

Pre-crafted templates use a time-saving service for producing a diverse variety of documents and files. These pre-designed formats and designs can be used for various personal and professional projects, including resumes, invitations, flyers, newsletters, reports, presentations, and more, streamlining the content creation procedure.

Fnma Self Employed Income Worksheet

Fannie Mae Income Worksheet ≡ Fill Out Printable PDF Forms Online

Self-Employed Borrower Form 1084 Part 1 - Personal Tax Returns

Mortgage News Digest: "I Need Income Computation Training" means I don't understand self-employment

Fannie Mae Liquidity Test Worksheet Form - Fill Out and Sign Printable PDF Template | signNow

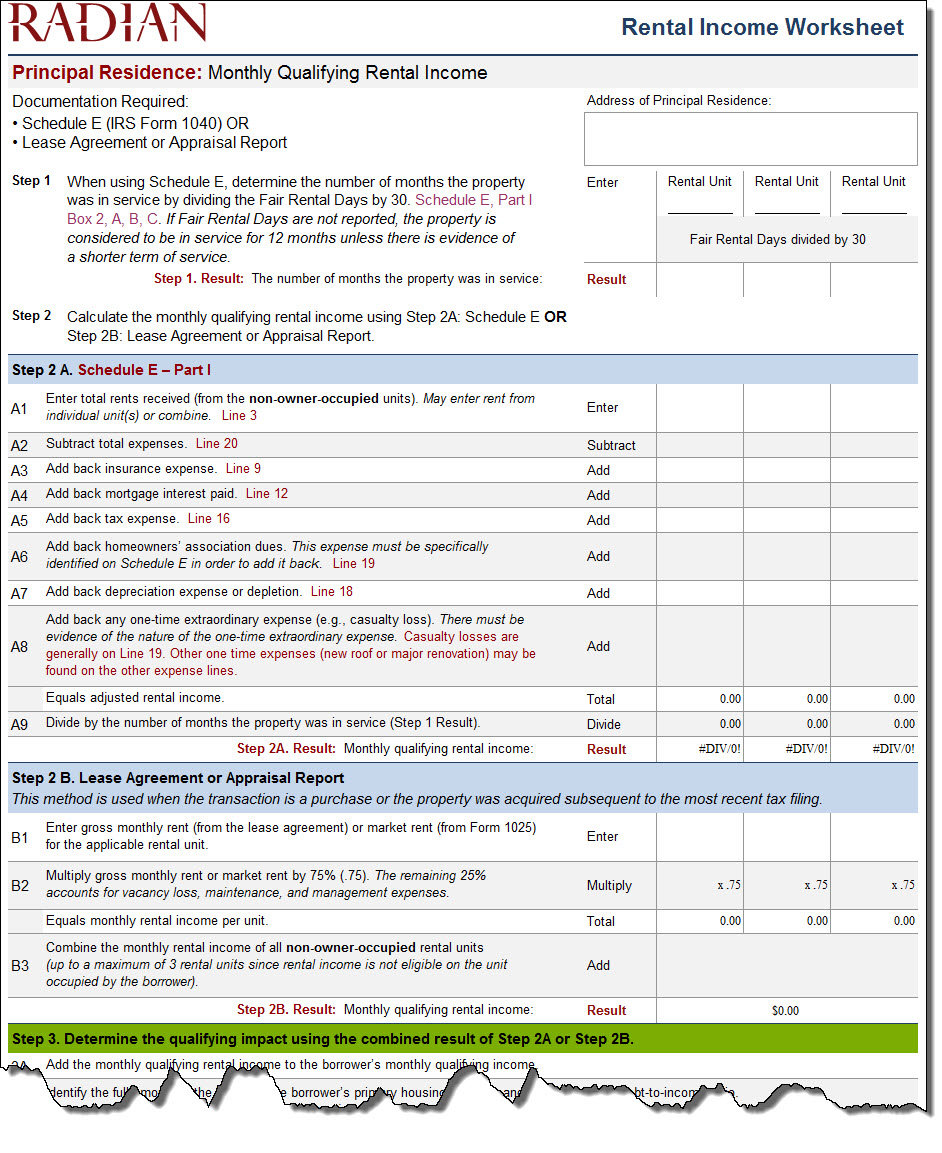

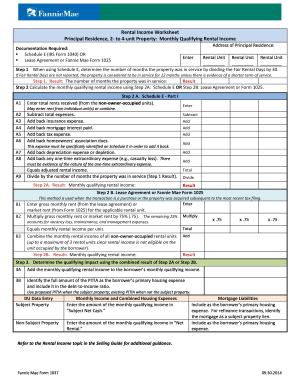

Rental Income Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

Fill - Free fillable Genworth PDF forms

https://enactmi.com/self-employed-borrower-calculators

Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1038 Individual Rental Income from Investment Property s up to 4 properties

https://selling-guide.fanniemae.com/Underwriting-Borrowers/Income-Assessment/Self-Employment-SE-Income/SE-Underwriting-Factors/1078960161/What-form-can-I-use-to-evaluate-income-from-self-employment.htm

This worksheet may be used to prepare a written evaluation of the analysis of income related to self employment The purpose of this written analysis is to

https://content.enactmi.com/documents/calculators/8608510.Training.FannieMae1084.Calculator.0221.pdf

A self employed borrower s share of Partnership or S Corporation earnings may be considered provided that The borrower can document ownership share for

https://www.houseloan.com/Corr/Forms/Self%20Employed%20Income%20Calculation%20Worksheet%20Conforming.xlsm

Income and be made part of the final self employed income calculation worksheet for each loan following Fannie Mae and Freddie Mac credit requirements The

https://www.mortgagegrader.com/uploads/selfemployedincome.pdf

The self employed income analysis form 1084A or 1084B should be used to determine the borrower s share or a corporation s after tax income and non cash

Cash Flow Analysis This self employed income analysis and the included descriptions generally apply to individuals At The Mortgage Calculator we believe that loan officers should be equipped with the

Guideline Comparison Employment Contracts and Job Offers Aid Use this job aid to compare agency guidelines when using employment offers as proof of income