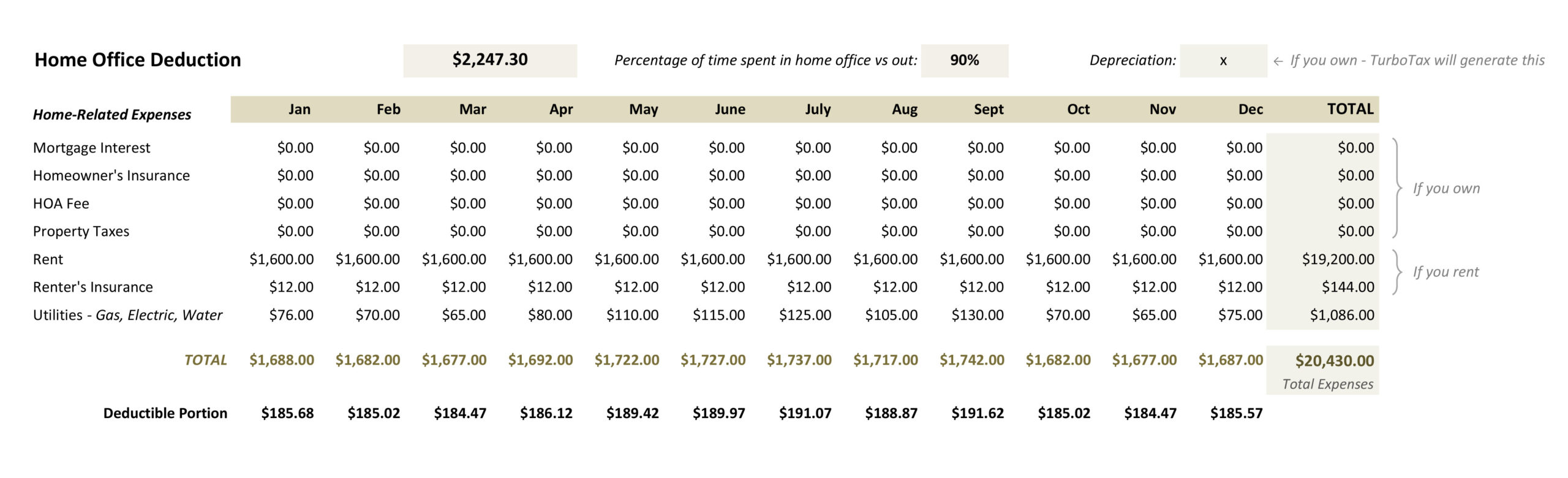

Home Office Deduction Worksheet 2021 For 2022 the prescribed rate is 5 per square foot with a maximum of 300 square feet If the office measures 150 square feet for example

Home Office Deduction Worksheet Please use this worksheet to give us information about your home office for preparation of your tax returns There are two If your home office is 300 square feet or less and you opt to take the simplified deduction the IRS gives you a deduction of 5 per square foot

Home Office Deduction Worksheet 2021

Home Office Deduction Worksheet 2021

Home Office Deduction Worksheet 2021

https://assets-global.website-files.com/637e5892fb4b6db88a62cc0a/6396309667bb253007f3bb1f_61923e7d1bfe911b7d6c2b4b_bonsai.png

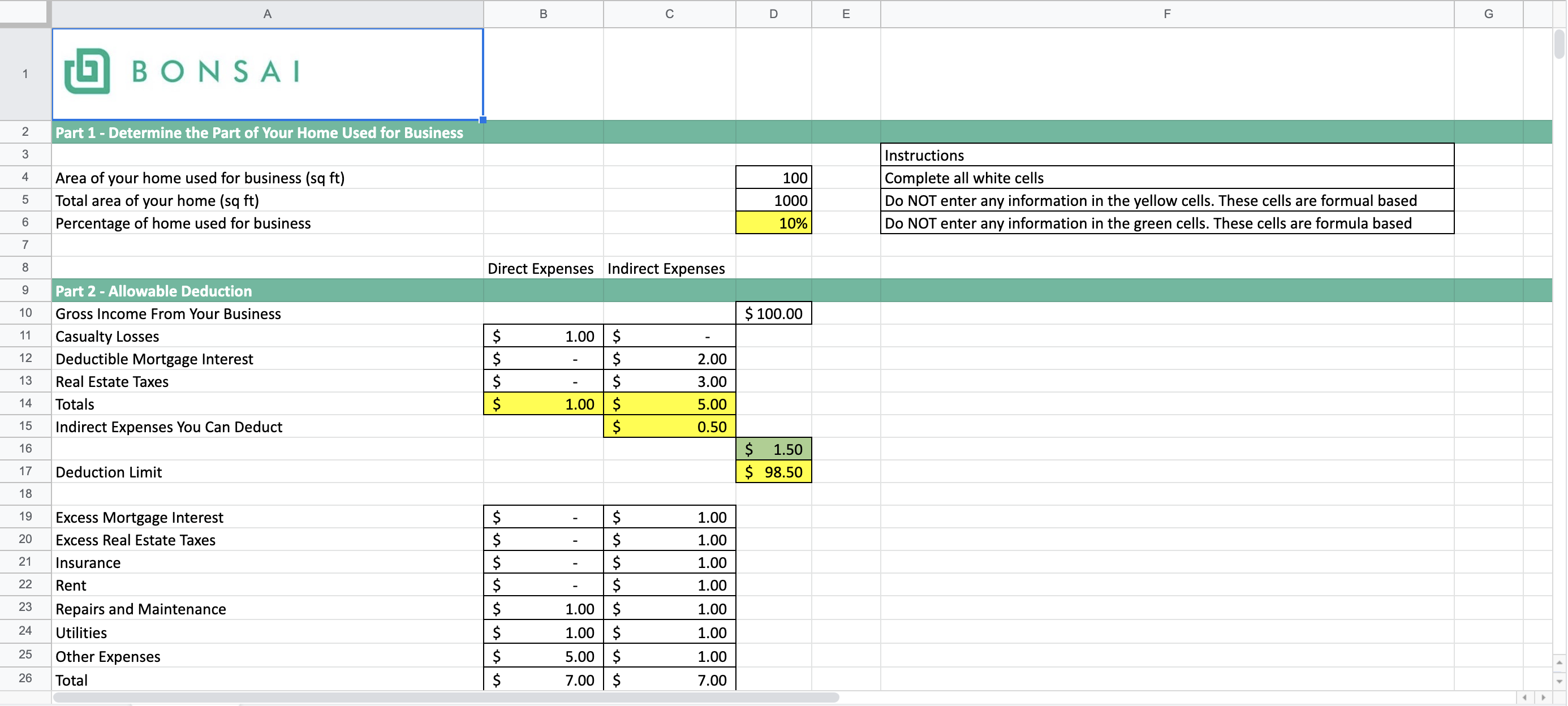

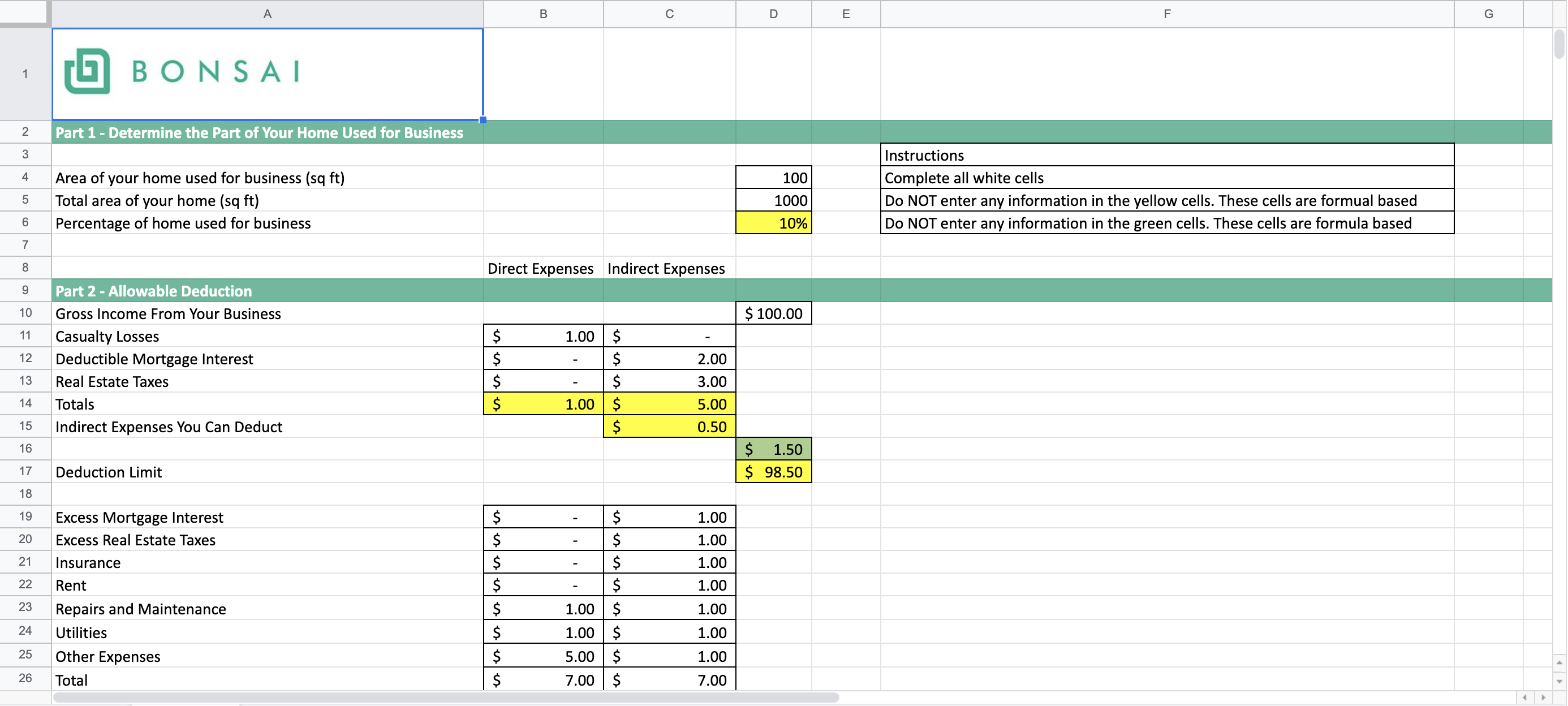

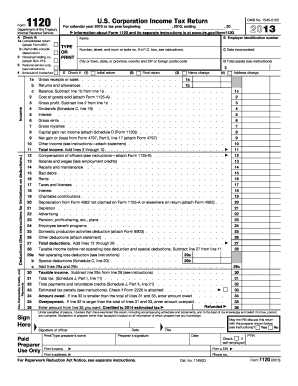

IRS Rules on Home Office 05 01 Business Use of Home Worksheet Pub 587 05 14

Templates are pre-designed documents or files that can be utilized for different functions. They can conserve effort and time by supplying a ready-made format and layout for creating different sort of content. Templates can be utilized for personal or expert projects, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Home Office Deduction Worksheet 2021

![The Best Home Office Deduction Worksheet for Excel [Free Template] the-best-home-office-deduction-worksheet-for-excel-free-template](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b3beeeb5b066ac98f471_home-office-expenses-spreadsheet-dragging-down-formula.png)

The Best Home Office Deduction Worksheet for Excel [Free Template]

Calculating Your Home Office Expenses As a Tax Write-Off // Free Template! - Lin Pernille

Home Business Worksheet Template | Business worksheet, Business tax deductions, Home business

How to Claim the Home Office Deduction with Form 8829 | Ask Gusto

Real Estate Agent Tax Deductions Worksheet Pdf - Fill Online, Printable, Fillable, Blank | pdfFiller

Home Office Tax Deduction: What to Know | Fast Capital 360®

https://www.irs.gov/businesses/small-businesses-self-employed/simplified-option-for-home-office-deduction

Highlights of the simplified option Standard deduction of 5 per square foot of home used for business maximum 300 square feet

![The Best Home Office Deduction Worksheet for Excel [Free Template] The Best Home Office Deduction Worksheet for Excel [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b3336fe7a9eecb8bd7da_home-office-expenses-worksheet-deductible-amounts.png?w=186)

https://www.keepertax.com/posts/home-office-deduction-excel-spreadsheet

The home office deduction is a huge source of tax savings but also a huge hassle Use this Excel sheet to simplify things

https://www.hellobonsai.com/blog/home-office-deduction-worksheet

To calculate the simplified home office deduction you simply multiply the square footage of your home used for business by 5 per square foot

https://etsmetairie.com/files/Home-Office-Deduction-Worksheet.pdf

Home Office Deduction Worksheet To deduct expenses for the business use of your home It must be your principal place of business for your trade or business

http://www.lbtaxservices.com/Forms/Business%20Use%20of%20Home%20Worksheet.pdf

Allowable home related itemized deductions claimed in full on Schedule A For example Mortgage interest real estate taxes

Here Home Office Deduction Worksheet etsmetairie Freelance Expenses Deductions Home Office claim the home office tax deduction on their 2021 WebIf Standard deduction of 5 per square foot of home used for business maximum 300 square feet Allowable home related itemized deductions claimed in full on

If someone else claims you on their tax return use this calculation 1 Enter your income from line 2 of the Standard Deduction Worksheet