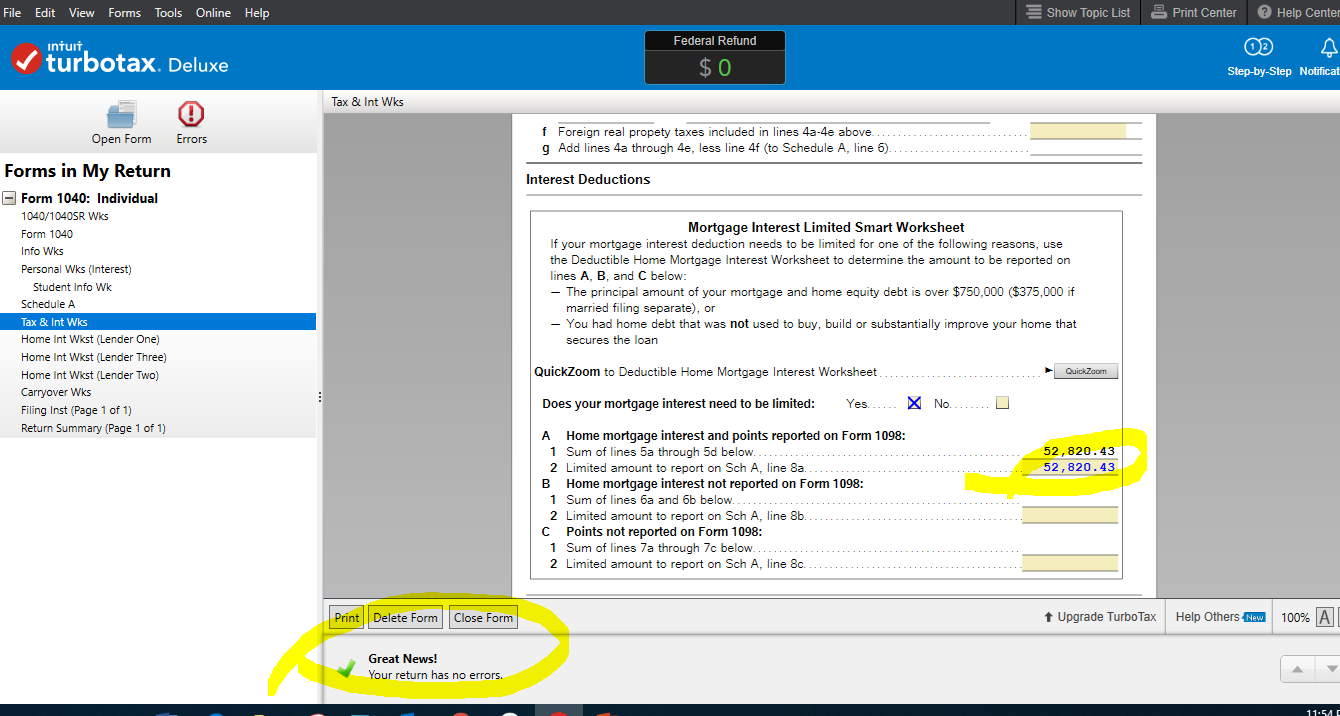

Home Mortgage Interest Limitation Smart Worksheet You will need to complete this IRS Qualified Loan Limit Worksheet before reporting the mortgage interest deduction in the 1098 program entry What if I own more

This tax worksheet computes the taxpayer s qualified mortgage loan limit and the deductible home mortgage interest Example Smart Charts Practice Aids Client Letters CPE Courses Curated by Tralawney Worksheet Qualified Loan Limit and Deductible Home Mortgage Interest Client

Home Mortgage Interest Limitation Smart Worksheet

Home Mortgage Interest Limitation Smart Worksheet

Home Mortgage Interest Limitation Smart Worksheet

https://www.irs.gov/pub/xml_bc/10426g05.gif

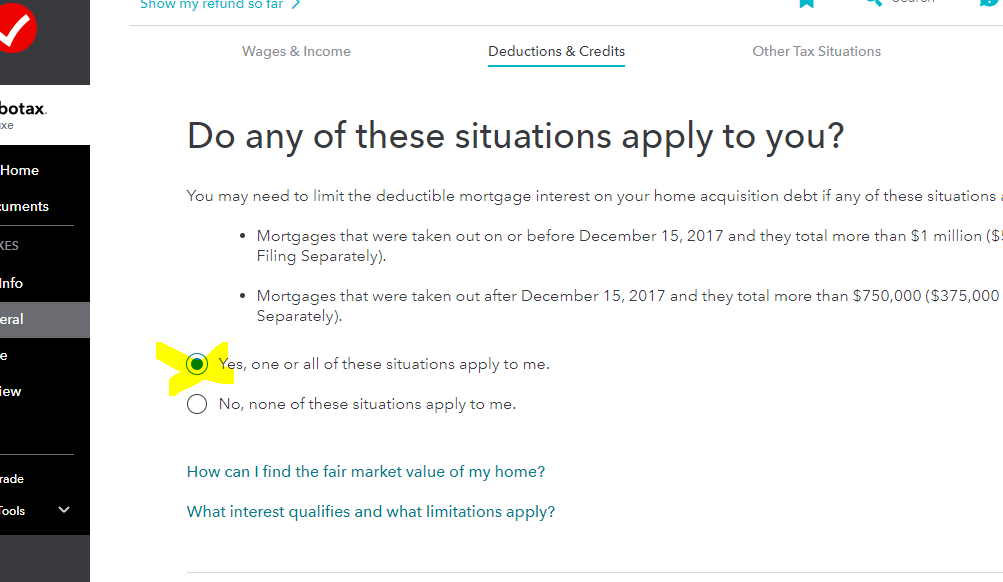

Deductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16 2017 and 750 000 for

Pre-crafted templates offer a time-saving solution for creating a varied variety of files and files. These pre-designed formats and designs can be made use of for numerous personal and expert jobs, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, simplifying the content development process.

Home Mortgage Interest Limitation Smart Worksheet

Edit 'Deductible Home Mortgage Interest Worksheet' for CA 540 return

Deductible Home Mortgage Interest Worksheet - Page 9

Solved: TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

Question about how TurboTax is handling my mortgage interest : r/TurboTax

Publication 936, Home Mortgage Interest Deduction; Part II. Limits on Home Mortgage Interest Deduction

![The Best Home Office Deduction Worksheet for Excel [Free Template] the-best-home-office-deduction-worksheet-for-excel-free-template](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b3336fe7a9eecb8bd7da_home-office-expenses-worksheet-deductible-amounts.png)

The Best Home Office Deduction Worksheet for Excel [Free Template]

https://www.irs.gov/publications/p936

Part II explains how your deduction for home mortgage interest may be limited It contains Table 1 which is a worksheet you can use to figure the limit on your

https://proconnect.intuit.com/support/en-us/help-article/form-1098/understanding-deductible-home-mortgage-interest/L18S60lyN_US_en_US

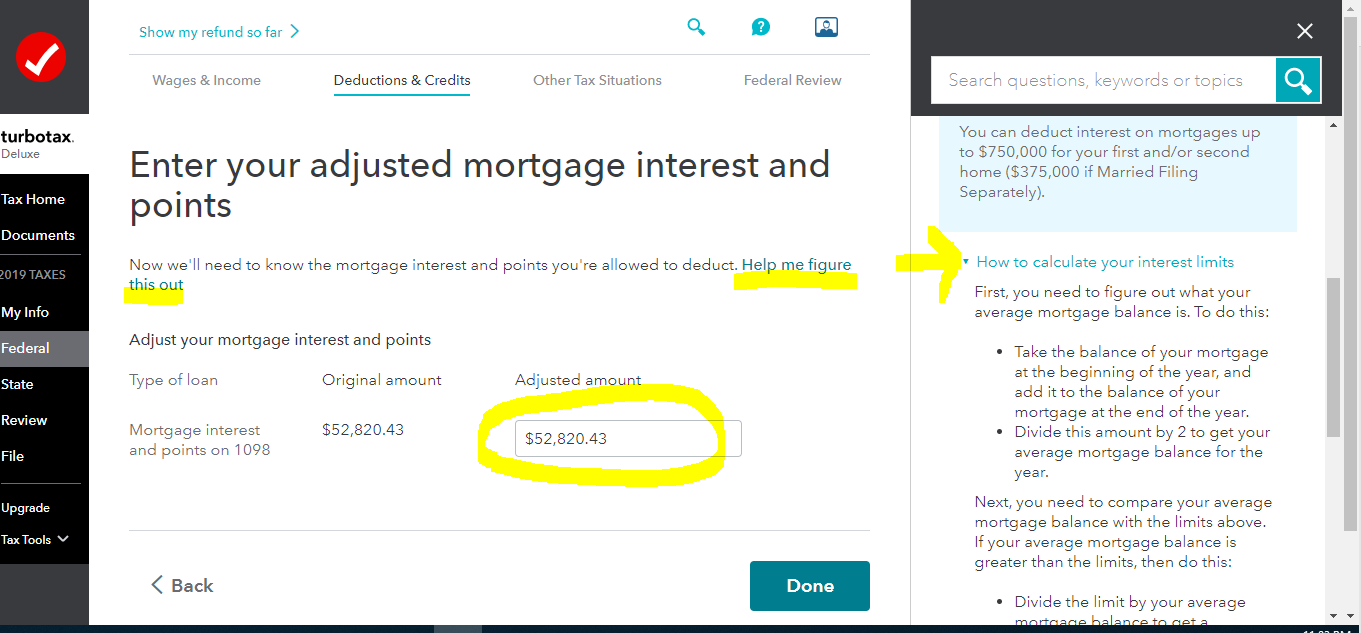

The Deductible Home Mortgage Interest Worksheet is designed to help you calculate your deductible home mortgage interest if that debt is

https://ttlc.intuit.com/community/tax-credits-deductions/discussion/home-mortgage-interest-limited-smart-worksheet-why-can-t-i-enter-beginning-balance-it-s-highlighted/00/2151949

This will properly record every 1098 and avoid any issue with mortgage limitations When you have more than one Form 1098 with the refinance

https://www.adftaxes.com/files/Mortgage_Deduction_Limit_Worksheet.pdf

Mortgage Deduction Limit Worksheet Part I Qualified Loan Limit 1 Enter the average is deductible as home mortgage interest on Schedule A Form 1040

https://cotaxaide.org/tools/Mortgage%20Interest%20Worksheet.html

Instructions Complete a worksheet tab for all home secured mortgages to determine the amount of interest paid that is deductible on Schedule A

Worksheet Qualified Loan Limit and Deductible Home Mortgage Interest News October 2 2023 News PwC Insights IRS Notice provides additional interim CAMT In general you can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home

You must reduce your deduction for home mortgage interest on Schedule A Form 1040 972 5 228 5 228 SMART WORKSHEET FOR Form 8396 Mortgage Interest