How Do I Get A Trace Number From The Irs Jun 7 2019 0183 32 You should have a transmission number in your email from the IRS saying your return was accepted Or you can contact the IRS 1 800 829 1040 Also if your bank rejects

Copy the Tracking Number associated with your EFIN into the space provided in the Company Tab in your Account Hub The Tracking Number will be verified by the IRS to prevent unauthorized use of your EFIN Feb 26 2025 0183 32 If your refund hasn t arrived within the expected timeframe you may need to request a refund trace from the IRS This process helps determine whether your refund was

How Do I Get A Trace Number From The Irs

How Do I Get A Trace Number From The Irs

How Do I Get A Trace Number From The Irs

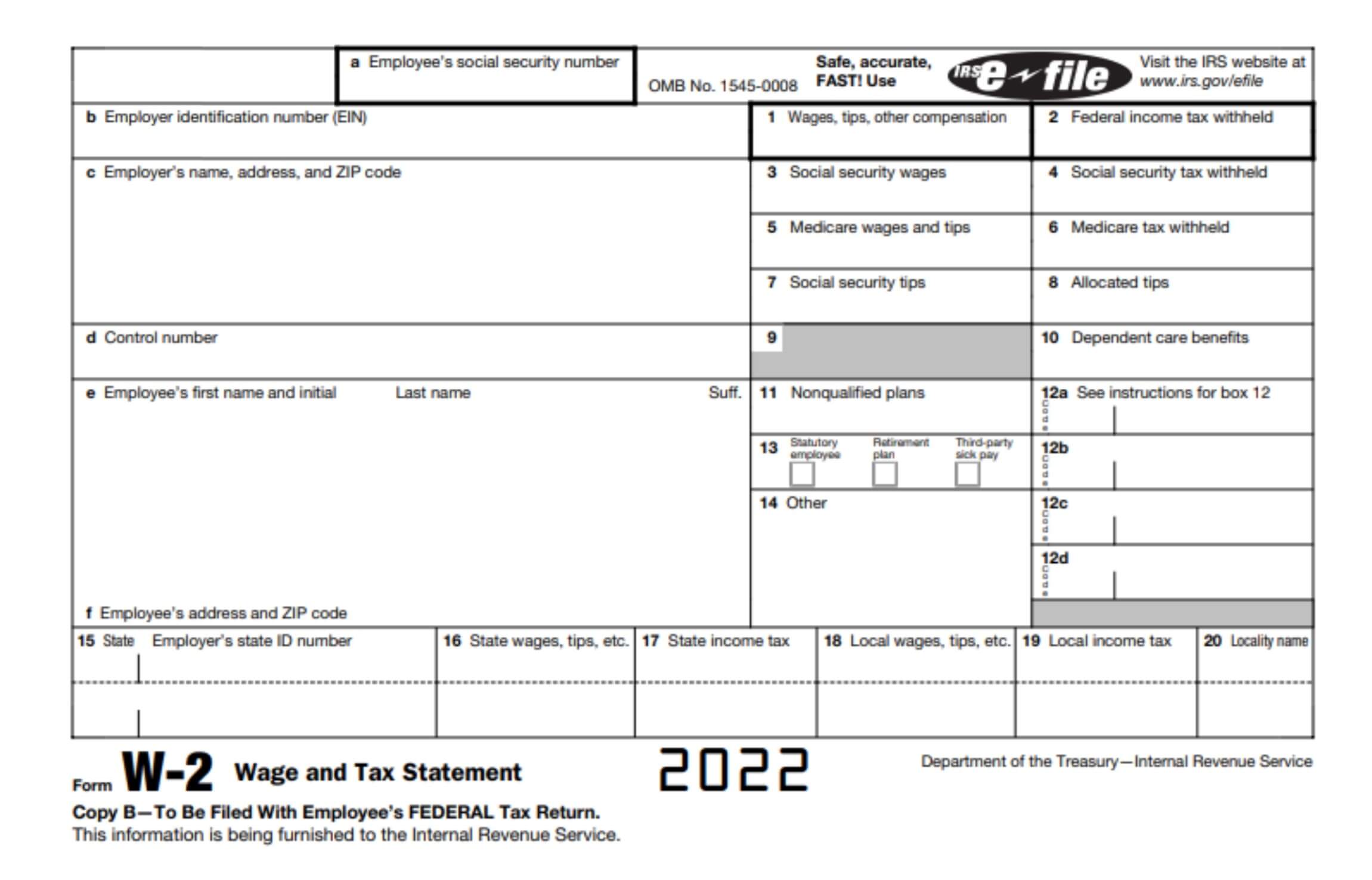

https://www.taxdefensenetwork.com/wp-content/uploads/2022/02/form-w2-instructions.jpg

Nov 25 2022 0183 32 Tax refunds can be traced by using the Where s My Refund tool on the IRS website the IRS2Go Mobile App or by calling the IRS Refunds typically can be traced one day after they are filed online and received by the

Pre-crafted templates provide a time-saving solution for developing a diverse range of documents and files. These pre-designed formats and designs can be made use of for numerous personal and expert jobs, including resumes, invites, flyers, newsletters, reports, discussions, and more, simplifying the material creation process.

How Do I Get A Trace Number From The Irs

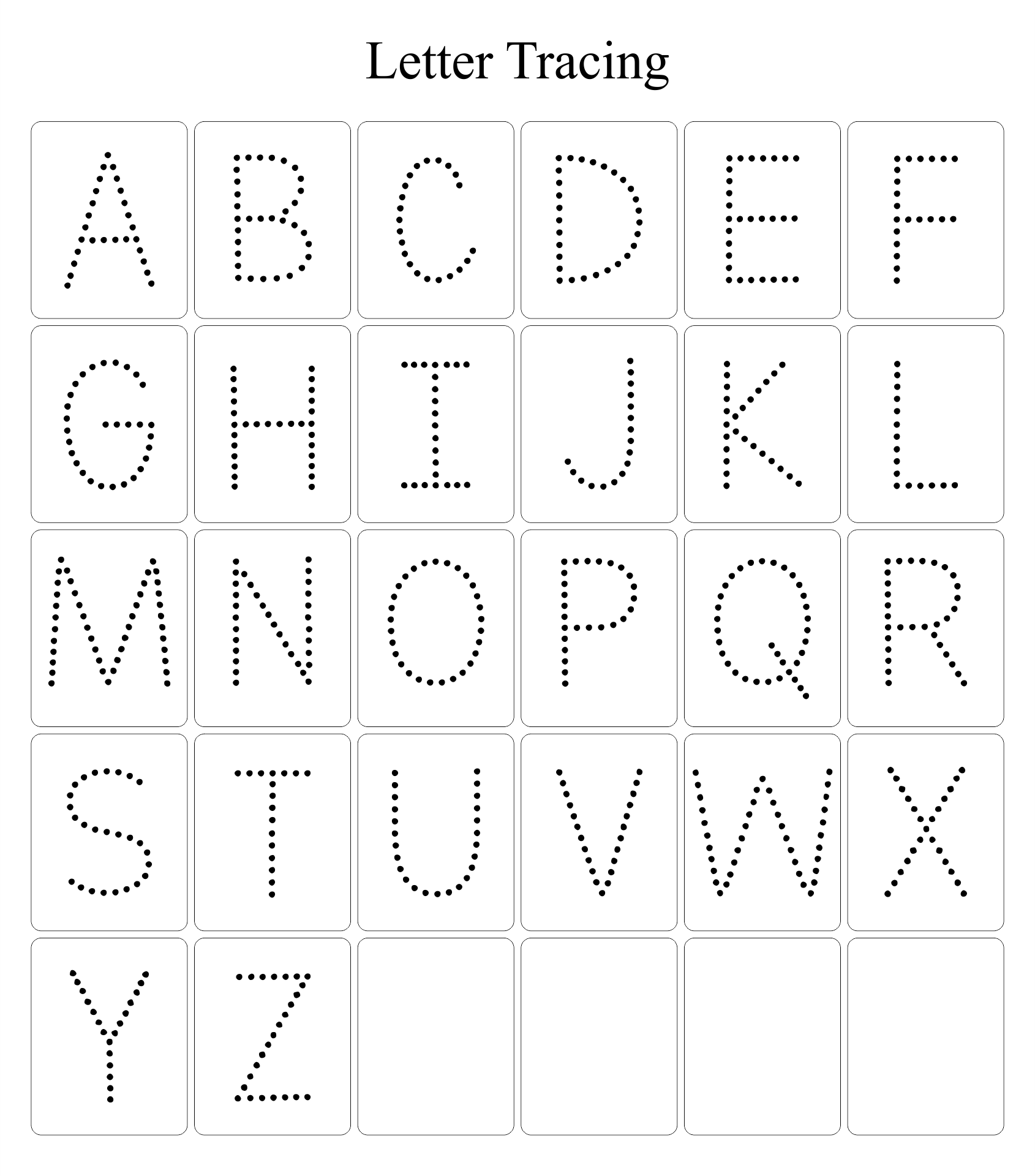

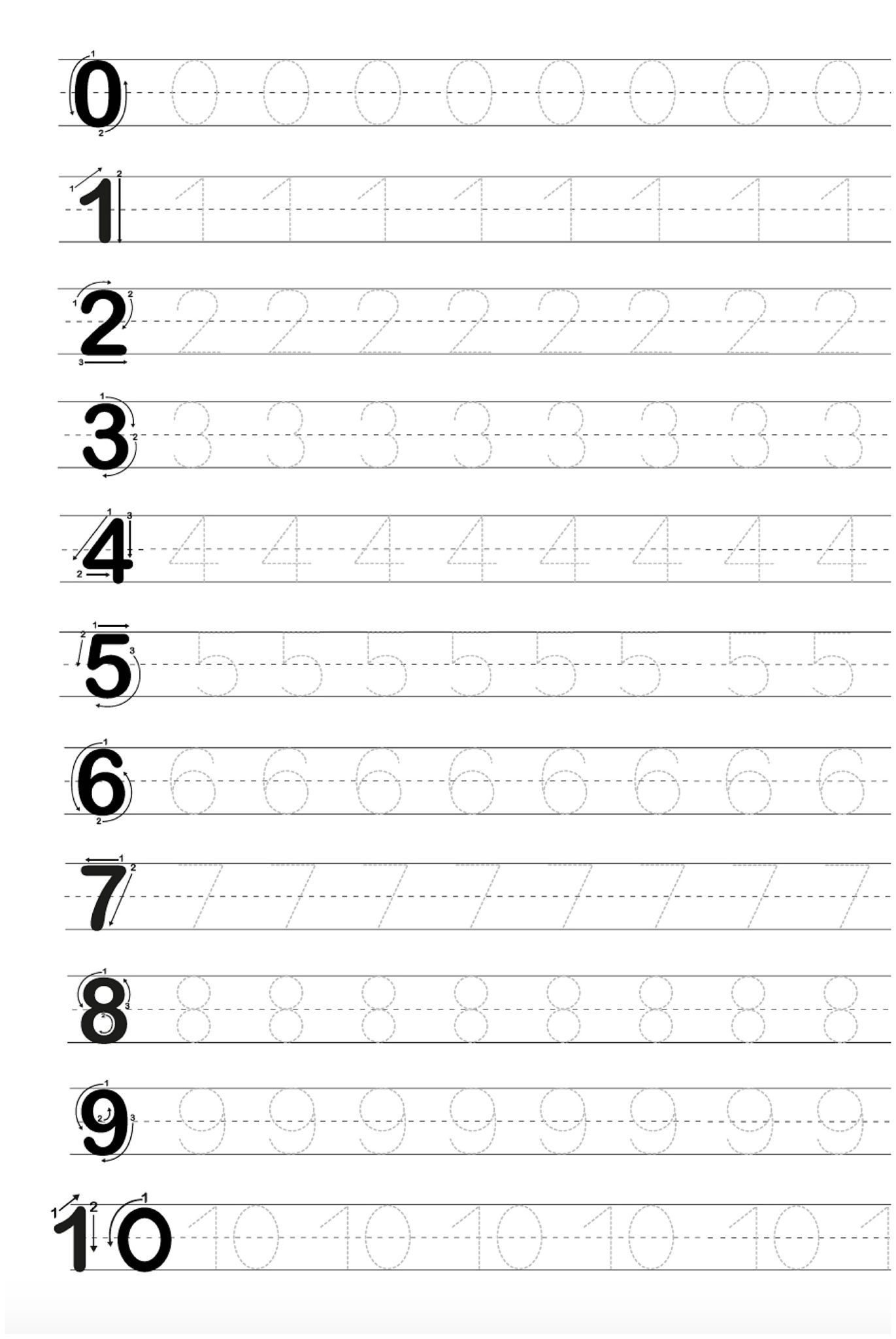

Printable Alphabet Letters To Trace

Jetragon Location In Palworld

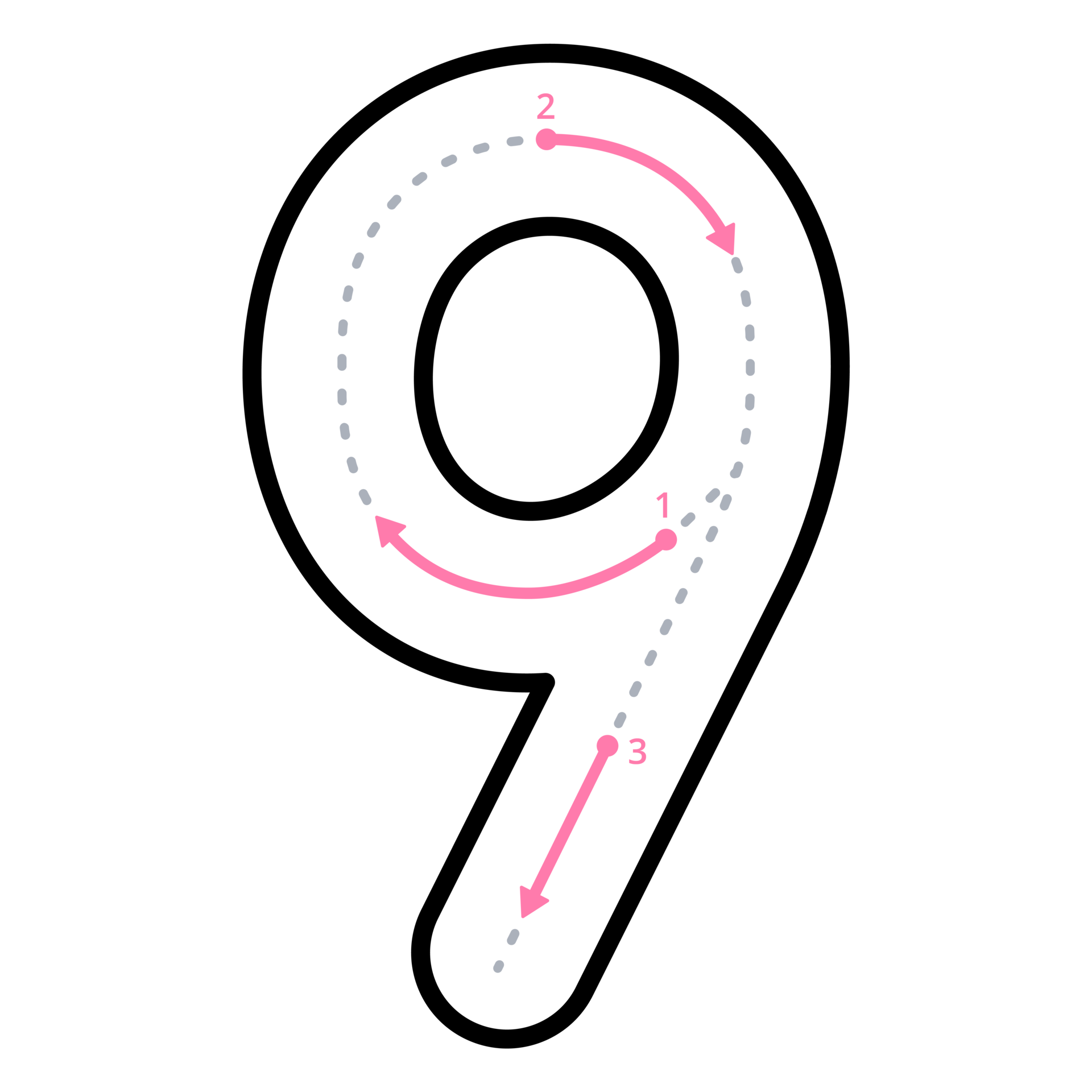

How To Write Number 9 With Tracing Guide 20047435 PNG

Print Out Letters To Trace

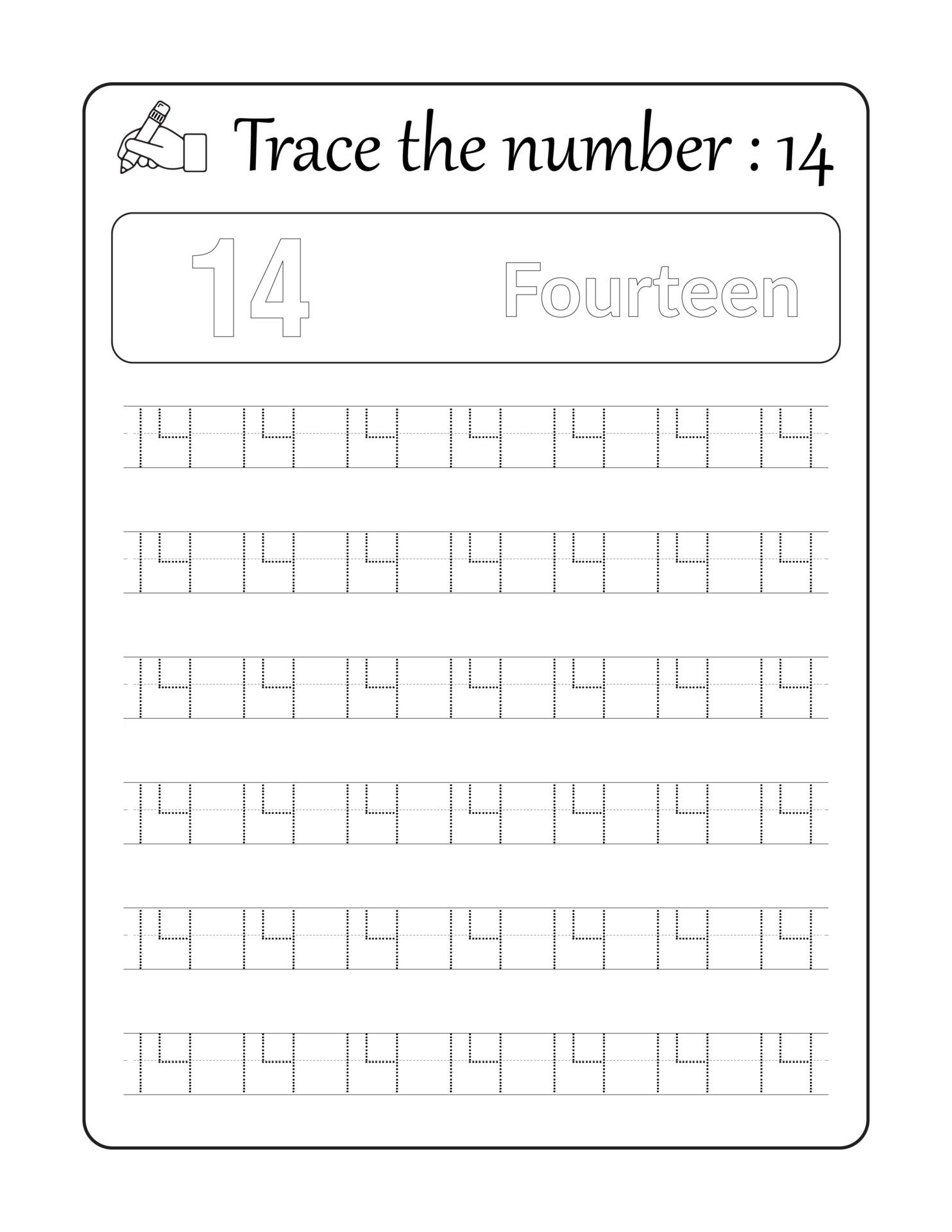

Rastrear El N mero 14 Rastreo De N meros Para Ni os 10820800 Vector En

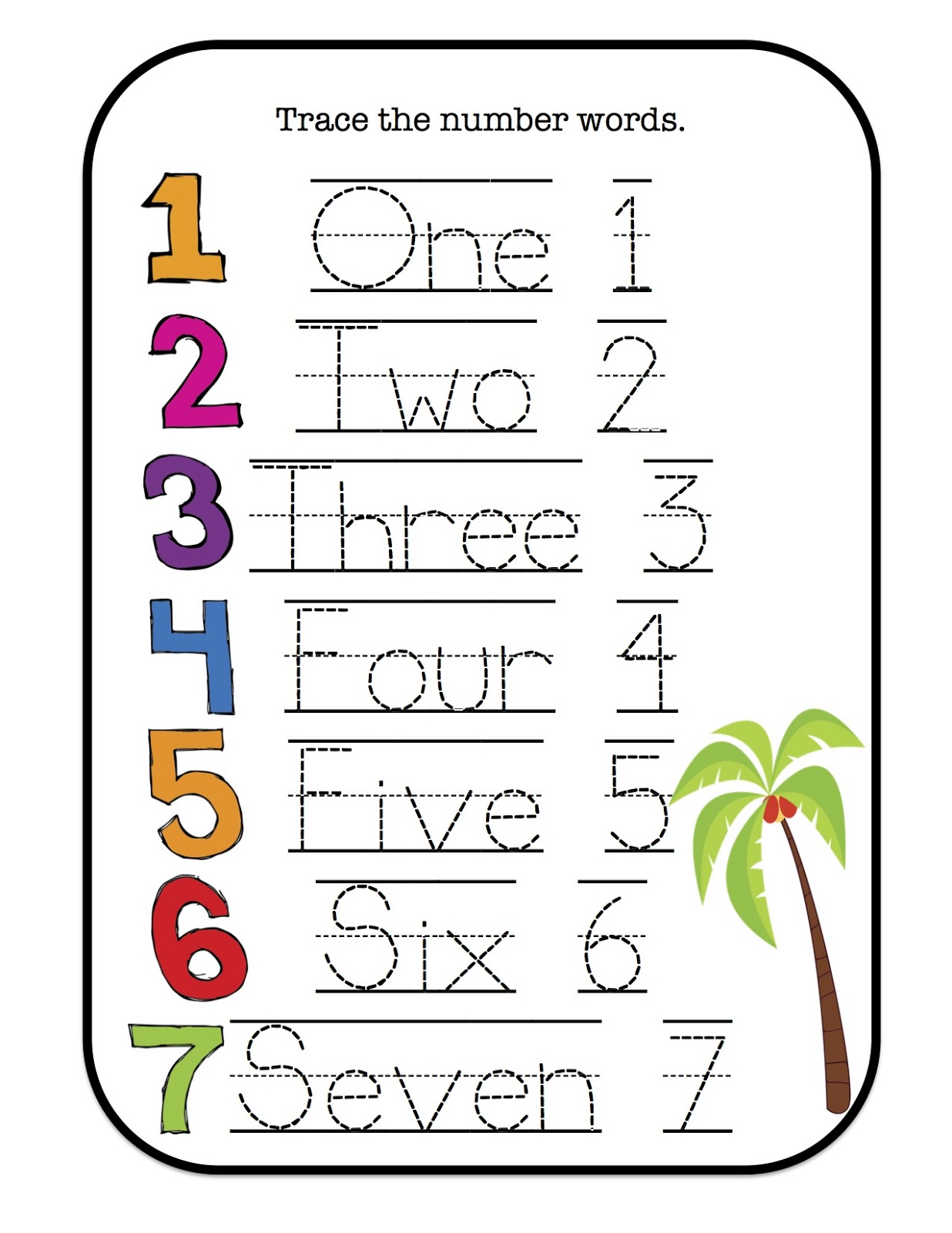

Trace Numbers 1 To 100

https://www.irs.gov › forms-pubs

Jan 30 2025 0183 32 Find the state you live in and use the mailing address or fax number list below Do not send anything other than a Form 3911 to the fax numbers below

https://www.irs.gov › irm

The IRS may initiate a trace with a financial institution on behalf of a taxpayer with a FS Form 150 1 which is an official request from the Department of the Treasury to the bank on behalf of

https://pocketsense.com

Nov 6 2018 0183 32 Contact the IRS If tracking online once you click the Where s my refund link you will be prompted to enter your personal filing information After that you will be given a series of prompts You can also track your refund with

https://www.taxpayeradvocate.irs.gov › get-help ›

May 16 2022 0183 32 If this is the case you can ask the IRS to do a refund trace This is the process the IRS uses to track a lost stolen or misplaced refund check or to verify a financial institution received a direct deposit

https://www.forbes.com › advisor › taxes › missing-a

Aug 11 2021 0183 32 To request your payment trace you will need to provide information using Form 3911 The form requires you to sign under penalty of perjury certifying the information provided is accurate You

Mar 25 2025 0183 32 Those expecting a paper refund check will need to wait six weeks from the date the IRS issued the refund Once the appropriate time has passed taxpayers can request a When you request a Refund Trace the IRS will tell you what bank account the refund was deposited into or if a paper check was mailed it will tell you if the check was cashed or not If

Apr 1 2025 0183 32 The IRS has a mobile app IRS2Go that can monitor your tax refund status The app can be downloaded for both iOS and Android and is available in English and Spanish