How Much Is The Recovery Rebate Credit For 2021 Published April 15 2021 Last Updated February 8 2024 TAS Tax Tips Recovery Rebate Credit and Economic Impact Payment information you might need to know Economic Impact Payments EIPs also known as stimulus payments and the related Recovery Rebate Credits RRCs are essentially divided into two tax years 2020 and 2021

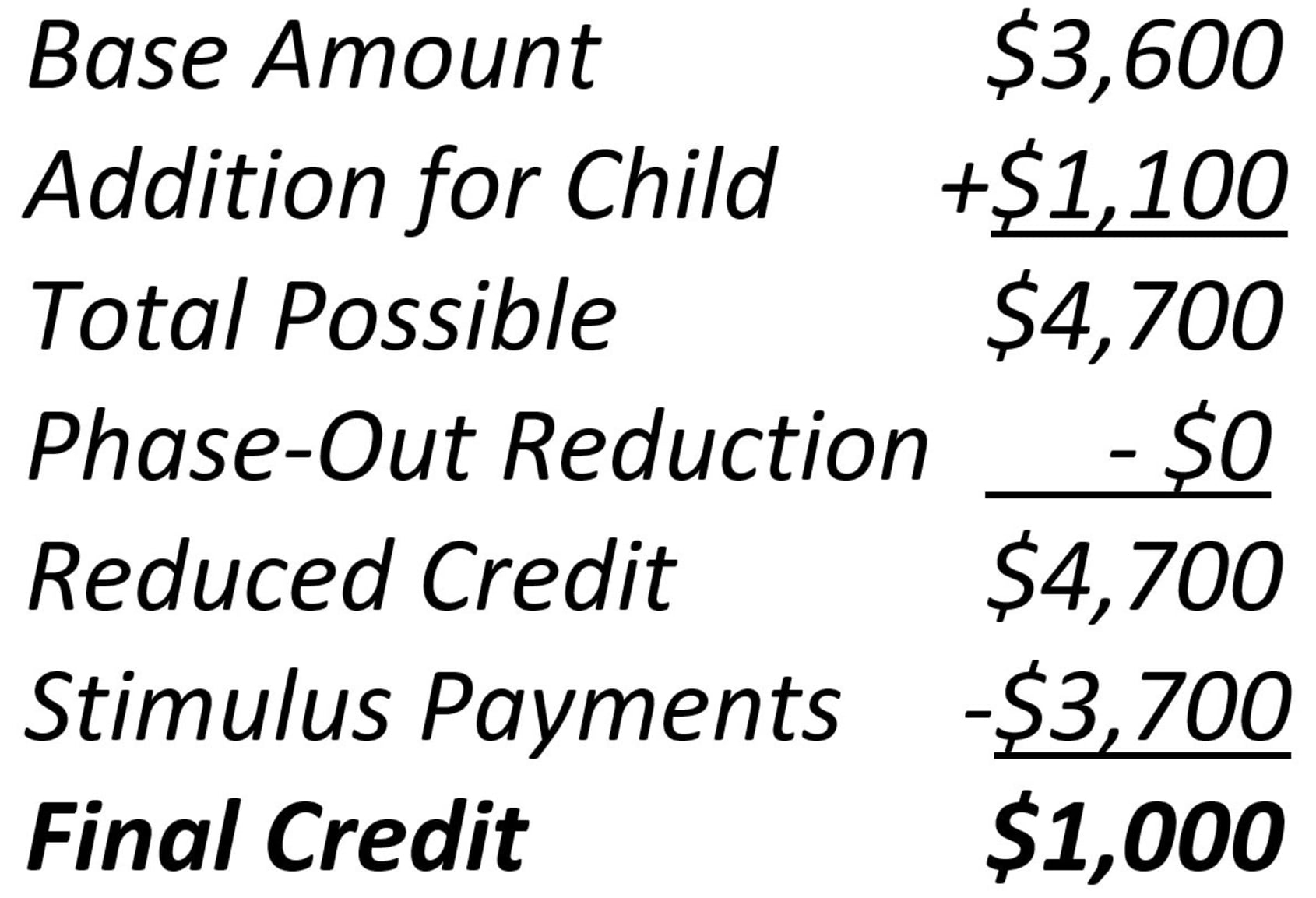

Oct 12 2022 0183 32 As a result after subtracting the amount of their third stimulus payment the recovery rebate credit they report on Line 30 of their 2021 tax return is equal to 840 4 200 3 360 840 Jan 14 2022 0183 32 The 2021 EIP recovery rebate credit has the same income phaseout thresholds as for 2020 75 000 for single filers and 150 000 for married couples filing jointly However the phaseout ceiling is lower 80 000 for

How Much Is The Recovery Rebate Credit For 2021

How Much Is The Recovery Rebate Credit For 2021

How Much Is The Recovery Rebate Credit For 2021

https://i1.wp.com/www.gannett-cdn.com/presto/2022/01/31/PDTF/ed4d450c-c21d-4e0c-8df6-4637a89241b9-Lett_6475.jpg

Jun 24 2021 0183 32 The 2021 Recovery Rebate tax credit is worth up to 1 400 or 2 800 if married filing jointly plus 1 400 for each qualifying dependent If you did not receive a third stimulus check but you were eligible for one your tax

Pre-crafted templates use a time-saving service for producing a varied range of documents and files. These pre-designed formats and designs can be made use of for various personal and professional jobs, including resumes, invitations, leaflets, newsletters, reports, presentations, and more, simplifying the material production procedure.

How Much Is The Recovery Rebate Credit For 2021

7 Easy Ways What Is Recovery Rebate Credit 2021 Outbackvoices

Recovery Rebate Credit Form Printable Rebate Form

The Tax Year 2021 Recovery Rebate Credit Better Financial Counseling

What Is The Recovery Rebate Credit And Do You Qualify The

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

How To File Recovery Rebate Credit Turbotax Recovery Rebate

https://www.irs.gov/newsroom/2021-recovery-rebate

Apr 13 2022 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

https://www.irs.gov/newsroom/recovery-rebate-credit

Feb 12 2024 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic Impact payment and any plus up payments to claim the 2021 Recovery Rebate Credit

https://www.taxpayeradvocate.irs.gov/covid-19-home/3rd-eip-and-2021-rrc

The 2021 RRC amount was 1 400 or 2 800 in the case of a joint return plus an additional 1 400 per each dependent of the taxpayer for all U S residents with adjusted gross income up to a phase out threshold of 75 000 150 000 in the case of a joint return or a surviving spouse and 112 500 in the case of a head of household who are n

https://melton-melton.com/blog/recovery-rebate

Mar 16 2022 0183 32 112 500 120 000 if filing as head of household 75 000 80 000 for all others There are many factors that can affect the calculation of the amount of Recovery Rebate Credit you are eligible to claim on your 2021 taxes Below is a non comprehensive list of factors that could affect your Recovery Rebate Credit

https://www.investopedia.com/recovery-rebate-credit-5090493

Aug 17 2022 0183 32 The CARES Act provided economic relief payments known as Economic Impact Payments or stimulus payments valued at 1 200 per eligible adult based on household adjusted gross income AGI plus

Jan 19 2022 0183 32 The payment amounts are different than in 2020 as the maximum credit is 1 400 per person including all qualifying dependents claimed on a tax return as this was the amount of the payment in Apr 27 2023 0183 32 The second full stimulus payment was 600 for single individuals 1 200 for married couples and 600 per dependent If you earned more than 99 000 198 000 for married couples you got no

Feb 1 2022 0183 32 The maximum Recovery Rebate Credit on 2021 returns amounts to 1 400 per person including all qualifying dependents claimed on a tax return A married couple with no dependents for example