Income Calculation Worksheet Excel Magic Apr 30 2025 0183 32 Personal income tax How to file a tax return You may choose to do your own taxes or have someone else do them for you using tax software or on paper If eligible you may be

You may request changes to an assessed income tax and benefit return if you need to correct amounts or forgot to include information on your return You must wait until you receive your Quebec 2024 Income tax package The following forms and schedules can be used to help you complete your federal tax return Quebec administers its own tax laws Quebec residents may

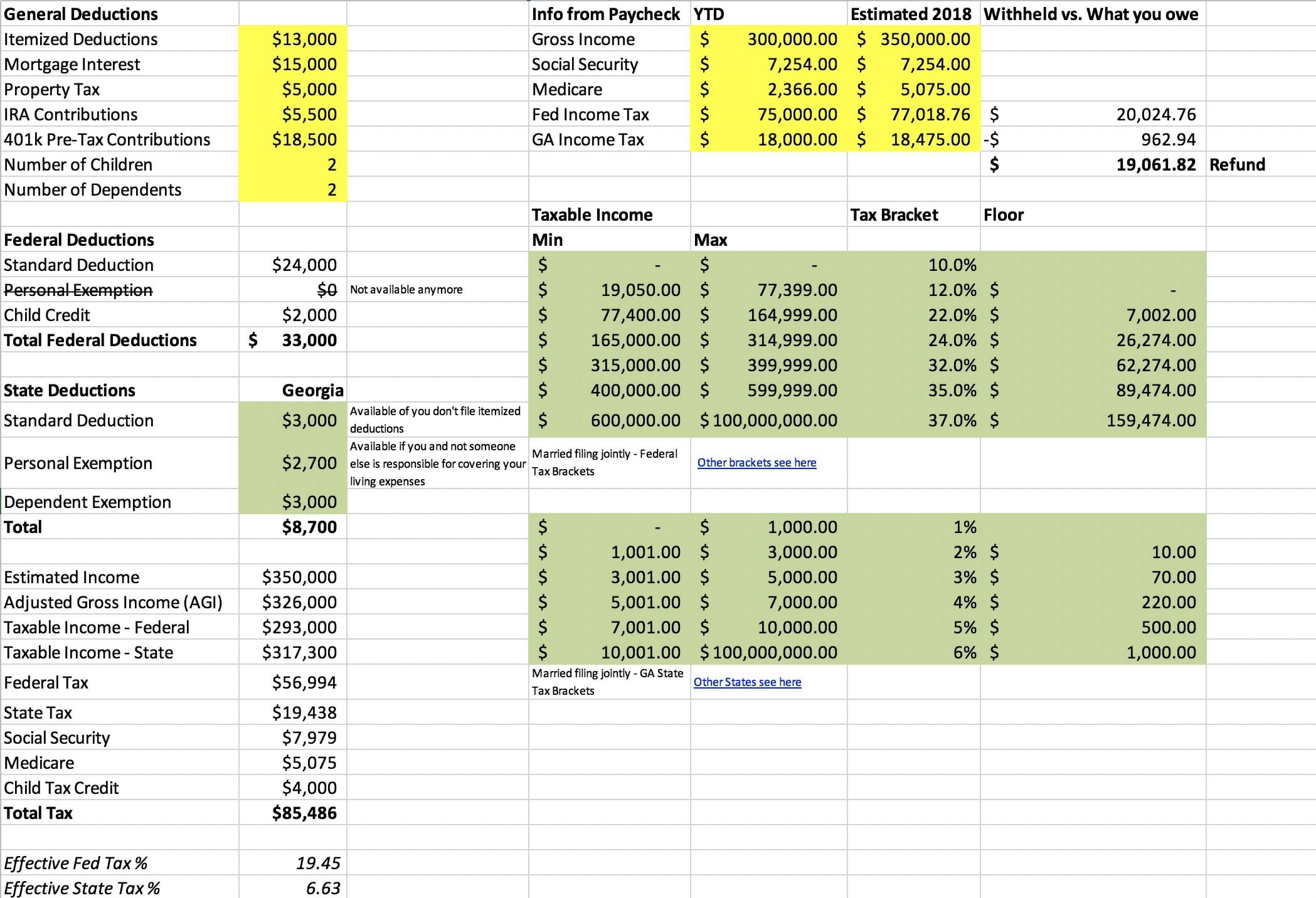

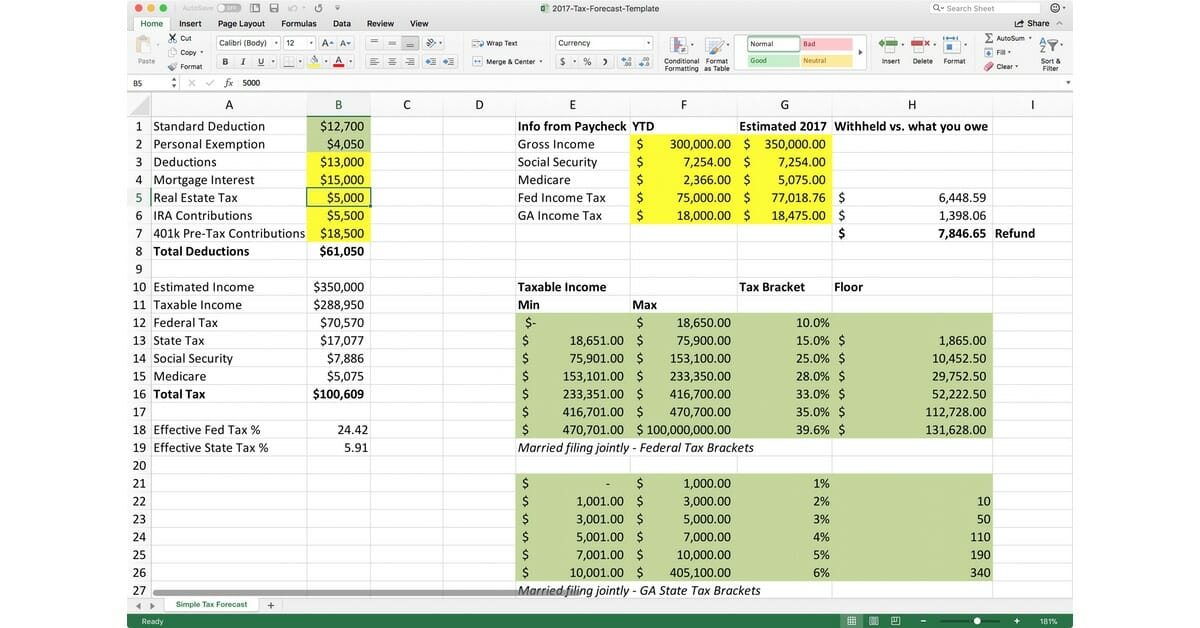

Income Calculation Worksheet Excel Magic

https://imgv2-2-f.scribdassets.com/img/document/743275738/original/6f7f4d841b/1721753347?v=1

Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year

Templates are pre-designed files or files that can be utilized for various functions. They can conserve time and effort by providing a ready-made format and design for developing various type of material. Templates can be utilized for personal or expert tasks, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Income Calculation Worksheet Excel Magic

Income Calculation Worksheet 2021

Tax Calculator 2025 25 Online Kimberly R Ogle

Calculate Tax Refund 2025 Anne W Berube

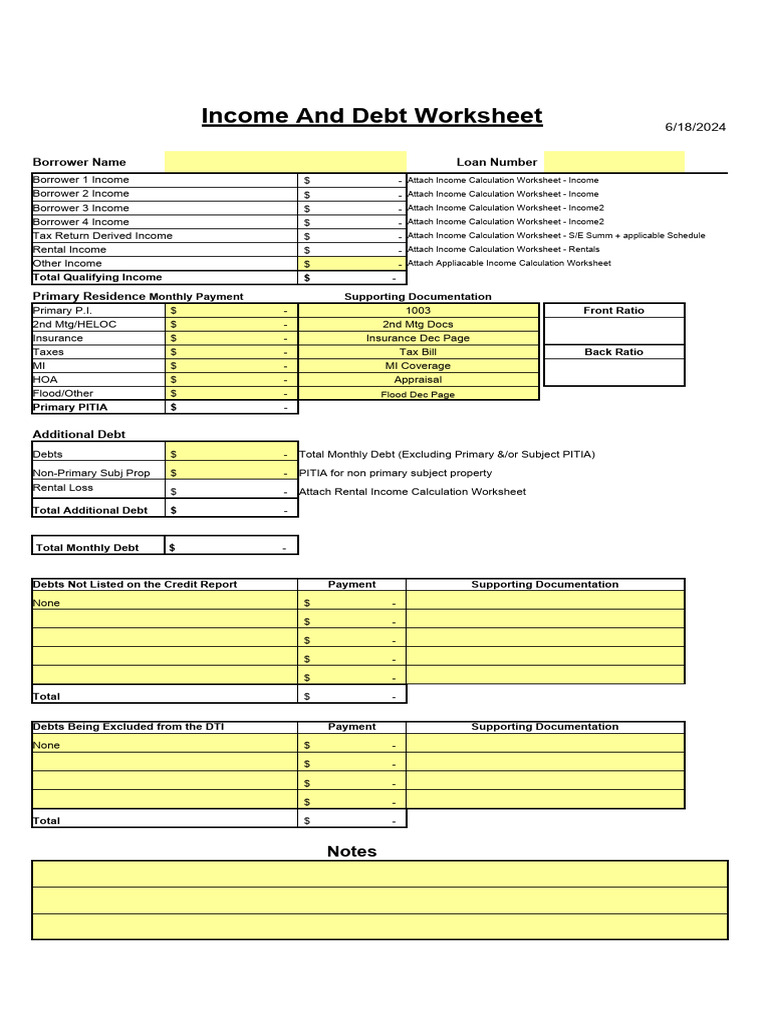

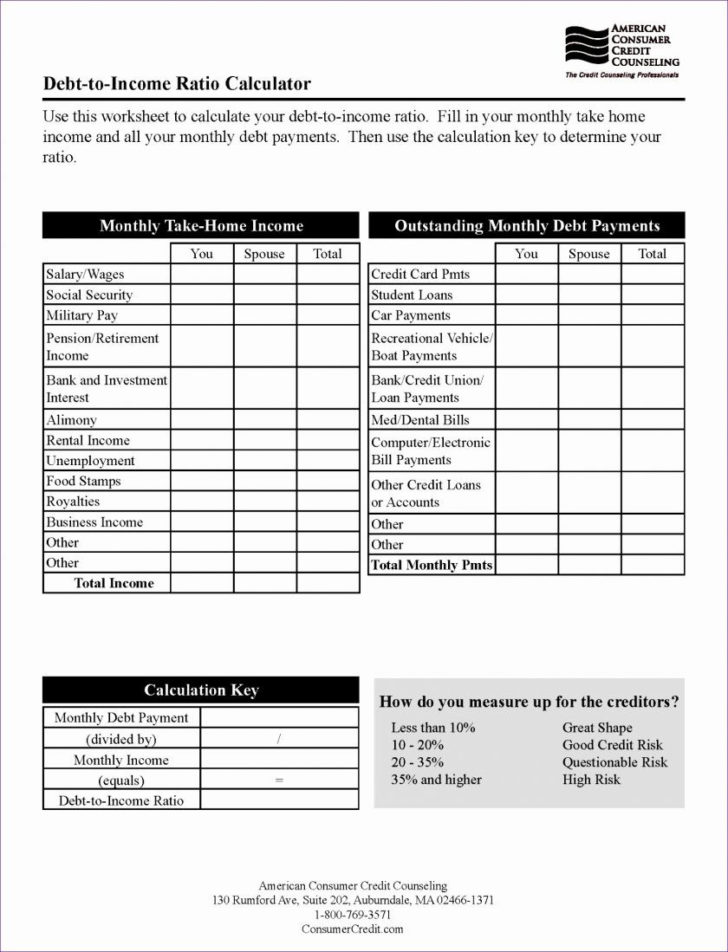

Fnma Income Calculation Worksheets

INCOME TAX CALCULATOR 2023 24

Income Calculation Worksheet 2024

https://www.canada.ca › en › services › taxes › income-tax

Income tax Personal business corporation trust international and non resident income tax

https://www.canada.ca › en › services › taxes › income-tax › personal-in…

Jul 9 2025 0183 32 NETFILE service in tax software that allows most people to submit a personal income tax return electronically to the Canada Revenue Agency

https://www.canada.ca › en › revenue-agency › services › e-services › di…

4 days ago 0183 32 The Payroll Deductions Online Calculator PDOC calculates Canada Pension Plan CPP Employment Insurance EI and tax deductions based on the information you provide

https://www.canada.ca › en › services › benefits › publicpensions › old-a…

How does the recovery tax deduction work Once your Old Age Security Return of Income form is received the net world income you report is used to estimate your Old Age Security OAS

https://www.canada.ca › en › services › benefits › publicpensions › old-a…

Your income It is considered taxable income and is subject to a recovery tax if your individual net annual income is higher than the net world income threshold set for the year 90 997 for

[desc-11] [desc-12]

[desc-13]