How To Reconcile W2 To Pay Stub Jan 21 2021 0183 32 These agencies reconcile your W 2s against your 941s and if W 2s are less than Form 941 SSA will send you a notice W 2s are more than Form 941 IRS will

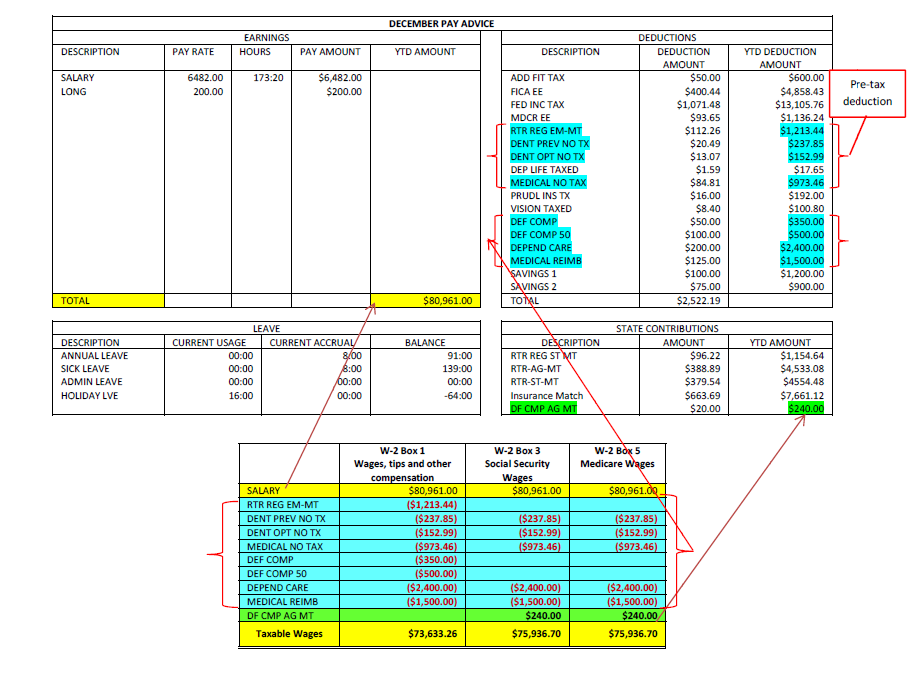

Use your last pay stub for the year to calculate the taxable wages in boxes 1 and 16 in your W 2 Begin with the Gross Pay YTD year to date and make the following adjustments if How to Reconcile Your Last Paystub to Your W 2 Form To match your paystub to your W 2 Form Box 1 Wages tips other compensation Take your year to date gross wages

How To Reconcile W2 To Pay Stub

How To Reconcile W2 To Pay Stub

How To Reconcile W2 To Pay Stub

https://static.paystubdirect.com/uploads/2022/01/w2-portra-scaled.jpg

each situation The following steps will show you the calculations of the W 2 wage amounts and help you to reconcile these to your final pay stub for the year CALCULATING

Templates are pre-designed files or files that can be utilized for various functions. They can conserve time and effort by supplying a ready-made format and layout for creating different type of material. Templates can be used for personal or professional tasks, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

How To Reconcile W2 To Pay Stub

Pay Stub To W2 Converter Free AndersonMyda

Pin On Beautiful Professional Template

How To File Taxes Without A W2 Or Pay Stub Online Pay Stub Generator

How To Obtain W2 Form From Walmart A Complete Guide 2023

Fill Out Kind W 2 TaskTaka

W2 To Paystub Reconciliation Wyoming State Auditor s Office

https://bizfluent.com/annual-payroll--w-2-reconciliation.html

Jan 1 2021 0183 32 To reconcile W 2s locate the employee s taxable gross wages in the respective boxes of the W 2 This includes Box 1 for federal wages Box 3 for Social

http://www.visionpayroll.com/wpForm-W-2-Reconciliation.pdf

To reconcile your Form W 2 box 16 state wages tips etc to year to date gross on your last pay stub make the following adjustments Add Year to date gross on your last pay

https://www.irsvideos.gov/Governments/Employers/10

Learn how to verify the accuracy of your payroll data and match it with the Form W 2 and Form W 3 before filing your final Form 941 or Form 944 Follow the four steps to

https://www.paystubcreator.net/blog/finance/…

Jan 3 2019 0183 32 The first step of calculating your W2 wages from a paystub is finding your gross income This is the total amount of money you ve earned without deductions or tax withholdings For many people this will

https://sao.wyo.gov//w2-to-paystub-reconc…

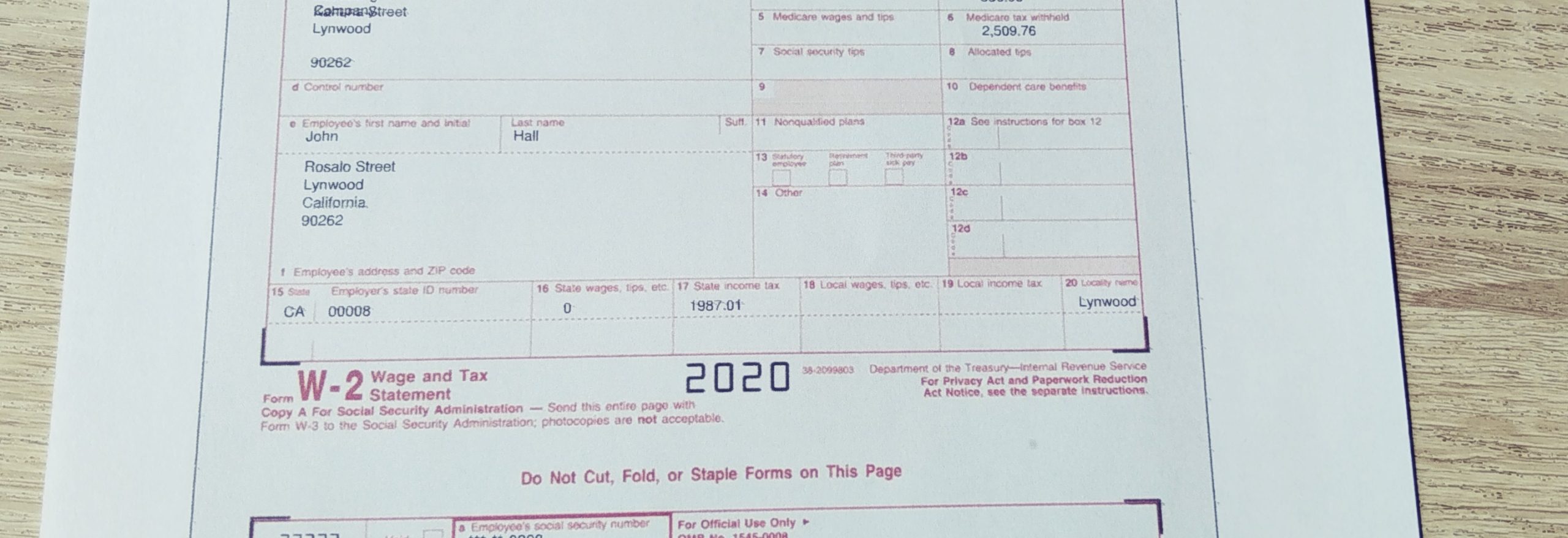

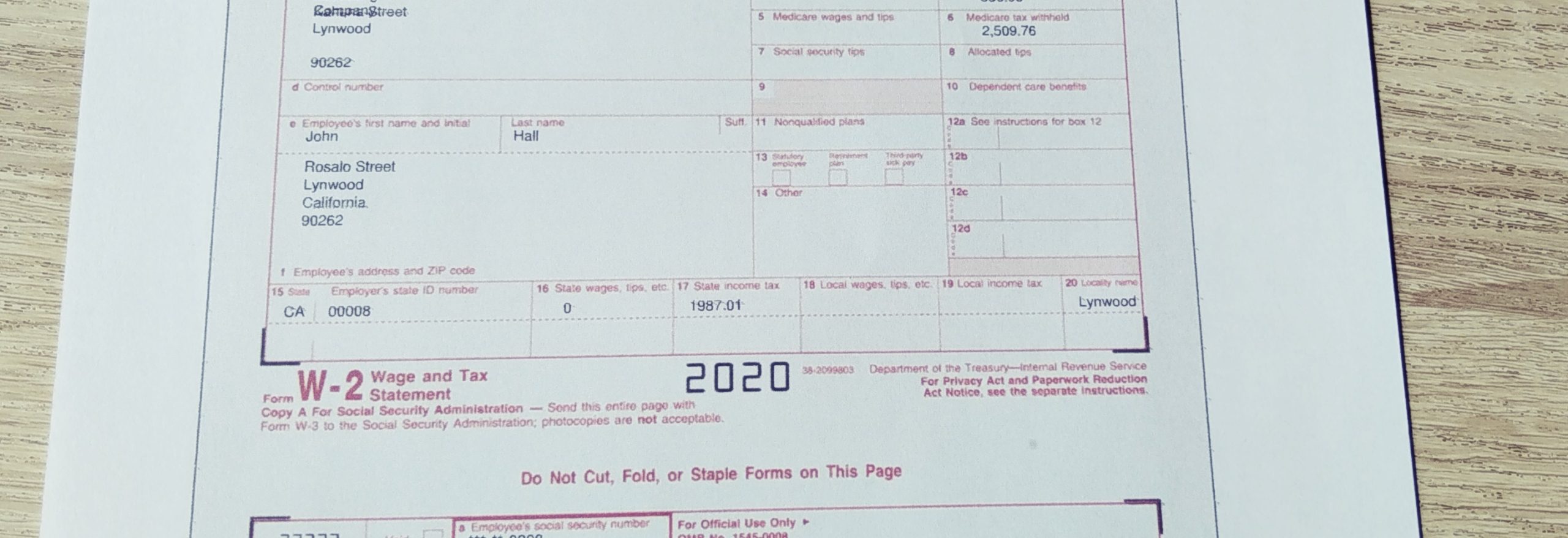

W2 to Paystub Reconciliation The information presented below is intended as an example to aid in reconciling an employee s December pay advice to their W 2 If December pay transactions required corrections after the

The W 2 reflects taxable earnings while the check stubs reflect total earnings To reconcile your W 2 to your last payslip start here Why don t I have any Social Security or Jul 8 2016 0183 32 RECONCILING YOUR PAY STUB TO YOUR W 2 Employees often ask what amounts are reported on a W 2 and why the amounts on their pay stubs are different

Jun 9 2017 0183 32 Dependent care reimbursement accounts You will subtract any of these items from your gross taxable wages The number you come to should match the number you