Home Mortgage Interest Limitation Calculation 3 days ago 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750 000 For taxpayers who use Understanding the Deductible Home Mortgage Interest Worksheet in ProSeries The Deductible Home Mortgage Interest Worksheet is designed to help you calculate your

Home Mortgage Interest Limitation Calculation

Home Mortgage Interest Limitation Calculation

Home Mortgage Interest Limitation Calculation

https://calgaryhomes.ca/uploads/agent-1/mortgage-interest-rates.jpg

Jan 4 2023 0183 32 A mortgage calculator can help you determine how much interest you paid each month last year You can claim a tax deduction for the interest on the first 750 000

Templates are pre-designed documents or files that can be used for various purposes. They can conserve time and effort by supplying a ready-made format and design for developing different kinds of content. Templates can be used for individual or professional tasks, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Home Mortgage Interest Limitation Calculation

What Is A Mortgage Interest Adjustment Nesto ca

Mortgage Interest Rate Calculator Ireland Moneysherpa

Interest Rates Are Rising New Homes For Sale Home Design Programs

RT Archives Collections Mortgage Interest Rate To Rise

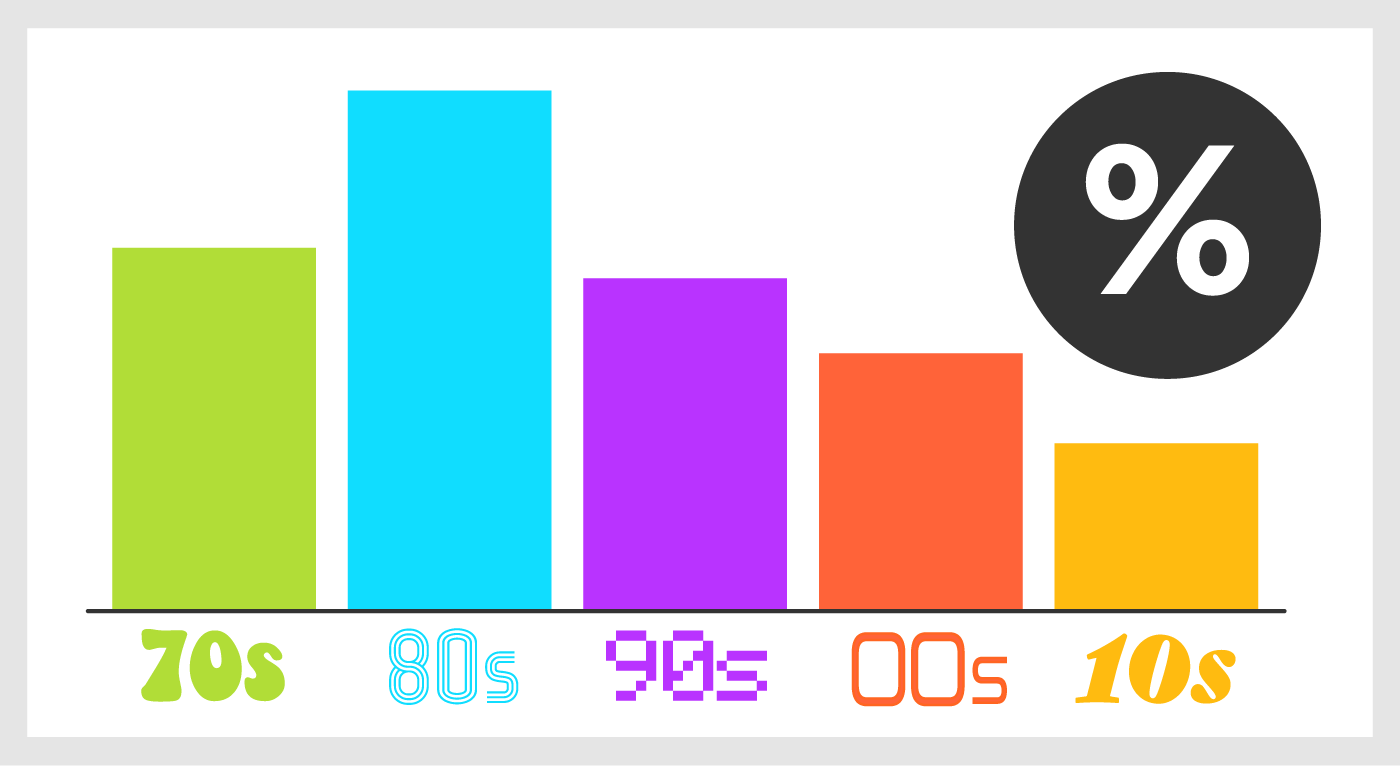

Home Mortgage Rates By Decade INFOGRAPHIC Benchmark Mortgage Providers

Mortgage Interest Rates Some Perspective

https://cs.thomsonreuters.com//csh_qualifiedloanlimitscreen.htm

Oct 31 2022 0183 32 This calculator computes your client s qualified mortgage loan limit and the deductible home mortgage interest Example Your clients want to buy a house with a

https://taxfoundation.org/research/all/federal/

Oct 15 2019 0183 32 The Tax Cuts and Jobs Act reduced the amount of principal and limited the types of loans that qualify for the deduction HMID allows itemizing homeowners to

http://www.jdunman.com/ww/Business/SBRG/…

Don paid 14 000 of interest on mortgage A and 16 000 of interest on mortgage B He figures the amount of home mortgage interest he can deduct by using Table 1 Since both mortgages are home equity debt

https://www.rocketmortgage.com/learn/mortg…

Feb 2 2024 0183 32 Any home that was sold before April 1 2018 is eligible for the 1 million limit only if there was a binding contract entered before December 15 2017 to close before January 1 2018 and the home was

https://www.quickenloans.com/learn/mortgage-interest-deduction

Nov 18 2023 0183 32 Heads of household 20 800 Married filing jointly or qualifying widow er 27 700 If the amount that can be taken off your taxes by itemizing is lower

Dec 1 2016 0183 32 The IRS issued Action on Decision 2016 02 in August indicating it will follow the Ninth Circuit s lead in applying the Secs 163 h 2 and 3 limitations on a per Oct 19 2010 0183 32 Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1

prove your home Home mortgage interest You can deduct home mortgage interest on the first 750 000 375 000 if married filing separately of indebt edness However